It's time to upgrade the financial system, rebuild global payment channels, and create the internet that the world deserves.

Written by: Daren Matsuoka, Robert Hackett, Jeremy Zhang, Stephanie Zinn, and Eddy Lazzarin

Translated by: Luffy, Foresight News

The year 2025 marks a year when global assets move on-chain.

When we released the first edition of the State of Crypto Report, the industry was still in its adolescence, with the total market capitalization of cryptocurrencies only half of what it is today, and blockchain technology was slower, more expensive, and less reliable.

Over the past three years, developers in the crypto industry have withstood the dual pressures of significant market corrections and regulatory uncertainties, continuously advancing infrastructure upgrades and technological breakthroughs. These efforts have brought us to today: cryptocurrencies have become an indispensable part of the modern economy.

The core narrative of the cryptocurrency industry in 2025 is maturity. In short, cryptocurrencies have grown up:

Traditional financial giants (such as Visa, BlackRock, Fidelity, and JPMorgan) and tech challengers (such as PayPal, Stripe, and Robinhood) are launching or preparing cryptocurrency products;

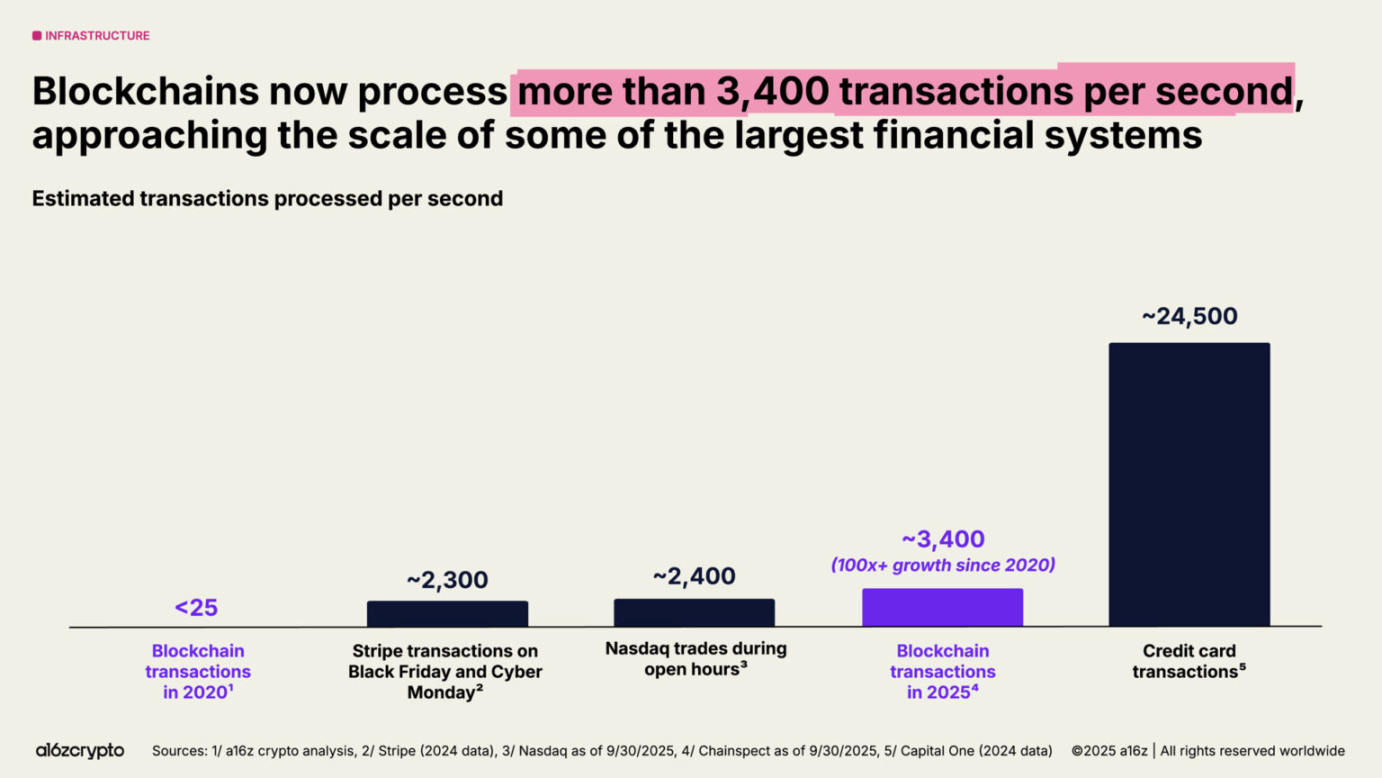

Blockchain transaction volume has surpassed 3,400 transactions per second, growing more than 100 times compared to five years ago;

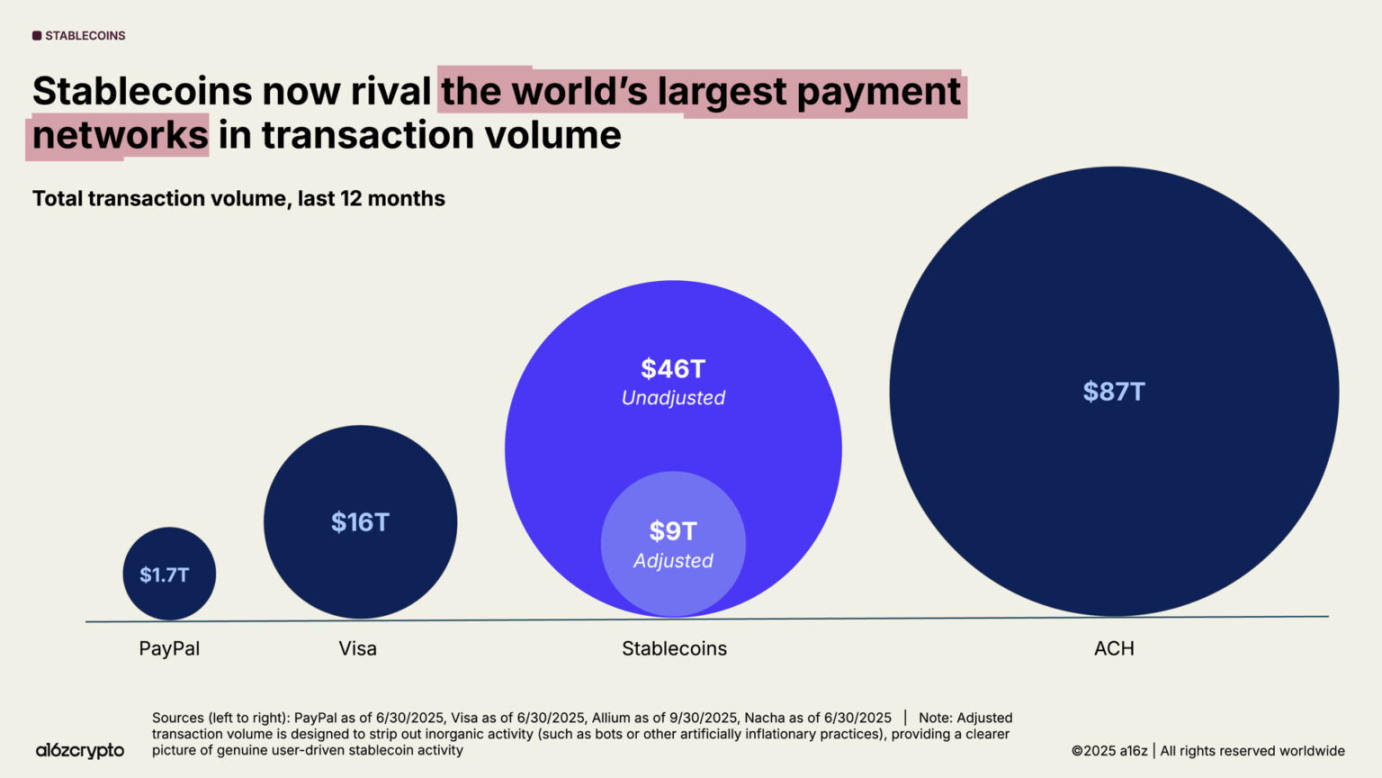

The annual transaction volume of stablecoins reached $46 trillion (adjusted to $9 trillion), rivaling Visa and PayPal;

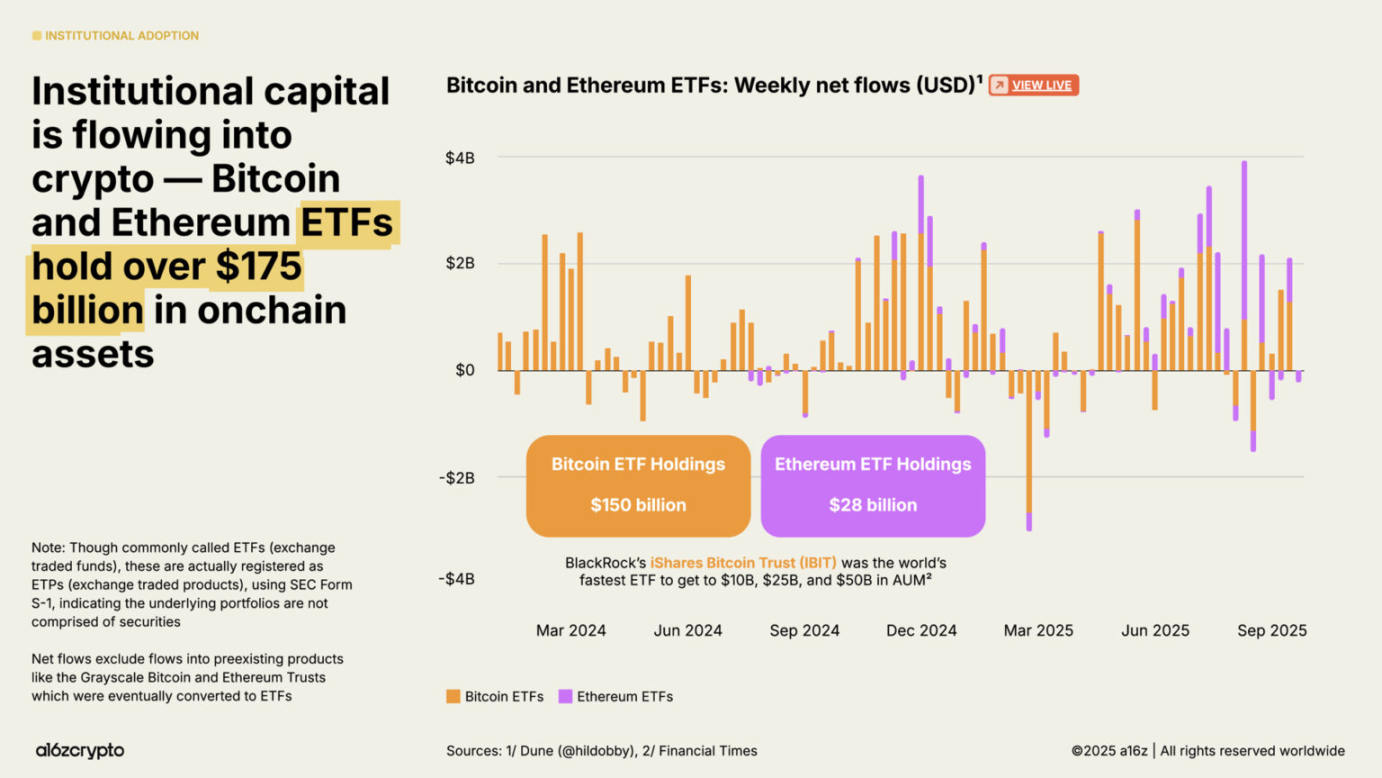

The holdings of Bitcoin and Ethereum exchange-traded products (ETPs) exceed $175 billion.

Our latest State of Crypto Report delves into this transformation in the industry, covering key trends such as institutional adoption, the rise of stablecoins, and the integration of cryptocurrencies with artificial intelligence. Additionally, we are launching the cryptocurrency status dashboard (https://stateofcrypto.a16zcrypto.com/) for the first time—this is a new data exploration tool that tracks industry developments in real-time through core metrics.

The cryptocurrency market is vast, global, and continuously growing

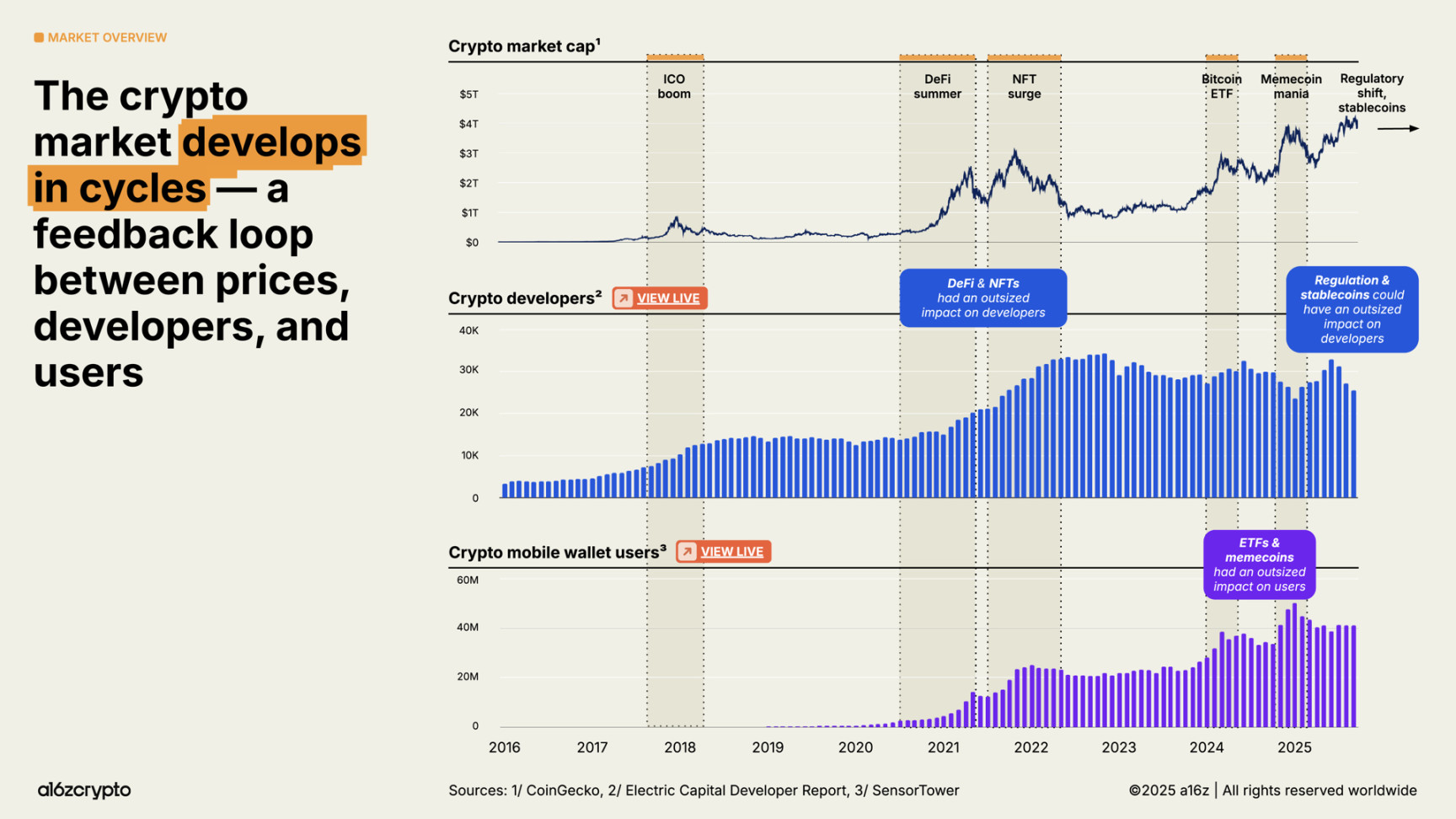

In 2025, the total market capitalization of cryptocurrencies will surpass $4 trillion for the first time, marking the industry's comprehensive development. The number of cryptocurrency mobile wallet users has also reached a historic high, growing 20% compared to last year.

The shift from regulatory hostility to regulatory support, combined with the acceleration of stablecoin applications, the tokenization of traditional financial assets, and the emergence of new use cases, will collectively define the next cycle of the industry.

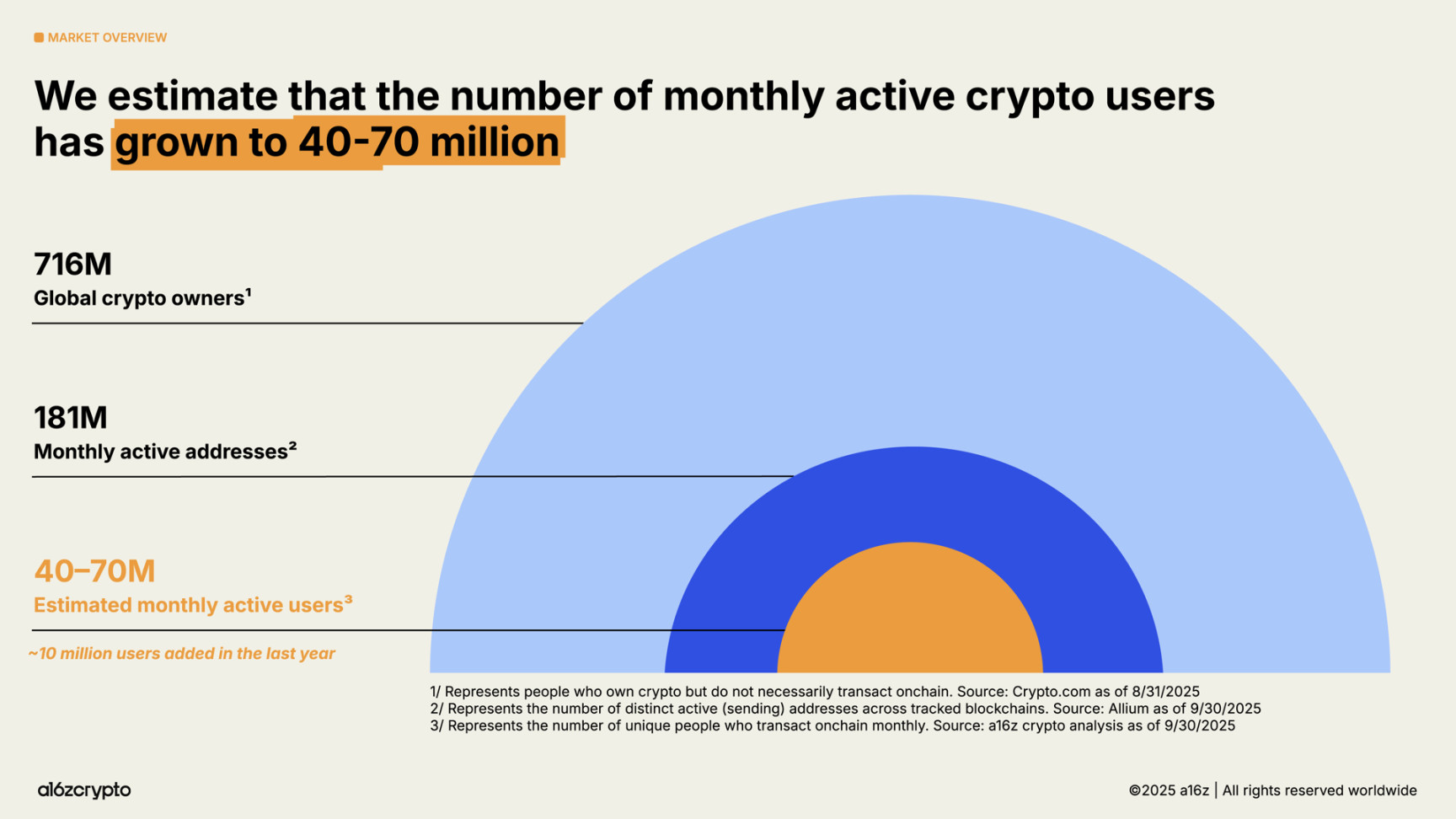

According to our latest analysis, the current number of active cryptocurrency users is approximately 40 million to 70 million, an increase of about 10 million from last year.

This number is just a small fraction of the total number of cryptocurrency holders (approximately 716 million, a 16% increase from last year) and is far lower than the number of monthly active addresses on-chain (approximately 181 million, an 18% decrease from last year).

The gap between passive holders (those who hold cryptocurrencies but do not engage in on-chain transactions) and active users (those who regularly conduct on-chain transactions) presents an opportunity for cryptocurrency developers to reach more potential users who already hold cryptocurrencies but have not actively participated.

So where are these crypto users, and what are they doing?

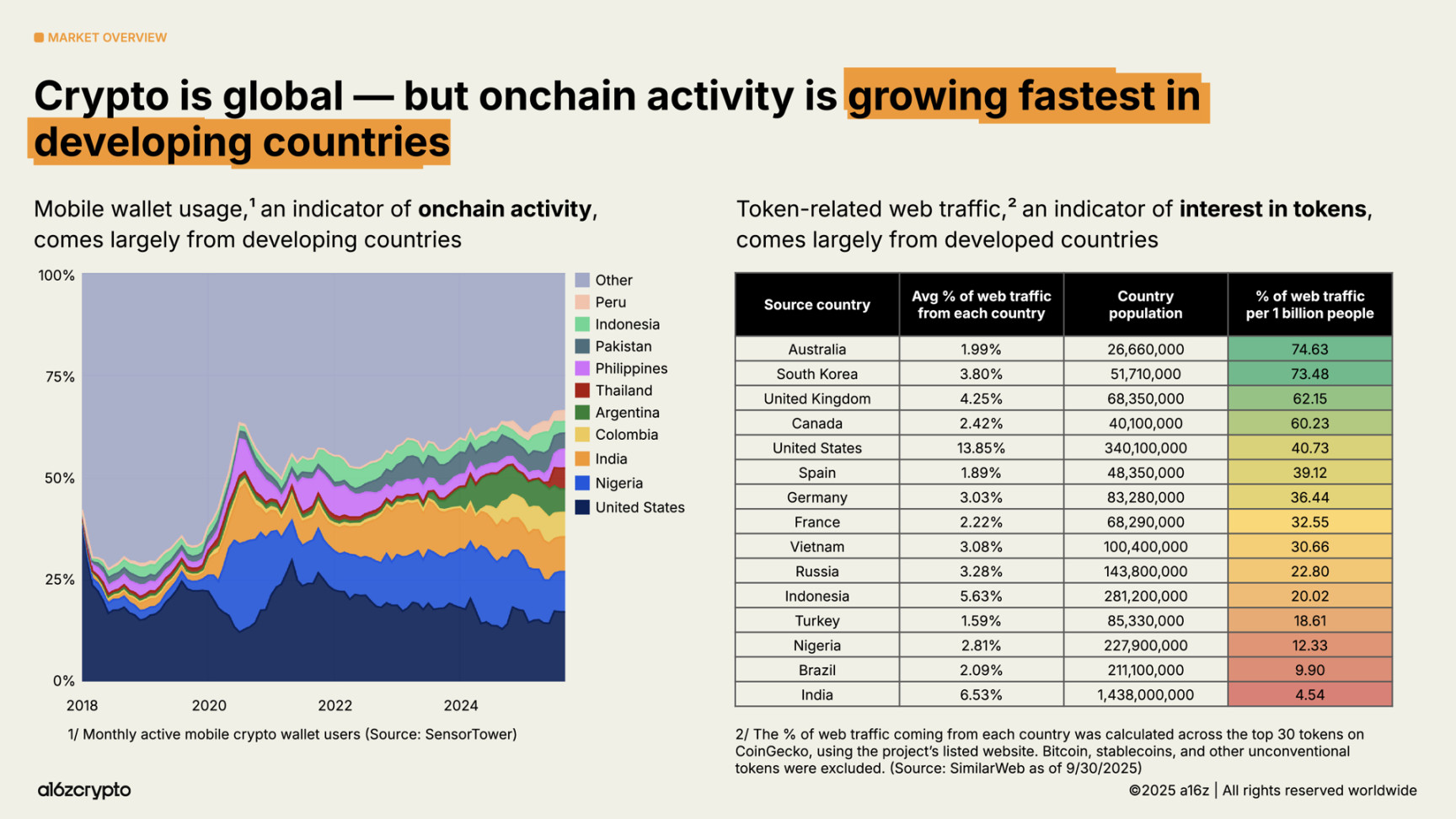

Cryptocurrency applications are global, but there are significant differences in usage scenarios across different regions. The usage rate of mobile wallets (an indicator of on-chain activity) is growing fastest in emerging markets such as Argentina, Colombia, India, and Nigeria. Particularly in Argentina, due to the escalating currency crisis, the usage rate of crypto mobile wallets has increased 16 times over the past three years.

Meanwhile, our analysis of the geographical sources of token-related network traffic shows that interest in tokens is more pronounced in developed countries. Compared to user behavior in developing countries, activities in these countries (especially Australia and South Korea) may be more focused on trading and speculation.

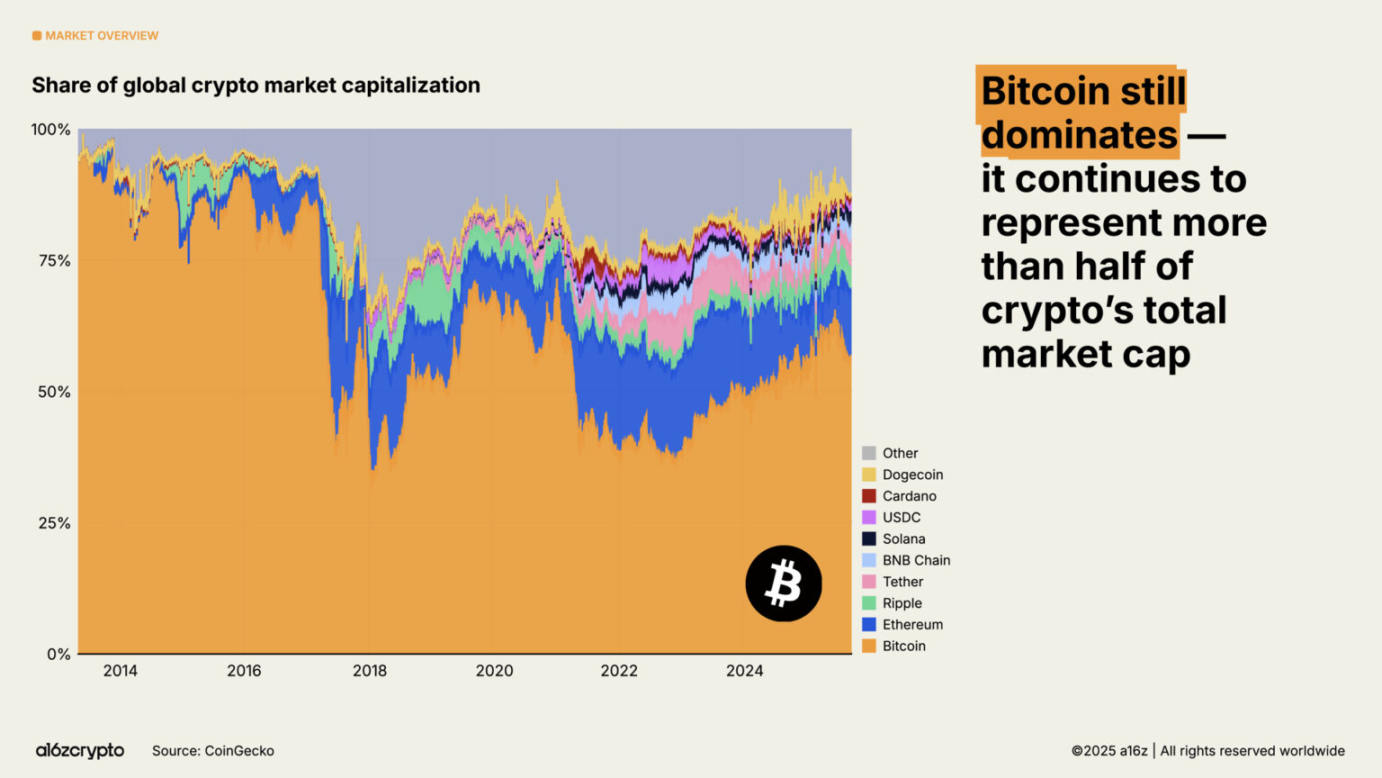

Bitcoin still accounts for half of the total market capitalization of cryptocurrencies, with its value storage properties recognized by investors, reaching a historic high of over $126,000. Meanwhile, Ethereum and Solana have also regained much of the ground lost since 2022.

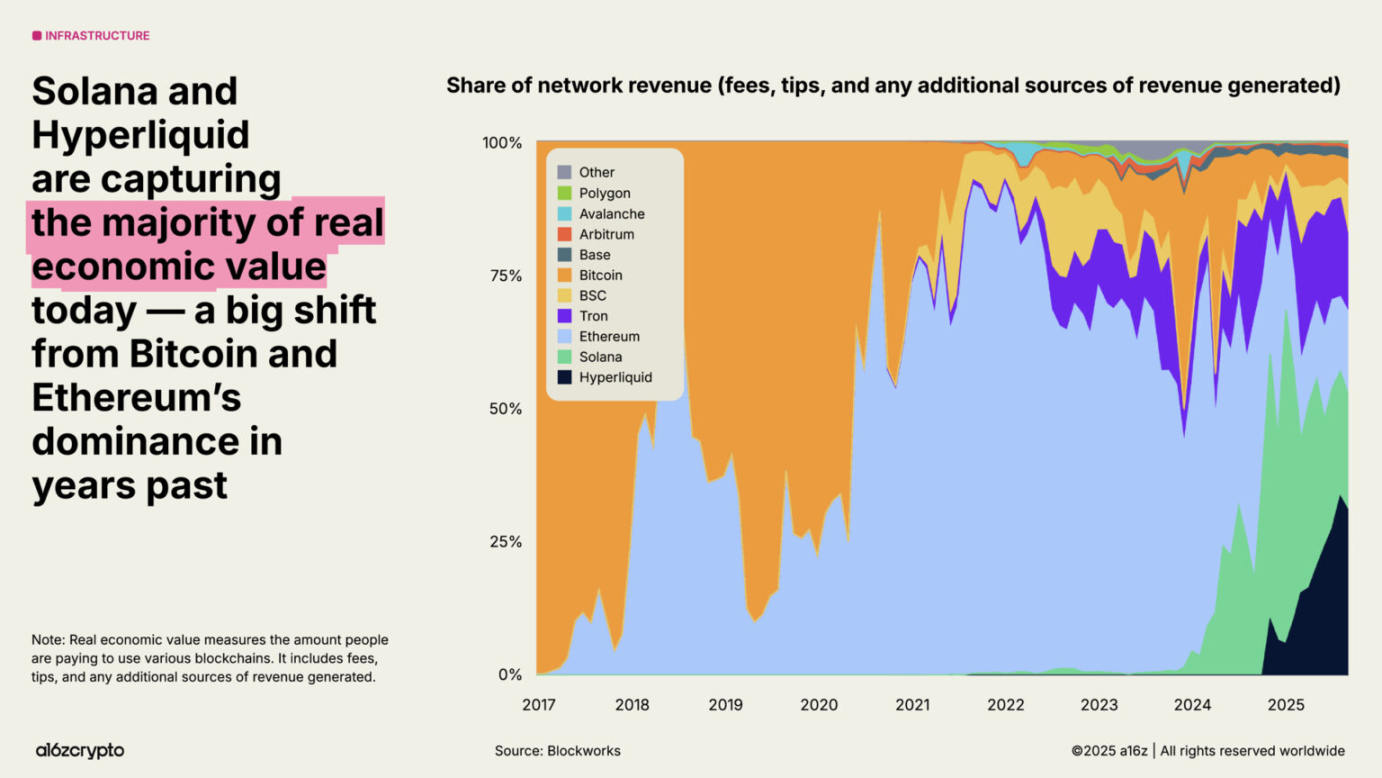

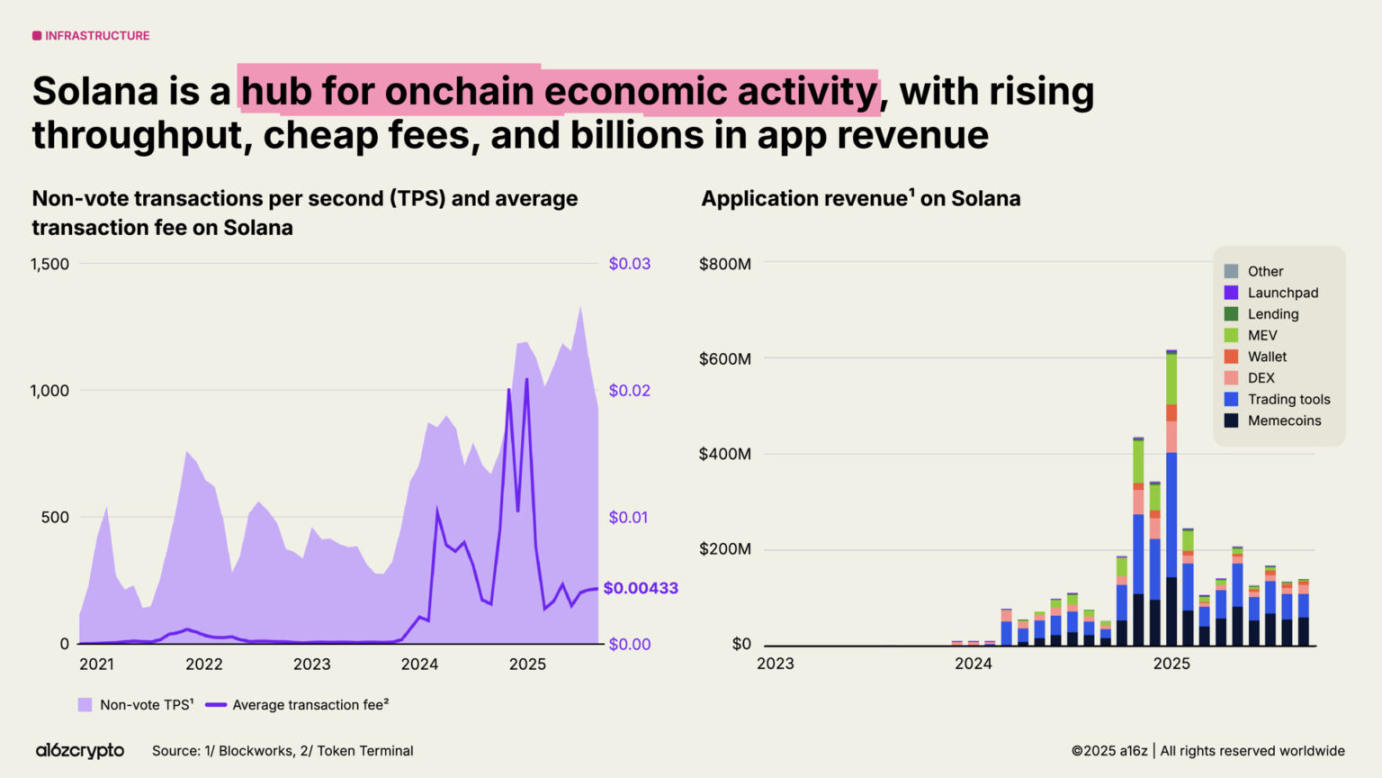

As blockchain continues to scale, the fee market matures, and new applications emerge, the actual economic value (measuring the real cost users incur for using blockchain payments) becomes a more important metric. Currently, Hyperliquid and Solana contribute 53% of revenue-generating economic activity—this marks a significant shift from previous years when Bitcoin and Ethereum dominated the market.

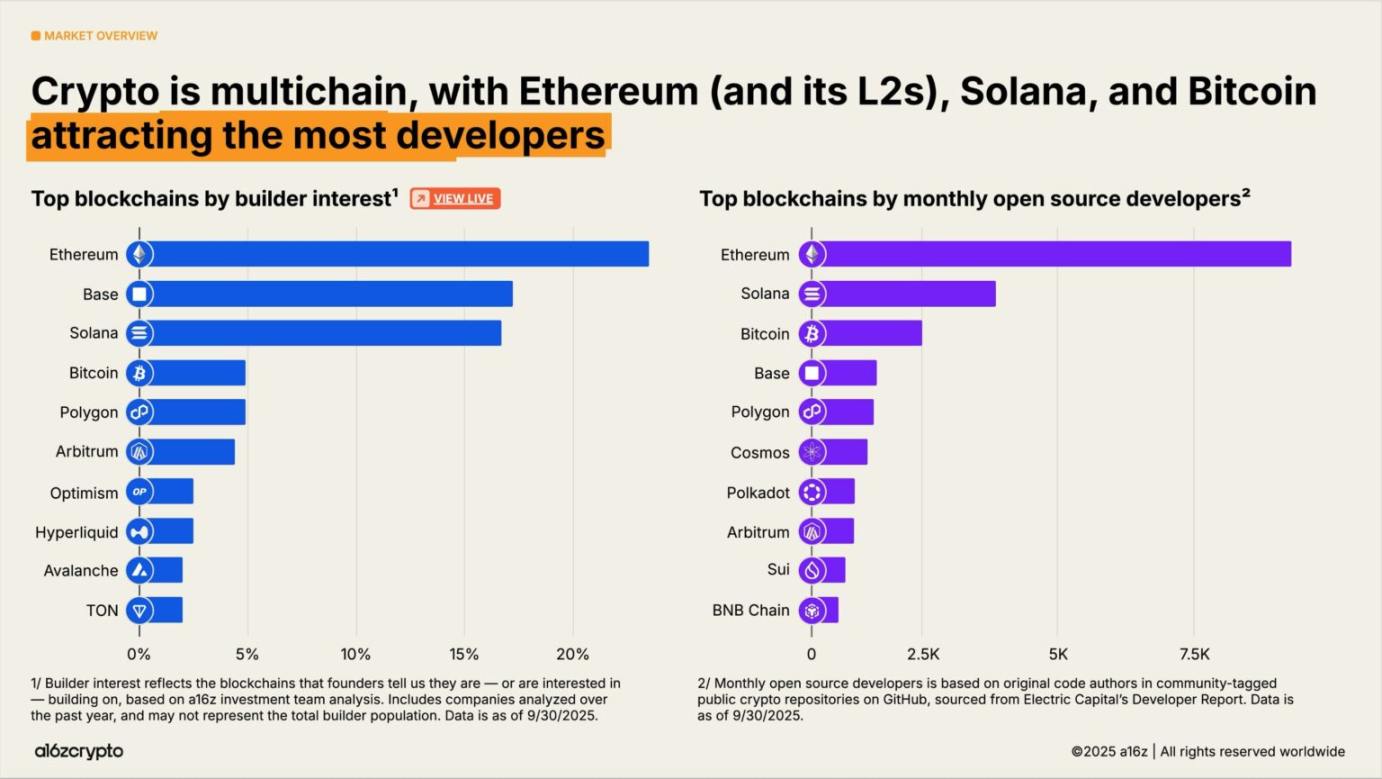

At the developer level, the cryptocurrency industry remains multi-chain. Bitcoin, Ethereum (and its Layer 2 networks), and Solana attract the most developers. In 2025, Ethereum and its Layer 2 networks are the preferred ecosystems for new developers; while Solana is one of the fastest-growing ecosystems, with developer interest increasing by 78% over the past two years.

Financial institutions fully embrace cryptocurrencies

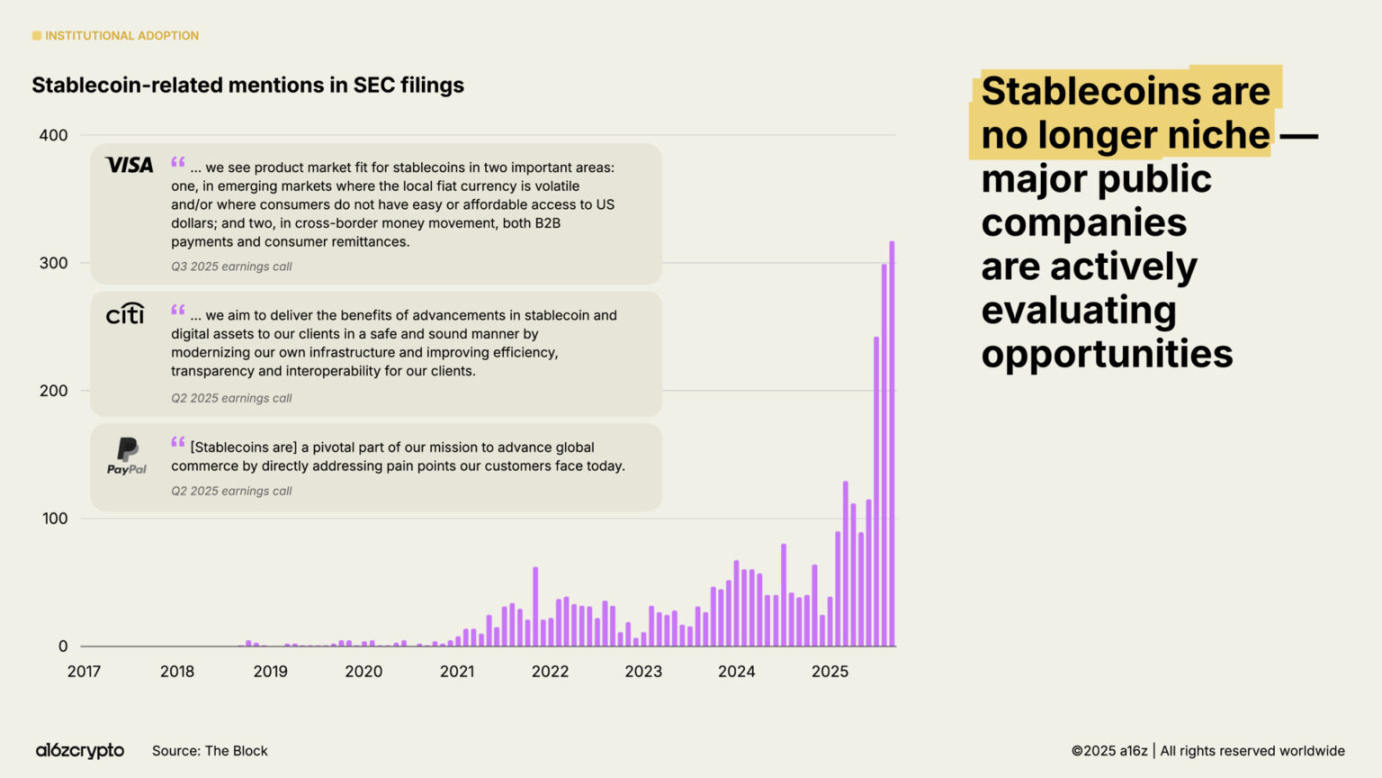

2025 is the year of institutional adoption of cryptocurrencies. Just five days after last year's State of Crypto Report stated that "stablecoins have found product-market fit (PMF)," Stripe announced plans to acquire the stablecoin infrastructure platform Bridge. The industry competition officially began, with traditional financial institutions also following suit and publicly laying out their plans in the stablecoin space.

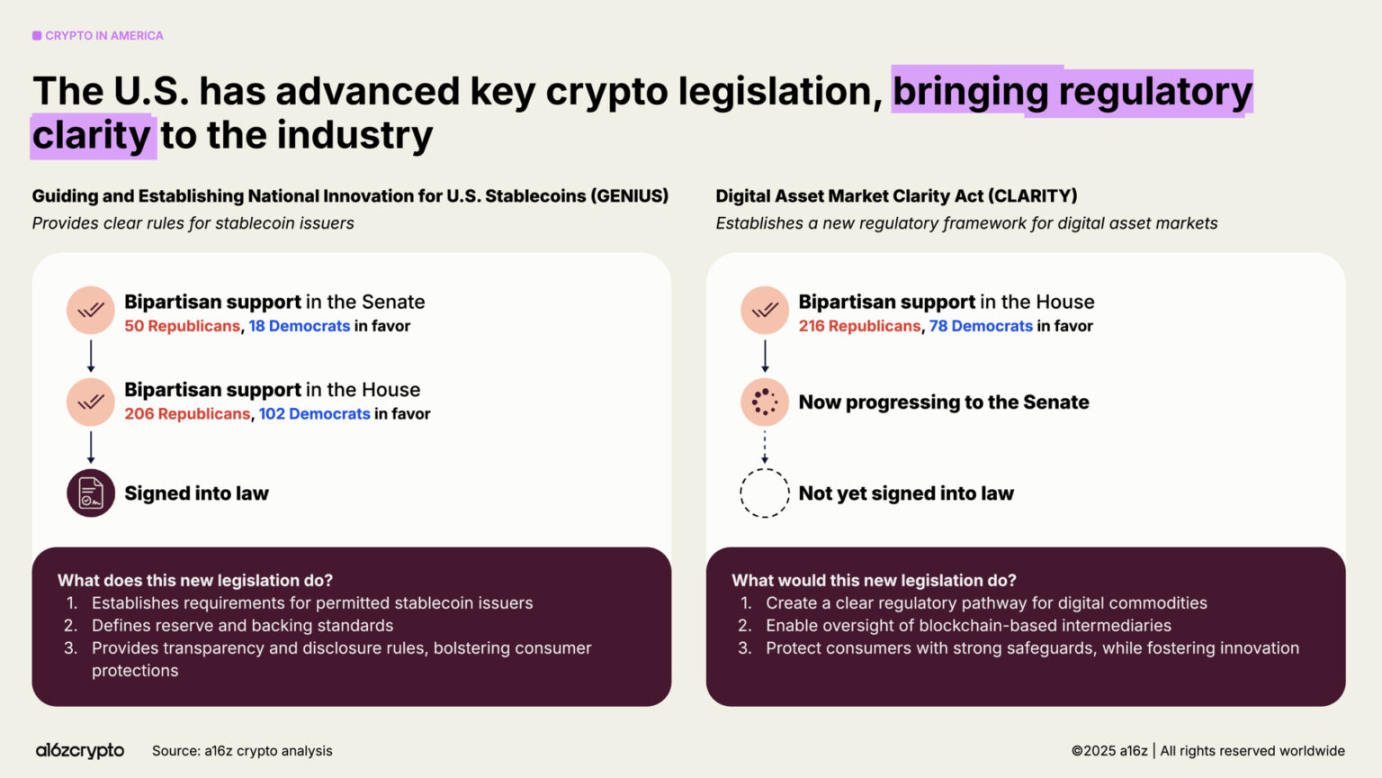

Months later, Circle's billion-dollar IPO marked the entry of stablecoin issuers into the ranks of mainstream financial institutions. In July, the bipartisan GENIUS Act officially took effect, providing developers and institutions with a clear compliance framework and eliminating previous policy uncertainties. In the following months, mentions of stablecoins in U.S. Securities and Exchange Commission (SEC) filings increased by 64%, and major financial institutions released a series of announcements related to cryptocurrencies.

The rate of institutional adoption is rapidly increasing. Traditional institutions, including Citigroup, Fidelity, JPMorgan, Mastercard, Morgan Stanley, and Visa, are now directly offering (or planning to offer) crypto products to consumers, allowing them to buy, sell, and hold crypto assets, as well as stocks, exchange-traded products, and other traditional tools. Meanwhile, platforms like PayPal and Shopify are doubling down on payment services and building infrastructure for everyday transactions between merchants and customers.

In addition to directly providing products, major fintech companies, including Circle, Robinhood, and Stripe, are actively developing or have announced plans to develop new blockchains, focusing on payments, physical assets, and stablecoins. These initiatives can lead to more on-chain payment flows, encourage enterprise adoption, and ultimately create a larger, faster, and more globalized financial system.

These companies have vast distribution networks. If they continue to develop, cryptocurrencies may become deeply integrated into the financial services we use daily.

Exchange-traded products are another key driver of institutional investment adoption, with on-chain cryptocurrency holdings exceeding $175 billion, a 169% increase from $65 billion a year ago.

BlackRock's iShares Bitcoin Trust (IBIT) is known as the highest-volume Bitcoin ETP ever; the subsequently launched Ethereum ETP has also seen significant inflows in recent months. (Note: Although these products are often referred to as exchange-traded funds (ETFs), they are actually exchange-traded products (ETPs) registered through SEC S-1 forms, with underlying portfolios that do not include securities.)

These products lower the investment threshold for cryptocurrencies, releasing large-scale institutional funds that had previously been on the sidelines due to compliance concerns.

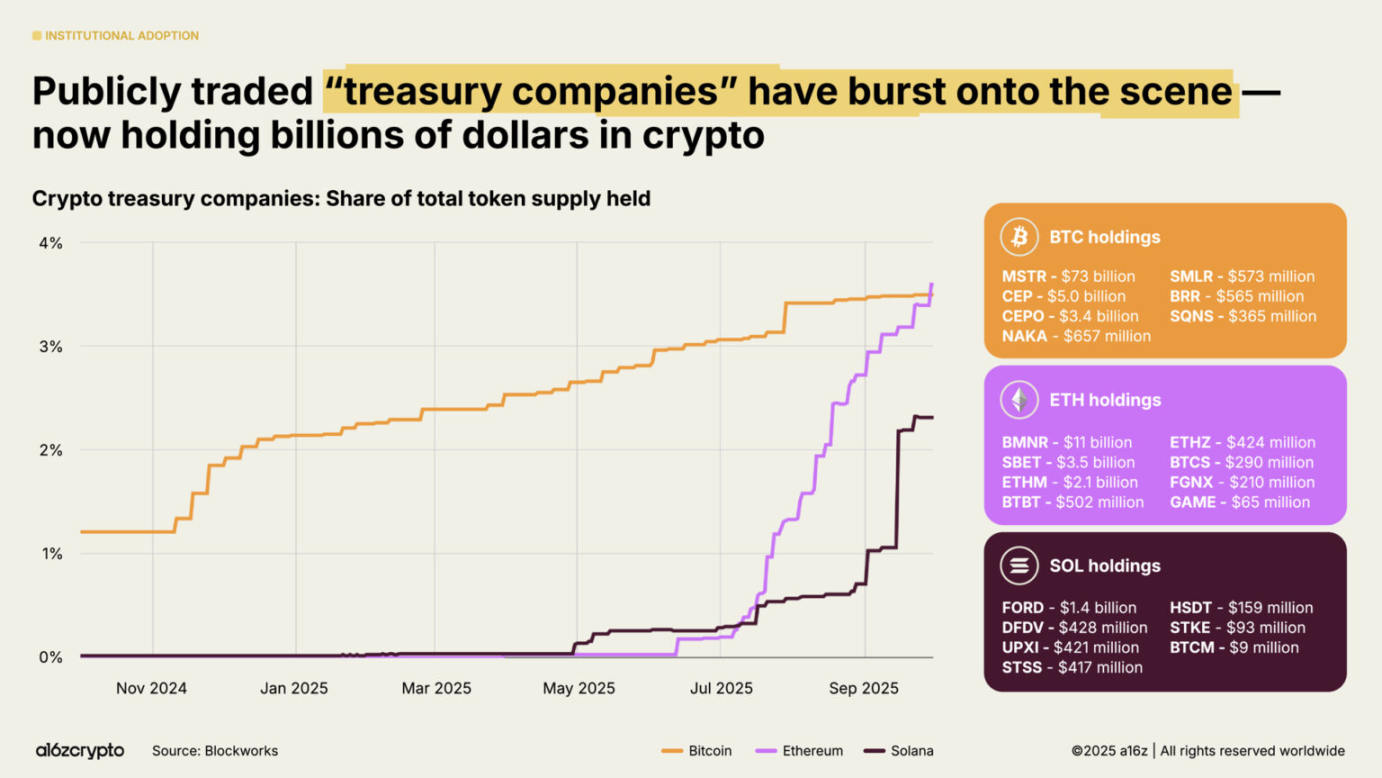

Publicly traded digital asset trust (DAT) companies currently hold approximately 4% of the circulating supply of Bitcoin and Ethereum. These DATs, along with exchange-traded products, currently hold about 10% of the supply of Bitcoin and Ethereum tokens.

Stablecoins enter the mainstream

In 2025, the rise of stablecoins is the best proof of the maturity of the cryptocurrency industry. A few years ago, the primary use of stablecoins was to settle speculative cryptocurrency trades; however, in the past two years, stablecoins have become the fastest and cheapest tool for dollar transfers globally—transactions can be completed in one second with fees of less than one cent, covering almost all regions of the world.

Today, stablecoins have become a core pillar of the on-chain economy.

In the past year, the total transaction volume of stablecoins reached $46 trillion, a 106% increase from the previous year. Although this figure primarily represents financial flows (rather than retail payments through credit card networks), it is nearly three times that of Visa and approaches the coverage of the entire U.S. banking system's ACH network.

When adjusted data is used (excluding inflated activities such as bot trading), the stablecoin transaction volume over the past 12 months reached $9 trillion, an 87% increase from last year. This scale is more than five times that of PayPal's transaction volume and exceeds half of Visa's transaction volume.

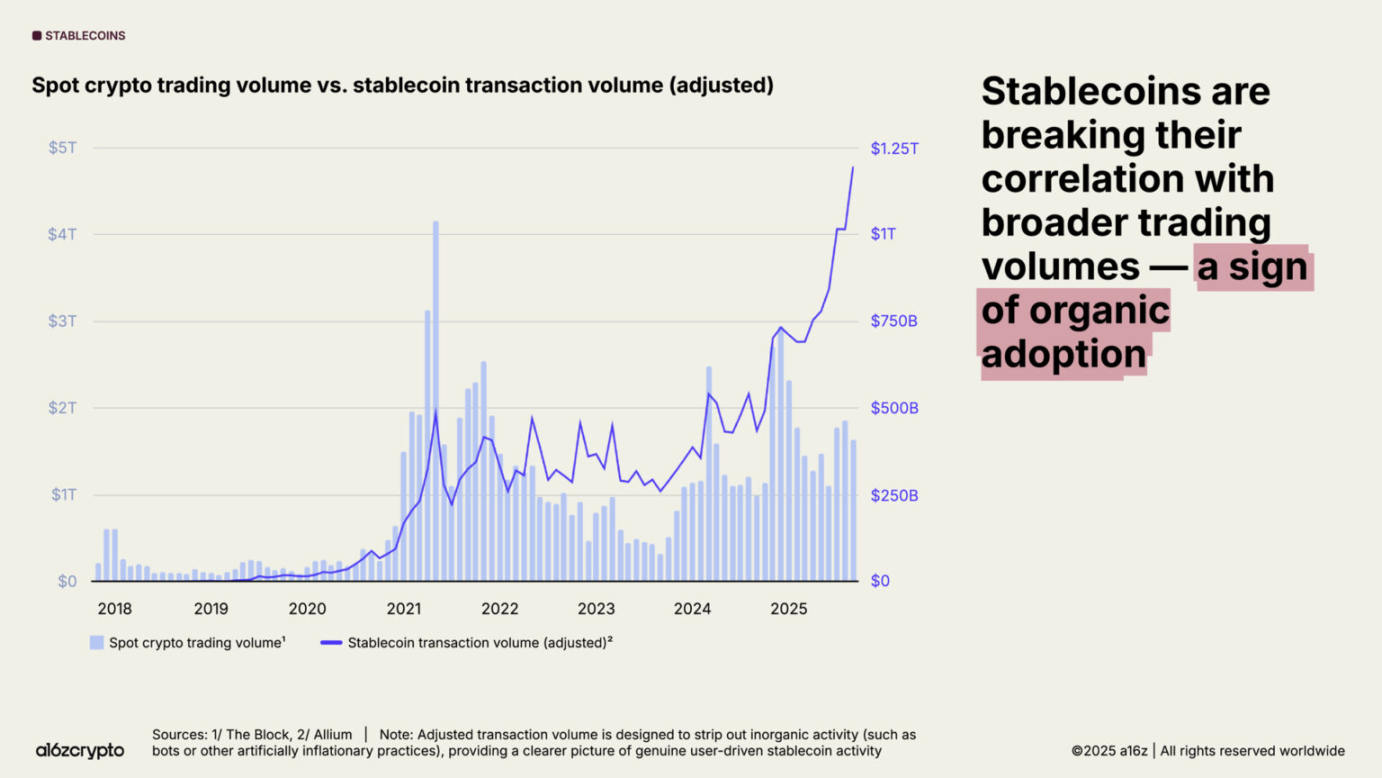

The adoption of stablecoins is accelerating. In September 2025, the adjusted monthly transaction volume of stablecoins hit a historic high, approaching $1.25 trillion.

It is noteworthy that this trading activity is largely unrelated to the overall cryptocurrency transaction volume. The non-speculative uses of stablecoins have been widely accepted, further confirming the robustness of their product-market fit (PMF).

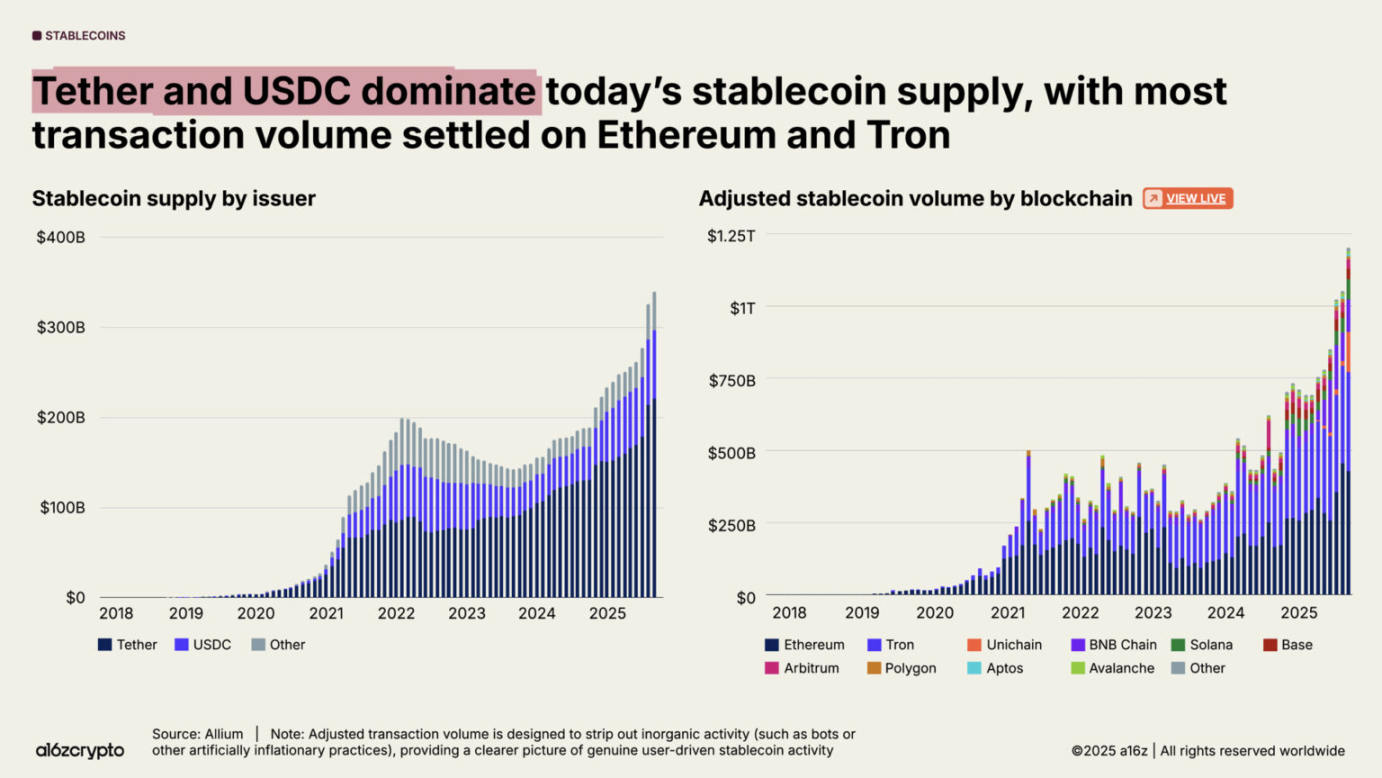

The total supply of stablecoins also reached a historic high, surpassing $300 billion.

The market shows a head-dominated pattern, with Tether and USDC collectively holding 87% of the market share. In September 2025, the adjusted stablecoin transaction volume on Ethereum and Tron blockchains reached $772 billion, accounting for 64% of the total market transaction volume. Although these two major issuers and their respective public chains dominate the market, the growth momentum of new public chains and new issuers is also accelerating.

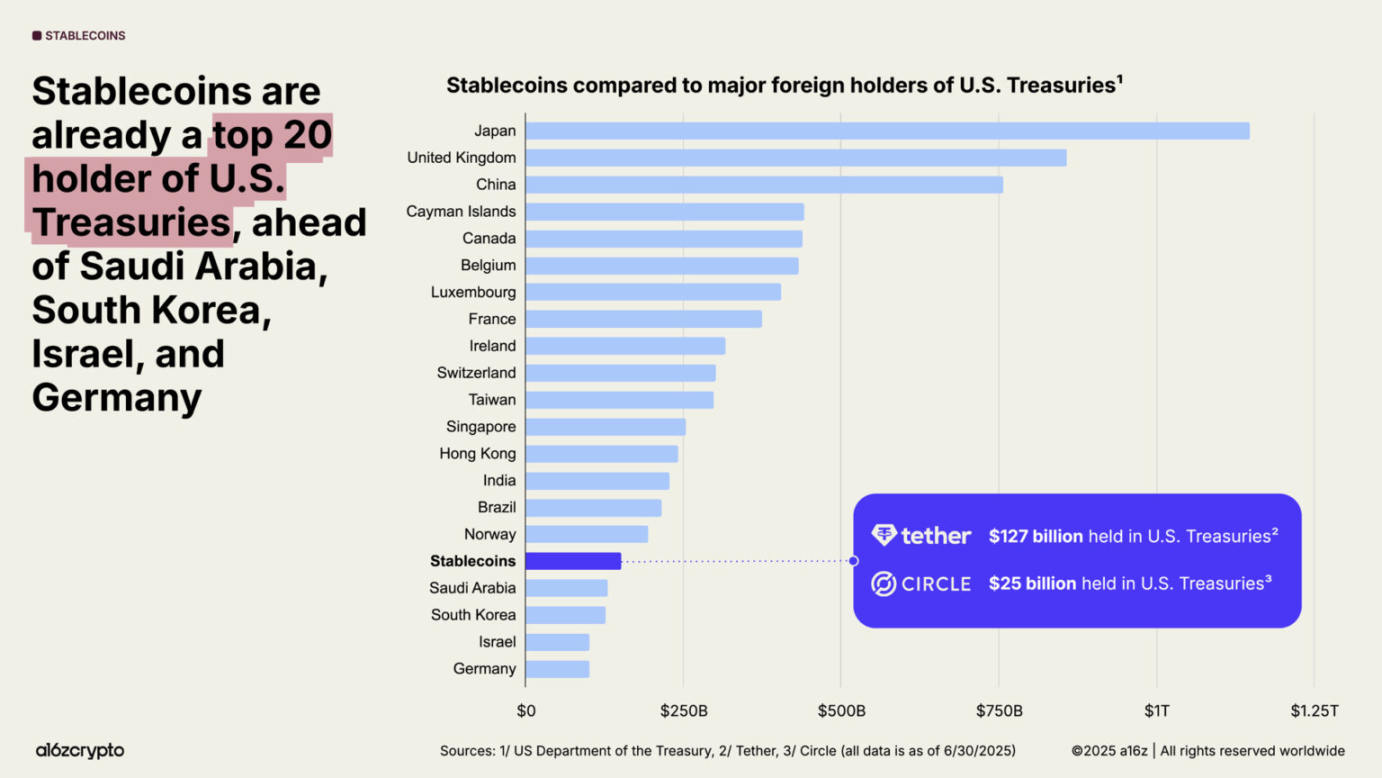

Stablecoins have now become a force in the global macroeconomy. Currently, over 1% of U.S. dollars exist on public chains in the form of tokenized stablecoins, and the amount of U.S. Treasury bonds held by stablecoins has risen from 20th place last year to 17th place this year. Stablecoins collectively hold over $150 billion in U.S. Treasury bonds, surpassing the bond holdings of many sovereign nations.

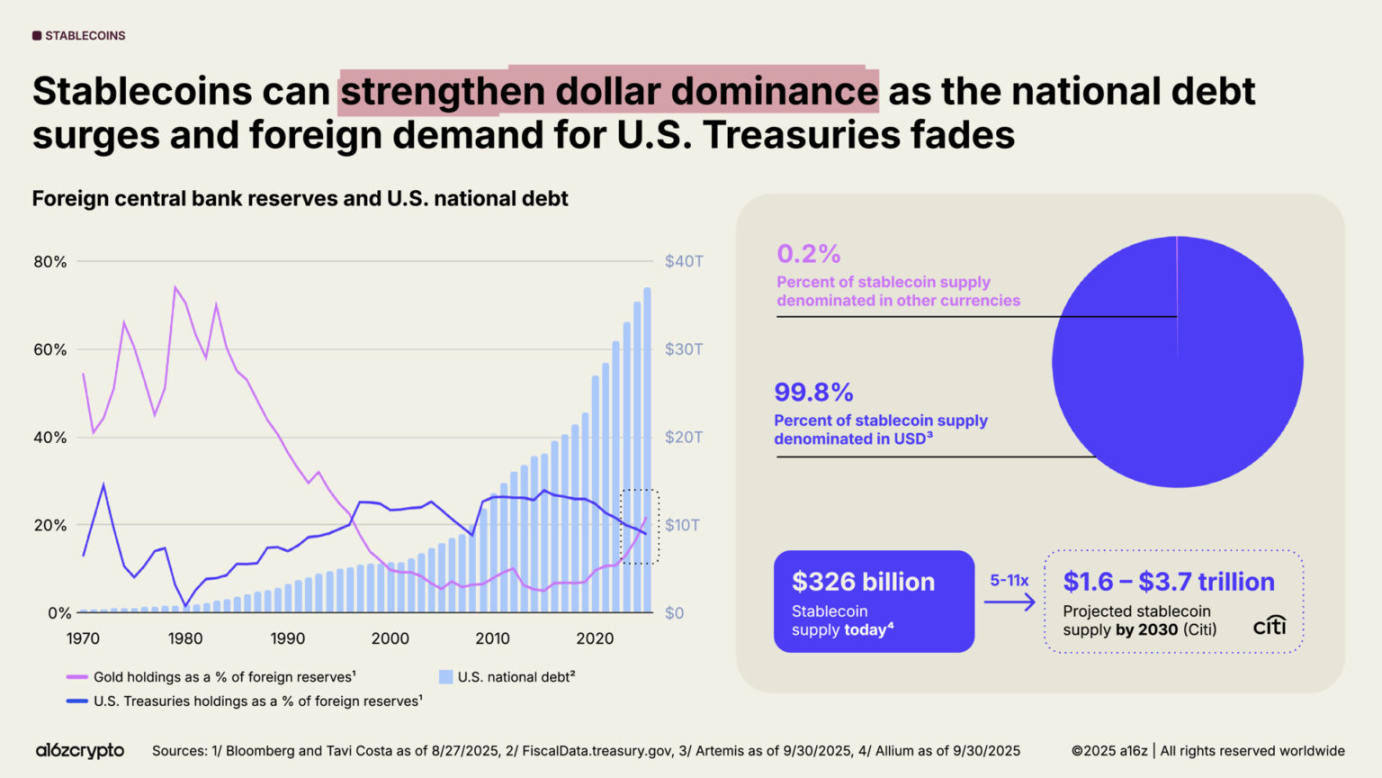

At the same time, there is a contradiction between the global decline in demand for U.S. Treasury bonds and the surge in the scale of U.S. Treasury bonds. For the first time in 30 years, foreign central banks' gold reserves have exceeded their U.S. Treasury bond reserves.

However, stablecoins are going against the trend: 99% of stablecoins are denominated in U.S. dollars, and it is expected that by 2030, their scale will grow tenfold, surpassing $3 trillion. This means that in the coming years, stablecoins may become a strong and sustainable source of demand for U.S. Treasury bonds, further consolidating the dollar's global dominance as foreign central banks reduce their holdings.

Cryptocurrency development in the U.S. is gaining unprecedented momentum

The U.S. has changed its previously hostile stance toward cryptocurrencies, reigniting developers' confidence.

The enactment of the GENIUS Act this year and the passage of the CLARITY Act in the House mark a bipartisan consensus on cryptocurrencies: they will not only exist long-term but will also thrive in the U.S. These two pieces of legislation together establish a framework for stablecoins, market structure, and digital asset regulation, balancing innovation encouragement with investor protection. Additionally, Executive Order 14178 overturned previous anti-crypto policies and established a cross-departmental working group to modernize federal digital asset policy.

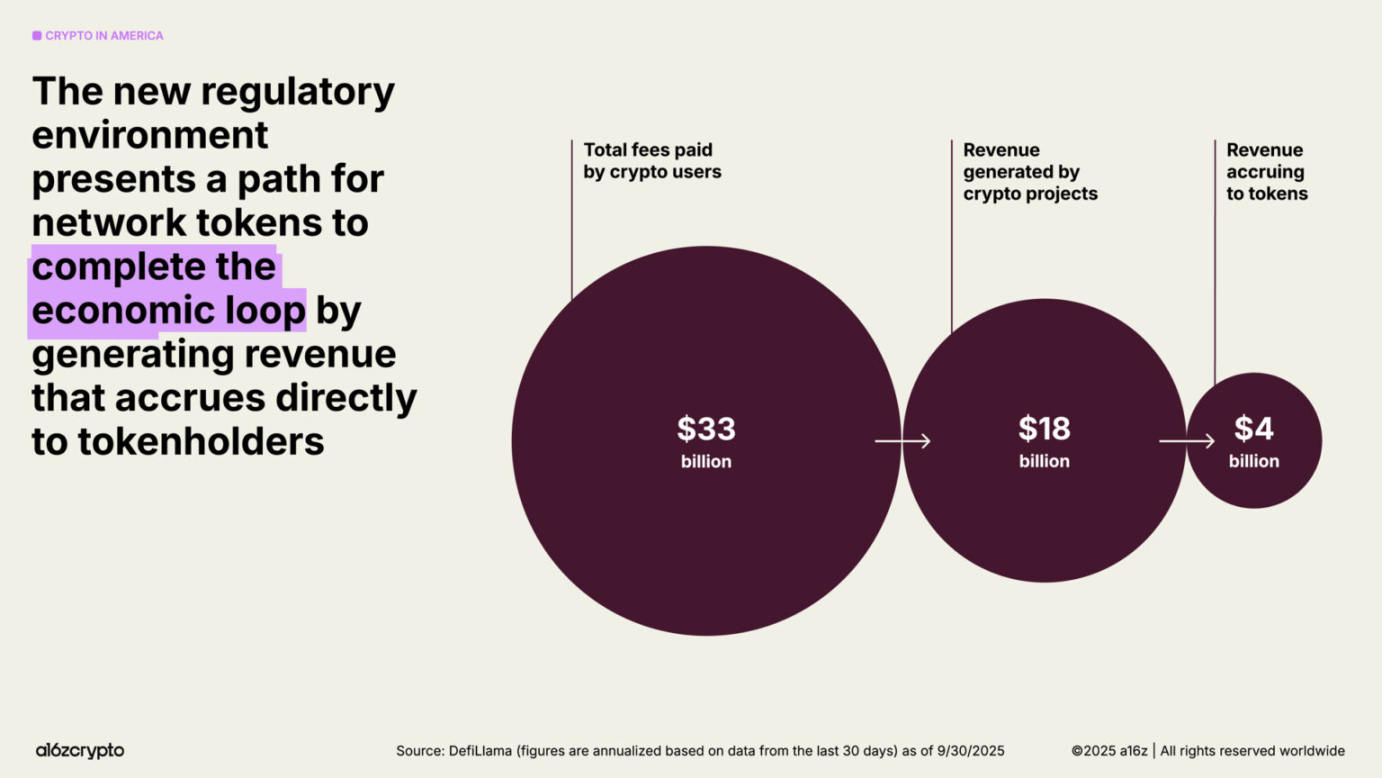

A clear regulatory environment paves the way for developers to create tokens as "next-generation digital building blocks." With regulatory clarity, more tokens will be able to complete economic cycles by generating returns for token holders, creating a new economic engine for the internet that is "self-sustaining and allows more users to have system rights."

Global assets are accelerating on-chain

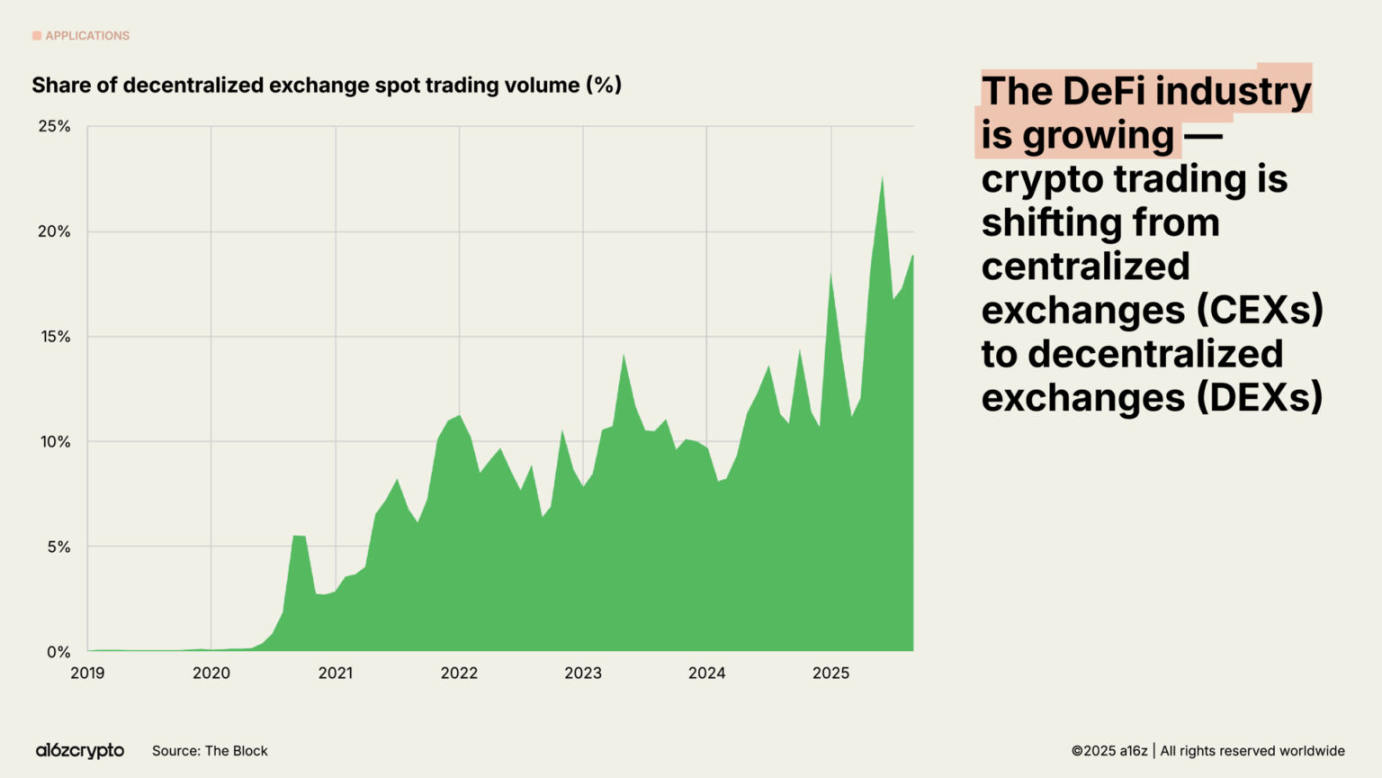

Once, the on-chain economy was a niche area for early adopters; now, it has developed into a large market covering multiple industries, with tens of millions of monthly active users. Currently, nearly one-fifth of spot trading volume comes from decentralized exchanges (DEX).

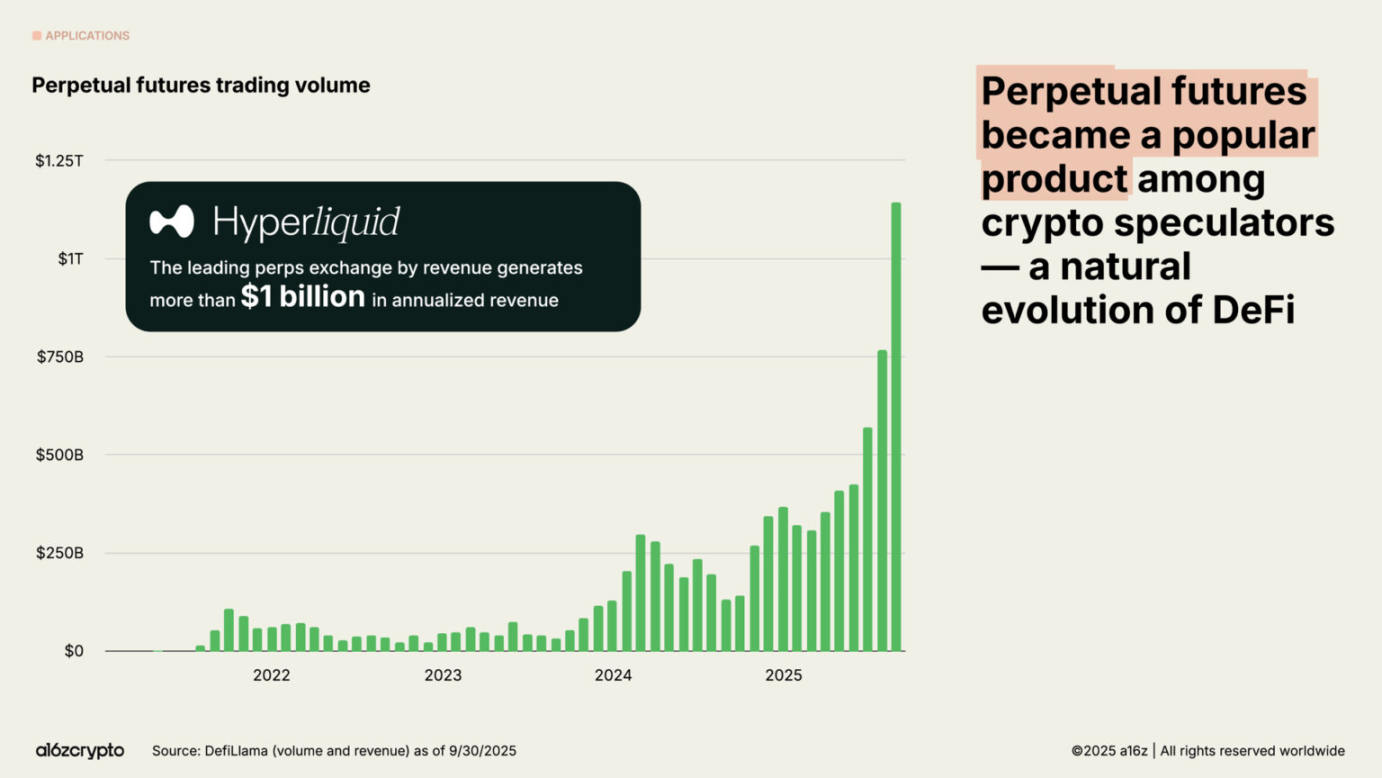

The trading volume of perpetual futures has grown nearly eightfold in the past year, rapidly gaining popularity among cryptocurrency speculators. Decentralized perpetual futures exchanges like Hyperliquid have processed trillions of dollars in transactions, with annualized revenue exceeding $1 billion, figures that rival some centralized exchanges.

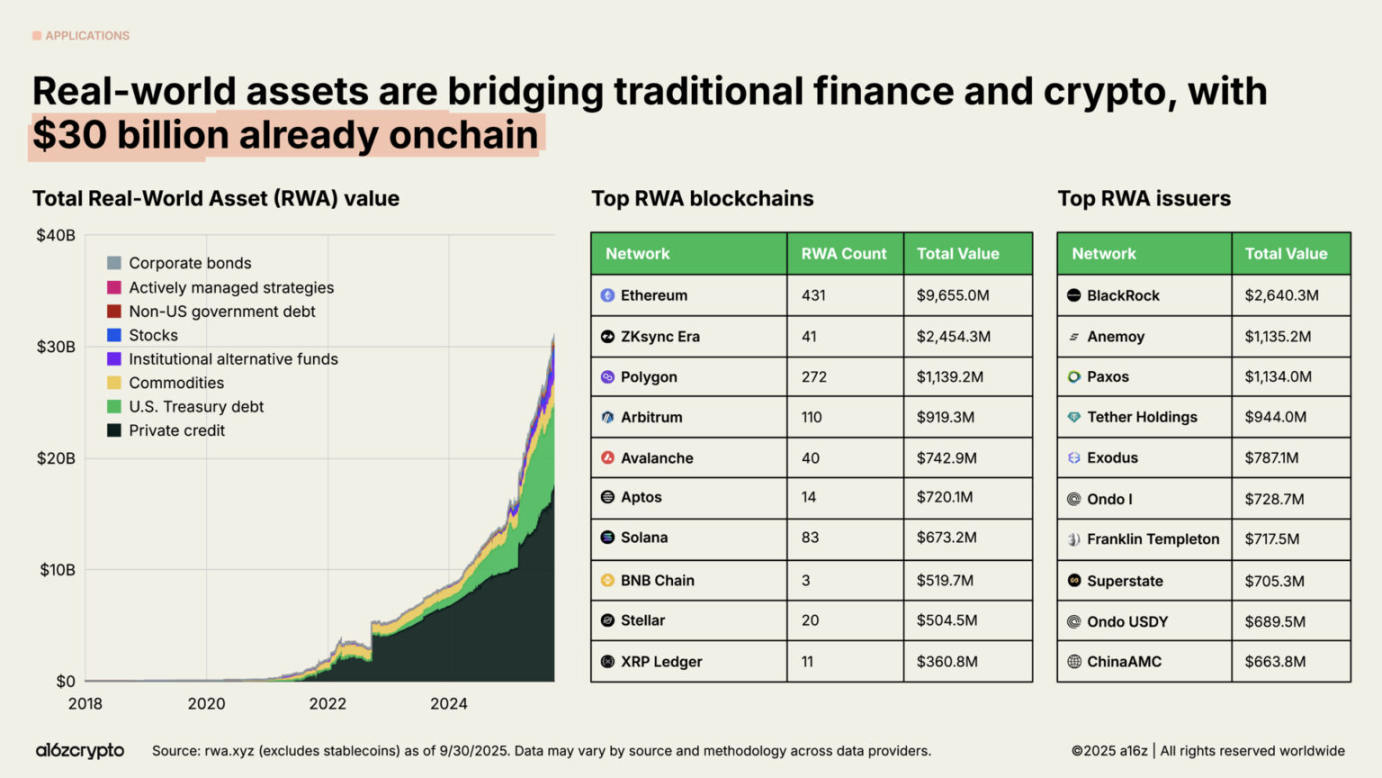

Real-world assets (RWAs)—such as U.S. Treasury bonds, money market funds, private credit, and real estate—are being represented on-chain, connecting cryptocurrencies with traditional finance. The total market size for tokenized RWAs is $30 billion, having grown nearly fourfold in the past two years.

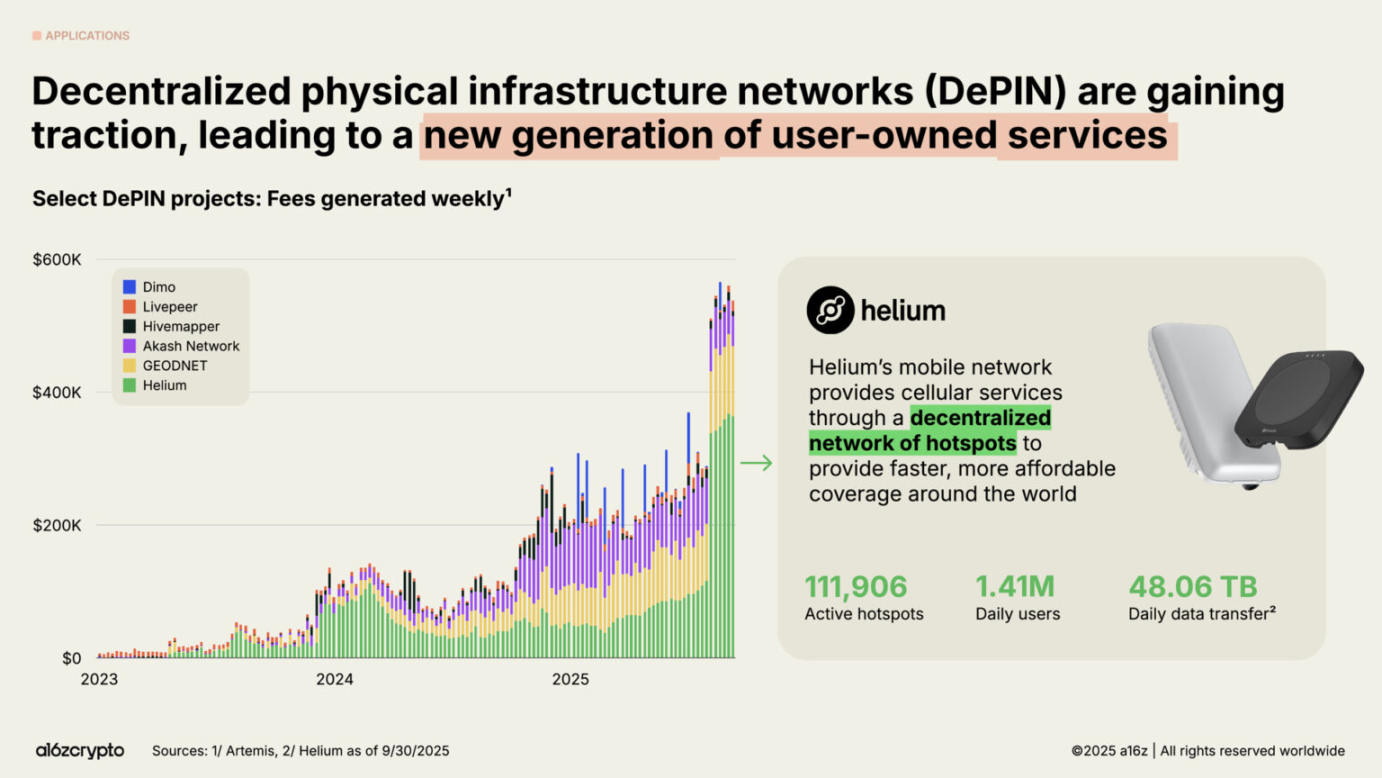

Beyond finance, one of the most ambitious frontiers for blockchain in 2025 is DePIN, or decentralized physical infrastructure networks.

If decentralized finance (DeFi) has restructured finance, then DePIN is restructuring physical infrastructure, including telecommunications networks, transportation networks, and energy grids.

The potential in this area is enormous: the World Economic Forum predicts that by 2028, the DePIN market will reach $3.5 trillion.

The Helium network is the most well-known case: this grassroots wireless communication network provides 5G cellular network coverage for 1.4 million daily active users through 111,000 user-operated hotspots.

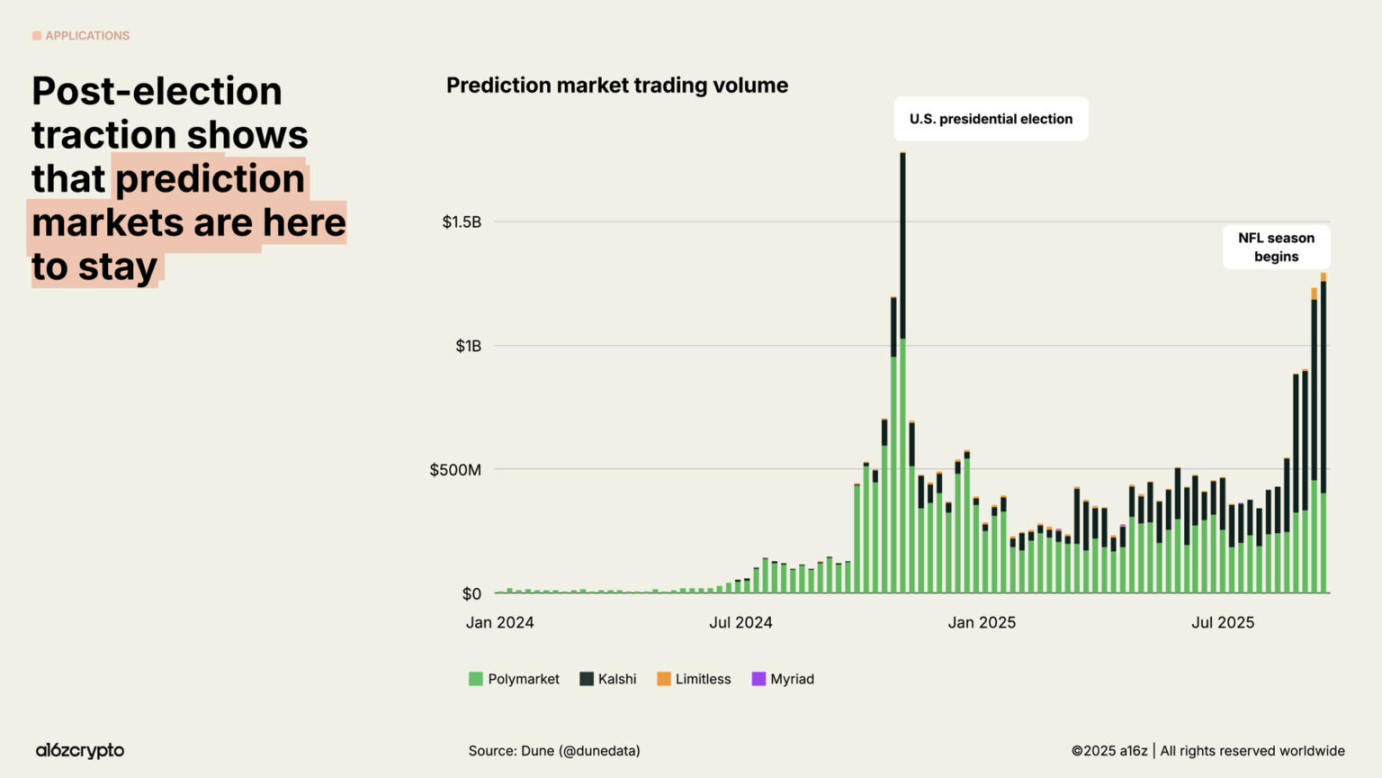

During the 2024 U.S. elections, prediction markets entered the mainstream for the first time. Leading platforms like Polymarket and Kalshi saw monthly total trading volumes reach billions of dollars. Although there are doubts about whether user activity can be maintained after the elections, trading volumes on these platforms have still grown nearly fivefold from early 2025 to now, approaching previous highs.

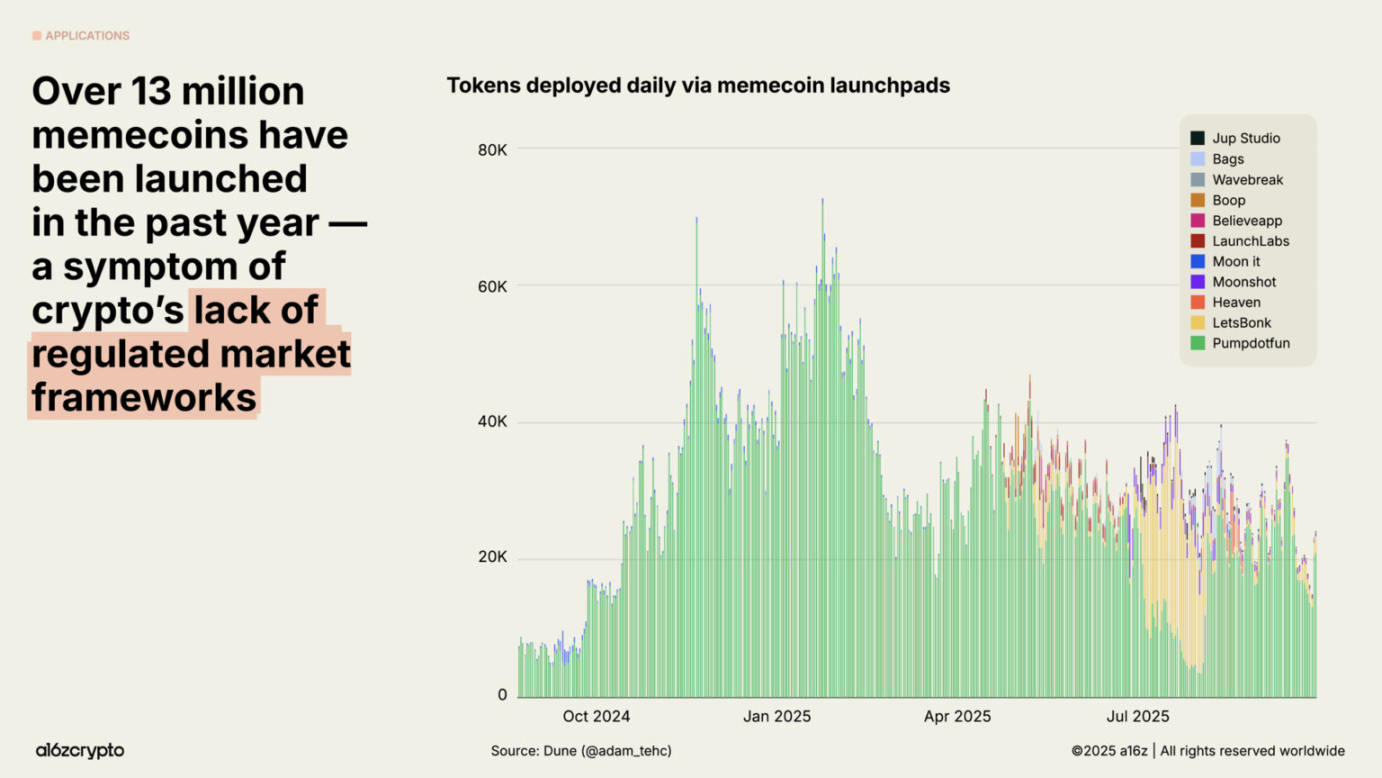

In a phase where regulation is still unclear, Memecoins once thrived: over the past year, more than 13 million new Memecoins were created. However, this trend has gradually cooled in recent months, with the issuance of Memecoins in September down 56% from January. As reasonable policies and bipartisan legislation pave the way for more practically valuable blockchain use cases, the popularity of Memecoins is being replaced by more meaningful applications.

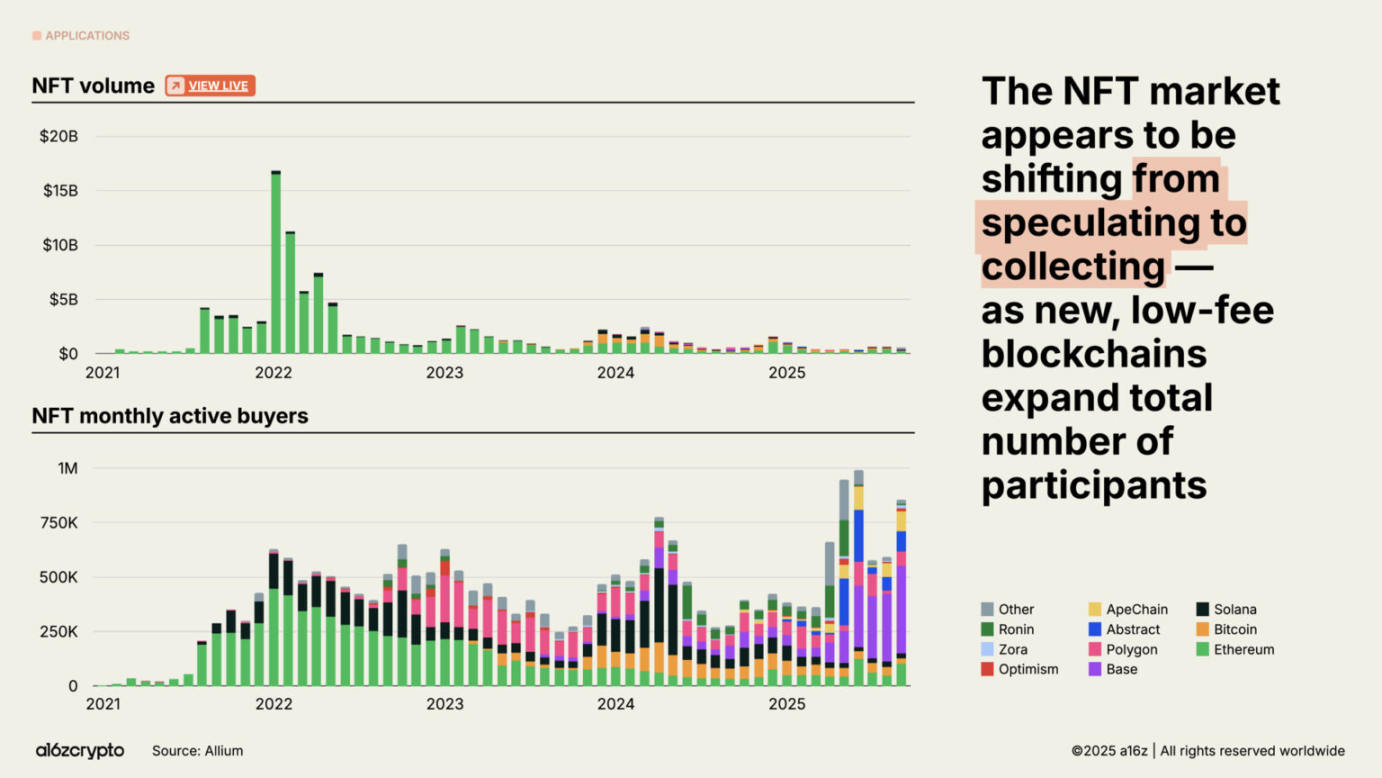

The NFT (non-fungible token) market's trading volume has yet to reach the peak levels of 2022, but the number of monthly active buyers continues to grow. This trend indicates a shift in consumer behavior from speculation to collecting. Behind this shift is the proliferation of low-cost block space on public chains like Solana and Base.

Blockchain infrastructure is ready for large-scale applications

Without significant breakthroughs in blockchain infrastructure, none of the above progress would be possible.

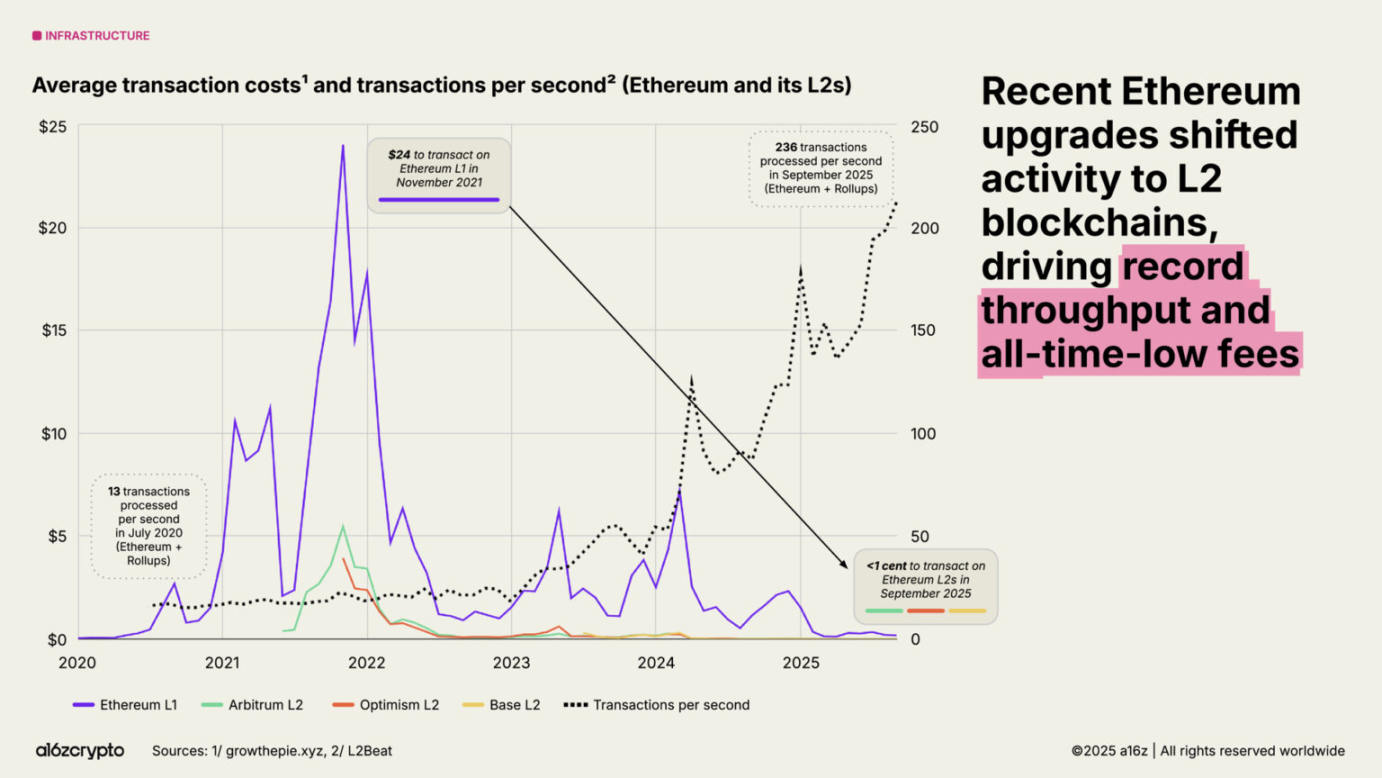

In the past five years, the total transaction throughput of mainstream blockchain networks has increased more than 100 times. Five years ago, blockchains could process fewer than 25 transactions per second; today, that number has reached 3,400, comparable to the number of transactions completed by Nasdaq or Stripe's global throughput during Black Friday, with costs being only a small fraction of historical levels.

Among various blockchain ecosystems, Solana has become one of the most prominent. Its high-performance, low-fee architecture now supports a variety of applications, from DePIN projects to NFT markets, with native applications generating $3 billion in revenue over the past year. By the end of the year, Solana's upgrade plans are expected to double the network's capacity.

Ethereum continues to advance its scaling roadmap, with most economic activity migrating to Layer 2 solutions like Arbitrum, Base, and Optimism. Layer 2 solutions have reduced Ethereum's average transaction cost from about $24 in 2021 to now less than one cent, making Ethereum-linked block space cheap and abundant.

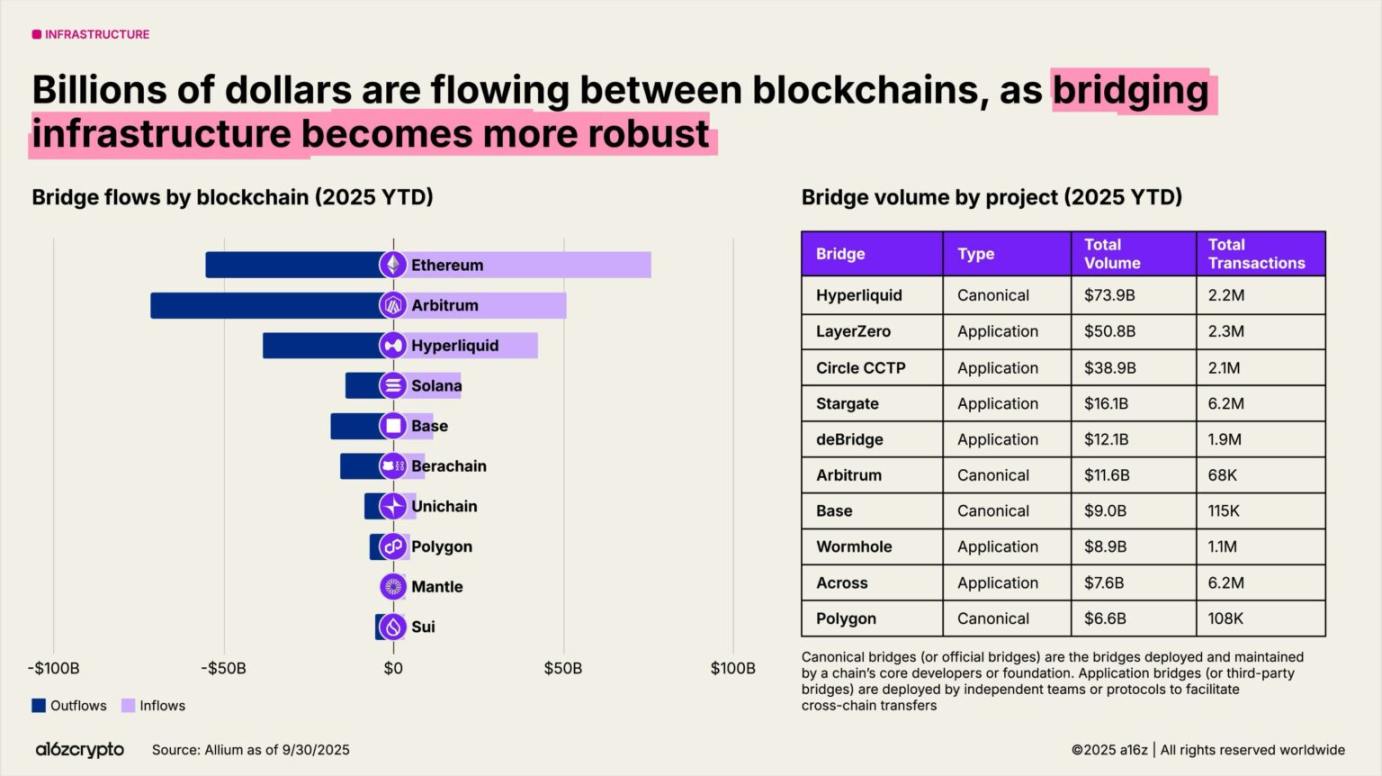

Cross-chain protocols have achieved interoperability between blockchains. Protocols such as LayerZero and Circle's cross-chain transfer protocol support users in transferring assets within multi-chain systems; Hyperliquid's standard bridge has seen a transaction volume of $74 billion so far this year.

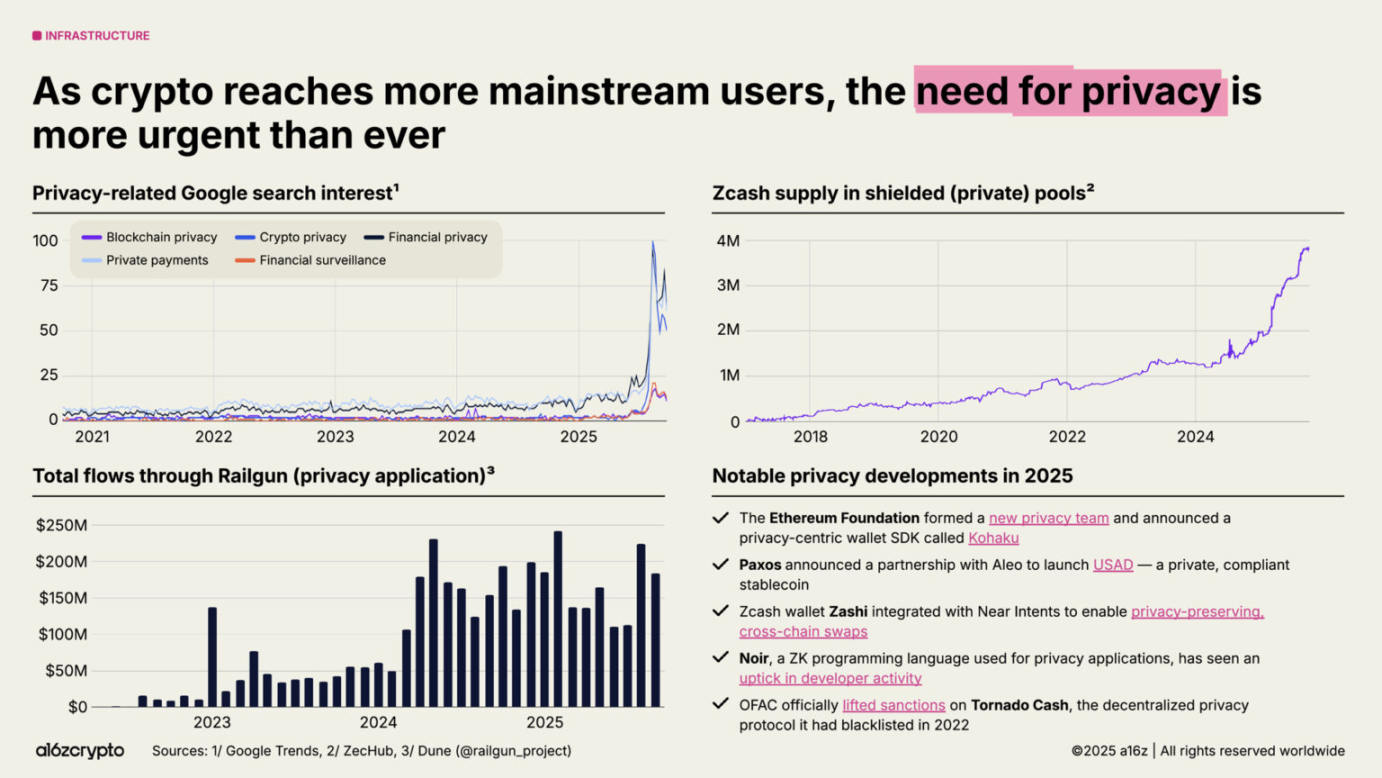

Privacy issues are regaining attention and may become a prerequisite for broader applications. The following indicators show a growing interest in this issue: in 2025, Google searches related to crypto privacy surged; the supply of Zcash's shielded pool grew to nearly 4 million ZEC; Railgun's monthly transaction volume exceeded $200 million.

More positive signals include: the Ethereum Foundation establishing a new privacy team; Paxos partnering with Aleo to launch a compliant privacy stablecoin (USAD); and the U.S. Office of Foreign Assets Control (OFAC) lifting sanctions on the decentralized privacy protocol Tornado Cash. As cryptocurrencies continue to mainstream, we expect the momentum for privacy protection to strengthen in the coming years.

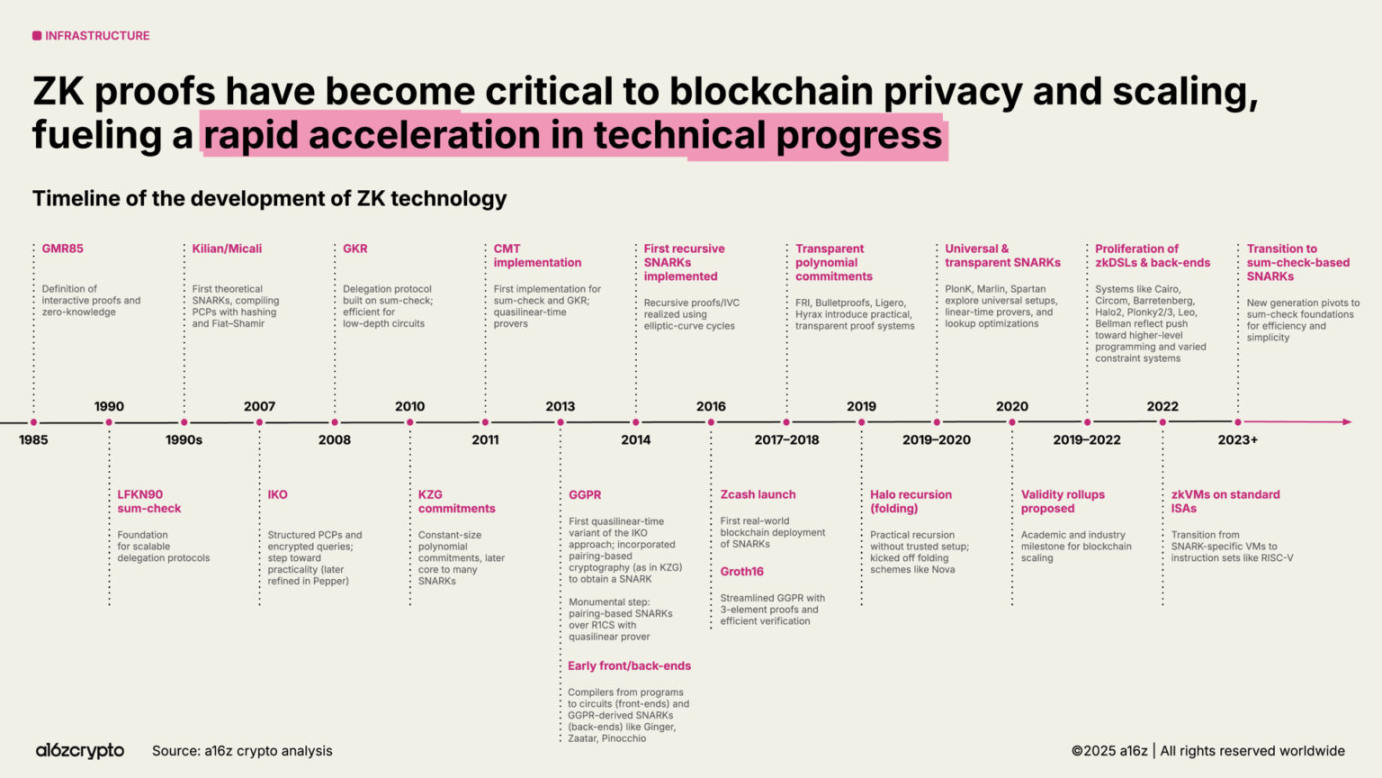

Zero-knowledge (ZK) and succinct proof systems are rapidly evolving from academic research decades ago into critical infrastructure. Zero-knowledge systems are now integrated into Rollups, compliance tools, and even mainstream web services, with Google's new ZK identity system being one example.

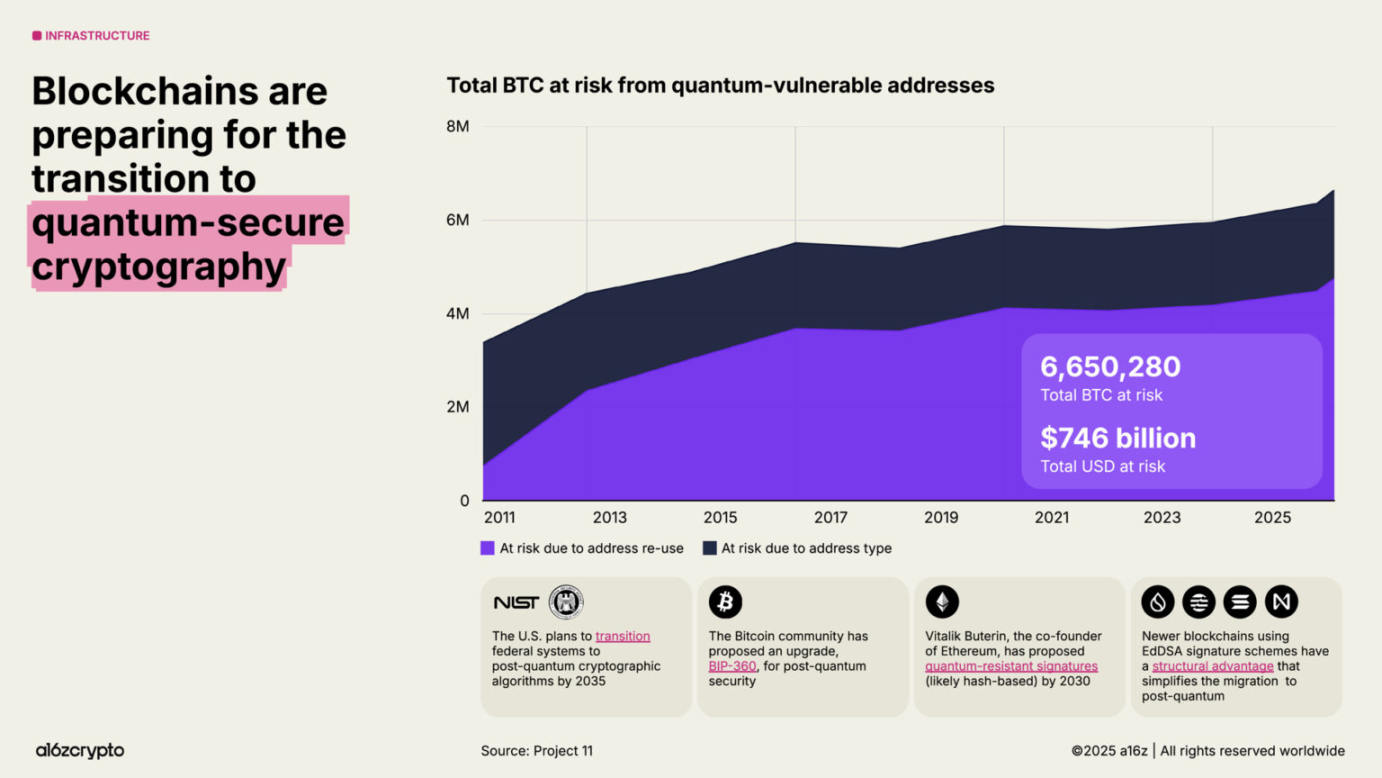

Meanwhile, blockchain is accelerating preparations for "post-quantum computing." Currently, about $750 billion worth of Bitcoin is stored in addresses vulnerable to future quantum attacks; the U.S. government plans to migrate federal systems to post-quantum cryptographic algorithms by 2035.

Artificial Intelligence and Cryptocurrency Accelerate Integration

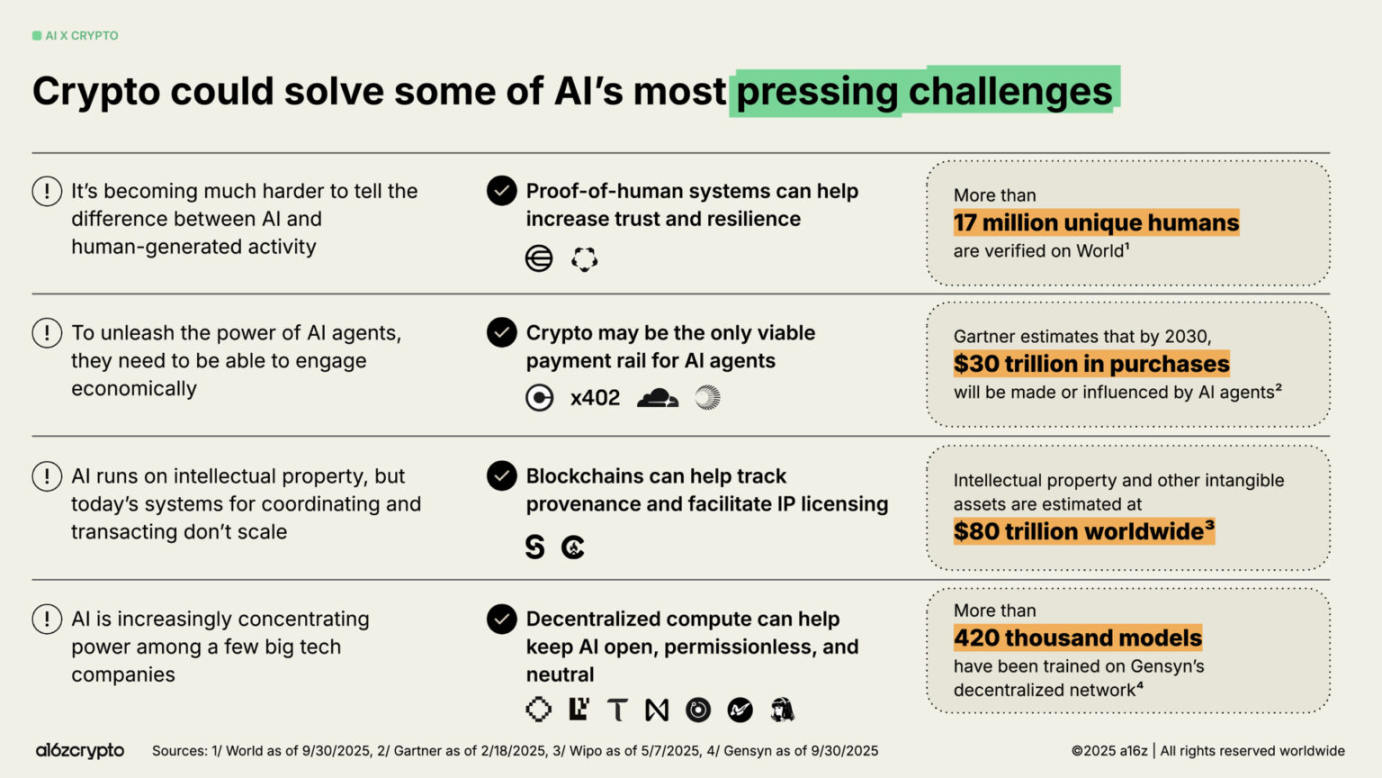

The launch of ChatGPT in 2022 brought artificial intelligence (AI) into the public spotlight and created clear opportunities for integration with cryptocurrency. From tracking provenance and intellectual property licensing to providing payment channels for AI agents, cryptocurrency may help solve some core challenges in the AI field.

Decentralized identity systems like World have verified the identities of over 17 million people, providing human proof and helping to distinguish between humans and robots.

Protocols like x402 are becoming potential financial pillars for autonomous AI agents, assisting them in making small transactions, accessing APIs, and settling payments without intermediaries. Gartner estimates that this economic scale could reach $30 trillion by 2030.

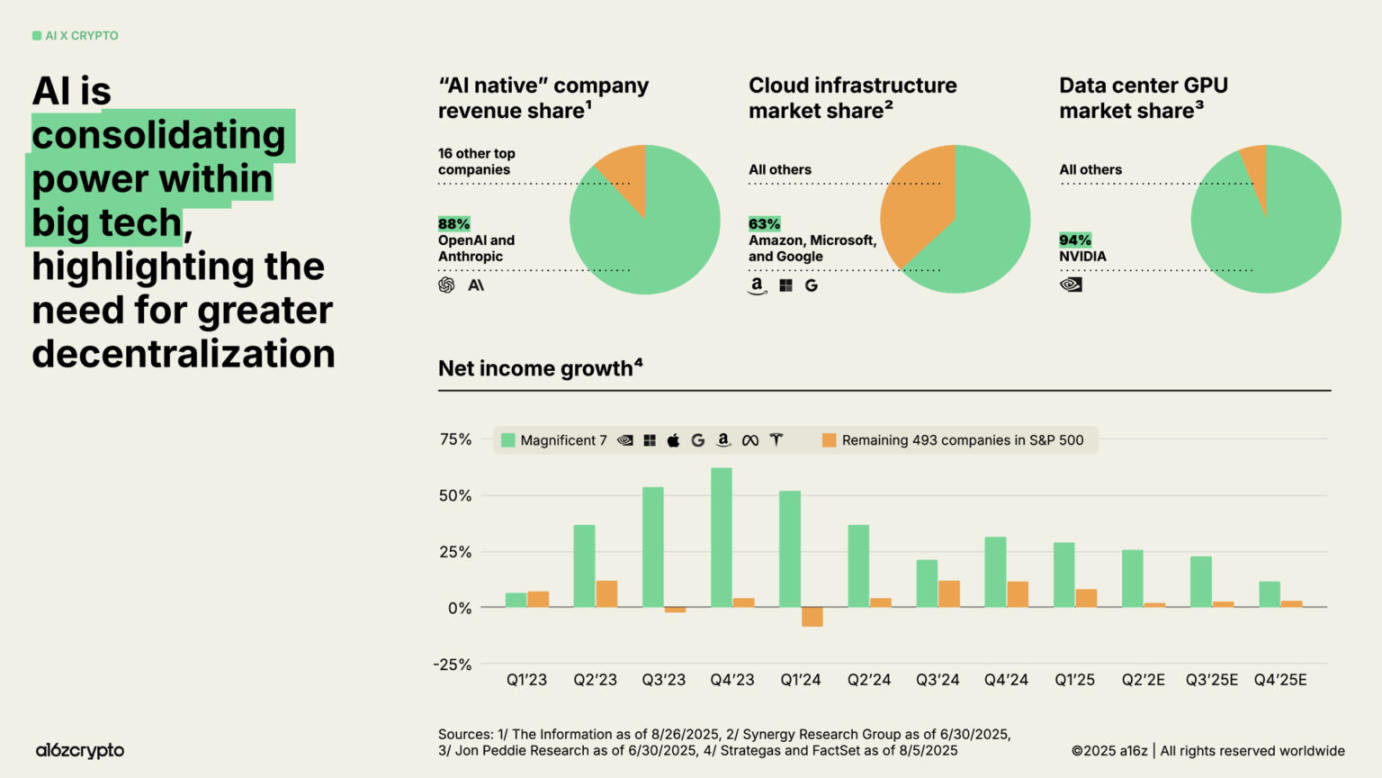

Currently, the computational layer of AI is gradually concentrating among a few tech giants, raising concerns about "centralization" and "censorship risk." OpenAI and Anthropic control 88% of the revenue of "AI-native" companies. Amazon, Microsoft, and Google control 63% of the cloud infrastructure market, while Nvidia holds 94% of the data center GPU market. This imbalance has driven the "Big Seven" to achieve double-digit quarterly net income growth over the past few years, while the overall profit growth of the remaining 493 S&P companies has failed to keep pace with inflation.

Blockchain offers a balancing solution to the "centralization trend of AI systems."

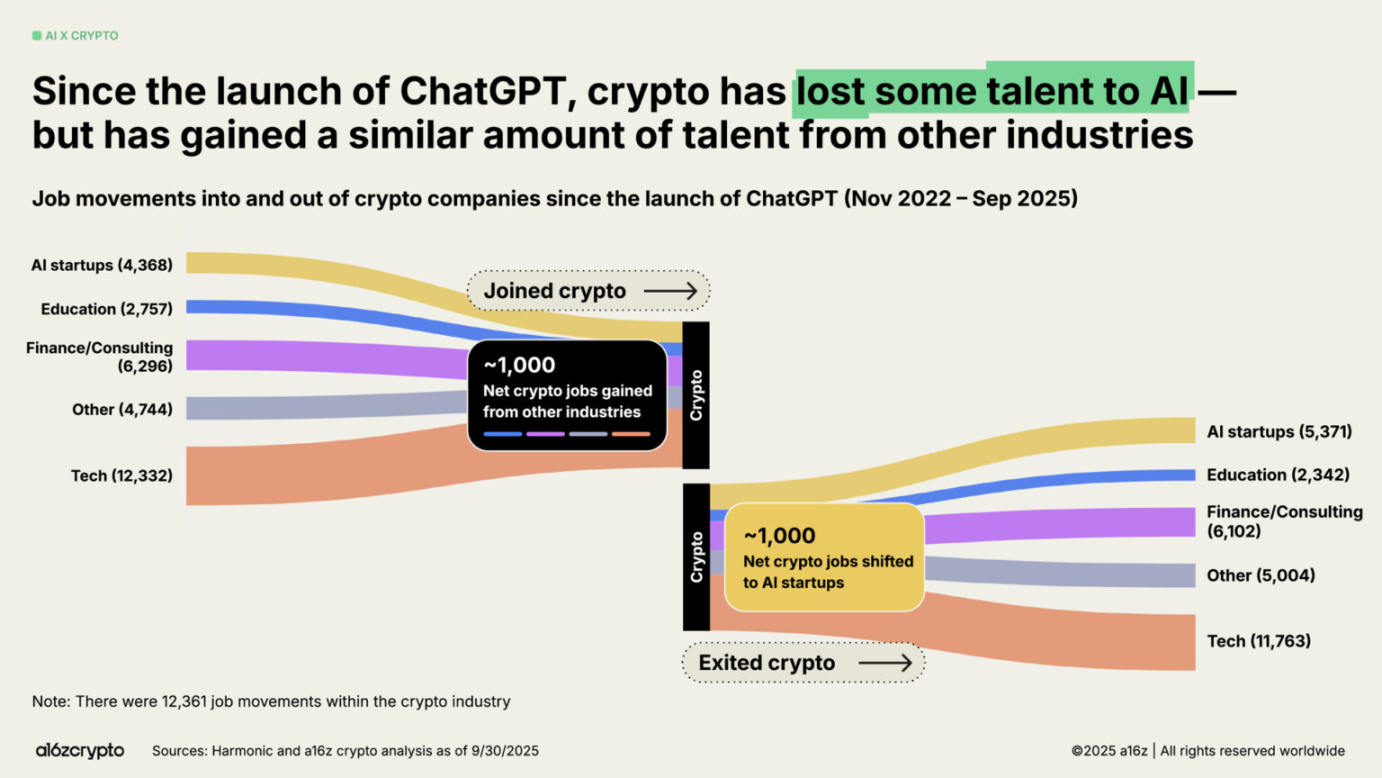

Driven by the AI boom, some developers have shifted away from the cryptocurrency field. Our analysis indicates that since the launch of ChatGPT, approximately 1,000 jobs have transitioned from the cryptocurrency sector to AI. However, this number has been offset by an equal number of developers joining the cryptocurrency field from other sectors, such as traditional finance and technology.

Future Outlook

What stage is the industry currently in? As regulations become clearer, the path for tokens to generate actual revenue through transaction fees has opened up. In the future, the adoption of cryptocurrencies by traditional finance and fintech will continue to accelerate; stablecoins will upgrade traditional systems and promote the democratization of global financial services; new consumer-grade products will drive the next wave of cryptocurrency users on-chain.

Today, we have the infrastructure and user outreach capabilities. If we can soon achieve clear regulations, cryptocurrency technology will officially enter the mainstream. It is time to upgrade the financial system, rebuild global payment channels, and create the internet that the world deserves.

After 17 years of development, cryptocurrency is bidding farewell to its adolescence and entering adulthood.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。