Stephen Miran Two Rate Cut Drives Bitcoin ETF Inflows: Can BTC Bounce?

Bitcoin is having a tricky day. Its price dropped a bit, but behind the scenes, Bitcoin ETF inflows show that smart investors are still buying. Federal Reserve Governor Stephen Miran said two interest rate cuts this year are possible.

Top prediction markets, like Kalshi BTC prediction, say there is a 75% chance for this. If it happens, it could help the BTC price go up soon.

Bitcoin ETF Inflows Spotlight: Where Institutional Money Is Moving

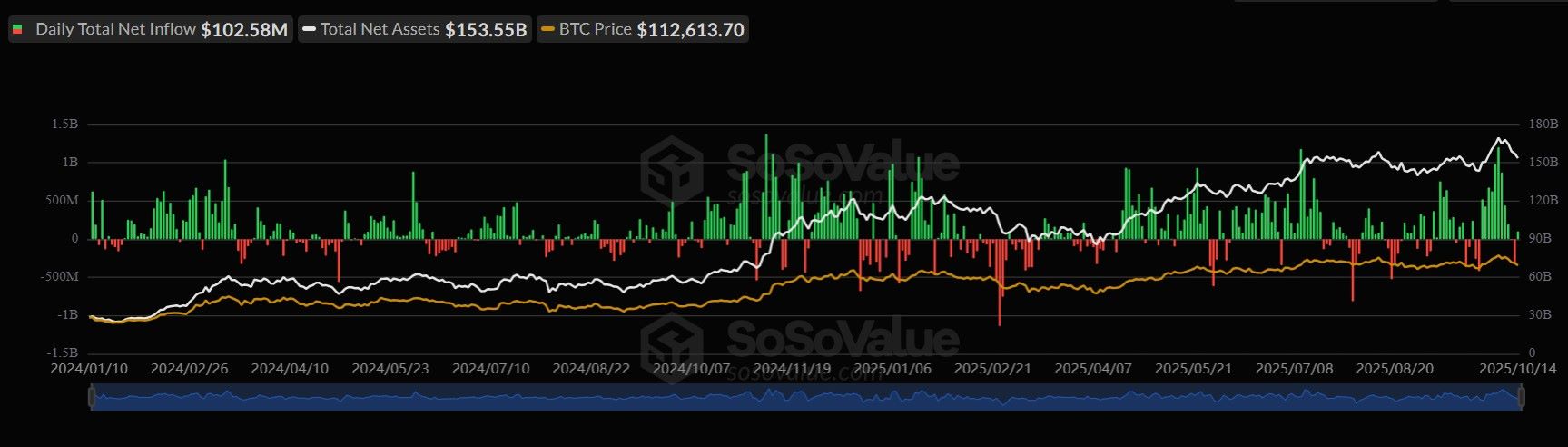

Today, Bitcoin ETFs inflows saw a total daily net inflow of $102.58 million, which is a good sign. Some of them are getting more money while others lost a little. Fidelity’s FBTC ETF was the top buyer today, adding $132.67 million. This shows big investors trust in this asset.

Other listed funds like Bitwise (BITB) and Ark/21Shares (ARKB) also got some money but not as much. On the other hand, BlackRock’s IBIT, even though it is the biggest with $65.29 billion cumulative influx, had a $30.79 million outflow.

This means one strong buyer, like Fidelity, can make up for other listed funds losing money and flip the script for the Bitcoin price crash. Watching btc spot ETF inflows helps understand where big money is moving.

Bitcoin Price Crash Impact : $62.55 Billion and Counting

Since their launch, Bitcoin ETF inflows have added $62.55 billion in total. This shows that big investors are playing an important role in the market.

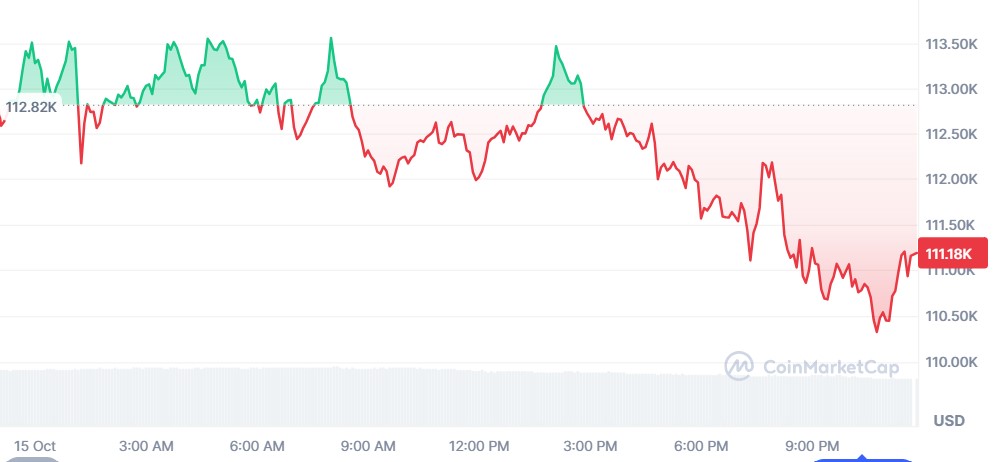

Right now as per CoinMarketCap data $BTC price trades at $111,080.23, down 2.01% in 24 hours. Trading volume is $74.78 billion, down 16%, which shows people are trading less.

Two levels to watch:

-

Support Level: Around $110,500 — this is where the price found some stability after the drop late in the day.

-

Resistance Level: Around $113,000 — the price faced repeated rejection near this zone earlier in the day.

These levels mark the near-term range where buyers may defend and sellers may step in. Even though the price went down, $ BTC ETF update shows the whale's confidence in the asset for the long term, which might push the token reversal.

Today’s data shows that investors are closely watching what the 29th October Fed rate cut will bring, adjusting their portfolios.

Is Stephen Miran Two Rate Cut Prediction A Hope For Market?

Stephen Miran’s comment about two realistic interest rate cuts this year has made the market hopeful. If the Fed cuts rates, borrowing becomes cheaper, investors feel more confident, and price can rebound to $115,403.

As per my analysis being a crypto observer, history shows that fed rate cut news often floods the market with positive momentum, until it clashes with any geopolitical tension.

With the upcoming two Fed rate cut 2025 prediction and $BTC spot ETF inflows, the $BTC price might write the uptrend script soon.

Bottom Line: A Volatile Market With Hidden Strength

BTC price crashed today, but bitcoin ETF inflows , big investors, and Stephen Miran two Fed rate cuts words, show the market is still strong.

Strong influxes like Fidelity’s can balance out outflows and keep the market steady. BTC at $111K looks weak for now, but it can also be a good entry point for traders before the major bull run.

Disclaimer: This article is for informational purposes only. Always DYOR before investing in the volatility crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。