From Illusion to Growth: The Truth of Doll Sister, Speculative Cycles, and Self-Evolution!

Doll Sister @MyHongKongDoll's article:

I strongly recommend everyone to take a look,

Every person working hard in the internet, crypto space,

or even in the creator industry should read it.

Although many people have different opinions on this content,

I firmly believe that good things,

the deep aspects of human nature should be learned.

I call this article she wrote:

A rare "Notes of the Awakened"—

Talking about truth, illusion, and growth,

And how she regained her narrative power

in a world full of speculation and lies.

In this article,

Three sentences left a deep impression on me:

The masses have never desired the truth;

True growth is learning to navigate between "rationality and wildness," being able to use reason to restrain greed, and also using greed to awaken ambition;

Each of us must pursue long-term self-evolution.

1️⃣ The masses have never desired the truth!

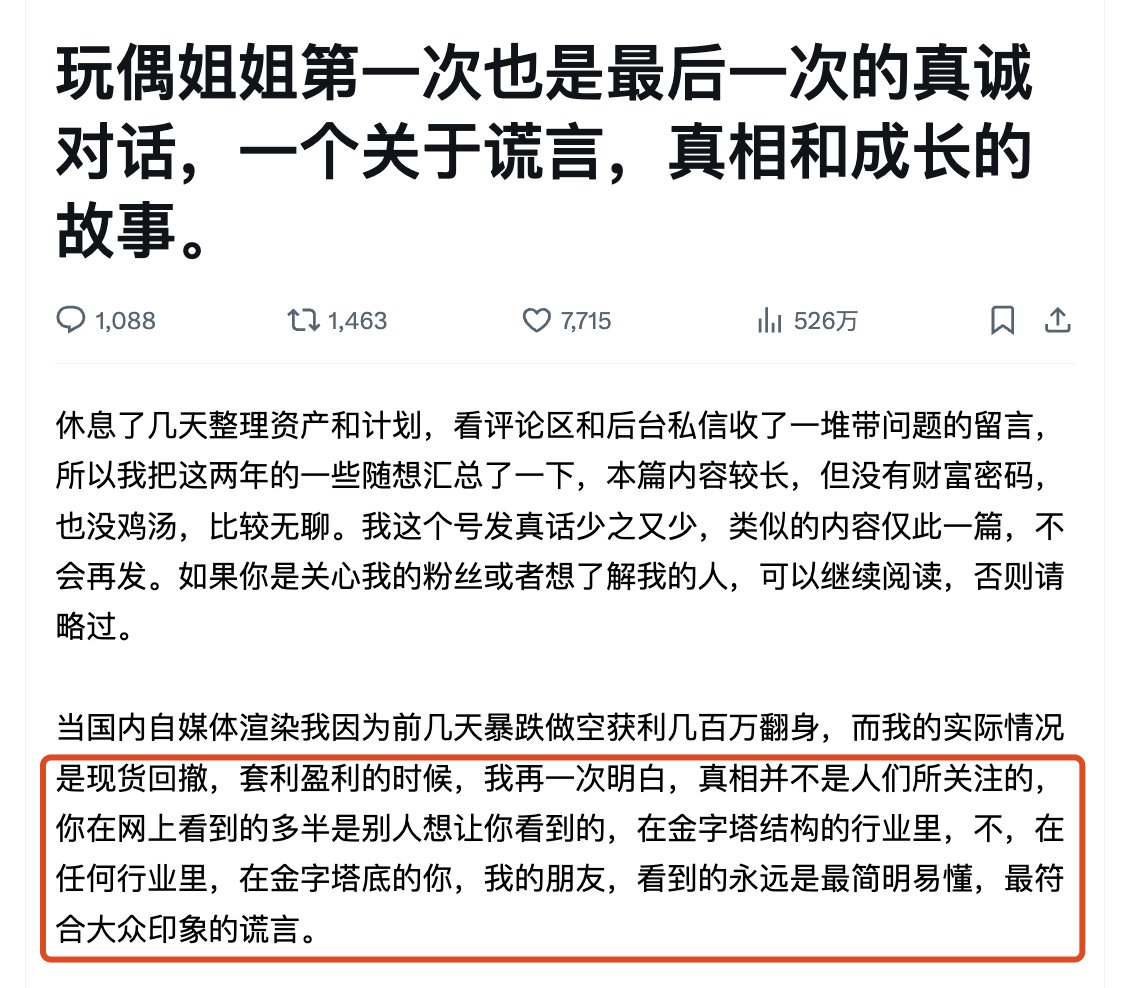

Doll Sister perfectly illustrates: "The public impression is always the simplest lie," and the underlying logic of the traffic economy is "to create understandable illusions."

If you understand this, you will know how to become a KOL who quickly gains traffic by capturing attention;

Years ago, I wrote a long article with a passage that said:

The masses have never desired the truth; when faced with unpalatable evidence, they will turn away. If a fallacy is tempting to them, they are more willing to worship the fallacy.

How reasonable it is! Anyone who can supply them with illusions easily becomes their master; anyone who shatters their illusions will become their victim.

2️⃣ True growth is finding balance in the cycle of "speculation—investment—speculation again."

I think this is the most valuable insight Doll Sister offers everyone:

Speculation → Investment → Speculation again → Achieving great success is a typical path of mental evolution for investors, and most people need to go through this process!

1) Behavioral Level: From Impulse to Rationality, then to Integration

Speculation Stage: Driven by intuition, emotions, and FOMO.

The initial "speculation" is often accompanied by greed and fantasy. People chase quick money, looking for shortcuts, hoping to change their fate with a single windfall.

At this stage, the core behavior is "short-term profit," not "cognitive accumulation."

Investment Stage: Starting to talk logic, look at the long term, and focus on structure.

After experiencing losses and disillusionment, people return to rationality—understanding the importance of asset allocation, position management, and time compounding.

At this point, the focus is on "long-term growth" and "systematic thinking."

Speculation Again Stage: Reclaiming adventure above rationality.

Mature speculation is not blind but a planned risk under the constraints of cognition and discipline.

You know where the risks are, where the odds are, and understand when to be aggressive and when to hold back.

At this stage, "speculation" is no longer gambling but strategy.

True growth is the ability to switch freely between rationality and adventure.

You will neither miss the dividends of the cycle nor be consumed by greed.

Finally, to the Rational Stage: Awe after experiencing black swans!

Many people become proud after achieving some results, only to be educated by the market, by LUNA and FTX, and by 312 and 1011, realizing what black swans truly mean. Either they experience painful lessons or go through dark times before they can be reborn! Entering true rationality.

2) Cognitive Level: Coexistence of Certainty and Uncertainty

Many people think they have "matured" after transitioning from "speculation" to "investment,"

But in reality, they have only moved from one extreme to another.

The key to growth is understanding:

The essence of the market is uncertainty,

Investment and speculation are not opposites but different ways of playing the game across time dimensions.

Investment allows you to stand on the side of time;

Speculation allows you to seize momentary fluctuations.

The former cultivates "patience and systems," while the latter trains "reaction and courage."

Together, they form a complete market survivor.

3) Philosophical Level: The Relationship Between Man and the Market:

The cycle of "speculation—investment—speculation again"

is also a practice of balancing control and letting go.

Speculation is "I can control my fate";

Investment is "I accept the arrangement of time";

Speculation again is "I understand fate, yet still dare to bet."

What this reflects is not only financial wisdom but also the maturity of life mentality:

You no longer fear fluctuations, nor are you obsessed with safety,

But understand—fluctuation itself is the cost of growth, and risk itself is the source of return.

True growth is not a one-way evolution from speculation to investment,

But after completing a cycle,

Learning to navigate freely between "rationality and wildness."

—Able to use reason to restrain greed and use greed to awaken ambition.

3️⃣ Pursuing long-term self-evolution.

Investment is a lifelong learning endeavor.

This is also the rule I currently follow!

Many people live in "goal anxiety"—how much money to earn, what position to reach, achieving the so-called "shore," but truly mature people realize: the endpoint of each stage will become the starting point of the next stage.

Self-evolution is no longer being enslaved by "results," but enjoying "the growth itself." You no longer ask "when will I succeed," but rather: Am I more awake today than yesterday? Is my response to difficulties more mature? Have I gathered more smart people and friends around me?

This long-term mindset allows you to break free from cyclical illusions and enter a life of compounding.

And "self-evolution" is not simply the accumulation of knowledge but the continuous overthrow of your original cognitive models.

It involves two actions:

1) Break: Dare to admit "I was wrong," "I was too superficial before."

2) Establish: Build a higher-dimensional understanding on the ruins.

For example, from chasing high profits → understanding risks → accepting fluctuations → coexisting with uncertainty, this is a "break—establish—break again—establish again" cycle. Only those who can experience this cycle multiple times are truly "evolving."

You must continuously try → review → adjust → try again.

It's like training a model; every mistake is a parameter update.

So what I want to say in the end is:

So-called evolution is not just about efficiency and cognitive improvement,

But a deep understanding and integration of oneself.

When you can accept your limitations, darkness, laziness, and desires,

No longer rushing to correct everything,

But learning to move forward with your flaws,

You can be considered truly evolved.

As Jung said:

"One does not become whole by imagining light, but by facing darkness."

After reading her content,

I think of my darkest moments and my conversations with myself,

I am reminded of Haruki Murakami's "The Wind-Up Bird Chronicle,"

Where Toru Okada stares into the darkness at the bottom of the well:

"The real enemy of man is within himself."

Everyone's life has a well—

Do you dare to go down and see what you truly fear?

That strange bird is calling, not as a portent, but as a reminder:

The world is moving, while you remain in place.

Thanks again to @MyHongKongDoll for her honesty and inspiration,

The power of "daring to expose" and "facing honestly"

is more precious than any wealth code.

Because true growth,

Is not about having more resources, traffic, or chips,

But—

Seeing the truth amidst illusions,

Finding order within speculation,

And continuously evolving amidst chaos.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。