After experiencing a "bloodbath" like correction, the price of Bitcoin once fell below the $101,500 mark, and the entire cryptocurrency market was filled with panic and uncertainty. According to data, Bitcoin's Open Interest (OI) recently plummeted by about 30%.

- What does a 30% drop in Open Interest really mean?

What is "Open Interest" (OI)? You can think of it as the total amount of all outstanding bets in a gambling game. When OI is at a historical high, it means the market is filled with highly leveraged speculators; the market seems prosperous but is actually like a block tower supported by matchsticks, where any slight price fluctuation could lead to the collapse of the entire structure.

The recent drop in OI is essentially a thorough "market detox" process. It directly reflects the following facts:

High-leverage longs have been washed out: Speculators who previously entered the market at high levels using high-leverage loans to go long have been massively liquidated (i.e., "blown out") during this decline.

Systemic risk has decreased: A 30% drop in OI means that the potential "gunpowder" in the market has decreased by nearly one-third. Even if prices fall again, the number of leveraged positions that can be triggered has significantly reduced, making it highly unlikely for another wave of liquidations in the tens of billions of dollars to occur.

Funding rates have returned to normal: The funding rates in the futures market have also fallen in line with OI. Reports indicate that the previously abnormally high positive funding rates (where longs pay fees to shorts) have returned to normal, indicating that the extremely bullish sentiment has receded and the market has returned to rationality.

In other words, the market has just undergone a "physical cooling" after a high fever; although the process was painful, the body (market structure) has become healthier as a result.

Market Impact Overview: From "Leverage-Driven" to "Spot-Driven"

Price and Trading Level: Volatility narrows, bottoming signals begin to appear

Short-term crash risk has been alleviated: The biggest positive is that, due to the leverage bubble being squeezed out, a waterfall decline led by derivatives "long killing long" is unlikely to be repeated in the short term.

Entering a consolidation bottoming phase: The market is likely to transition from a "frightened bird" state to a consolidation bottoming period. Prices may repeatedly fluctuate within a range, trading time for space, and re-accumulating upward momentum.

- On-chain Fundamentals: A "clearing, not a failure"

Rational investor behavior: On-chain data shows that investors are more engaged in stop-loss operations rather than panic selling at any cost. This is a defensive and disciplined capital management behavior.

Laying the foundation for a new phase of the bull market: Every bull market needs to undergo several deep corrections to clear out floating capital. A healthy low-leverage environment lays a solid foundation for the next round of sustainable increases driven by spot demand.

- Capital and Liquidity: Opportunities hidden in institutional divergence

Despite the gloomy market sentiment, the capital landscape presents a complex picture:

Capital Movements

Specific Manifestations

Market Interpretation

ETF Capital Flow

Continuous net outflow from Bitcoin spot ETFs for several days

Institutional investors and profit-taking positions are taking the opportunity to cash out, creating short-term selling pressure

Long-term Capital Layout

Funds like Bitmine are still making long-term infrastructure-level layouts

Long-term capital has not exited the market; instead, they view the correction as a buying opportunity and are confident about the industry's future

This divergence precisely indicates that the market is shifting from being dominated by short-term hot money to being supported by more stable long-term capital.

- Industry and Sentiment: A Tug-of-War Between Panic and Caution

Optimists believe: "When Open Interest drops to this 'extreme fear' zone, it often signals the market bottom and exhaustion of selling, creating conditions for the end of the main liquidation cycle and a potential rebound."

Cautious individuals warn: "Although Open Interest has decreased, any sharp drop in spot prices could trigger a new round of chain liquidations, and the possibility of testing the critical support level of $100,000 still exists."

Potential Risk Warnings: Do Not Be Blindly Optimistic, Two Major "Reefs" Remain

Macroeconomic "Black Swan" Shock Risk. The cryptocurrency market is not an island. If there are sudden changes in the global macro economy, such as the Federal Reserve issuing unexpected hawkish signals, geopolitical conflicts escalating, or key economic data falling far short of expectations, it could trigger a collective sell-off of global risk assets. In this case, while Bitcoin may not face internal leverage collapse concerns, it could still fall into a "slow decline" based on external shocks.

Liquidity Drought Risk. The sharp decline in Open Interest also means that market depth and liquidity may weaken. In a low liquidity environment, once large sell orders appear, it is easier to trigger severe price slippage, leading to a vicious cycle of "small declines causing large fluctuations."

Market Outlook and Strategy: How Should Investors Position Themselves?

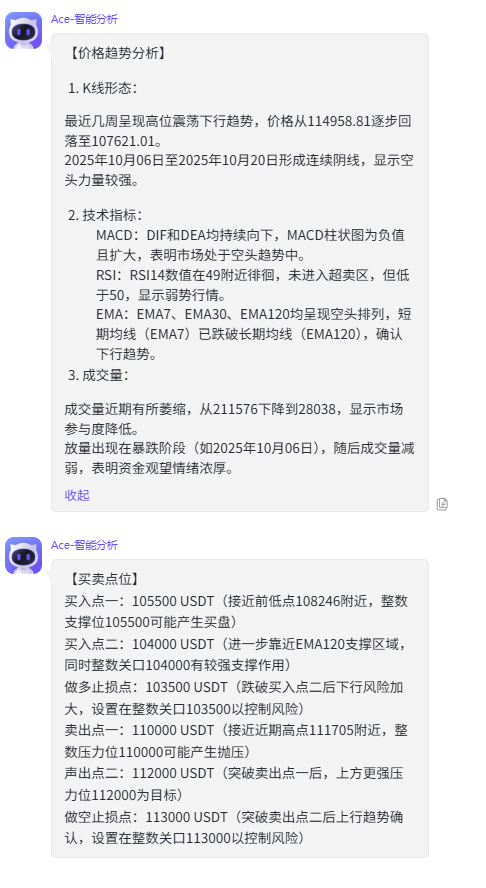

Short-term traders: They can look for long opportunities near key support levels, as the reduced liquidation risk has improved the safety of the trading environment. Set stop-loss orders to capture rebound profits.

Long-term investors: They should view this as a positive "bottoming signal." A "dollar-cost averaging" strategy can be adopted to gradually build or increase core positions. The market's focus will return to spot demand, ETF capital flows, and industry fundamentals.

Join our community to discuss and grow stronger together!

Official Telegram Community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。