A sharp rebound in investor appetite sent crypto exchange-traded funds (ETFs) soaring on Tuesday, Oct. 21, with both bitcoin and ether funds bouncing back decisively from Monday’s outflows. The wave of capital inflows hinted at returning conviction in digital assets as traders stepped back into the market after a brief pause.

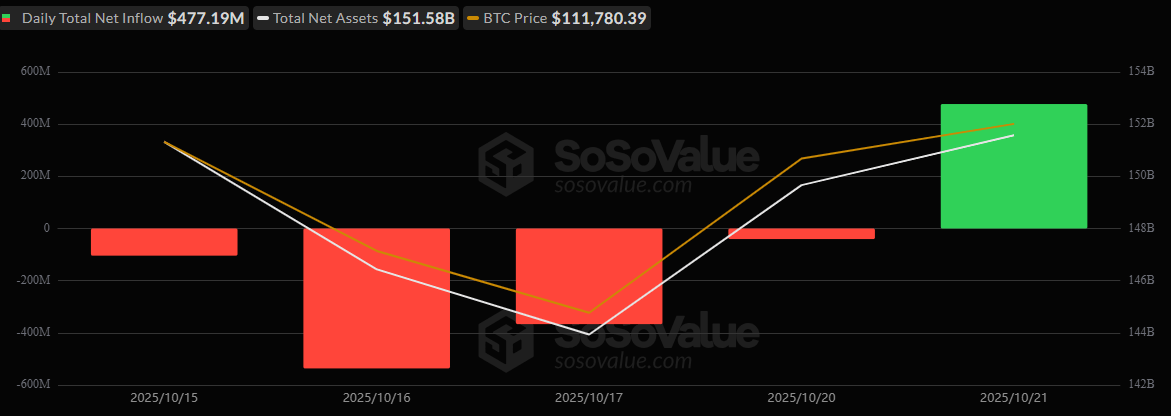

Bitcoin ETFs dominated the day’s narrative with a $477.19 million inflow, snapping a short-lived outflow streak. Institutional titan Blackrock’s IBIT captured nearly half the total with a $210.90 million surge, reaffirming its leadership position. Ark & 21shares’ ARKB followed with a robust $162.85 million, while Fidelity’s FBTC drew in $34.15 million.

Additional inflows came from Bitwise’s BITB ($20.08 million), Vaneck’s HODL ($17.41 million), and Grayscale’s Bitcoin Mini Trust ($13.86 million). The rally extended to Invesco’s BTCO ($8.92 million), Franklin’s EZBC ($6.48 million), and Valkyrie’s BRRR ($2.53 million), with not a single fund seeing red. Total trading volume surged to $7.41 billion, lifting net assets to $151.58 billion.

Bitcoin ETFs bounce back after four days of outflows. Source: Sosovalue

Ether ETFs mirrored the optimism, logging $141.66 million in net inflows. Fidelity’s FETH led with $59.07 million, followed by Blackrock’s ETHA at $42.46 million. Grayscale’s Ether Mini Trust ($22.58 million), ETHE ($13.14 million), and Vaneck’s ETHV ($4.40 million) rounded out a day of across-the-board gains. Total trading volume reached $3.17 billion, and net assets climbed to $27.17 billion.

After a choppy start to the week, Tuesday’s performance suggests investors aren’t done betting on digital assets just yet, and the inflow momentum could be a sign of what’s to come.

FAQ

What drove the strong ETF inflows on Oct. 21?

Renewed investor confidence and a rebound in crypto sentiment fueled major inflows into bitcoin and ether ETFs.How much did Bitcoin ETFs gain?

Bitcoin ETFs attracted $477 million in net inflows, led by Blackrock’s IBIT and ARK 21shares’ ARKB.What was the performance of Ether ETFs?

Ether ETFs brought in $142 million, with Fidelity’s FETH and Blackrock’s ETHA leading the charge.What does this mean for the crypto market?

The surge signals returning institutional demand and growing optimism for digital asset recovery.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。