This marks the official transition of JST from "fully circulated distribution" to a new development stage of "sustainable deflation."

The core DeFi protocol of the TRON ecosystem, JustLend DAO, has reached a milestone moment with the successful completion of the first large-scale destruction of JST. This signifies the official shift of JST from "fully circulated distribution" to a new development stage of "sustainable deflation."

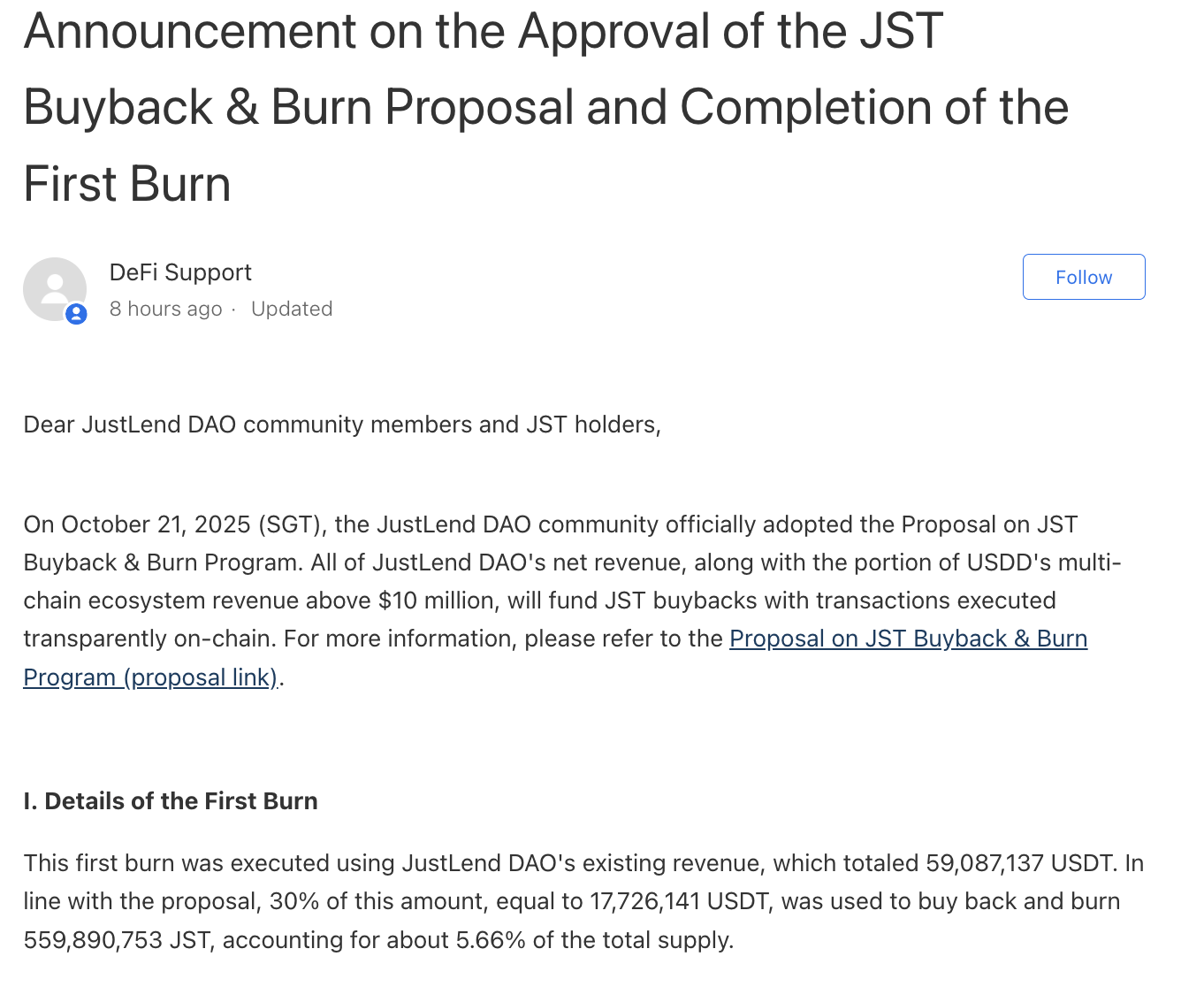

According to the latest destruction announcement, JustLend DAO has extracted over 59 million USDT in existing earnings, and for the first time, 30% of this amount has been destroyed, totaling approximately 560 million JST. This destruction accounts for 5.6% of the total supply of JST. The remaining 70% of the existing earnings will be distributed over four quarters and has already been deposited into the USDT lending market of JustLend DAO's SBM for interest generation.

The first round directly destroys 5.6% of the total supply, igniting enthusiasm in the crypto community and eliciting a positive market response.

More importantly, this repurchase and destruction is not merely a short-term stimulus but the starting point of JST's "long-term deflation model" based on real ecological earnings. From the approximately 60 million US dollars of existing earnings from JustLend DAO to the continuous injection of incremental earnings from the USDD multi-chain ecosystem in the future, and the value support of the entire JUST ecosystem, JST is gradually forming a positive cycle of "ecological profit-driven deflation → deflation enhancing scarcity → scarcity boosting value → value feeding back into the ecosystem." As the ecological details continue to be implemented, the long-term value and growth potential hidden behind JST are becoming increasingly clear.

Repurchase and destruction are being implemented in an orderly manner: the first round of destruction accounts for 5.6% of the total supply, with over 41 million US dollars in earnings still to be destroyed.

The repurchase and destruction mechanism initiated by JST demonstrates unique competitiveness. It does not rely on short-term, one-time financial subsidies for maintenance but is rooted in the real business profits of the two ecological pillars, JustLend DAO and USDD. By directly linking the value of JST with ecological earnings and employing a clever design of "existing earnings as a base, incremental earnings as a continuation," it ultimately establishes a clear and sustainable long-term deflationary closed loop, fundamentally distinguishing it from the common "flash-in-the-pan" short-term repurchase behaviors in the crypto market.

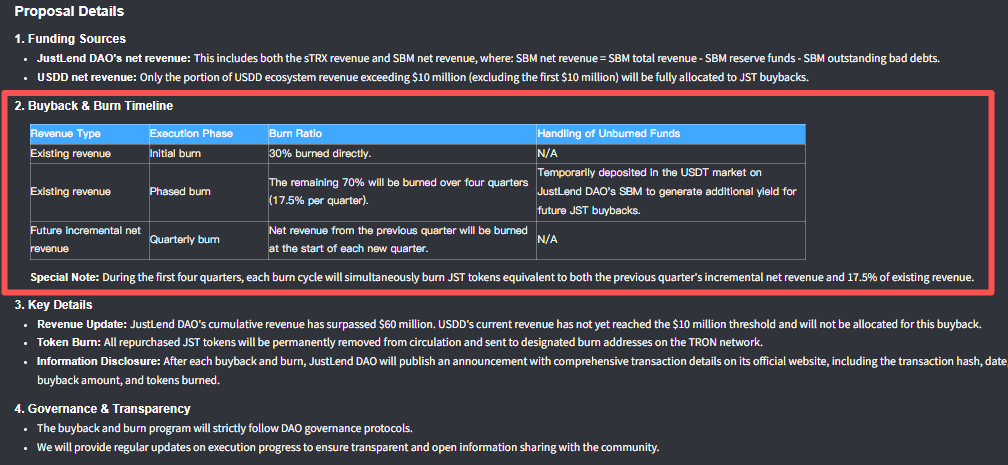

In terms of funding sources, the funds for JST repurchase are transparent and possess strong sustainability. They precisely focus on the profitability of the two core components of the JUST ecosystem: "JustLend DAO and USDD," eliminating the risk of "robbing Peter to pay Paul," fundamentally ensuring the stability of the deflation mechanism.

Specifically, the funds are divided into two categories: one is the existing and future net income of JustLend DAO, covering "existing earnings + future incremental earnings"; the other is the incremental earnings from the USDD multi-chain ecosystem after surpassing 10 million dollars, both of which will be fully directed into JST repurchase and permanently destroyed. This design deeply links the value of JST with the earning capacity of JustLend DAO (the core lending protocol of the TRON ecosystem) and USDD (the second-largest stablecoin on TRON), forming a virtuous cycle of "the more prosperous the ecosystem → the higher the business profits → the stronger the deflationary force," laying a logical foundation for the long-term value growth of JST.

According to previous proposal announcements, the JustLend DAO platform has accumulated existing earnings of approximately 60 million dollars, which will be fully injected into the JST repurchase and destruction in batches; the incremental earnings from the USDD ecosystem will only join the repurchase and destruction queue after surpassing the 10 million dollar threshold, providing additional momentum for long-term deflation.

In the implementation phase of the destruction, JST adopts a rhythm of "existing earnings being gradually and orderly released, and incremental earnings being continuously and stably injected." This strategy effectively avoids market short-term speculation caused by one-time large-scale destruction, ensures the impact of short-term deflation, and reserves "compound growth space" for the long-term reduction process.

Regarding existing funds, the JustLend DAO platform has extracted over 59 million USDT in earnings. According to the destruction announcement, for this portion of funds, a rhythm of "30% as the first batch of destruction funds + 70% gradually destroyed quarterly" has been adopted.

Currently, the first batch of JST destruction has been successfully completed. According to TRONSCAN data, 30% of JustLend DAO's existing earnings have been successfully destroyed, corresponding to approximately 560 million JST, which accounts for over 5.6% of the total supply of JST. This first round of destruction has wiped out over 5.6% of the total supply, a rare move among many projects in the crypto world, fully demonstrating the team's and community's firm determination to promote the long-term value growth of JST.

The remaining 70% of JustLend DAO's existing earnings will be used for JST repurchase and destruction in batches at a rate of 17.5% per quarter over the next four quarters, until the fourth quarter of 2026. Currently, this portion of funds is deposited in the USDT market on JustLend DAO's SBM in the form of jUSDT for interest generation, and subsequent earnings will be used for JST repurchase and destruction.

In terms of incremental funds, the new net income of JustLend DAO each quarter will be fully included in the repurchase pool; once USDD's profits exceed the 10 million dollar threshold, its incremental earnings will also be injected into the repurchase pool. This means that as the business scale of the dual ecosystems (such as the lending TVL of JustLend DAO and the circulation of USDD) continues to expand, the deflationary momentum of JST will continue to strengthen, completely eliminating the issue of "insufficient subsequent momentum."

The repurchase and destruction work for each subsequent quarter will be specifically operated by JustLend Grants DAO, with clear and defined execution rules: at the beginning of each of the first four quarters, destroy "the incremental net income of JustLend DAO from the previous quarter + 17.5% of existing earnings." This "small amount, high frequency" operational model ensures the sustainability of deflation while smoothing market expectations, laying the foundation for JST's long-term deflation.

In addition to executing the repurchase and destruction, Grants DAO itself is also the JST incentive and ecological empowerment institution led by the JustLend DAO community, with the core mission of empowering developers, contributors, and all ecological construction projects through diversified means while maintaining market stability. As a core accelerator of the ecosystem, it benefits all participants, including JST holders, voters, and liquidity providers, by injecting the JUST ecosystem reserve funds and partner funds into the Grants Pool. Currently, the Grants DAO treasury has a fund reserve of approximately 130 million dollars, providing solid support for the long-term development of the JustLend DAO ecosystem.

The implementation of this deflationary closed loop marks the official transition of JST from "fully circulated tokens" to "continuously shrinking value assets." The first batch of destruction exceeding 5.6% of the total supply is just the starting point. As existing funds are released in batches and incremental funds are continuously injected, the cumulative destruction will exceed 20% of the total supply.

JustLend DAO and USDD's ecological earnings work together to drive JST's value growth.

Of course, the value growth of JST does not rely solely on the logic of deflation but is deeply supported by the entire JUST ecosystem's "full-chain value closed loop" — the synergistic profit empowerment of the two core components, JustLend DAO and USDD, not only provides continuous funding for the deflation mechanism but also constructs a complete transformation path from "deflationary reduction" to "value enhancement."

As the core DeFi system of the TRON ecosystem, JUST has built a "lending + staking + energy leasing" composite service system around the core lending protocol JustLend DAO, while also expanding a matrix of comprehensive DeFi products such as the stablecoin USDD and cross-chain JustCrypto, providing systemic ecological support for JST's transformation from "deflation mechanism implementation" to "substantial value enhancement."

Among them, JustLend DAO, as the core pillar of the JUST ecosystem, has long completed the strategic upgrade from a single lending protocol to a comprehensive service platform, evolving into a multifunctional DeFi platform that integrates lending markets (SBM), liquid staking (sTRX), and energy leasing (Energy Rental). This means that JustLend DAO's profitability does not rely on a single lending business but builds a multi-layered income structure through diversified businesses, significantly enhancing its risk resistance and growth potential compared to similar protocols. The diversity of this profit model and the stability of its market position ensure that the "fund pool" for JST's deflation will continue to be filled.

This can be clearly evidenced by the operational data of JustLend DAO. As of October 21, the total locked value (TVL) of the JustLend DAO platform has surpassed 7.62 billion dollars, with a user base of 477,000, firmly maintaining its position as the leading DeFi protocol in the TRON ecosystem. Even in the global lending sector, JustLend DAO, with the advantage of single-chain deployment, has consistently ranked among the top four in the industry in terms of TVL, firmly positioned in the "first tier of lending DeFi protocols."

In terms of profitability, the feasibility of JustLend DAO's business model has been fully validated through long-term operational data. According to the disclosed destruction data, JustLend DAO has extracted approximately 59 million dollars in cumulative platform earnings; according to DeFiLlama data, the fees captured in Q3 of this year approached 2 million dollars, with daily earnings exceeding 20,000 dollars and maintaining a steady growth trend. This level of profitability means that even without considering existing funds, the incremental income alone can support a repurchase scale of nearly 6 million dollars per month, providing sustainable funding assurance for JST's long-term deflation and serving as "bottom-line funding" for long-term deflation.

At the same time, USDD, as the decentralized stablecoin launched by JUST, constitutes the "second profit engine" of JST's deflation mechanism. According to the mechanism design, when the USDD multi-chain ecosystem's profits exceed the 10 million dollar threshold, the excess earnings will be directed into the JST repurchase fund pool.

As the second-largest stablecoin in the TRON ecosystem, USDD is accelerating towards the 10 million dollar profit threshold through diversified profit models such as "excess collateral asset interest income" and "cross-chain transfer fees." Currently, USDD has completed multi-chain deployment, successfully expanding to mainstream public chains such as Ethereum and BNB Chain, with a circulation exceeding 450 million dollars. This means that as the circulation scale of USDD expands, its application scenarios are extending from basic trading mediums to DeFi collateral, payment tools, and more, and it is expected to become an important source of JST deflationary funds in the future.

From the overall scale of the JUST ecosystem, its total locked value (TVL) has reached 12.2 billion dollars, directly accounting for 46% of the total locked value across the TRON network. This means that nearly half of the assets on the TRON chain actively choose to settle within the JUST ecosystem. This overwhelming scale is no coincidence; it intuitively confirms the market's high trust and broad recognition of the JUST ecosystem, and it also signifies that it possesses the core capability of "continuously generating large-scale stable income." In the future, every lending operation, staking action, or cross-chain transaction within the ecosystem may ultimately translate into actual earnings for JustLend DAO or USDD, and these earnings will directly become the core funding pool for JST repurchase and destruction, solidifying the "fundamental base" of the deflation mechanism.

What is even more promising is that the growth momentum of the JUST ecosystem has not slowed down; instead, it continues to strengthen — the business expansion of JustLend DAO and USDD is accelerating. The TVL scale and market share of both are steadily rising, and the corresponding earnings volume will also expand simultaneously, undoubtedly injecting stronger financial support into the JST deflation mechanism, ultimately forming a virtuous cycle of "ecological prosperity → earnings growth → accelerated deflation → value enhancement," providing a solid foundation for the long-term value growth of JST at the ecological level.

Resonance of the deflation mechanism and ecological earnings opens a new channel for JST's value growth

With the official implementation of the first round of JST repurchase and destruction, the large-scale deflation process has been fully initiated. Currently, the deflation mechanism of JST resonates with the positive cycle of JustLend DAO and USDD, mutually reinforcing each other. This combined force is expected to directly propel JST into a new price increase channel.

The JST token achieved 100% full circulation in Q2 2023, with a total issuance fixed at 9.9 billion tokens, and there is no future unlocking pressure. This characteristic means that every repurchase and destruction is a real reduction of the "actual circulating supply," rather than a nominal adjustment of numbers, making the deflation effect pure and direct.

In terms of the scale of destruction, the first round destroyed approximately 560 million JST, resulting in a one-time reduction of over 5.6% of the total supply. With the continued progress of subsequent quarterly repurchases, relying solely on the existing earnings of JustLend DAO, the cumulative deflation ratio will approach 20%. The continuous reduction in circulation will significantly enhance the scarcity of the token, thereby providing strong support for the price of JST.

It is particularly noteworthy that the high proportion of destruction of JST is especially prominent in the industry. Currently, the market capitalization of JST is only about 300 million dollars, while JustLend DAO's single platform has 60 million dollars in existing earnings, which is equivalent to 20% of JST's market capitalization. In comparison to similar tokens in the crypto market, most repurchase and destruction plans have a funding ratio of less than 5% (for example, Aave's repurchase fund announced in March this year was only 24 million dollars), making JST's over 20% destruction rate a "benchmark in the industry." More critically, this ratio does not yet account for the future incremental earnings that will continue to be generated; as the profitability of JustLend DAO and USDD ecosystems grows, the deflation effect will further amplify.

Looking further into the product fundamentals, as TRON founder Justin Sun previously pointed out, the product support logic behind JST has undergone a fundamental transformation. It is no longer a single lending tool but a comprehensive DeFi platform that integrates multiple functions such as "lending (comparable to Aave), stablecoins (comparable to MakerDAO), and staking (comparable to Lido)," effectively condensing the core competitive advantages of three leading products in the industry into one, with fundamental strength far exceeding that of similar single protocols.

Especially as the core support of JST, JustLend DAO, which was launched in 2020 as an established DeFi protocol, has achieved significant breakthroughs on the business front through long-term accumulation: from the initial single lending, it has gradually expanded to staking, energy leasing, and innovative GasFree features, building a diversified income structure, enhancing both risk resistance and profit potential; in terms of secure operations, it has maintained a robust operational record with zero security incidents, a reliability that is particularly rare in the industry.

At the same time, JustLend DAO also receives strong support from the complete TRON ecosystem — including the world's largest USDT circulation center and a user base of over 340 million, among other core resources. These advantages not only provide underlying support and value amplification space for its diversified business but will also continuously translate into core value support for the JST token, solidifying its long-term growth foundation.

While most crypto projects are still indulging in short-term benefits and chasing market hotspots, JST has solidified its long-term deflation logic through the "repurchase and destruction mechanism." It relies on the dual profit engines of JustLend DAO and USDD, along with the full-chain support of the JUST ecosystem, ultimately carving out a differentiated development path centered on "value-driven" principles, standing in stark contrast to the market's short-term profit-seeking behaviors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。