The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

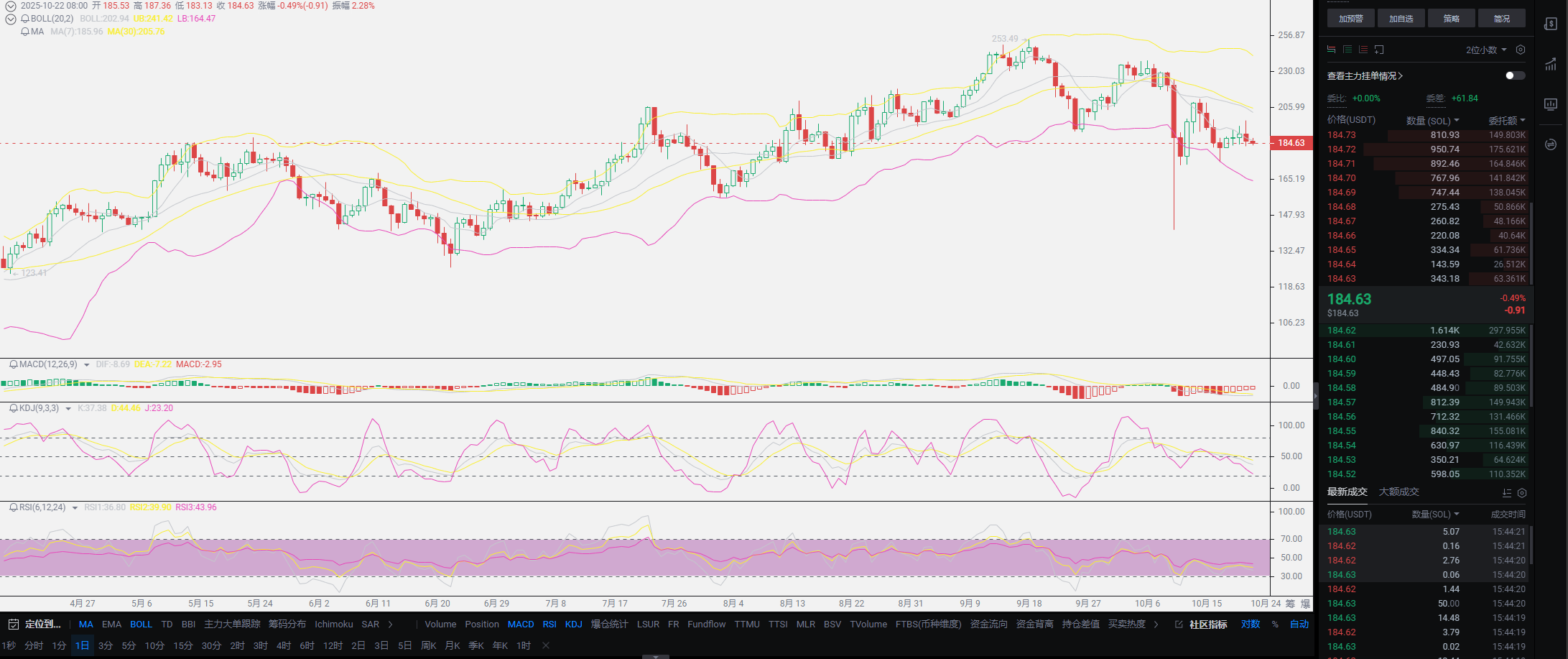

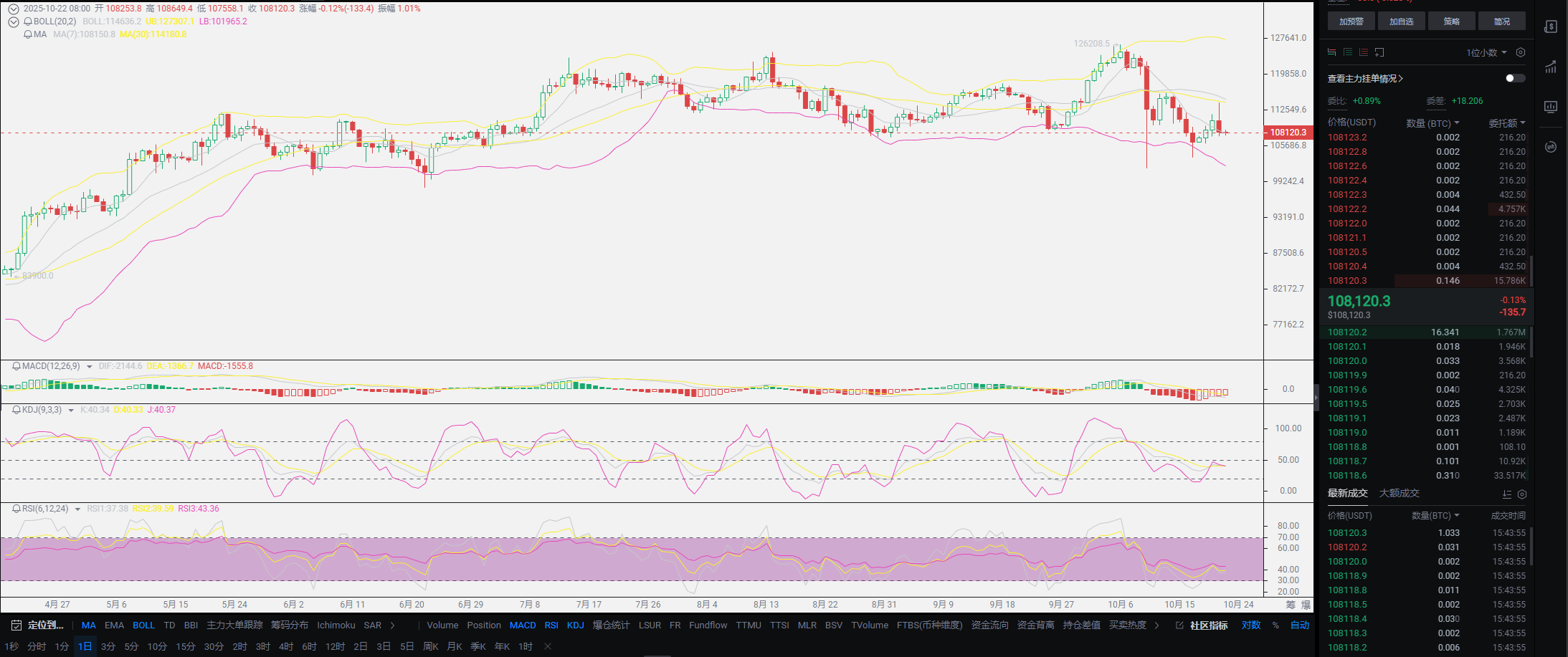

After discussing the overall trend, we cannot neglect the short-term movements. Today, I will talk about short-term trends. Following yesterday's failed surge in Bitcoin, the short-term has once again entered a bearish zone. The current trend is becoming increasingly difficult to understand; it seems that every time the market attempts to break through, there is significant selling from large funds, indicating some manipulation behind the scenes. However, today's data is actually very optimistic, as Bitcoin's contract positions have decreased by 30%. Through the previous washout, retail investors' positions have almost been cleared, which is a signal for growth. This signal, however, does not have much effect for contract users, as we cannot guarantee whether there will be another dip before an upward movement. Lao Cui finds it difficult to provide an answer to this question, but it can be almost confirmed that as long as there are no negative news impacts, it is hard for the market to drop below the previous new low of Bitcoin, which is 101516. Even if it does drop, it will only be in the form of a spike.

The above speculation is based on the current market feedback, so it should not be taken as a reference. This year's predictions have encountered issues, with the biggest variable being Trump; we cannot predict the future tariff issues. Looking at the overall direction, Lao Cui is confident about future growth, and it is highly likely that we will return to new highs. The remaining issue is about the balance sheet reduction. Many friends have different views from Lao Cui regarding the risk attributes in the cryptocurrency circle. It is important to understand that once the balance sheet reduction ends and expansion begins, capital will definitely choose to invest in low-risk asset markets, such as gold and energy. In Lao Cui's view, the cryptocurrency market has precisely avoided this choice and is considered a high-risk investment product. While stablecoins belong to the low-risk investment category, they are pegged to the US dollar and US Treasury bonds, which, after expansion, become a depreciating option. Capital will not favor the stablecoin market, so Lao Cui is not optimistic about large inflows of funds.

If expansion begins, it indicates a decline in government bond yields. According to traditional finance, dollar-denominated assets will appreciate. However, the cryptocurrency market is a fascinating existence, more akin to speculation, especially under the premise of the US stock and gold markets. It is worth pondering what large funds will get involved. Although these two markets are highly correlated, the decision-making ability of large funds is not something we can predict. Including the current state of the cryptocurrency market, how high is the bubble? These are unverifiable data, and we can only rely on everyone's guesses to estimate. The bubble attribute certainly exists, without a doubt. So, looking back at the short-term trend, we are still in a situation without large fund inflows, which will reach a delicate balance. There are significant positive news expected in the future, but the market also needs to pull back to clear out retail investors.

This is also a test for the market makers: how to clear out retail investors while maintaining their own chips? This requires market makers to calculate their costs, which is why every breakthrough encounters resistance. To seek a breakthrough in the short term, there can only be large fund involvement, which requires a boost from interest rate cut expectations. If next Monday only brings interest rate cuts without ending the balance sheet reduction and lowering deposit rates, then for the cryptocurrency market, speculation on interest rate cuts will lead to another downturn. The current balance of funds is largely due to the support from platforms and market makers, who want to go down but cannot drop too harshly; the concentration of chips increases the cost of holding. This is the short-term game; even if everyone knows that the future is a growth state, for contract users, it is about seizing this slim chance. If this is Lao Cui's choice, it is more about entering at the low point.

The current market is in a state of tug-of-war between bulls and bears. Once the game ends, the trend will officially begin. Lao Cui is clearly on the bullish side, and there is no reason to sell short based on the signals given to Lao Cui. I vaguely remember a certain investment mogul saying that buying stocks is like buying a company, just buying a part or the whole. Lao Cui's understanding of this statement is also very simple: if you are optimistic about a company, you are optimistic about its future profitability and whether its future stock price meets your return expectations (such as a 30% annual compound return). It is not about hearing some news or that a certain expert says it will rise soon, or that everyone is optimistic about this company. Investment is a long-term matter, but the cryptocurrency market divides it into two: long-term investments in spot and short-term contract speculation. Therefore, doing well in contracts is extremely difficult. A large part of the reason Lao Cui can profit is due to encountering a period of rapid growth in the cryptocurrency market, not personal ability.

Simply put, as long as you are willing to buy spot, during the period from 2010 to 2019, anyone who bought and held until now is at a low stage; this is an era of information disparity, and such investments cannot be attributed to personal ability. However, for contracts, there is no single contract that can be held until now. This is not to belittle contracts, but the nature of contracts is such that they have high holding costs, and you cannot bear the fees. At this point, Lao Cui hopes that those doing contracts can have a clear understanding: contracts are just a stage for accumulating chips. Once the original accumulation is completed, you need to reduce your dependence on contracts. During the 2016-2019 period, Lao Cui's understanding of contracts was also very extreme, thinking it was an opportunity to cross classes. The current understanding is that it provides an opportunity for you to cross while also giving you a fast track to lower your class. This is a double-edged sword, so everyone must grasp it properly and not try it lightly.

Lao Cui summarizes: For short-term contract users, you can ignore the impact of trend levels in the short term, as the market makers are currently more inclined towards bearish trends. If you are only doing short-term contracts, you must build positions around short positions, and once profits reach about 50%, you should take profits promptly. Try not to hold positions for more than a day; the sooner, the better. The depth of the current downward breakthrough will not be too deep; it will only give you an opportunity for one trade, so accumulate slowly. This process tests one's inner strength. The timing for building positions has also been given to everyone: Bitcoin's daily new low is above 2000 points, and Ethereum is above 150 points; profits are only half of the trend. This bearish trend will not last too long, and we are about to enter speculation on interest rate cuts. If you are investing based on a week’s time frame, you need to focus on being bullish at this stage. Do not confuse this concept; bullish and bearish do not conflict because the short-term will show bearish trends every day, but it will not break through the highs. Therefore, within a day, there will definitely be a downturn. However, if you are doing contracts based on a weekly trend, the high point next week will definitely be higher than this week. So, as long as your holding time is estimated to be two days or even a week, you must go long. The increase in time cost will definitely increase returns. If you cannot grasp this scale well, you can discuss it with Lao Cui in detail, and do not hold onto losing positions; correct mistakes when they occur! Remember one thing, the big trend does not determine the daily trend! The current price is such that if you can go long, you cannot go short! For those who want to short, you can wait until after the upward movement!

Original article created by WeChat Official Account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one square, aiming for the final victory, while the novice fights for every inch, frequently switching between bullish and bearish, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。