Author: Alex Danco

Translation by: Shen Chao TechFlow

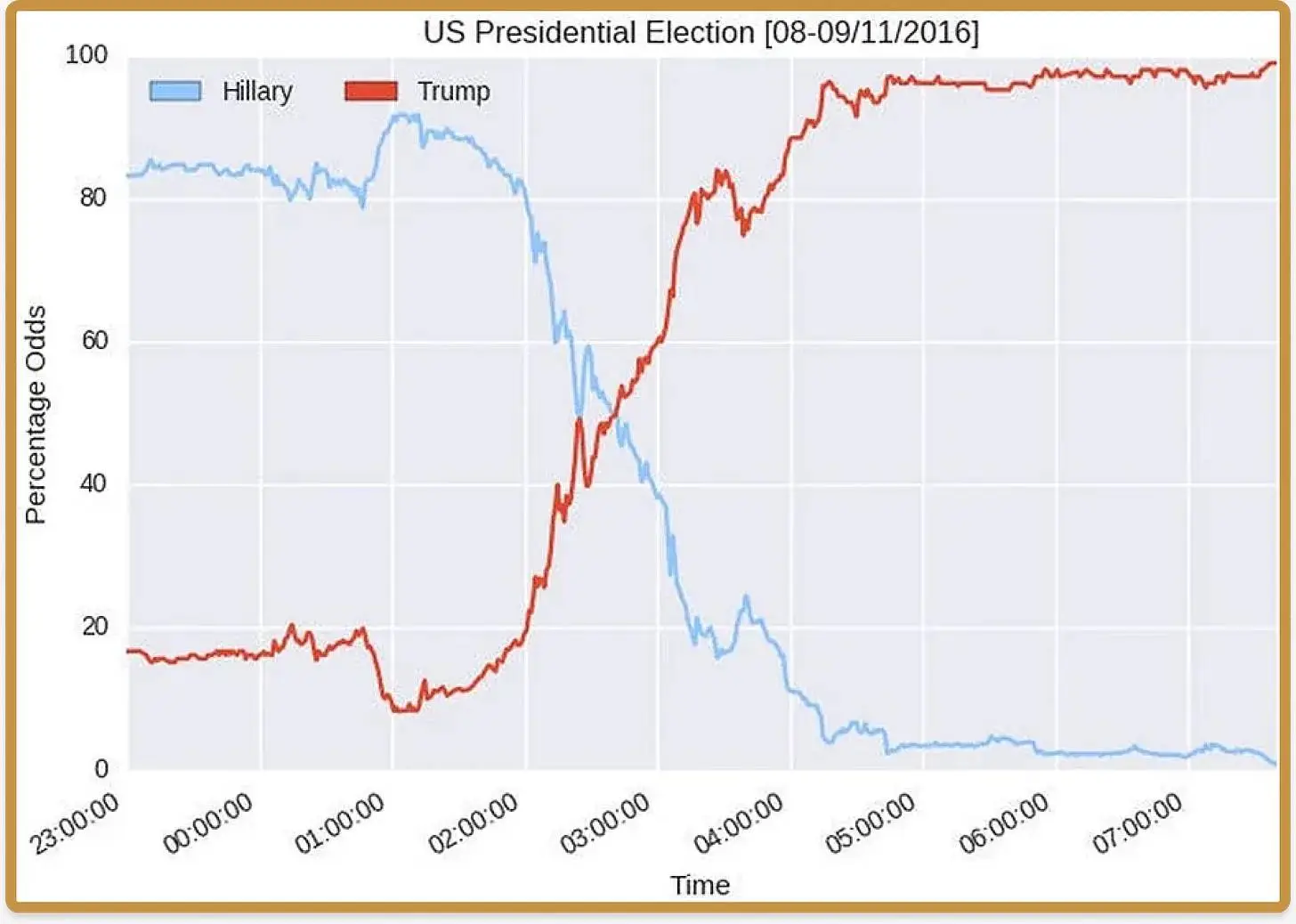

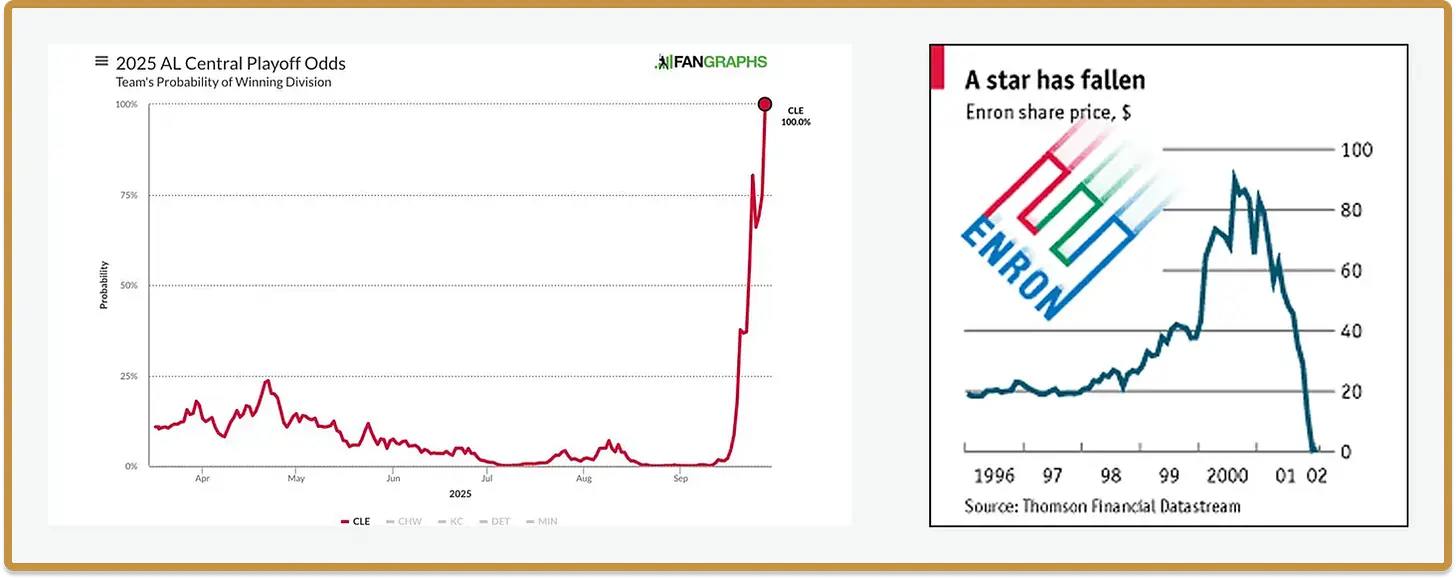

In the mid-2010s, a new form of visual content began to emerge in elections, sports events, and playoff competitions: charts that depict "probabilities changing over time." These charts are compelling because they tell an engaging story: what was initially expected to happen and what actually occurred.

Through these images, you can narrate many fascinating stories. Just by showing changes in probability, you can tell stories about collapse, redemption, or the underdog's comeback. (Kurt Vonnegut famously named many such stories: for example, "The Man Who Fell Into the Abyss," "Boy Meets Girl," and "The Downward Spiral," each with its own shape.) These images are a kind of "meme": they compress a large amount of information into a small space and convey the story intact when shared.

Despite their appeal, these charts have a major limitation: they almost exclusively exist in the realms of politics, sports, or financial markets. The reason is obvious: the operation of these charts requires widely accepted predictive odds, and these odds must be legally utilized. Financial markets have always had these odds; elections have polling data to leverage, allowing for the construction of these probability paths like Nate Silver does. Sports seasons (and even individual games) have clear structures and enough historical data to confidently predict playoff advancement probabilities for teams. Beyond that, the form of "story shapes" cannot be more deeply extended into popular culture.

The Slow Arrival of Prediction Markets

Prediction markets solve this problem in an obvious way. As long as you can define a contract and its resolution terms, we now have a method to bring these "predictive shapes" into any ongoing story in the world. The initial ingredient needed for this story—popular predictions—has shifted from scarcity to abundance.

In reality, these markets did not emerge overnight, nor were they initially so. In early 2024, the magazine Works in Progress published an article titled "Why Prediction Markets Are Unpopular." The author argued that "the natural demand for prediction market contracts is low," because the three traditional groups that make up market participants—savers (seeking wealth accumulation), passionate bettors (betting for the thrill), and savvy traders (trying to profit from market distortions caused by the first two groups)—have no particular reason to engage in prediction markets. Savers might buy market indices to accumulate wealth over the long term, but they have no reason to bet on the outcome of a presidential election. Passionate bettors might be more inclined to participate, but they have more interesting speculative avenues (like day trading, meme coins, or sports betting) than predicting the outcome of a state senate election. And with lower participation from the other two groups, savvy traders also see little opportunity to profit from entering the market.

Due to the limited participation of these three groups, prediction markets were destined to remain illiquid and relatively useless in forecasting the future. This viewpoint was further validated by the poor performance of prediction markets in forecasting the results of the 2022 midterm elections.

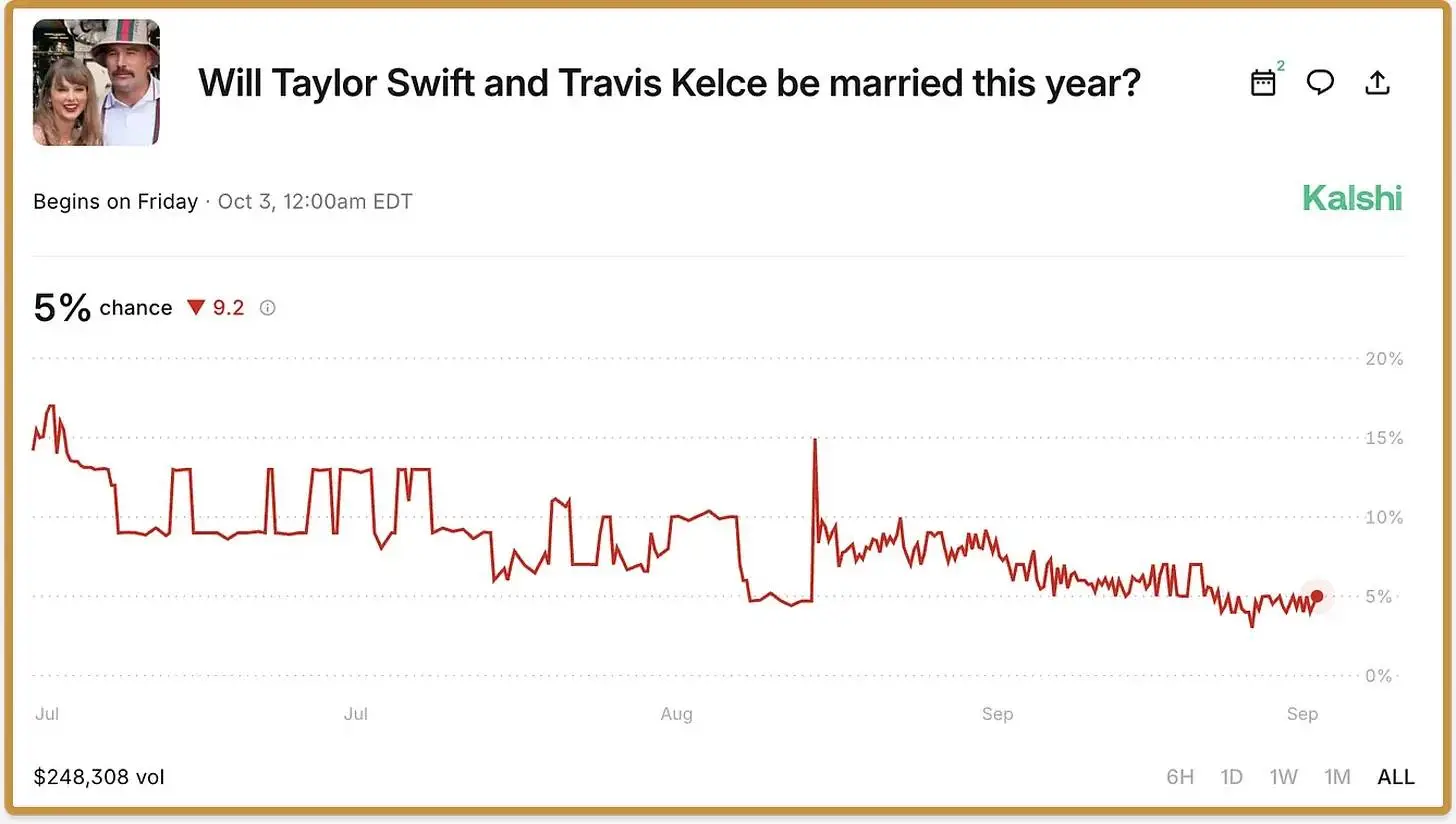

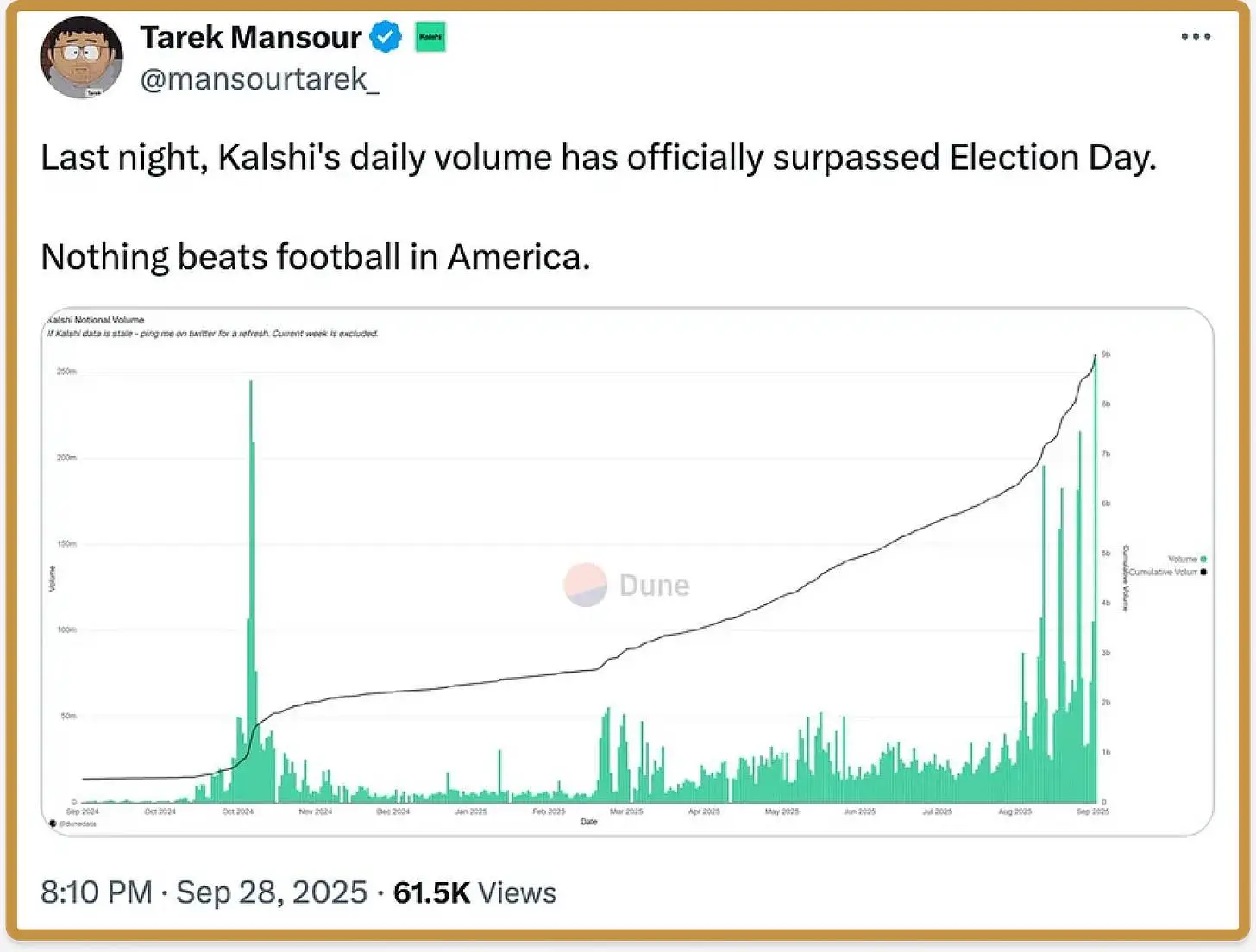

However, since that article was published a year and a half ago, interesting changes have occurred: prediction markets have rapidly entered mainstream popular culture. As predicted by the enormous betting volume on weekly sports events, the largest markets are in the sports domain. But they have successfully penetrated mainstream culture—becoming even the theme of an episode of South Park—while covering a variety of markets from the New York City mayoral election results to the Federal Reserve's policy interest rate path, and even the timeline for Taylor Swift's marriage.

Breaking the "Fourth Wall"

What has changed in the past two years? There may not be a one-size-fits-all solution. The 2024 election undoubtedly played a role: Americans have a long history of betting on elections, and the trading volume in prediction markets grew 42 times from early June to election week. But the excitement did not wane after the election.

A key player in this positive feedback loop is a new type of market participant that did not exist a few years ago but is now ubiquitous. This participant resembles promoters in traditional betting activities, such as those for Las Vegas boxing matches. They are ordinary social media users, along with a new form of meme—posting screenshots of predictive paths.

Prediction markets today are not just about classic market dynamics; they are also about social media-driven viral spread. The key behavioral mechanism is to post screenshots when predictive contracts become topical, thereby attracting attention and bringing liquidity to the contracts.

A good example is a pop culture question contract on the Kalshi platform: "Will Taylor Swift and Travis Kelce get married in 2025?" If you look at the chart, you will notice two important events occurring on August 26, when Swift and Kelce announced their engagement on Instagram. First, there was a surge in odds; second, there was a significant increase in liquidity as people began to pay attention to the contract. While some degree of liquidity surge would occur regardless, there is no doubt that these screenshots shared at critical moments constituted the viral spread of the contract itself and became an entry point for attracting bets. This phenomenon of "breaking the fourth wall" suddenly made a broader audience aware of this meme (or more accurately, aware of the reason to pay attention to this contract), adding an interesting new meta element to future stories.

New "Protagonists" on the Timeline

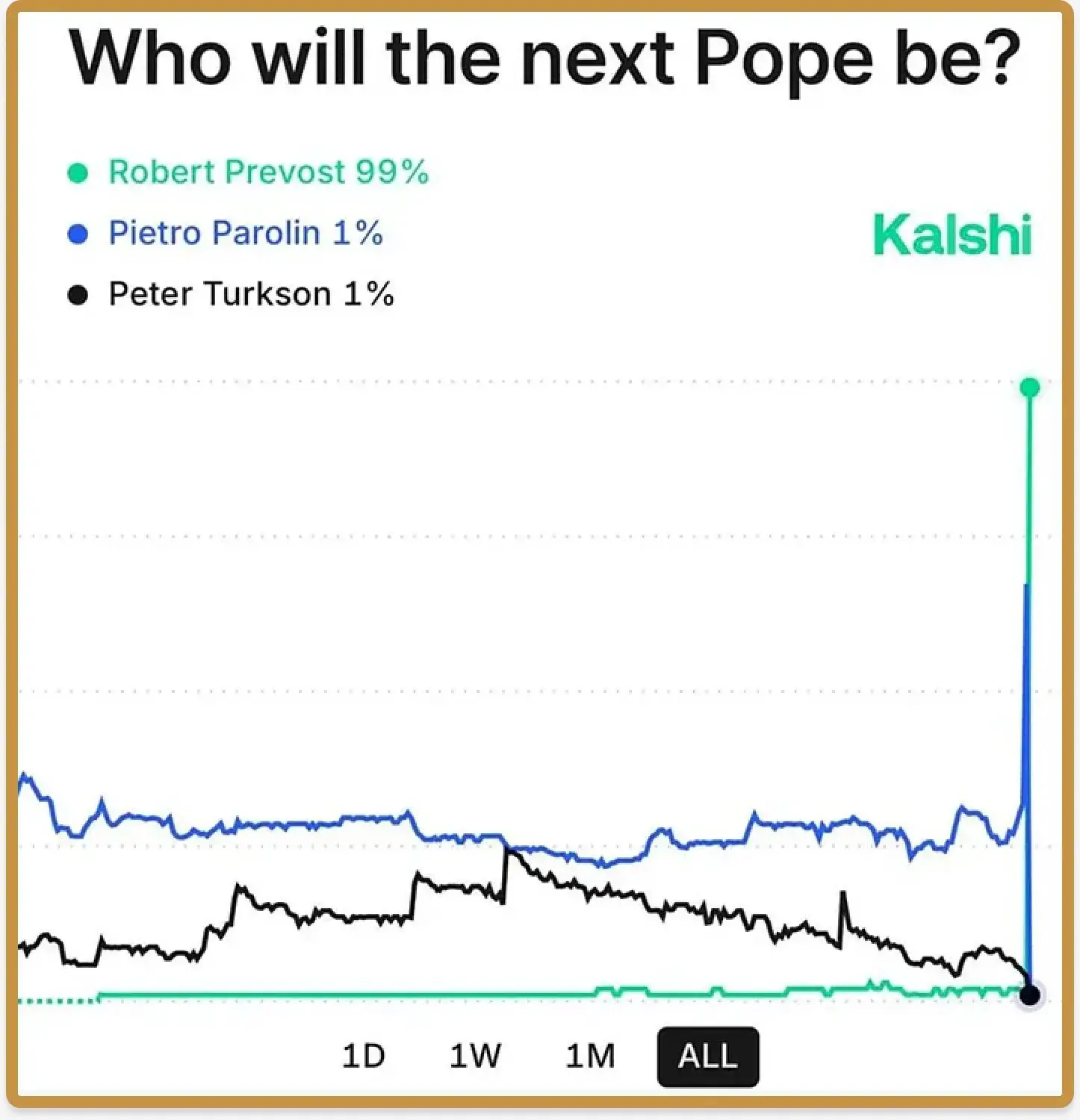

Betting on the Pope is said to be "the original prediction market," and the most recent instance witnessed a glorious return of this tradition. For Catholics around the world, it was a great moment as Cardinal Robert Prevost became the first American Pope—Pope Leo XIV. And for the betting market, it was also a significant moment, as few considered him a competitive candidate: most attention was focused on popular figures like Pietro Parolin and Luis Antonio Tagle.

The day after the smoke cleared, @Domahhhh on X shared the true essence of the timeline: a detailed breakdown of his thought process and betting scale during the critical moments before the meeting and between the decision and announcement.

In his words: "As a directional bet, I decided to wager a large sum of money that the next Pope would not be [the frontrunners Parolin and Tagle].

After the fourth round of voting, white smoke rose (indicating a new Pope had been successfully elected). Relatively speaking, this was quick. The logical conclusion (which I thought of immediately) was that this meant the strong vote-getter from the first round had consolidated votes and become Pope. Parolin's odds rose to about 65%. Tagle remained around 20%. These two had an 85% chance of becoming Pope, and honestly, looking back now, that price seems extremely wrong, but at the time it was hard to feel it was that outrageous. I was sure I had lost a lot of money! I decided not to chase bad money anymore and not to bet more on Tagle/Parolin. I would accept my loss like a good child.

But I did browse the list of other options. When two people were trading at over 85%, everyone else was in the clearance zone. I rummaged through the discount area and found Prevost's odds at 200 to 1. In hindsight, I should have bought in at that price.

I knew one piece of information: there were a total of four ballots. For a long shot, this was too fast. Throw all the long-shot tickets in the trash. You need a strong candidate who can cast two-thirds of the votes in a relatively short time. And those two were the ones I picked. While other traders were focused on Tagle/Parolin, I bought thousands of shares of Prevost.

Minutes later, I was astonished to see Prevost—the person I had just bought shares of at 200 to 1—walk onto the balcony as Pope."

There was once a joke: "There is a protagonist on the timeline every day, and the goal is to never become the protagonist." This "victorious prediction publisher" is a new protagonist, capable of becoming a fleeting certified hero.

Placing Bets

The 2024 presidential election has brought a well-deserved redemption story to prediction markets. It began with the long process of Biden's withdrawal from the race, during which prediction markets provided a useful quantitative tool to measure the impact of various events on the probability of the president's withdrawal. From journalists to Wall Street traders, everyone began to rely on prediction markets as well as traditional polling and commentary tools. Ultimately, despite criticism of prediction markets throughout the campaign due to the influence of "whale" traders, they outperformed polls. A year later, Kalshi's daily trading volume has now surpassed levels during the 2024 election (at least during football games).

Prediction markets now represent something significant, not just in terms of their practicality as financial tools or sources of information. They represent a sense of accountability and a new role on the timeline: "the hero making brave decisions" and "the fool making bad decisions." These individuals are now pushed to the forefront, becoming Vonnegut-esque caricatures, as if they were characters in his short stories.

In politics, business, and culture, we ask our leaders and public figures to truly guide our institutions toward a successful future. And that means making bold decisions and proving them right. Over the past few decades, the public has generally felt that we have slipped into a culture of leaders lacking accountability, and when individuals step up to resist this trend, we appreciate it even more.

Perhaps this is the main mechanism by which prediction markets are about to change the trajectory of popular culture: not only because betting itself is a flow of information that can direct attention where it is needed, but also because the path from prediction to completion brings new memes to the timeline and pushes new roles to the forefront.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。