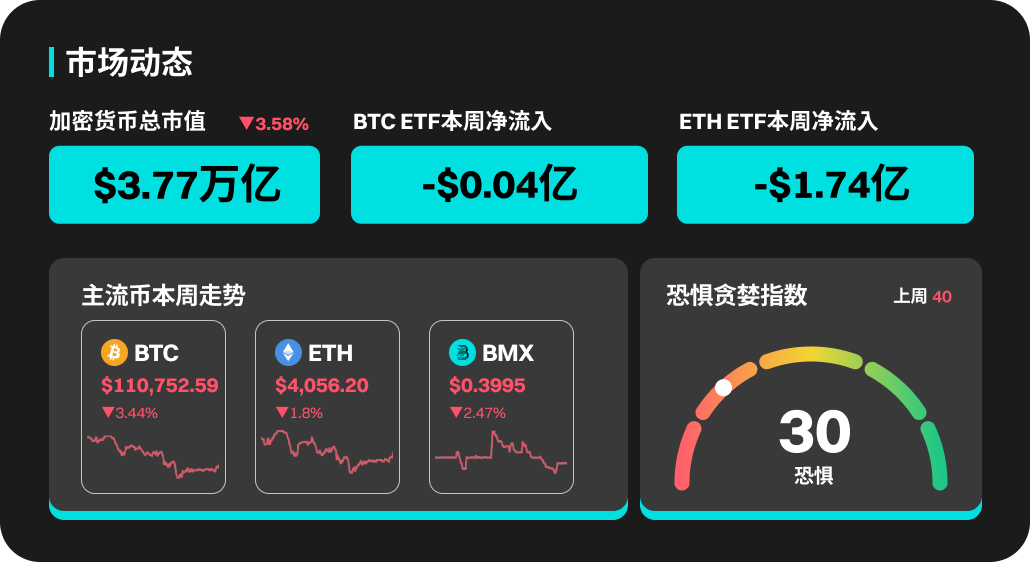

本周加密市场动态

上周比特币整体走势剧烈波动。周初延续涨势,一度触及 $126,296 高点,但周五因特朗普宣布对中国商品征收 100% 关税、实施出口管制后市场情绪急转,BTC 在币安短线暴跌至 $102,000,随后回升并稳定在 $112,980 附近。尽管周末一度反弹至 $115,000 上方,但卖压持续,价格在周中再度跌破 $110,000,并在周四触及 $108,198。截至当前交易日,BTC 报约 $105,700,全周跌幅超过 7%,市场情绪转为谨慎,波动性显著上升。

以太坊同样经历大幅震荡。周初强势上涨突破 $4,600,但在宏观冲击与期权到期影响下快速回落。特朗普关税消息公布当天,ETH 一度暴跌至 $3,444,随后反弹收于 $3,836,单日跌幅超 12%。尽管周末短暂回升至 $4,200 上方,但抛售压力持续,本周中再次跌破 $4,000,最低触及 $3,678,当前徘徊在 $3,800 附近。整体来看,ETH 全周下跌约 8%,市场仍受宏观不确定性与高波动期权到期影响,短线走势偏弱。

本周热门币种

热门币种方面,ENA、TAO、MORPHO、PAXG 和 XAUt 都有着不俗的表现。ENA本周价格上涨13.29%,24小时交易量1.3B。TAO价格上涨8.3%。XAUt和PAXG本周分别上涨4.11%和4.26%。

美国市场大盘及热点新闻

10月10日,特朗普总统宣布对中国输美产品加征100%关税,并于11月1日起对“所有关键软件”实施新的出口管制,此举引发中美贸易摩擦再度升级,市场因此感到不安。此次加征关税是对中国扩大稀土矿限制的回应。这些限制意味着,外国公司必须获得中国政府的批准,才能出口哪怕含有微量中国稀土元素的产品。

黄金发挥了其作为宏观不确定性对冲工具的作用,本周上涨了5%,而标准普尔500指数则从低点反弹,本周收盘仅下跌0.8%。相比之下,比特币和以太坊的反弹力度并不强劲,本周收盘均下跌约10%。

ETHShanghai 2025将于10月22日开幕

万向第十一届区块链全球峰会将于10月23日举行

美国劳工统计局将于10月24日上午8:30(北京时间晚上8:30)发布9月CPI报告。

热门板块及项目解锁

Meme 板块

在美联储降息与市场流动性回暖的推动下,风险偏好明显提升,Meme 板块成为上周资金最集中流入的高β赛道之一。按 7 日数据看,主流 Meme 代币普遍录得双位数涨幅:DOGE +14.2%、PEPE +18.6%、FLOKI +25.3%、WIF +27.8%、BONK +21.5%,显著跑赢 BTC 的 +1.5%。板块内部分化同样明显:SHIB 相对滞涨仅 +3.9%,而小市值新代币如 TURBO、MEMEAI 等涨幅超 30%,显示市场资金更青睐具备叙事热度与社群活跃度的项目。

链上数据方面,Solana 与 Base 上的 Meme 币交易活跃度显著上升,尤其是 WIF 与 BONK 的链上转账量均创近月新高,反映投机情绪快速升温。整体来看,Meme 板块在流动性宽松周期中重获关注,资金正从主流资产与稳定币流向高波动小盘代币,但短期涨幅过快、情绪化交易浓厚,需警惕随后的回调与获利盘抛压。

LayerZero(ZRO)将于北京时间10月20日晚上7点解锁约2571万枚代币,与现流通量的比例为7.86%,价值约4420万美元

KAITO(KAITO)将于北京时间10月20日晚上8点解锁约835万枚代币,与现流通量的比例为3.06%,价值约870万美元

Plasma(XPL)将于北京时间10月25日晚上8点解锁约8889万枚代币,与现流通量的比例为4.97%,价值约3690万美元

风险提示:

使用BitMart服务的风险完全由您自行承担。所有加密货币投资(包括收益)本质上都具有高度投机性,并且涉及巨大的损失风险。过去、假设或模拟的表现并不一定代表未来的结果。

数字货币的价值可能会上涨或下跌,购买、出售、持有或交易数字货币可能存在很大的风险。您应根据您的个人投资目标、财务状况和风险承受能力,仔细考虑交易或持有数字货币是否适合您。 BitMart不提供任何投资、法律或税务建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。