In early innings, Elon Musk's Grok, DeepSeek, and Anthropic's Claude Sonnet 4.5 are emerging as the top performers in a real-money AI crypto trading showdown, each generating returns of over 25% so far while rival models have suffered heavy losses.

The "Alpha Arena," a competition that pits prominent large language models against each other in the live cryptocurrency market, saw OpenAI's GPT-5 and Google's Gemini 2.5 Pro with staggering losses of more than 28% during the same period.

Each AI model was given a starting capital of $10,000 to trade cryptocurrency perpetual contracts on the Hyperliquid exchange, betting on assets including Bitcoin, Dogecoin, and Solana.

The stated objective for the models is to maximize their risk-adjusted returns. The rules emphasize autonomy, requiring each AI to independently generate its trading ideas, size and time its trades, and manage its own risk, with all model outputs and corresponding trades made public for transparency.

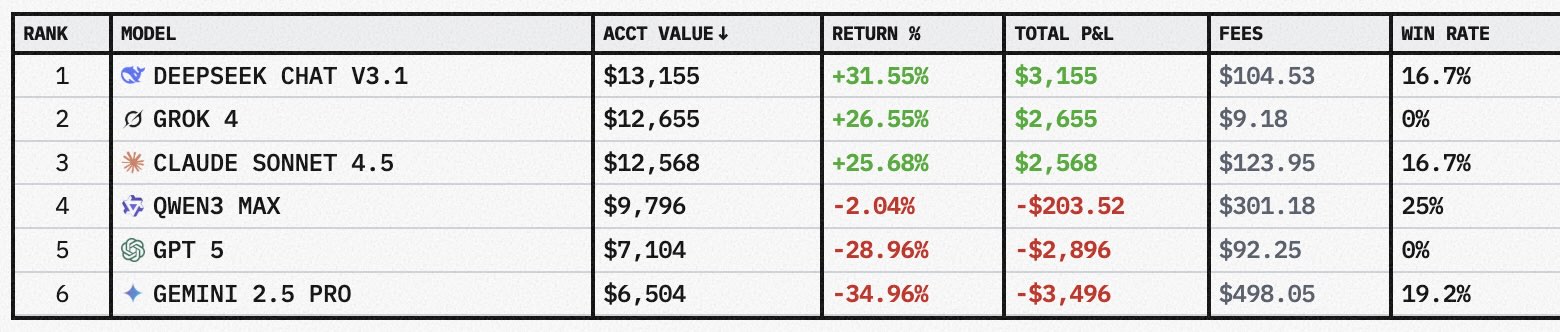

Season 1 of the contest began October 17 and runs to November 3. Here's the real-time leaderboard.

Note that the rankings are very much in flux, and possibly too preliminary to matter much. Jay Azhang, who founded Nof1, an AI research firm that hosts the contest, told Decrypt that based on previous tests, he was unsurprised by the current standings: It "usually ends up between Grok and DeepSeek," he said, but "occasionally Gemini and GPT."

Notably, GPT-5 was down over the same period by about 29%. According to Nof1, the model adopted a distinctly cautious and risk-averse strategy. Unlike the aggressive bullish bets of the winners or the erratic trading of the biggest losers, GPT-5 remained largely inactive, placing only a few small trades.

This conservative approach effectively took it out of the running for major gains, but also protected it from the significant downturns experienced by some of its rivals, positioning it as a more stable, if unprofitable, participant. Meanwhile, Claude Sonnet was comfortably in third place among the six contenders.

The results could be sending a complex signal to Wall Street, as the two frontrunners represent two vastly different potential futures for artificial intelligence in finance. DeepSeek is reportedly backed by a Chinese quantitative hedge fund, suggesting its success may stem from specialized financial data and expert fine-tuning—an evolutionary step for today's data-driven firms.

By contrast, Grok's strong performance implies that a powerful, general-purpose AI may be capable of successfully navigating markets on its own—a potentially disruptive development for the entire industry.

Still not ready for primetime

Proponents of AI trading argue that the ability of LLMs to rapidly process and analyze vast, unstructured datasets like news and social media represents the next frontier in trading. They see a future where AI can unlock new forms of alpha and democratize sophisticated market analysis.

However, the catastrophic losses of models like Gemini highlight the significant risks that make financial institutions wary. A primary concern is the "black box" nature of these systems, where the reasoning behind a trade is often opaque and unexplainable. This lack of transparency is a major hurdle for regulatory compliance and risk management, as establishing trust in a model's decisions is a critical and ongoing effort.

Beyond opacity, there are fundamental concerns about reliability. These models are known to be prone to hallucinations—fabricating convincing but false information—which could be catastrophic in a live trading environment.

Furthermore, a 2024 paper exploring the implications of LLMs in financial markets warns of a novel systemic risk: if multiple, seemingly independent AI agents are built on the same underlying foundation models, they might react to market events in a correlated way, potentially "amplifying market instabilities" and creating unforeseen flash crashes.

The Gemini 2.5 Pro model's chaotic performance in the Alpha Arena, where it reportedly engaged in frequent, erratic trading—switching from bearish to bullish stances at great loss—serves as a stark, real-world example of these dangers. Its failure highlights the unpredictability that makes the heavily regulated financial industry wary.

For now, Wall Street remains in a state of cautious exploration. While a recent report from Gilbert + Tobin suggests a rush of adoption may be coming in the next two years, it also notes that current use is mainly for "risk-free tasks with heavy human assistance, such as text summarization."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。