Original Title: State of Crypto 2025: The year crypto went mainstream

Original Authors: Daren Matsuoka, Robert Hackett, Eddy Lazzarin, Jeremy Zhang, Stephanie Zinn, a16z

Original Translation: xiaozou, Jinse Finance

The world is undergoing a comprehensive on-chain transformation.

When we released our first report on the crypto industry, the field was still in its adolescence. At that time, the total market capitalization of crypto was only half of what it is today, with slower blockchain speeds, higher costs, and insufficient stability.

Over the past three years, crypto builders have navigated market crashes and policy uncertainties while continuously driving significant upgrades in infrastructure and technological breakthroughs. These efforts have brought us to the present moment—a historic time when crypto assets are becoming an important component of the modern economy.

The main narrative of crypto in 2025 is industry maturation. In short, the crypto world has grown up:

Traditional financial giants (Visa, BlackRock, Fidelity, JPMorgan) and tech-native challengers (PayPal, Stripe, Robinhood) have all launched crypto products;

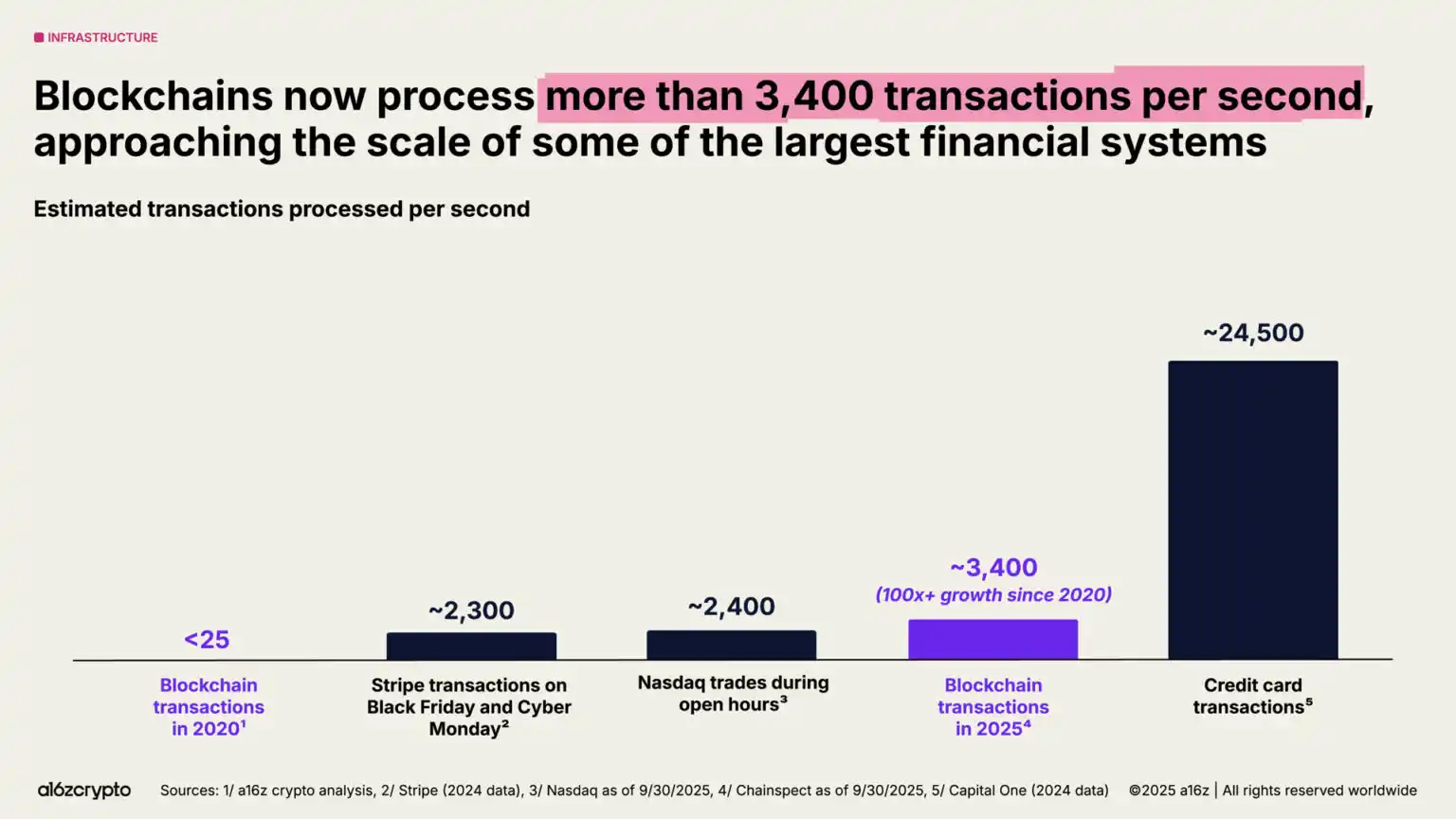

The blockchain processes over 3,400 transactions per second (a more than 100-fold increase over five years);

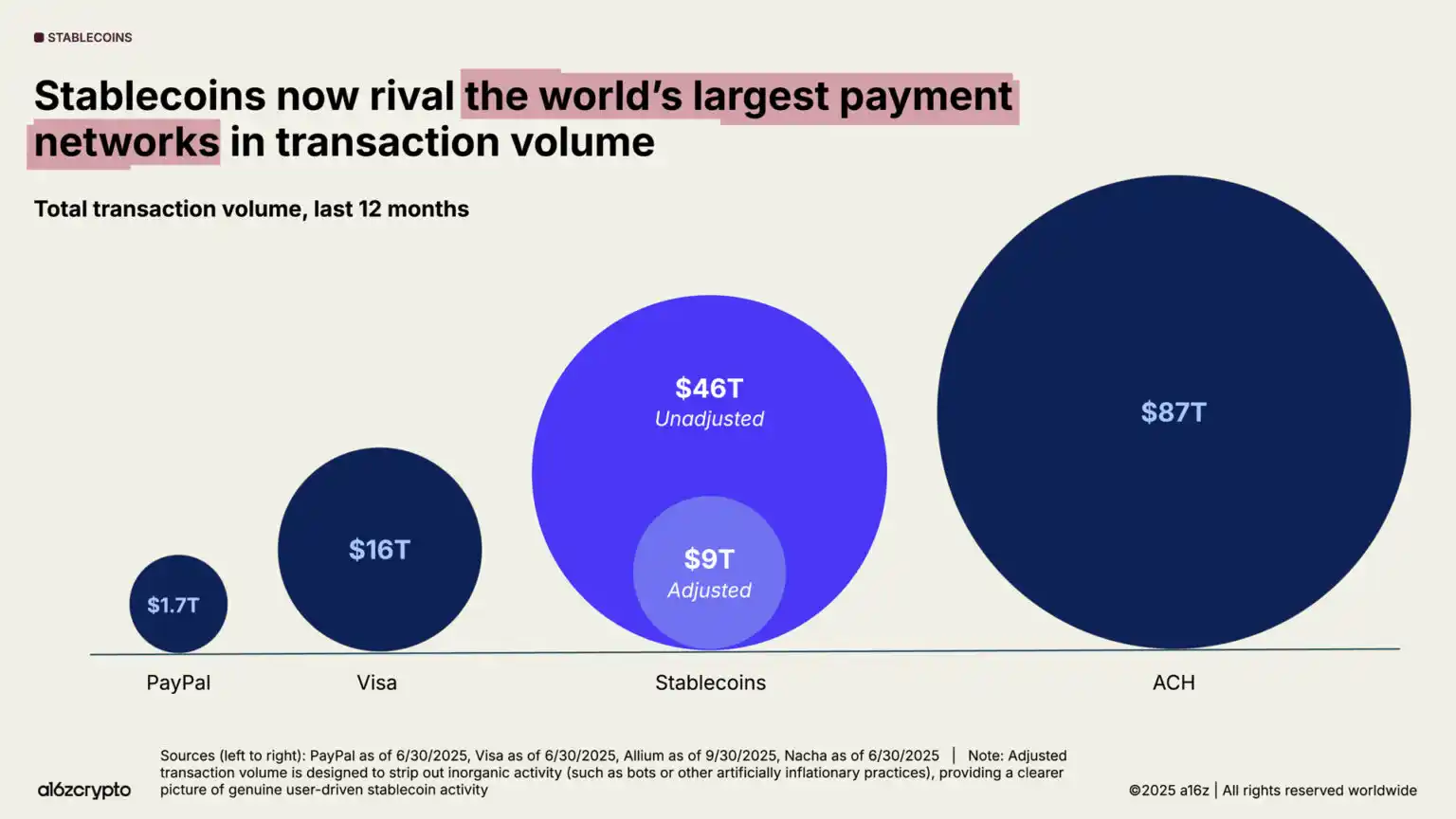

Stablecoins support an annual transaction volume of $46 trillion (adjusted to $9 trillion), rivaling Visa and PayPal;

The scale of Bitcoin and Ethereum exchange-traded products has surpassed $175 billion.

This year's report delves into industry transformations: from institutional adoption and the rise of stablecoins to the integration of crypto and artificial intelligence. We are introducing a crypto data dashboard for the first time, tracking the evolution of the industry through key metrics.

Here are the core points of this article:

· The crypto market has formed a scalable, global, and continuously growing trend;

· Financial institutions are fully embracing crypto assets;

· Stablecoins are entering the mainstream;

· The resilience of the U.S. crypto ecosystem has reached a historical peak;

· The global on-chain process is accelerating;

· Blockchain infrastructure is nearing a maturity threshold;

· Crypto and artificial intelligence technologies are deeply integrated.

1. The crypto market has formed a scalable, global, and continuously growing trend

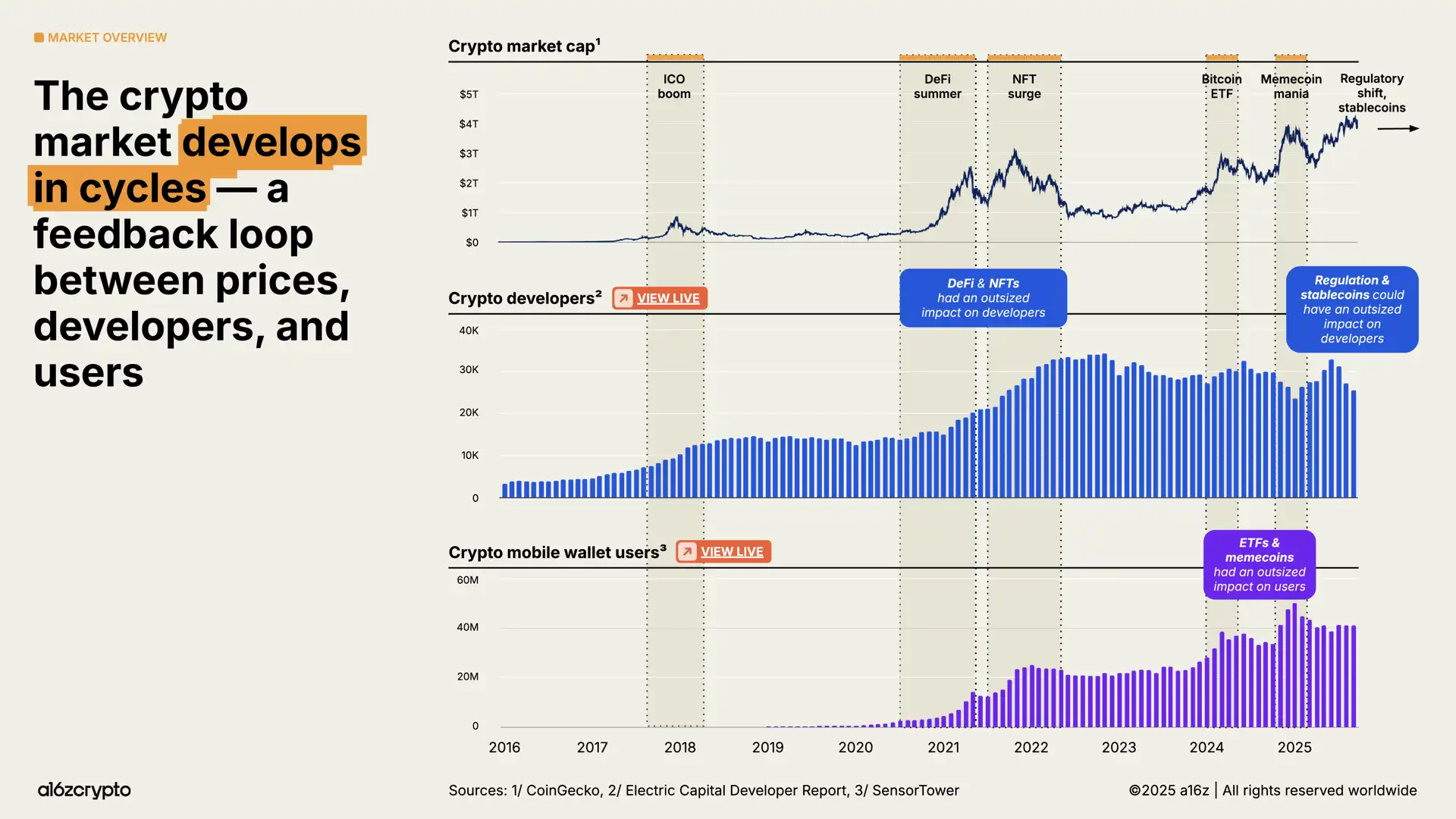

In 2025, the total market capitalization of crypto surpassed $4 trillion for the first time, showcasing a significant leap for the industry. The number of active crypto wallet users surged by 20% year-on-year, reaching a historic high. The dramatic shift from regulatory resistance to policy support, combined with the accelerated implementation of technologies like stablecoins and the tokenization of traditional financial assets, will define the trajectory of the next development cycle.

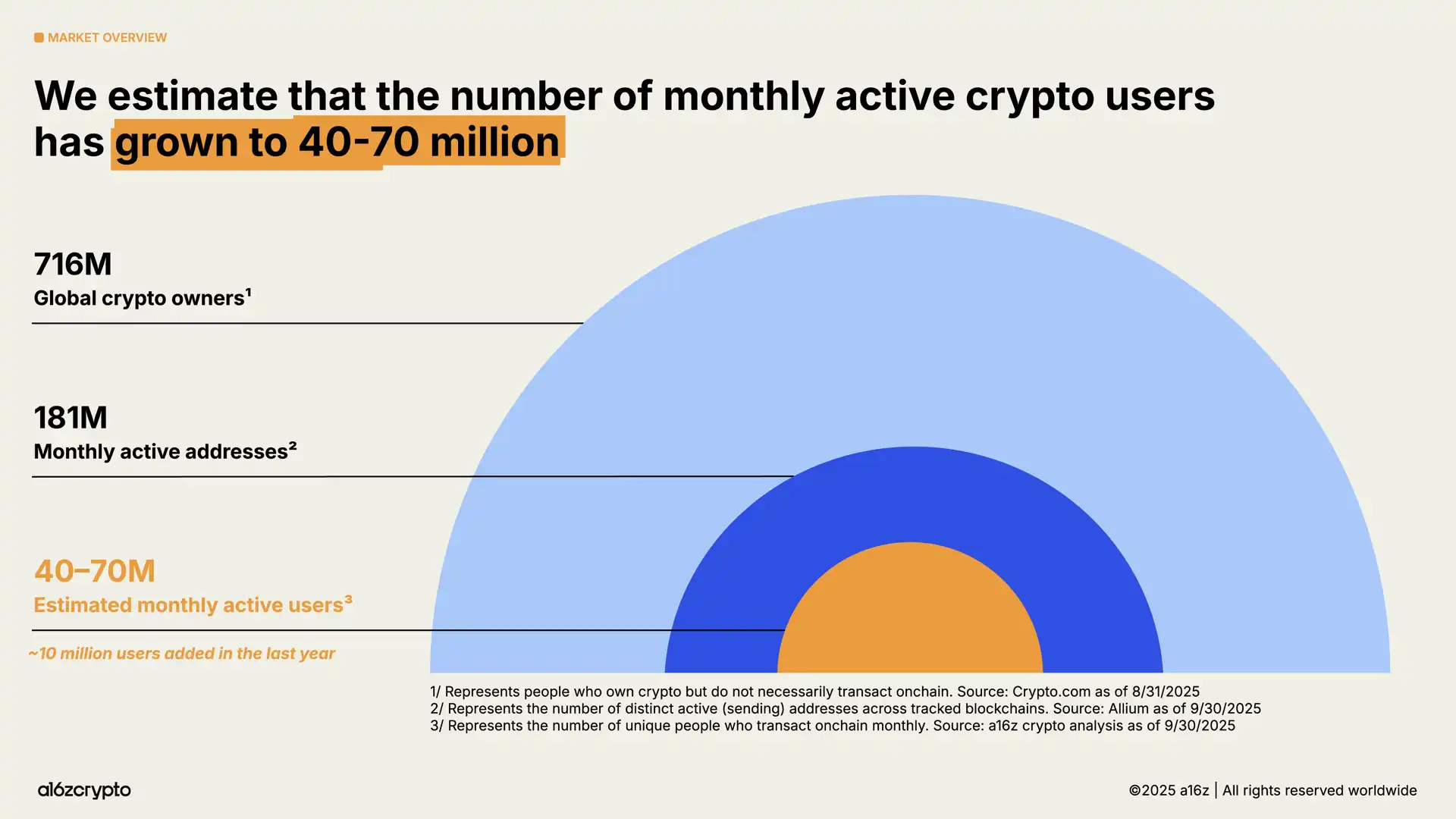

According to our analysis based on updated methodologies, there are currently approximately 40 million to 70 million active crypto users globally, an increase of about 10 million from last year.

This number represents only a small fraction of the 716 million global crypto asset holders (a year-on-year increase of 16%) and is far below the scale of approximately 181 million monthly active addresses on-chain (a year-on-year decrease of 18%).

The gap in numbers between passive holders (those who own crypto assets but do not engage in on-chain transactions) and active users (those who regularly conduct on-chain transactions) reveals an important opportunity for crypto builders: how to reach the potential user base that already holds crypto assets but has not yet participated in on-chain activities.

So where are these crypto users distributed? What activities are they engaged in?

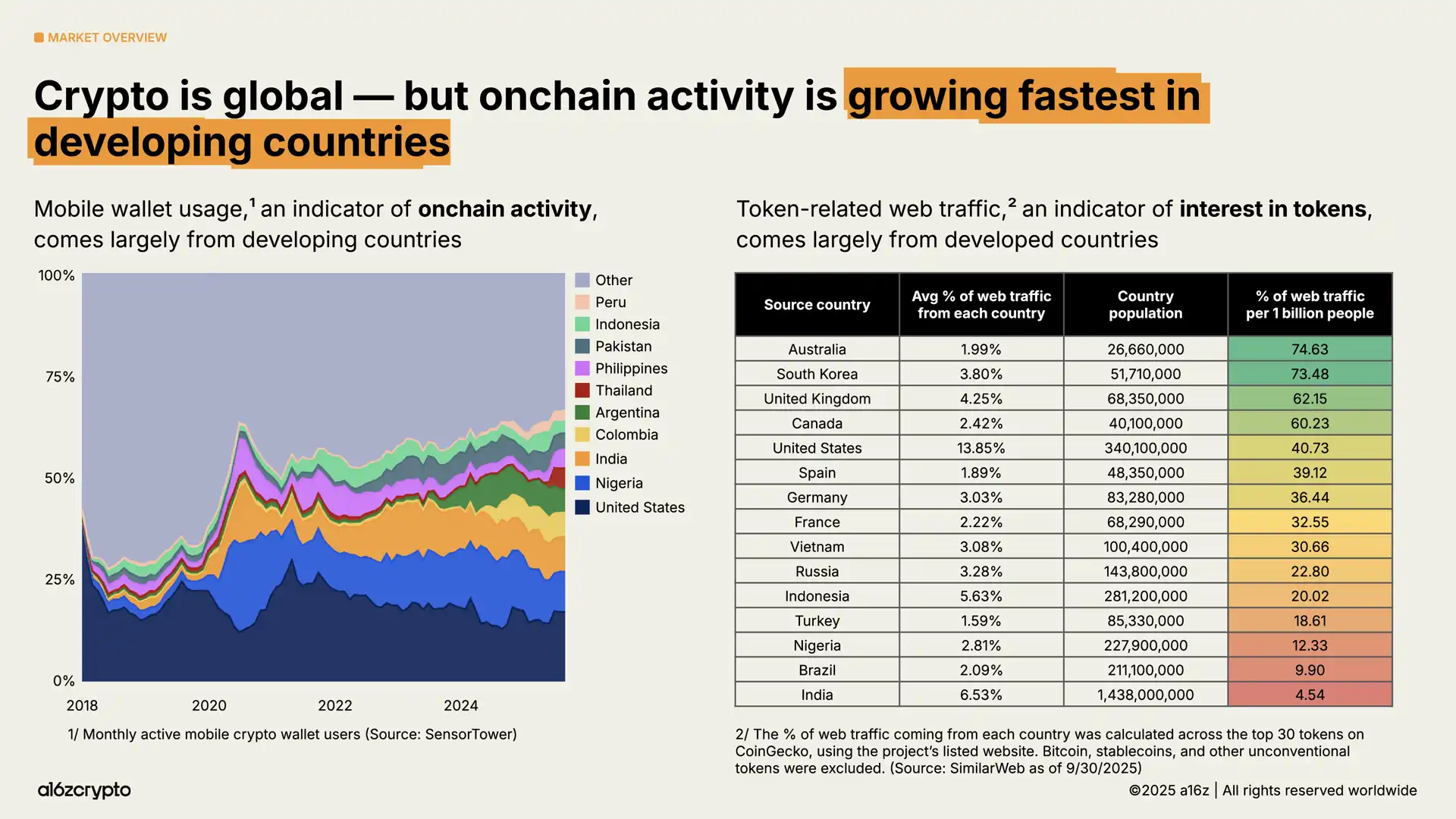

The crypto ecosystem has global characteristics, but different regions of the world exhibit differentiated usage patterns. The usage of mobile wallets, as an indicator of on-chain activity, has seen the fastest growth in emerging markets such as Argentina, Colombia, India, and Nigeria (especially in Argentina, where the usage of crypto mobile wallets surged 16 times amid ongoing currency crises over the past three years).

Meanwhile, our analysis of the geographical sources of token-related network traffic shows that token interest indicators are more skewed towards developed countries. Compared to user behavior in developing countries, activities in countries like Australia and South Korea may be more concentrated in trading and speculation.

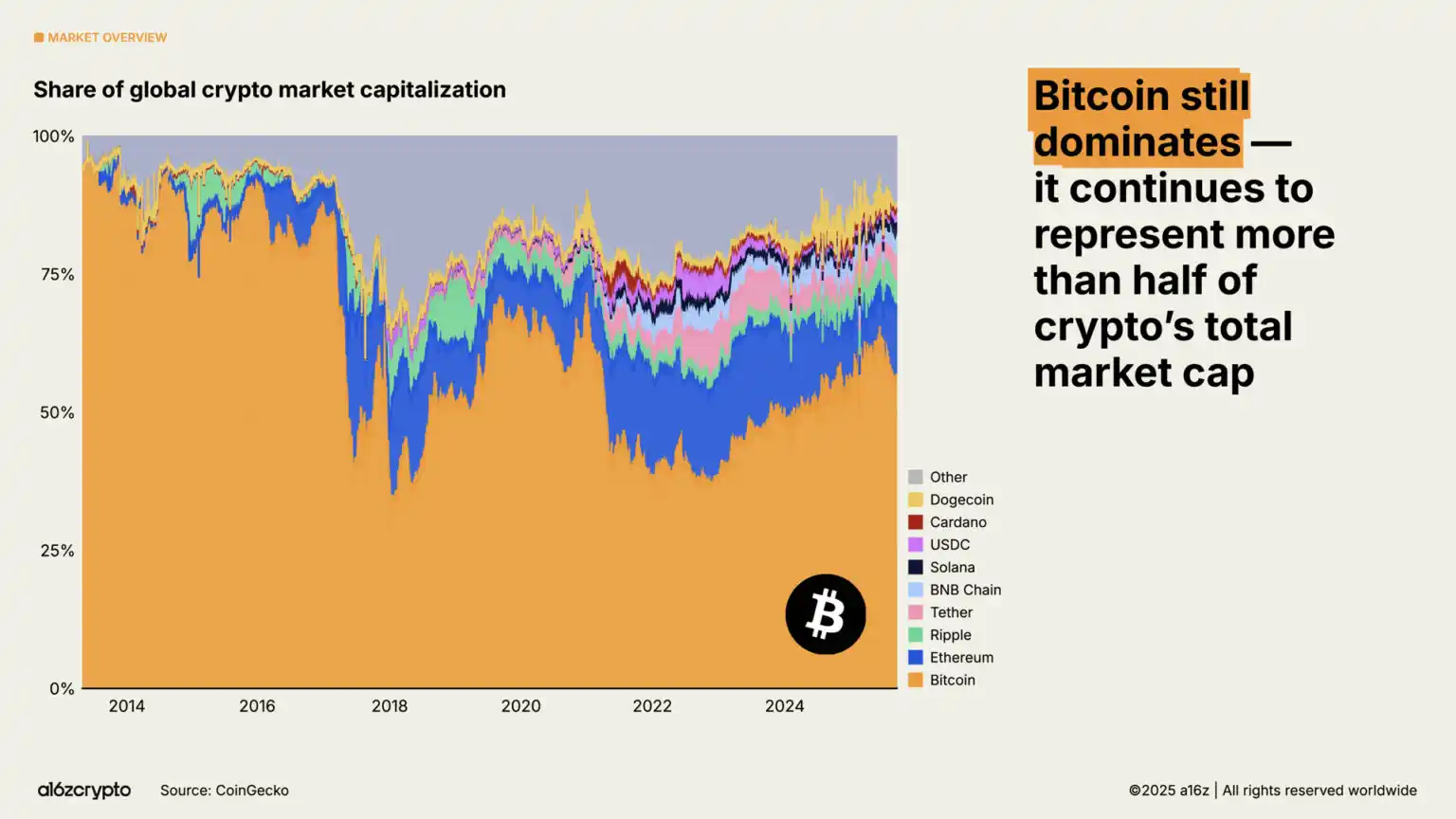

Bitcoin (which still accounts for more than half of the total market capitalization of crypto) has gained favor among investors as a store of value, reaching a historic high of over $126,000. Meanwhile, Ethereum and Solana have recovered most of their losses from the 2022 crash.

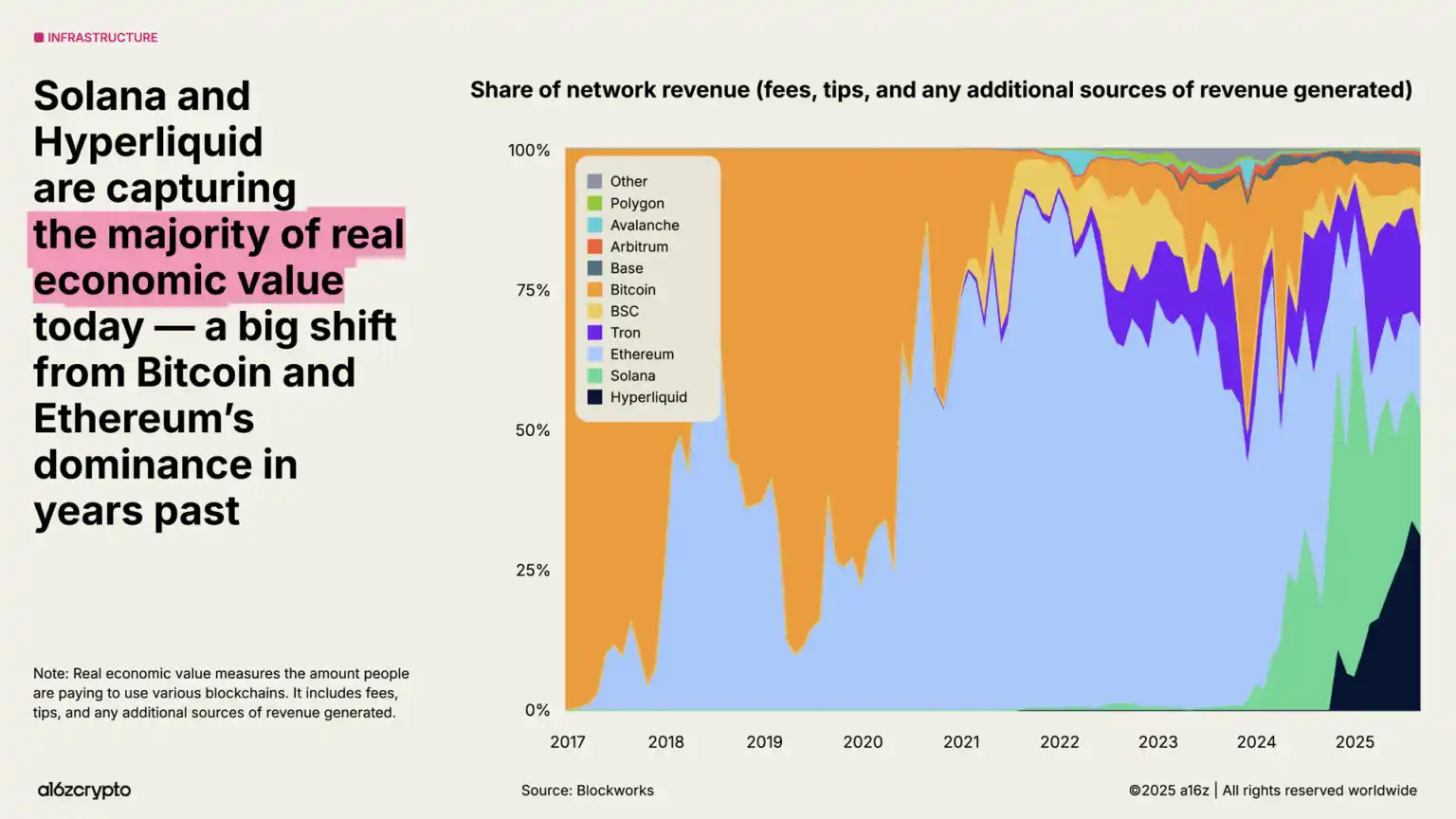

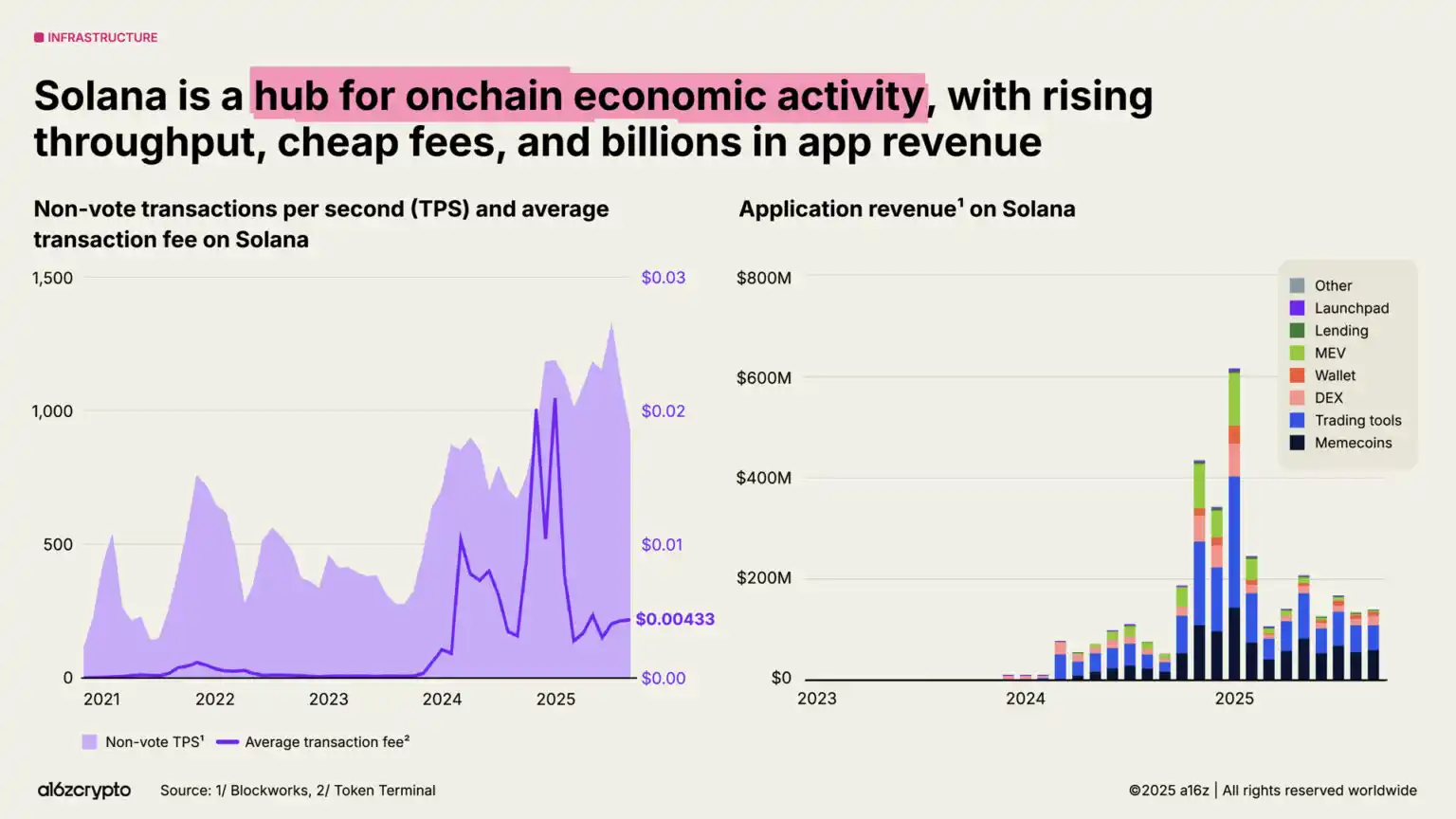

As blockchain continues to expand, the fee market matures, and new applications emerge, certain metrics are becoming increasingly important—one of which is "real economic value," which measures the actual fees users pay to use blockchain for payments. Currently, Hyperliquid and Solana account for 53% of revenue-generating economic activity, marking a significant shift from the earlier dominance of Bitcoin and Ethereum.

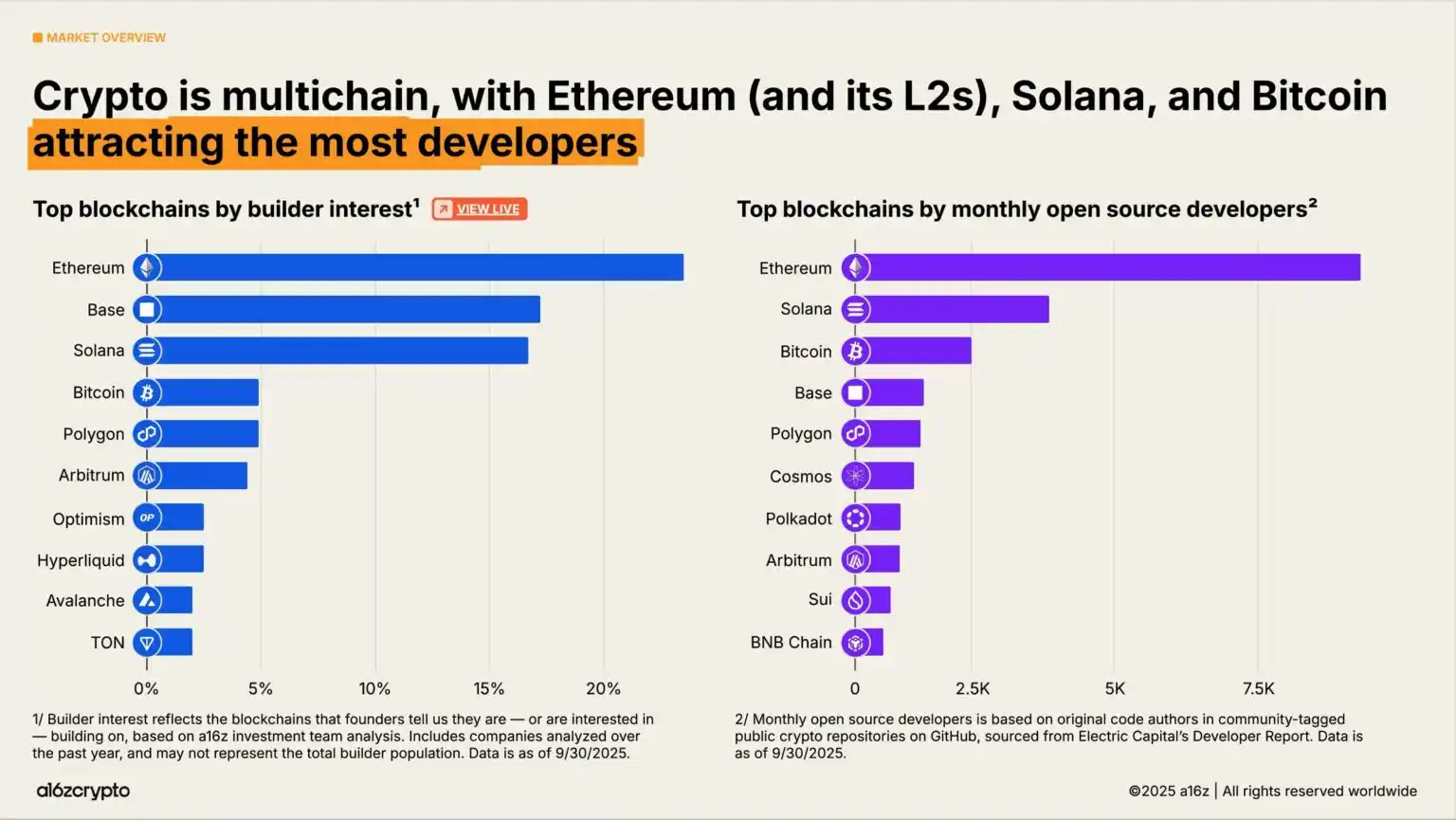

From a developer ecosystem perspective, the crypto world still exhibits a multi-chain pattern, with Bitcoin, Ethereum and its layer-2 networks, and Solana forming the three core developer hubs. In 2025, Ethereum and its layer-2 networks became the preferred targets for new developers, while Solana emerged as one of the fastest-growing ecosystems—developer interest increased by 78% over the past two years. This data comes from a16z's crypto investment team's research and analysis of entrepreneurs' preferred development platforms.

2. Financial institutions are fully embracing crypto assets

2025 is considered the year of institutional adoption. Following last year's report on the "State of the Crypto Industry," which announced that stablecoins achieved product-market fit in just five days, Stripe announced the acquisition of the stablecoin infrastructure platform Bridge, marking the beginning of traditional financial companies publicly laying out their stablecoin strategies.

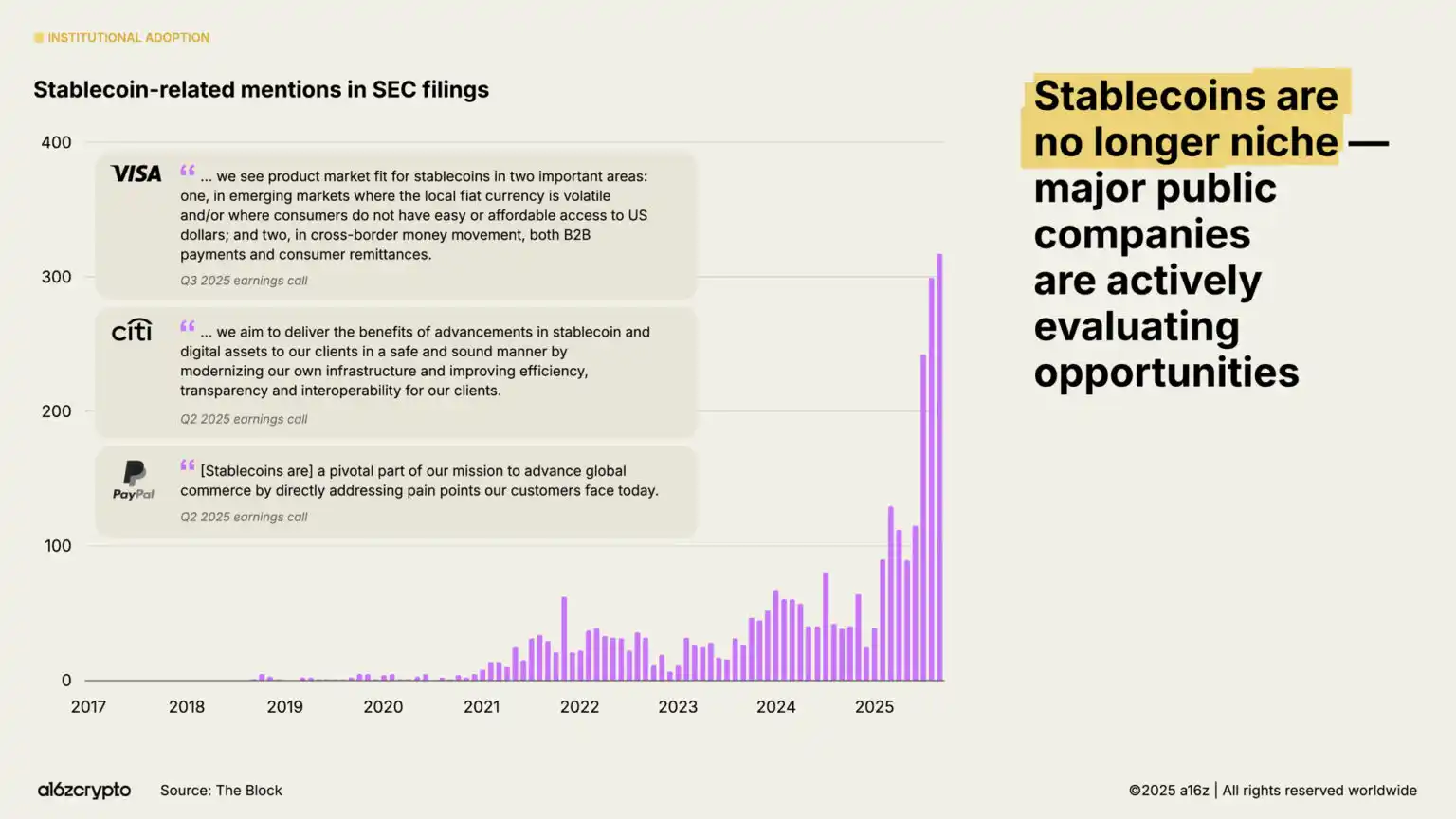

Months later, Circle's $10 billion IPO signified that stablecoin issuers had officially entered the ranks of mainstream financial institutions. The bipartisan support for the "GENIUS Act" in July provided a clear action guide for builders and institutions. Subsequently, the frequency of mentions of stablecoins in SEC filings increased by 64%, and announcements of major financial institutions' strategies surged.

Institutional applications are accelerating. Traditional financial institutions such as Citigroup, Fidelity, JPMorgan, Mastercard, Morgan Stanley, and Visa have begun (or plan to) directly offer crypto products to consumers, enabling them to buy, sell, and hold digital assets as well as traditional tools like stocks and exchange-traded products. Meanwhile, platforms like PayPal and Shopify are doubling down on the payment sector, building infrastructure for everyday transactions between merchants and consumers.

In addition to directly providing products, major fintech companies like Circle, Robinhood, and Stripe are actively developing or have announced plans to develop new blockchains focused on payments, real-world assets, and stablecoins. These initiatives may drive more payment flows on-chain, promote enterprise applications, and ultimately build a larger, faster, and more global financial system.

These companies have vast distribution networks. If development continues to deepen, crypto technology is expected to be fully integrated into the financial services we use daily.

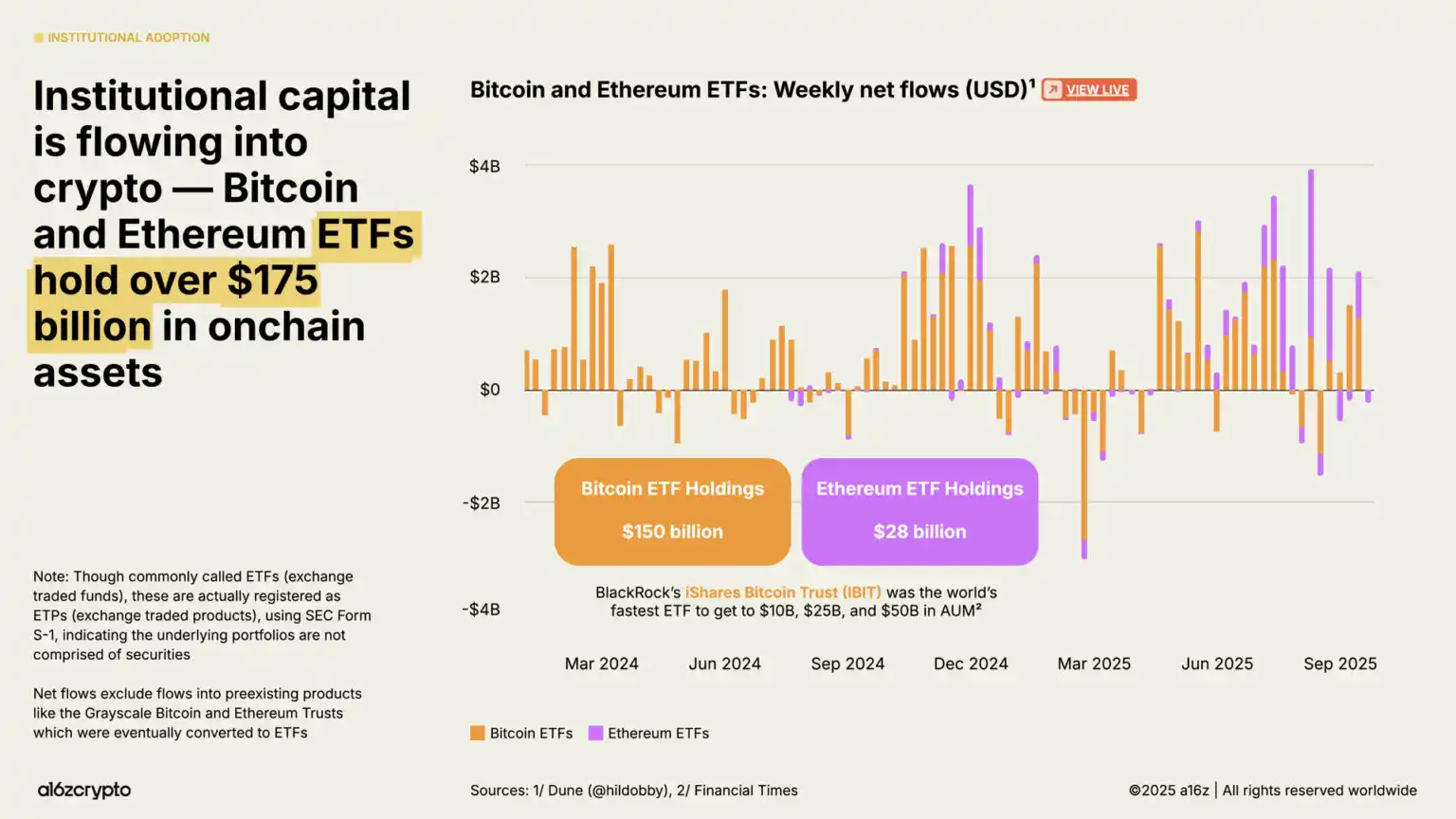

Exchange-traded products have become another key driver of institutional investment, with the on-chain crypto asset holdings surpassing $175 billion, soaring 169% from $65 billion a year ago.

BlackRock's iShares Bitcoin Trust has been hailed as the most actively traded Bitcoin exchange-traded product in history, and the recently launched Ethereum exchange-traded product has also seen significant inflows in recent months. (Note: Although often referred to as exchange-traded funds, these products are actually registered with the SEC as exchange-traded products, indicating that their underlying assets do not include securities.)

These products significantly lower the investment threshold for crypto assets, opening the door for large institutional funds that have historically hovered on the periphery of the industry.

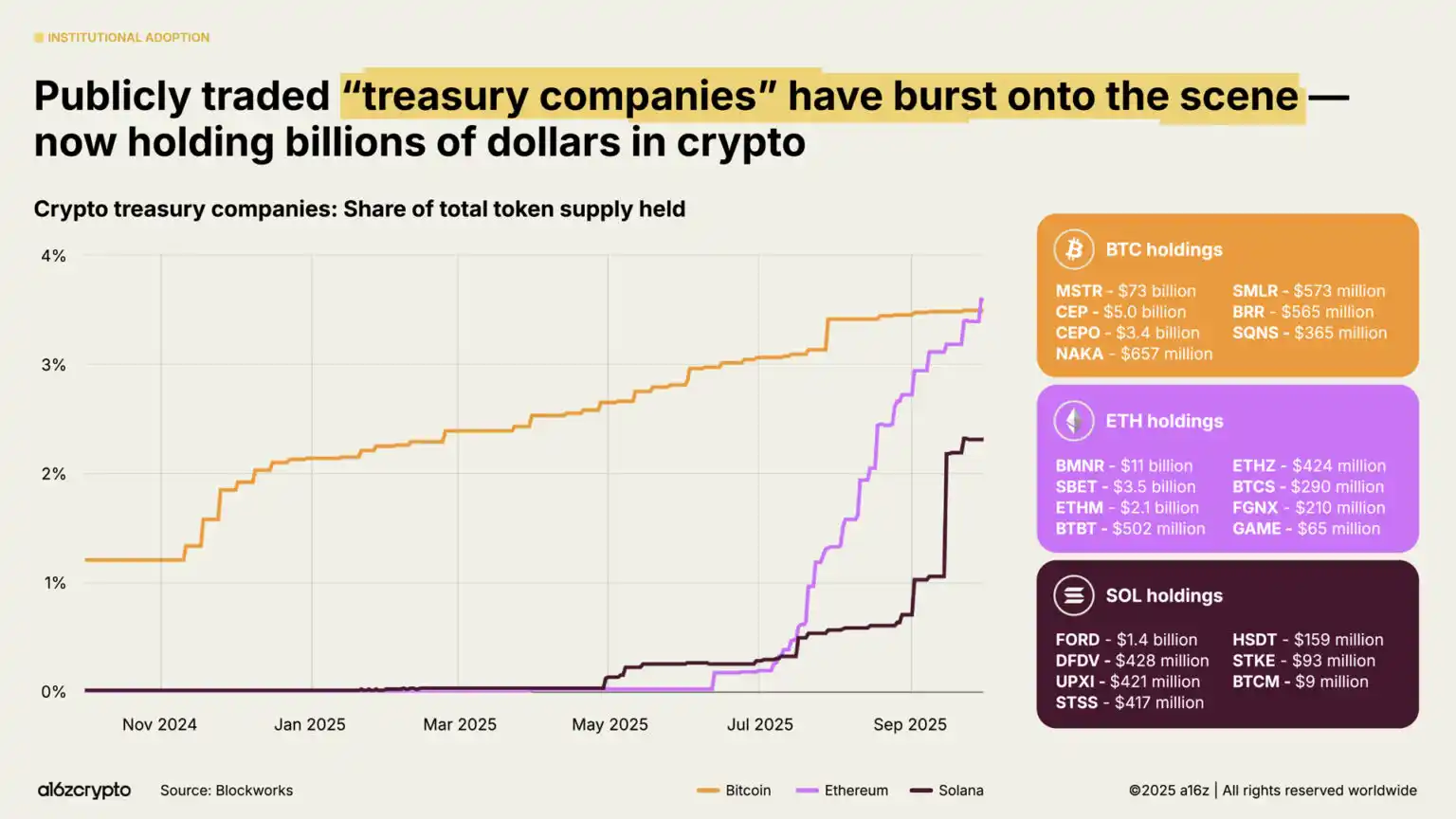

Publicly traded "digital asset reserve" companies—those that hold crypto assets on their balance sheets (similar to how corporate treasuries hold cash)—currently hold about 4% of the circulating supply of Bitcoin and Ethereum. These digital asset reserve companies, along with exchange-traded products, currently hold about 10% of the circulating supply of Bitcoin and Ethereum.

3. Stablecoins are entering the mainstream

The most significant indicator of the maturity of the crypto market in 2025 is undoubtedly the rise of stablecoins. In previous years, stablecoins were primarily used for settling speculative crypto trades, but in the past two years, they have become the fastest and lowest-cost means of dollar circulation globally—processing millions of transactions per second at a cost of less than one cent per transaction, covering the vast majority of regions worldwide.

This year, stablecoins have become the backbone of the on-chain economy.

In the past year, the total transaction volume of stablecoins reached $46 trillion, a year-on-year increase of 106%. Although this primarily represents capital flow (unlike retail payments by card organizations), the scale has reached three times that of Visa and is approaching the ACH network that connects the entire U.S. banking system.

Adjusted for bots and human volume manipulation data, the real transaction volume of stablecoins over the past 12 months was $9 trillion, a year-on-year increase of 87%, which is more than five times the volume processed by PayPal and exceeds half the scale of Visa.

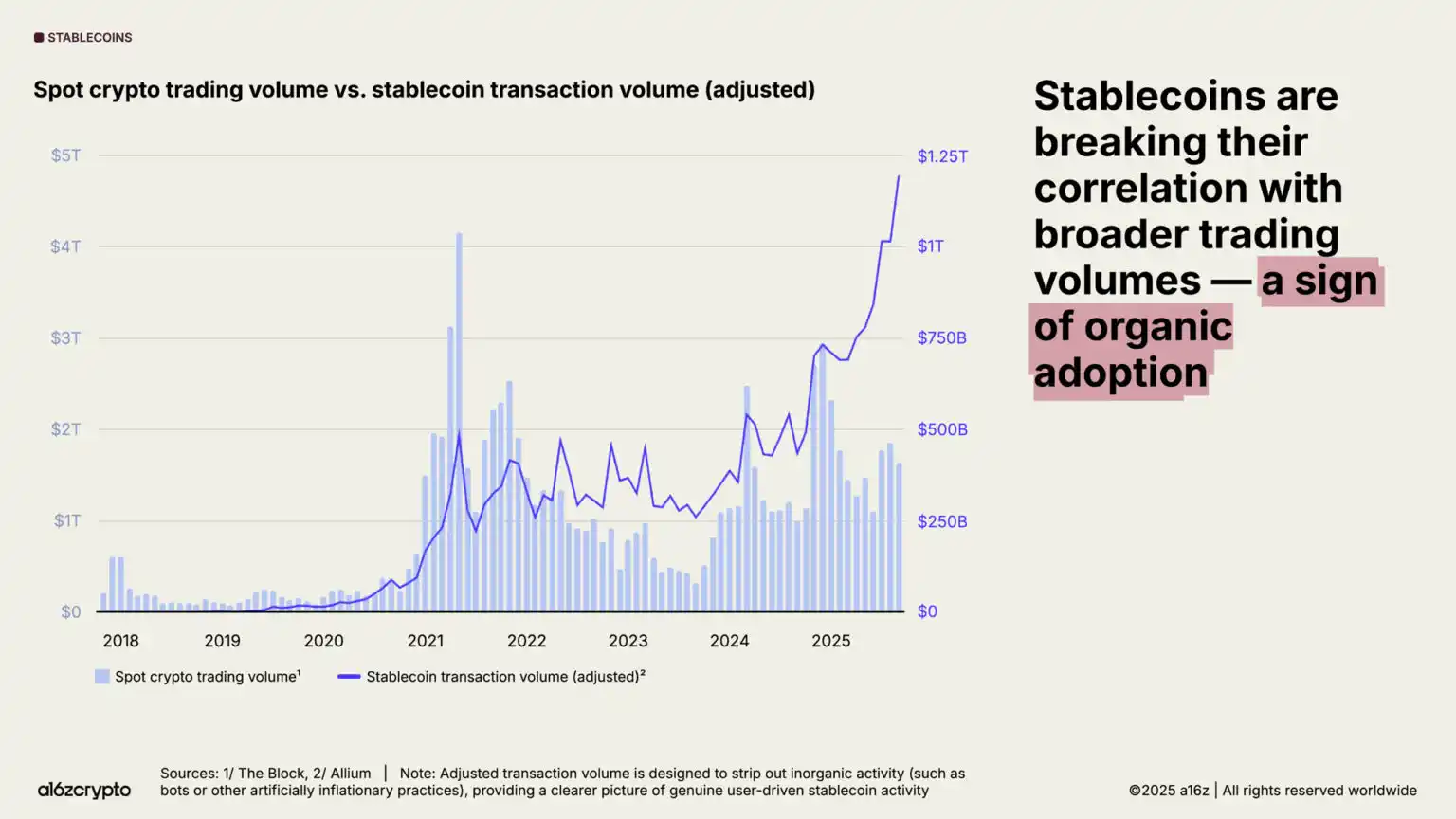

Application is accelerating in popularity. The adjusted monthly stablecoin transaction volume has surged to a historic high, approaching $1.25 trillion in September 2025 alone.

Notably, this activity is less correlated with overall crypto trading volume—indicating that stablecoins are being used for non-speculative purposes, and more importantly, this confirms their product-market fit.

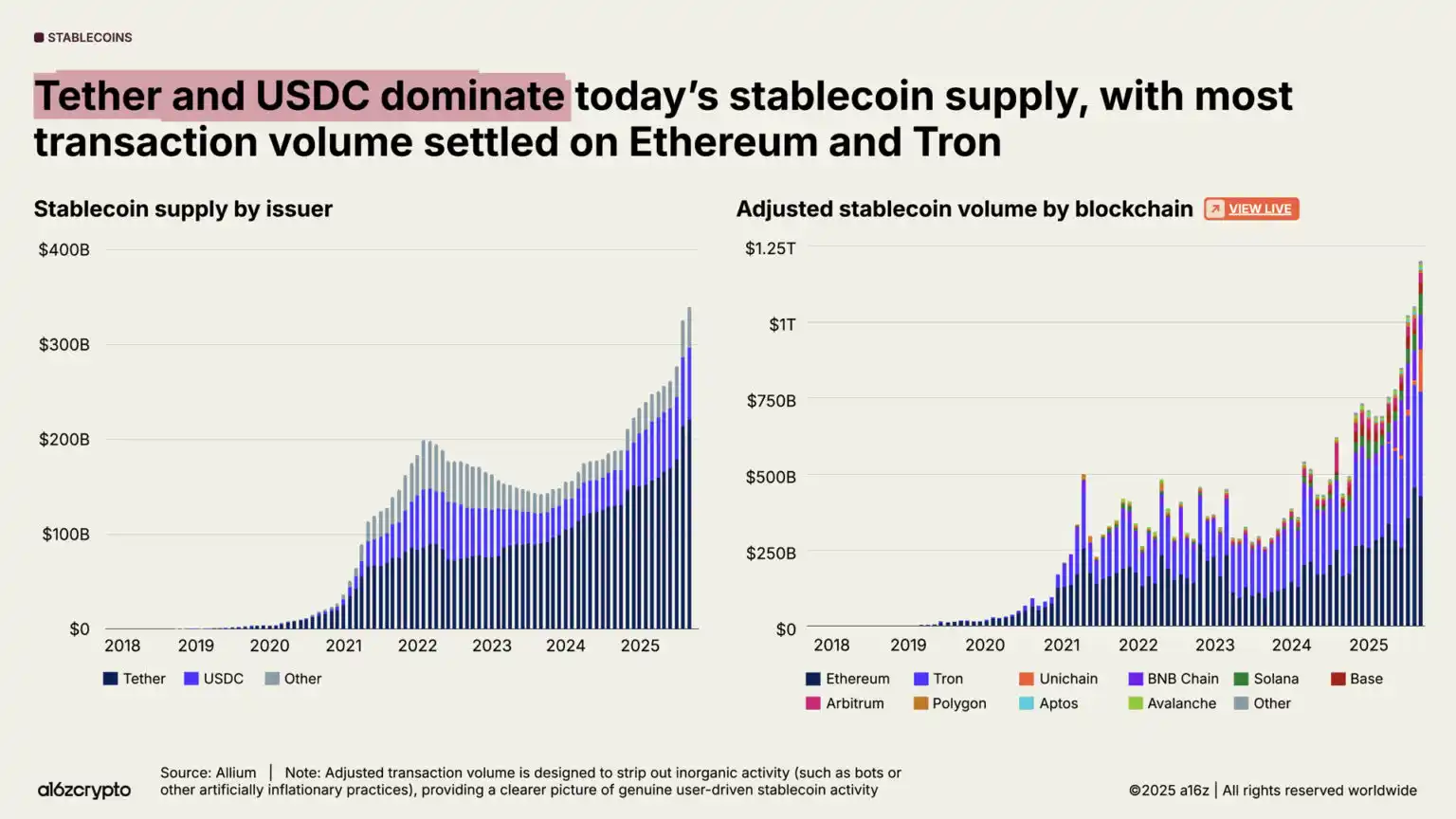

The total supply of stablecoins has also reached a historic high, now exceeding $300 billion.

The market is dominated by leading stablecoins: Tether and USDC account for 87% of the total supply. In September 2025, the stablecoin transaction volume processed on the Ethereum and Tron blockchains (adjusted) reached $772 billion, accounting for 64% of all transaction volume. Although these two issuers and blockchains hold the majority share of stablecoin activity, the growth momentum of emerging blockchains and issuers is also accelerating.

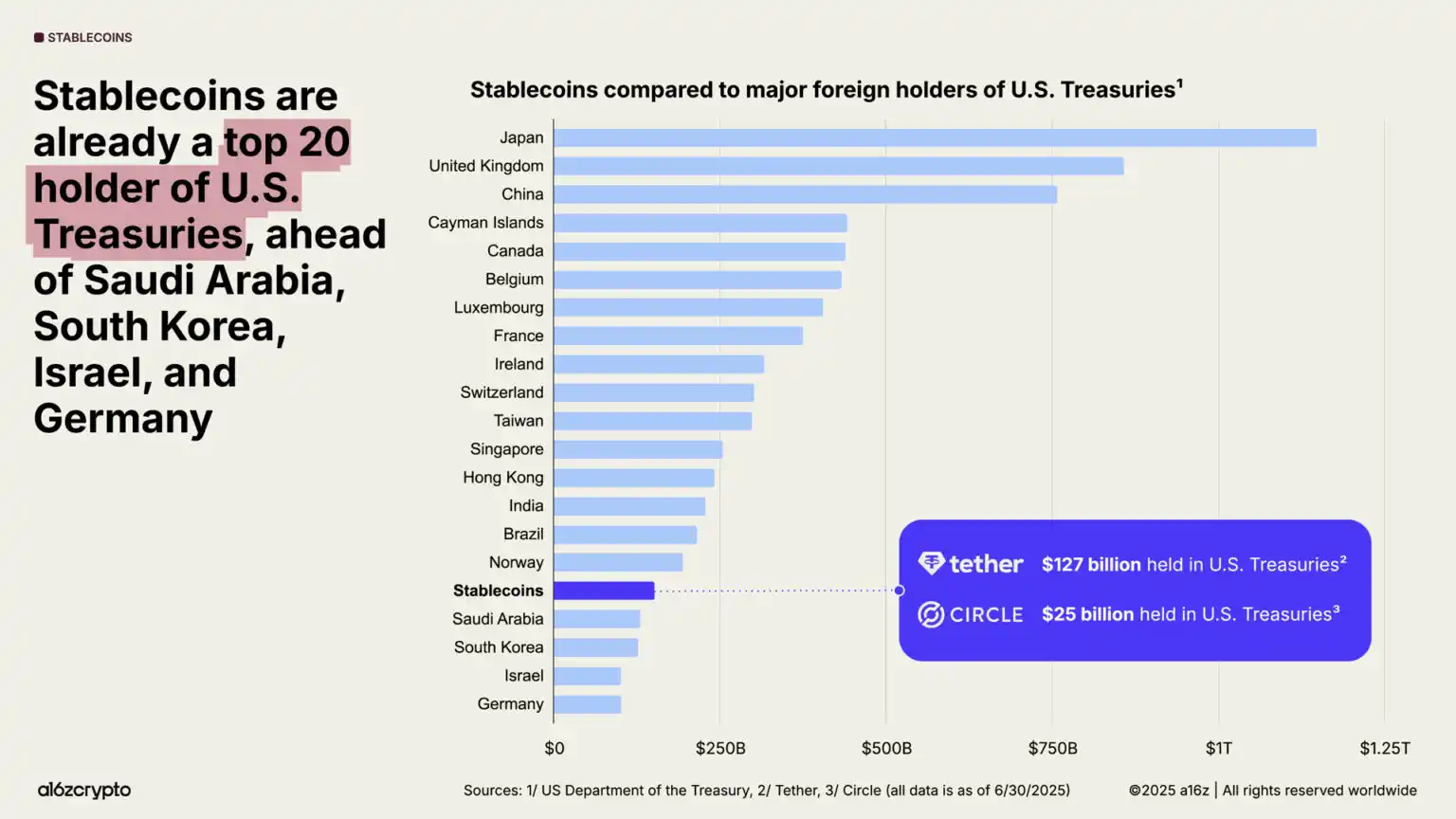

Stablecoins have become an important force in the global macroeconomy: over 1% of dollars exist in tokenized stablecoin form on public blockchains, with their holdings of U.S. Treasury securities rising from 20th to 17th place compared to last year. Currently, stablecoins hold over $150 billion in U.S. Treasuries—more than many sovereign nations.

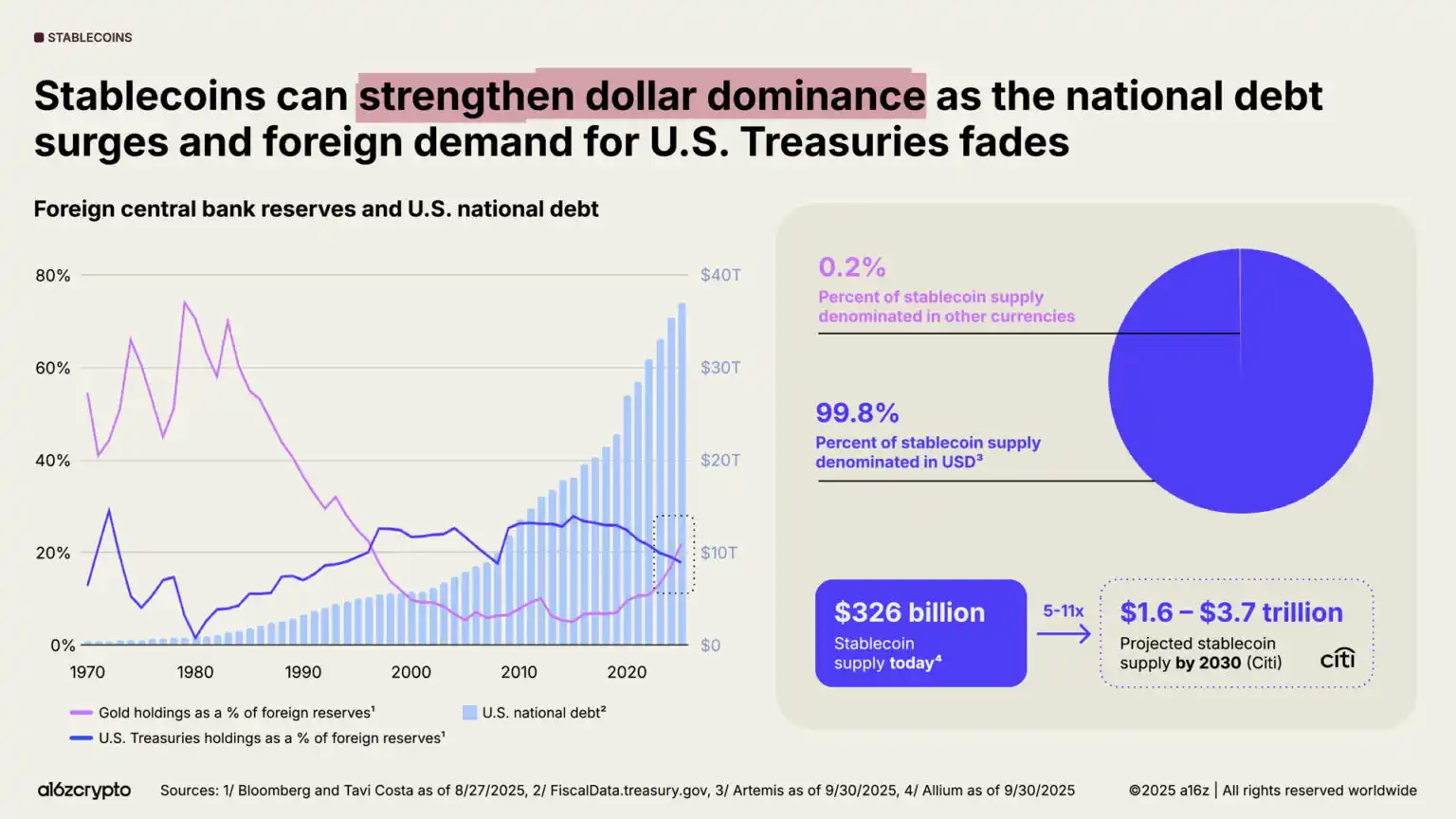

Meanwhile, despite a weakening global demand for U.S. Treasuries, national debt continues to surge. For the first time in 30 years, foreign central bank gold reserves have surpassed U.S. Treasury holdings.

However, stablecoins are thriving: over 99% of stablecoins are dollar-denominated, and they are expected to grow tenfold to over $3 trillion by 2030, potentially providing a strong and sustainable source of demand for U.S. debt in the coming years.

Even as foreign central banks reduce their holdings of U.S. Treasuries, stablecoins continue to solidify the dollar's dominance.

4. The resilience of the U.S. crypto ecosystem has reached a historical peak

The U.S. has reversed its previous adversarial stance towards the crypto sector, revitalizing builder confidence.

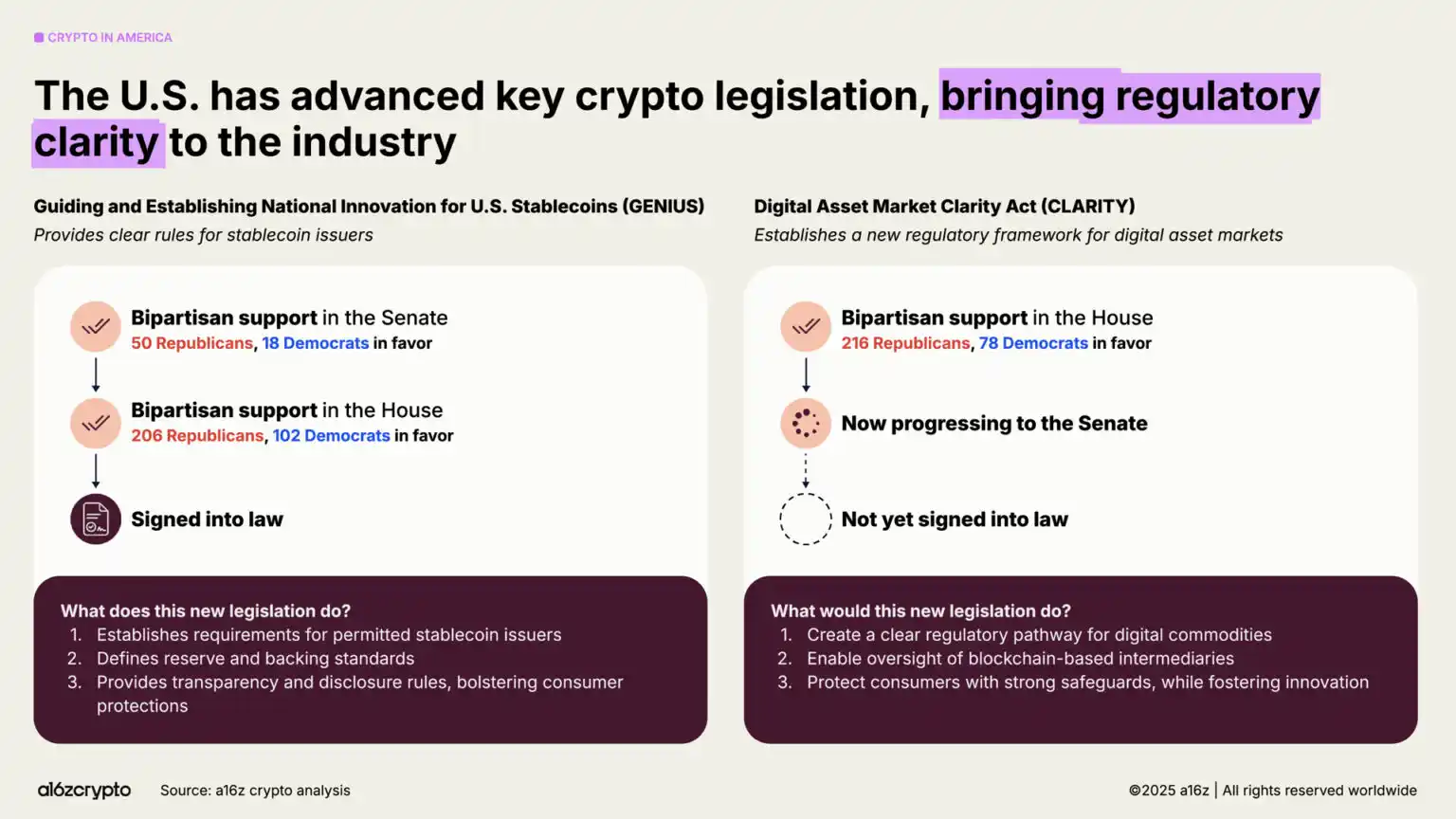

The passage of the GENIUS Act this year and the House approval of the CLARITY Act signify a bipartisan consensus: crypto assets not only will persist in the U.S. but also have the conditions for prosperous development. Together, these two bills establish a regulatory framework for stablecoins that balances innovation and investor protection, as well as market structure and digital asset oversight. Meanwhile, Executive Order 14178 has repealed earlier anti-crypto directives and established an interagency working group to promote the modernization of federal digital asset policy.

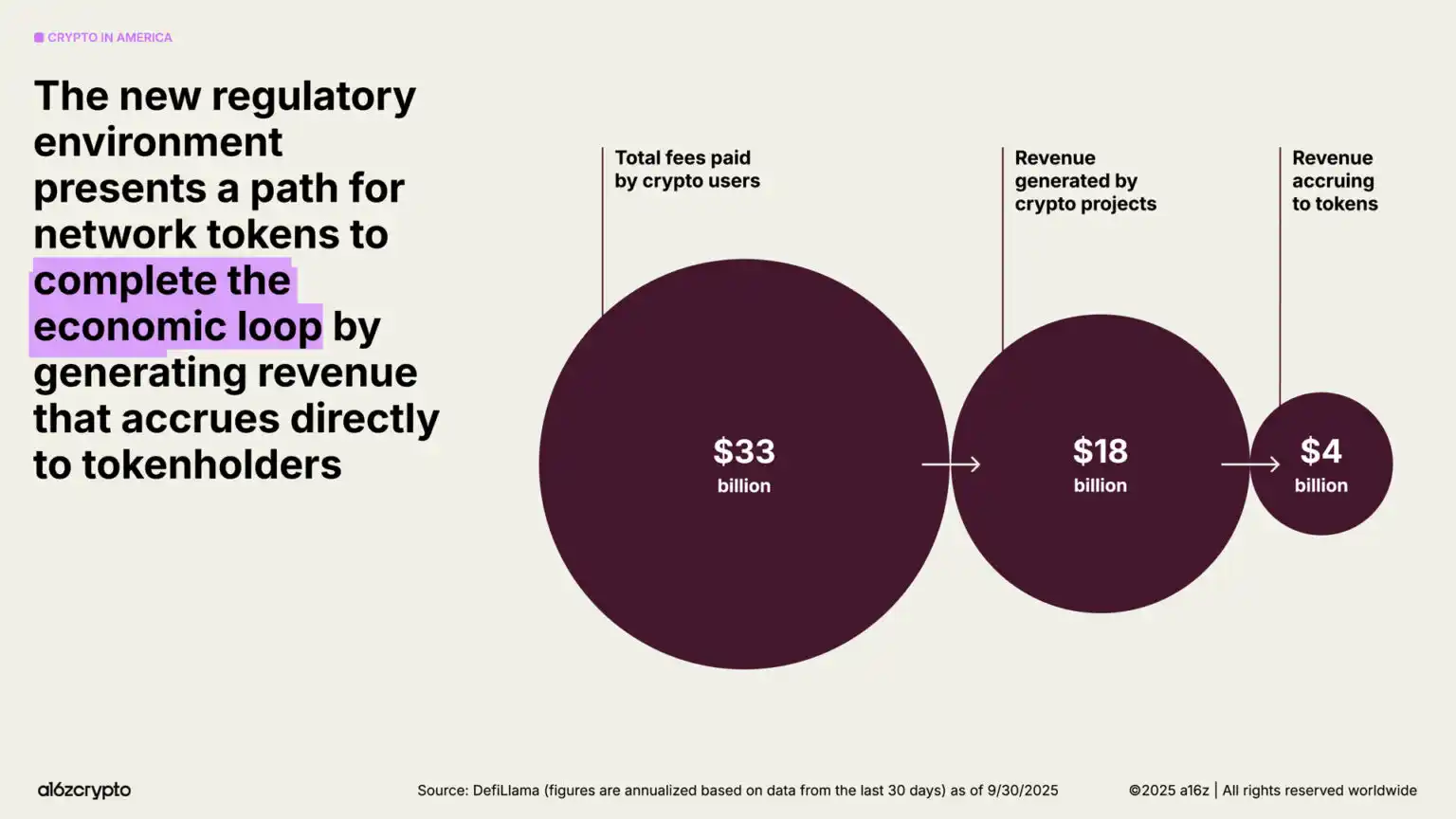

The regulatory environment is paving the way for builders to fully unleash the potential of tokens as new digital primitives—much like the significance of the web for previous generations of the internet. With clearer regulatory frameworks, more network tokens will complete economic cycles by generating returns for holders, thereby creating a self-sustaining new economic engine that allows more users to share in the system's benefits.

5. The global on-chain process is accelerating

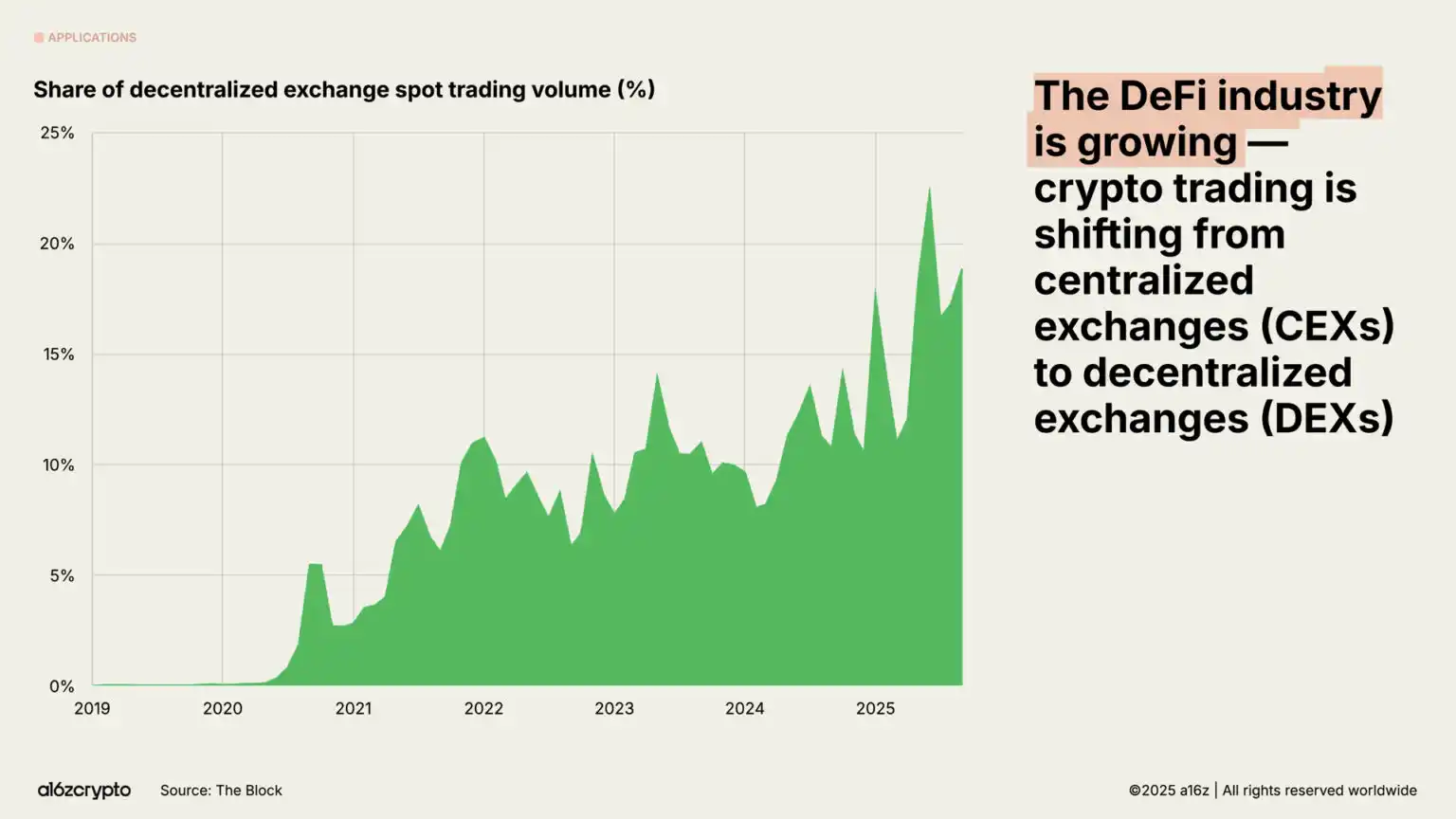

What was once a niche experimental ground for early adopters has evolved into a diverse ecosystem with tens of millions of monthly active participants. Nearly one-fifth of spot trading volume is now completed through decentralized trading platforms.

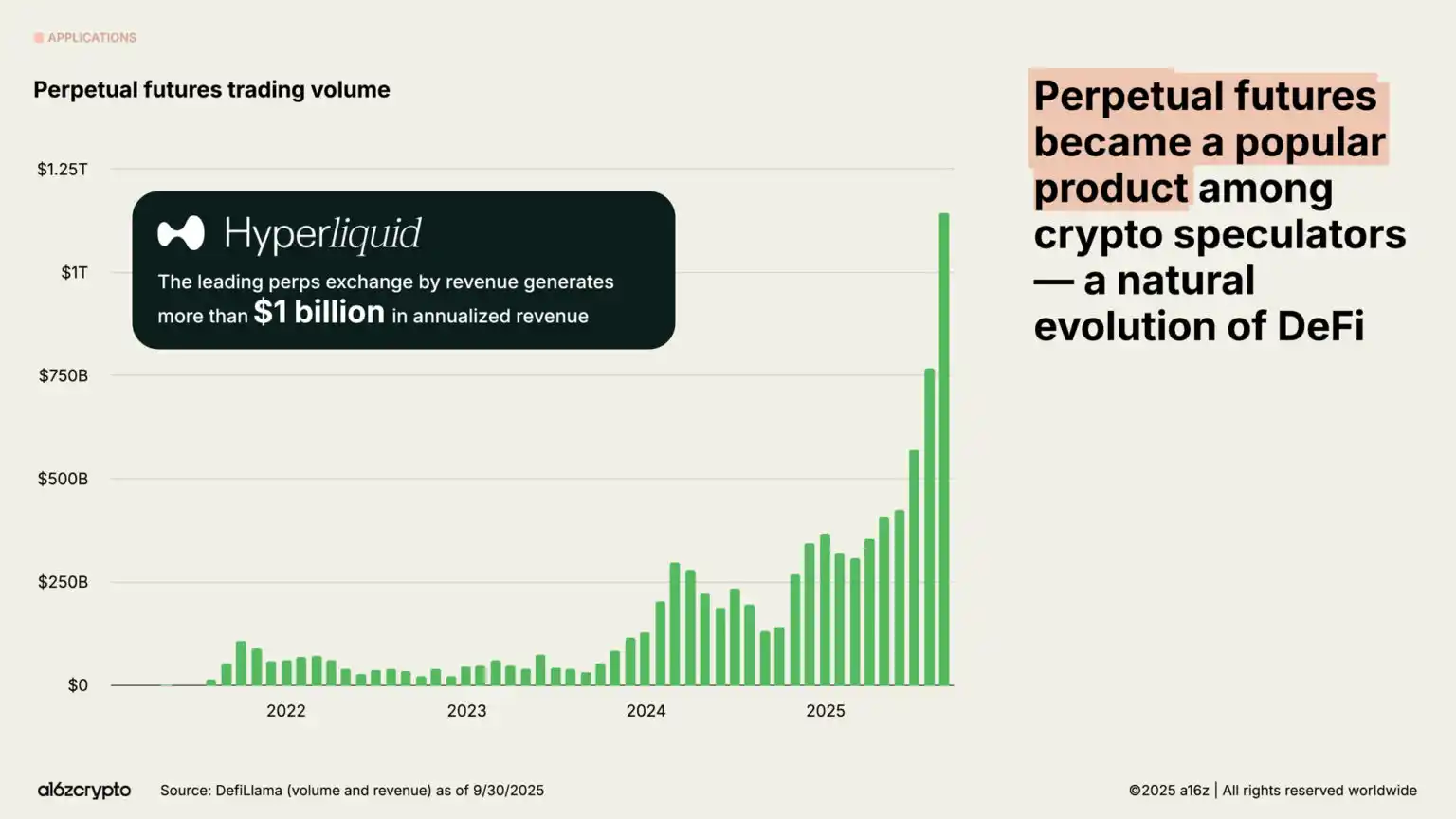

Perpetual contract trading volume has surged nearly 8 times in the past year, showing explosive growth among crypto speculators. Decentralized perpetual contract trading platforms like Hyperliquid have processed trillions of dollars in trading volume, generating over $1 billion in annualized revenue this year—data that is now comparable to some centralized trading platforms.

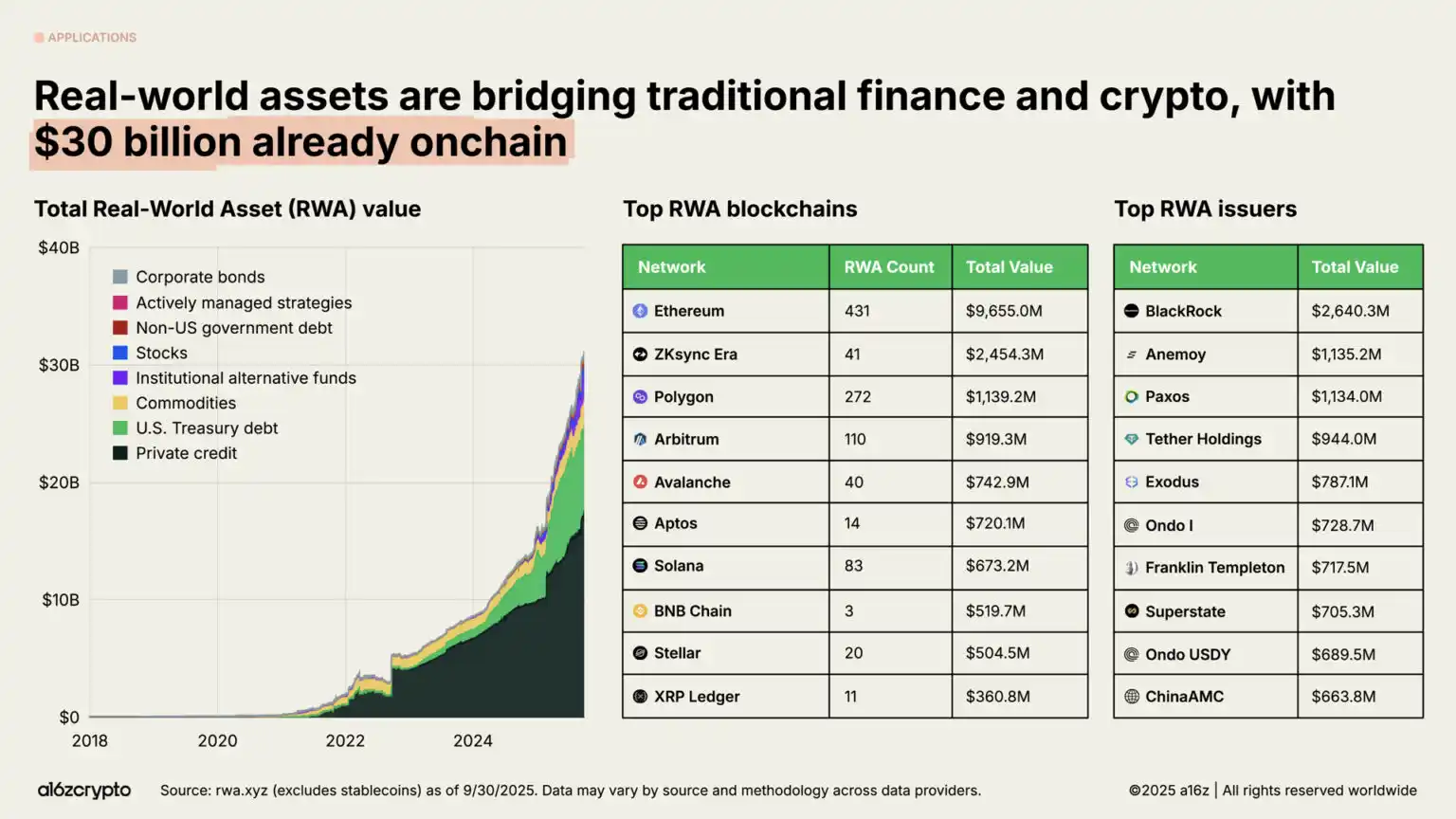

Real-world assets—including U.S. Treasuries, money market funds, private credit, and real estate—are being tokenized and presented on-chain, connecting crypto with traditional finance. The total market size of tokenized RWAs has reached $30 billion, growing nearly fourfold in the past two years.

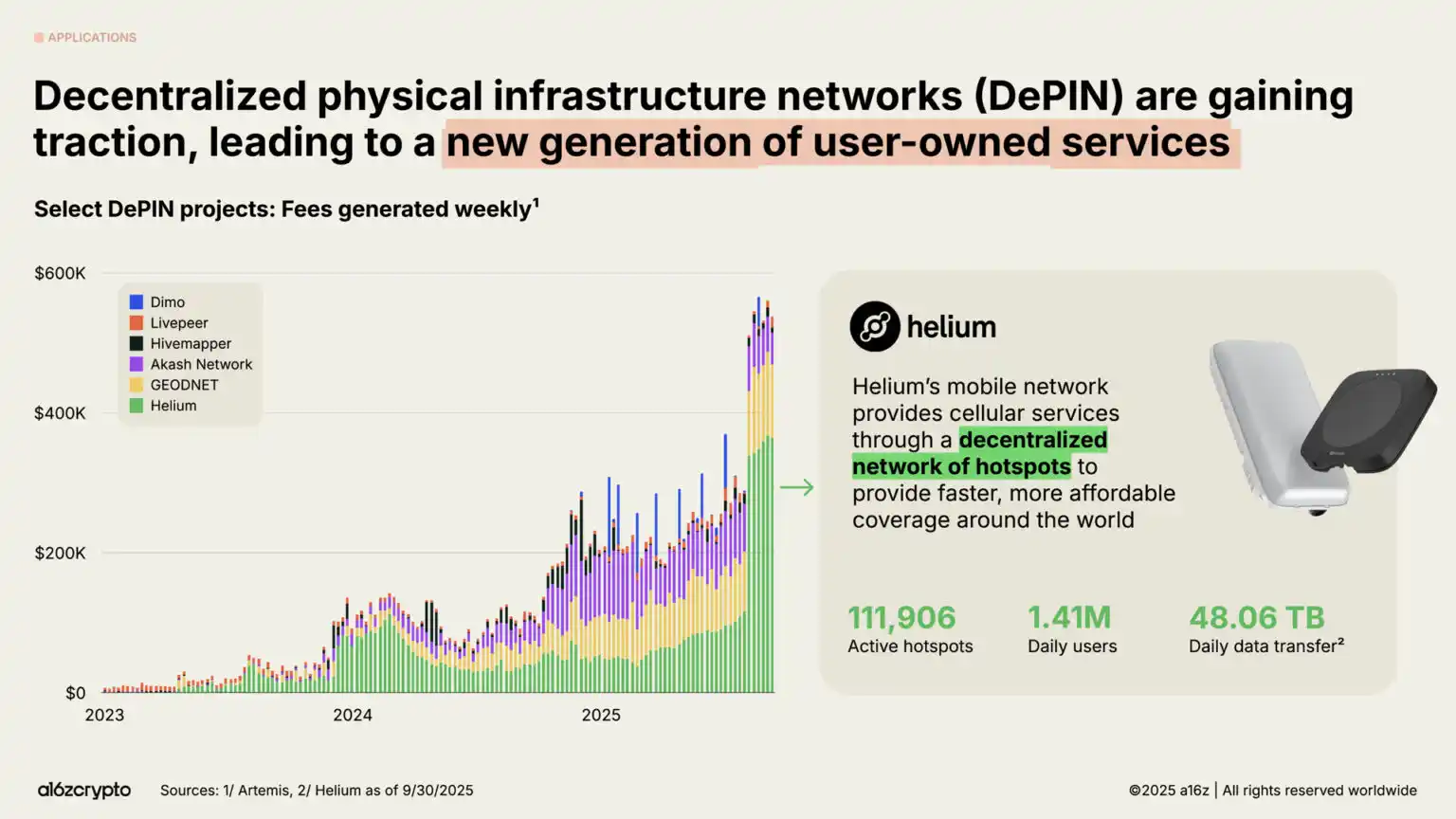

Beyond finance, the most ambitious frontier for blockchain in 2025 is DePIN—decentralized physical infrastructure networks.

Just as DeFi is reconstructing the financial system, DePIN is reshaping physical infrastructures such as telecom networks, transportation systems, and energy grids. This field holds immense potential: the World Economic Forum predicts that the DePIN market will reach $3.5 trillion by 2028.

The Helium network is the most representative case. This grassroots-driven wireless network, operated by over 111,000 users, currently provides 5G cellular network coverage for 1.4 million daily active users.

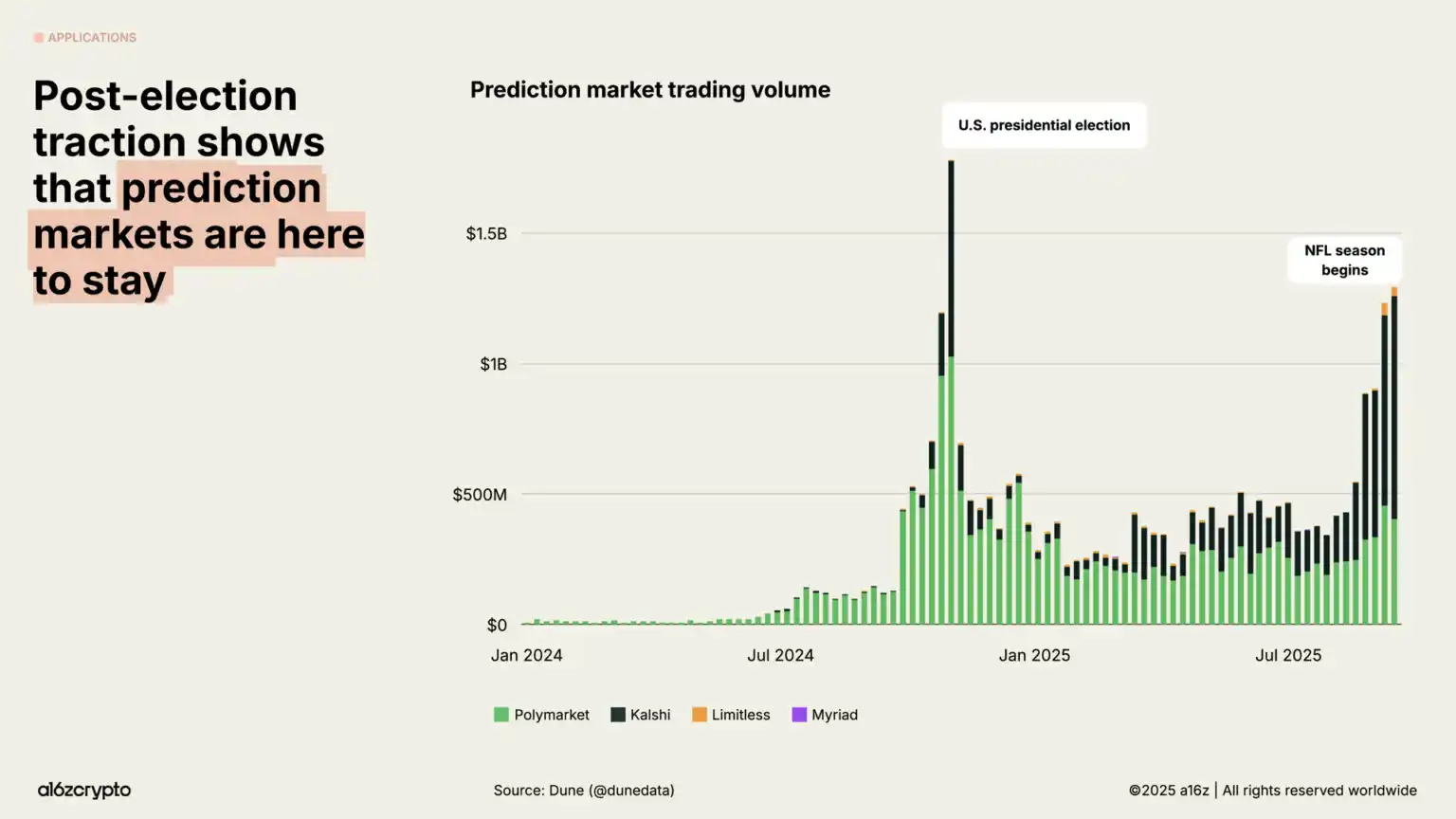

Prediction markets are expected to break into the mainstream during the 2024 U.S. presidential election cycle, with leading platforms Polymarket and Kalshi reaching monthly trading volumes in the billions of dollars. Despite facing skepticism about whether they could maintain activity in a non-election year, these platforms have seen their trading volume grow nearly fivefold since early 2025, approaching historical peaks.

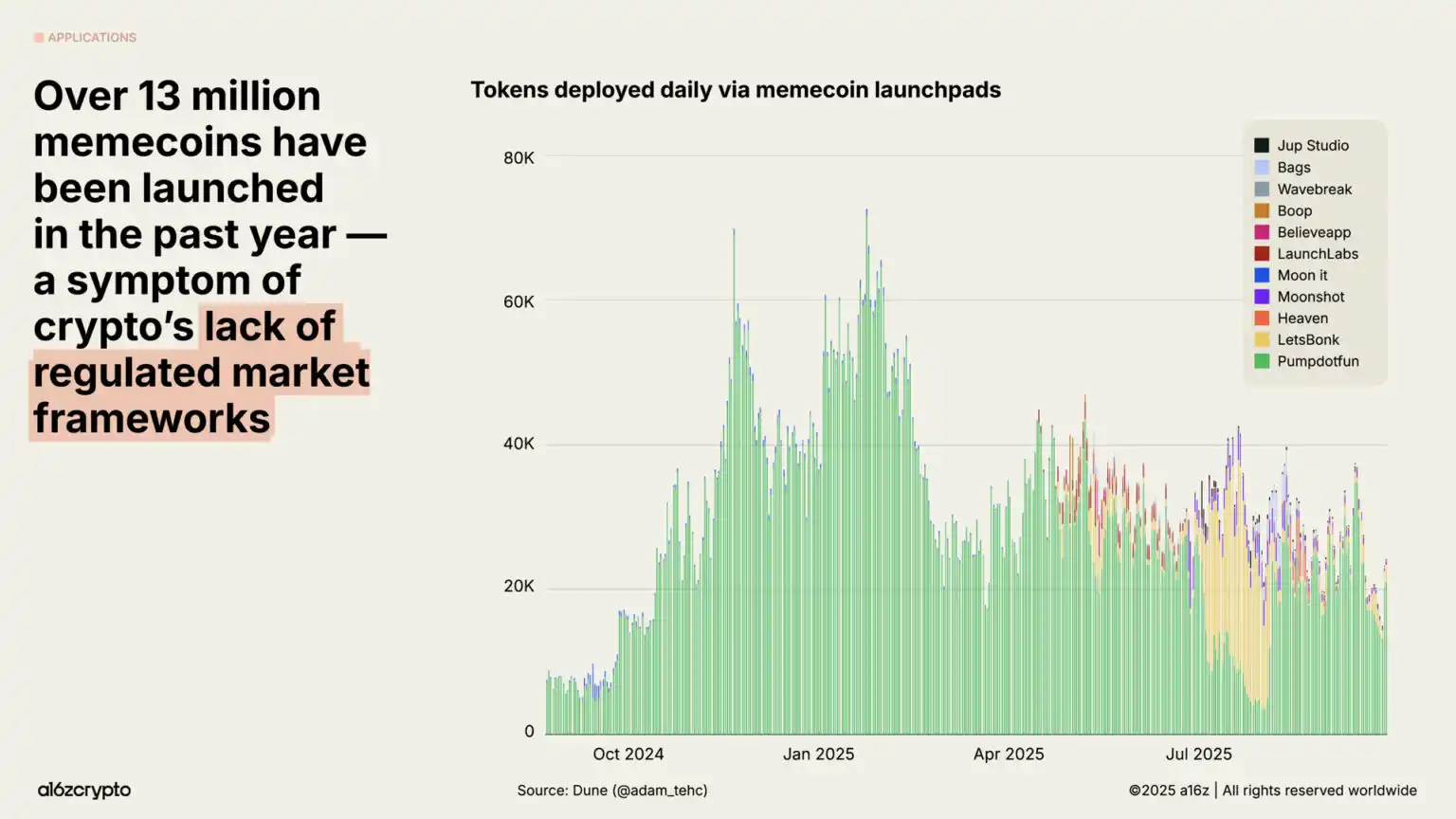

In the absence of clear regulation, Memecoins have experienced explosive growth, with over 13 million new varieties emerging in the past year. As constructive policies and bipartisan legislation clear obstacles for more constructive blockchain use cases, this trend has cooled in recent months—September's issuance was down 56% compared to January.

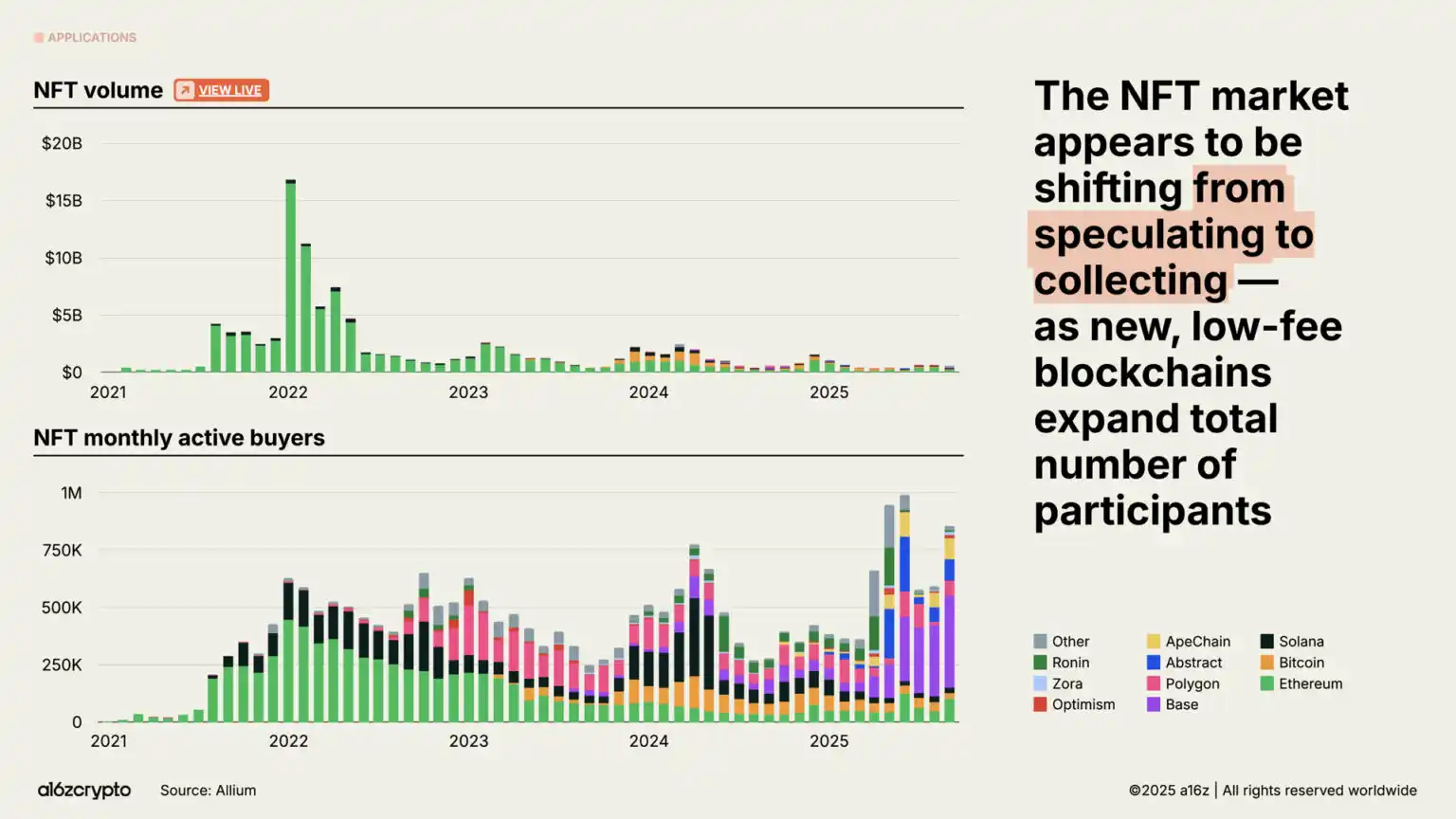

Although the NFT market's trading volume has not returned to the peak levels of 2022, the number of monthly active buyers continues to grow. These trends seem to indicate a shift in consumer behavior from speculation to collecting, with lower on-chain space costs on chains like Solana and Base facilitating this shift.

6. Blockchain infrastructure is nearing a maturity threshold

Without significant advancements in blockchain infrastructure, all these activities would not be possible.

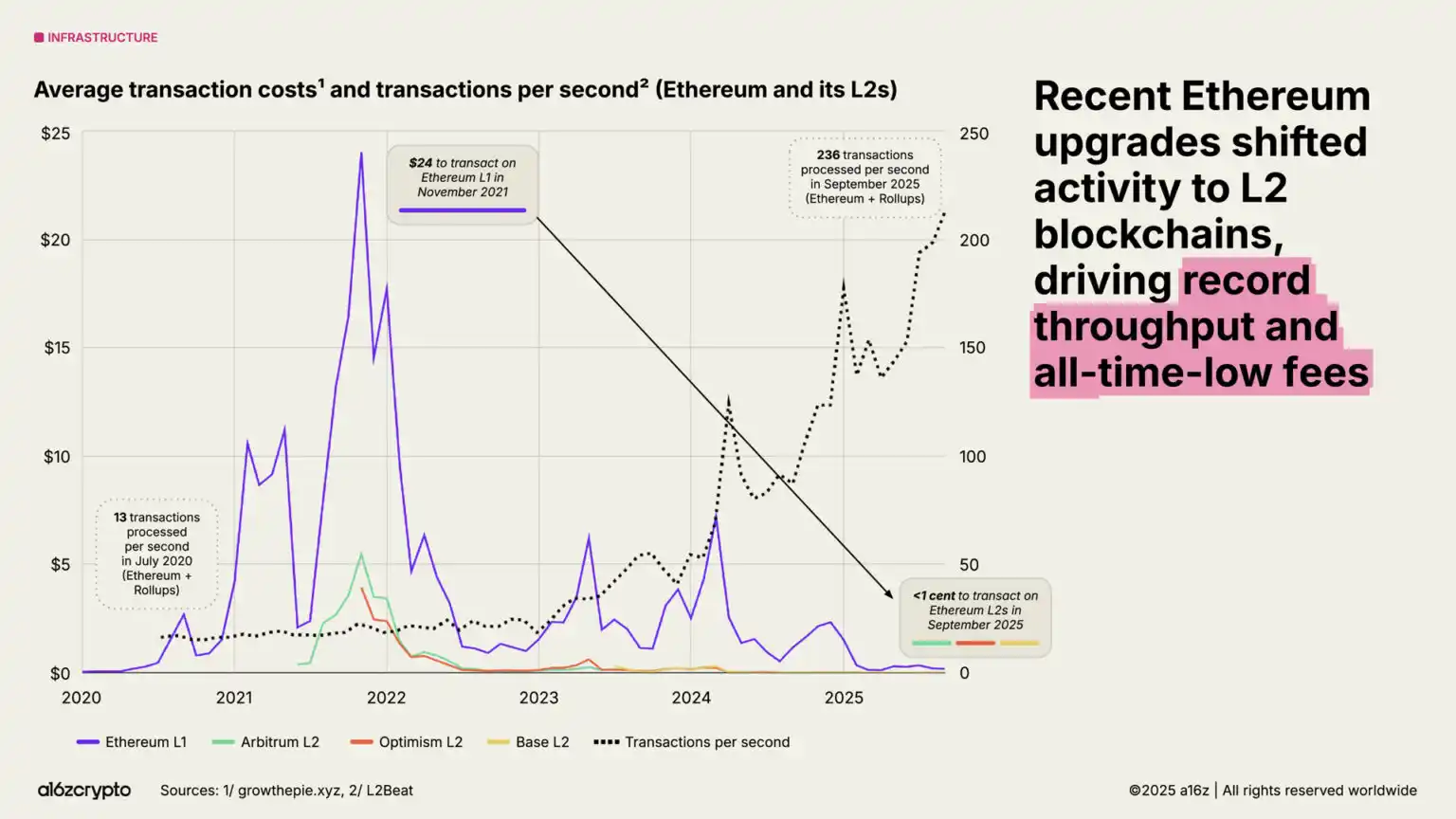

In just five years, the total transaction throughput of mainstream blockchain networks has increased more than 100 times. In the past, blockchains processed fewer than 25 transactions per second; now, they handle 3,400 transactions per second, matching the trading speed of Nasdaq and Stripe's global processing volume during Black Friday, while costs are only a fraction of historical costs.

Within the blockchain ecosystem, Solana has become one of the most prominent representatives. Its high-performance, low-fee architecture now supports a variety of applications, from DePIN projects to NFT markets, generating $3 billion in revenue from native applications over the past year. Planned upgrades are expected to double network capacity by the end of the year.

Ethereum continues to advance its scaling roadmap, with most economic activity migrating to layer-2 solutions like Arbitrum, Base, and Optimism. The average transaction cost on L2 has dropped from about $24 in 2021 to less than one cent today, making Ethereum-related block space both cheap and abundant.

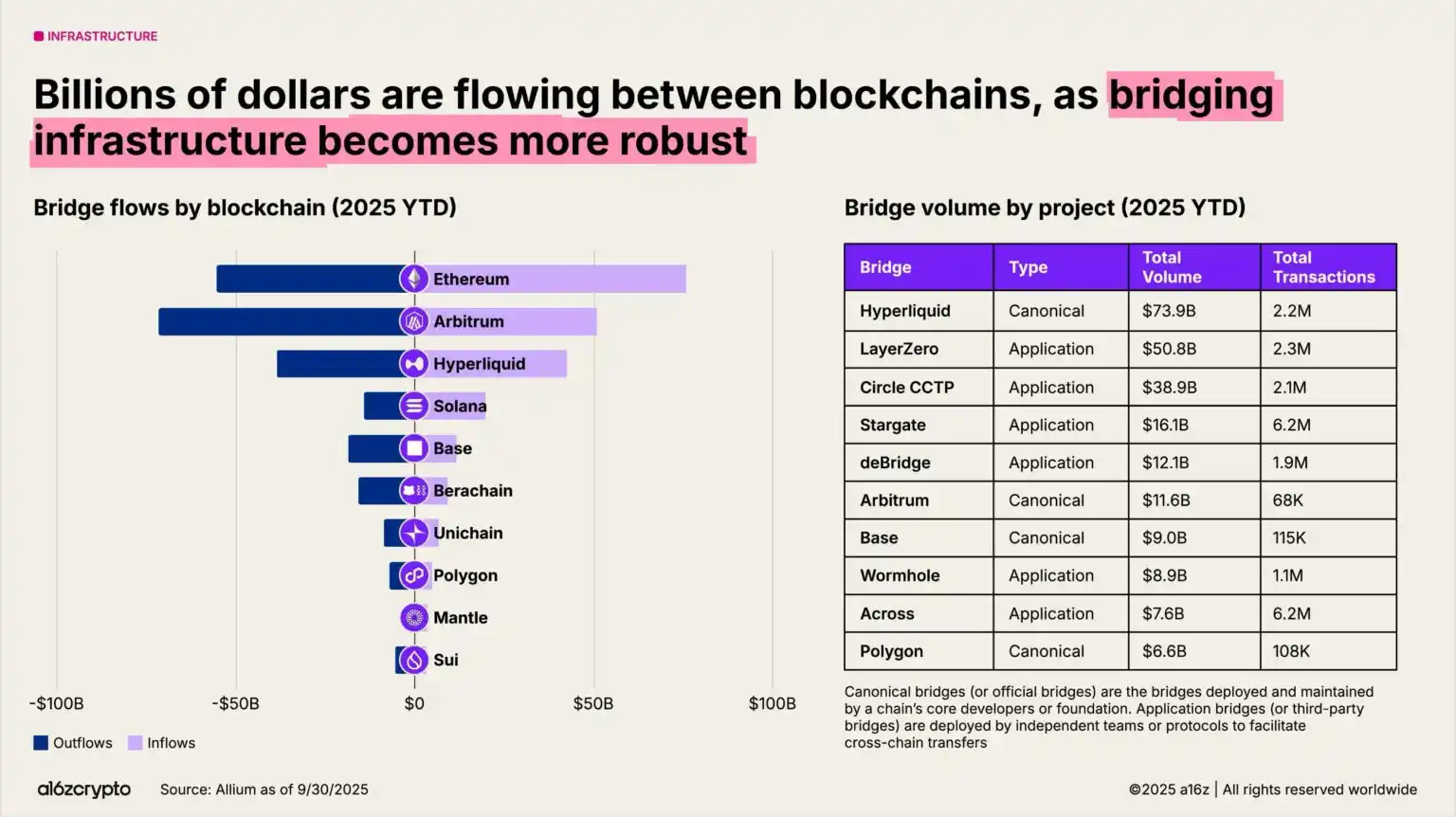

Cross-chain bridges are achieving blockchain interoperability. Solutions like LayerZero and Circle's cross-chain transfer protocol enable users to transfer assets within multi-chain systems. Hyperliquid's standard bridge has processed $74 billion in trading volume since the beginning of the year.

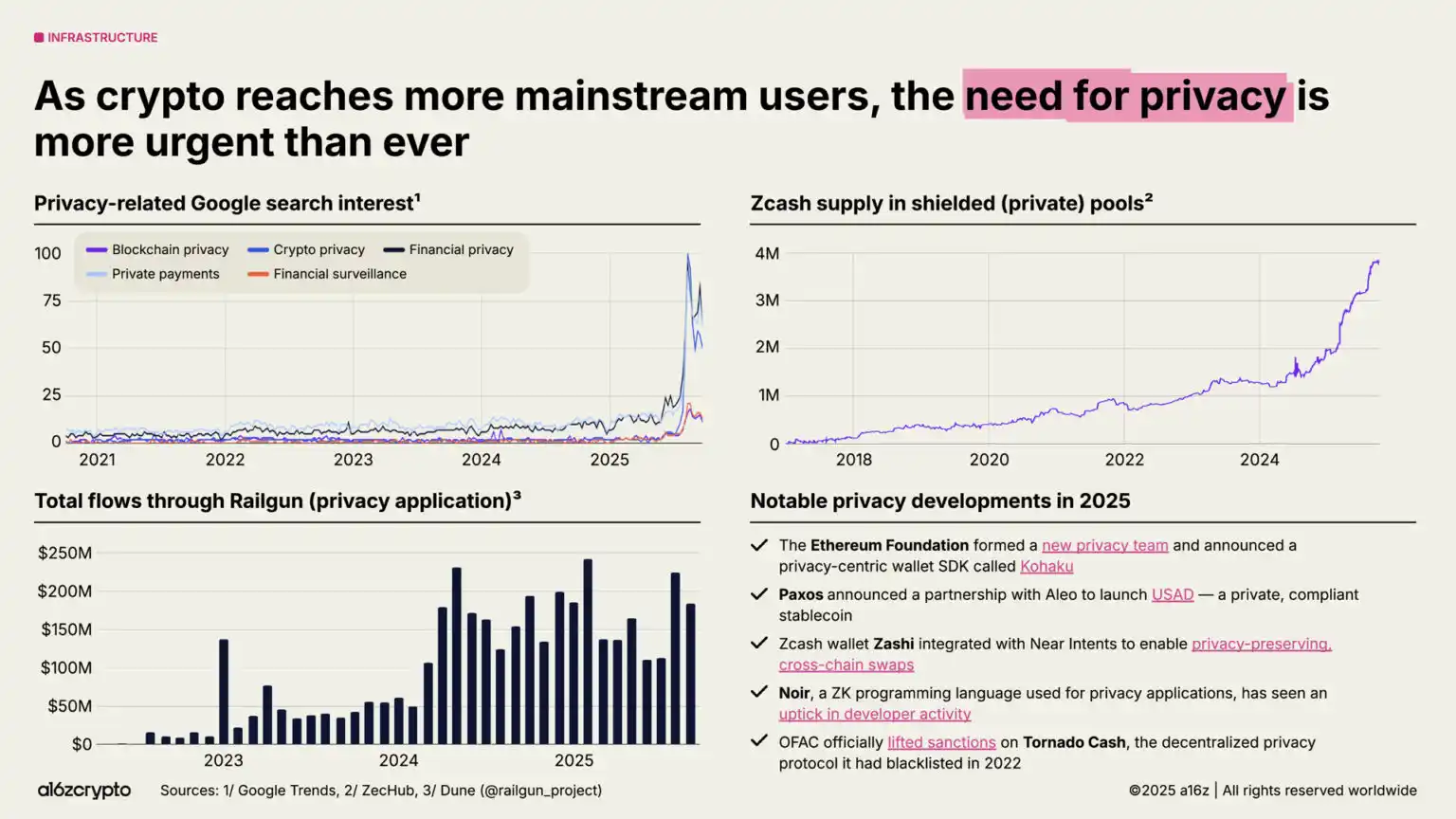

Privacy protection is regaining focus and may become a prerequisite for large-scale applications. Signs of rising attention include: a surge in Google searches related to crypto privacy in 2025; the supply of Zcash's shielded pools growing to nearly 4 million ZEC; and Railgun's monthly transaction volume surpassing $200 million.

More signs of development momentum: The Ethereum Foundation has established a new privacy team; Paxos has partnered with Aleo to launch a private and compliant stablecoin (USAD); and the Office of Foreign Assets Control has lifted sanctions on the decentralized privacy protocol Tornado Cash. We expect this trend to gain greater momentum in the coming years as crypto technology continues to mainstream.

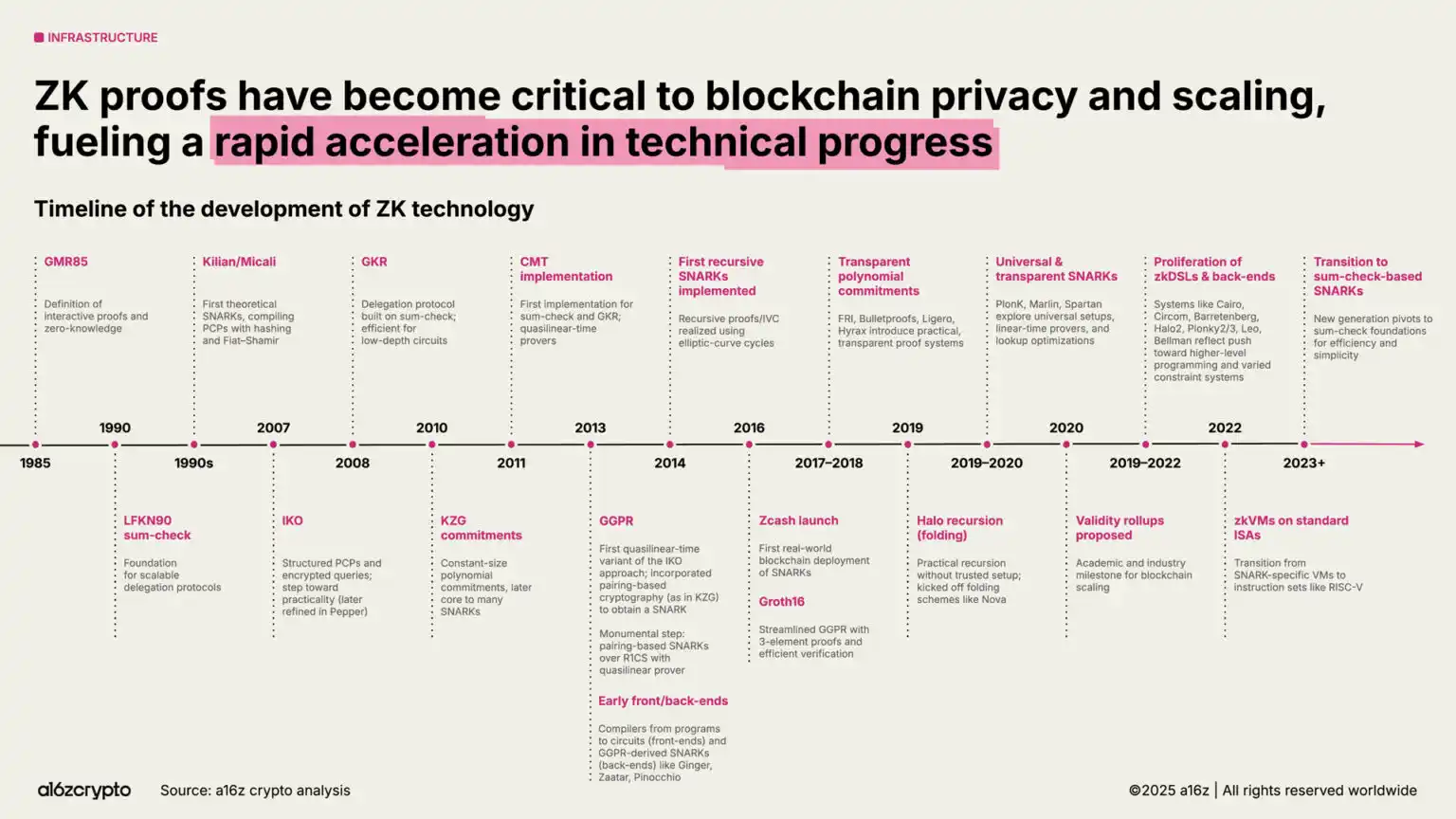

Similarly, zero-knowledge proofs and succinct proof systems are rapidly evolving from decades of academic research into critical infrastructure. Zero-knowledge systems are now integrated into Rollups, compliance tools, and even mainstream web services—Google's newly launched ZK identity system is one such example.

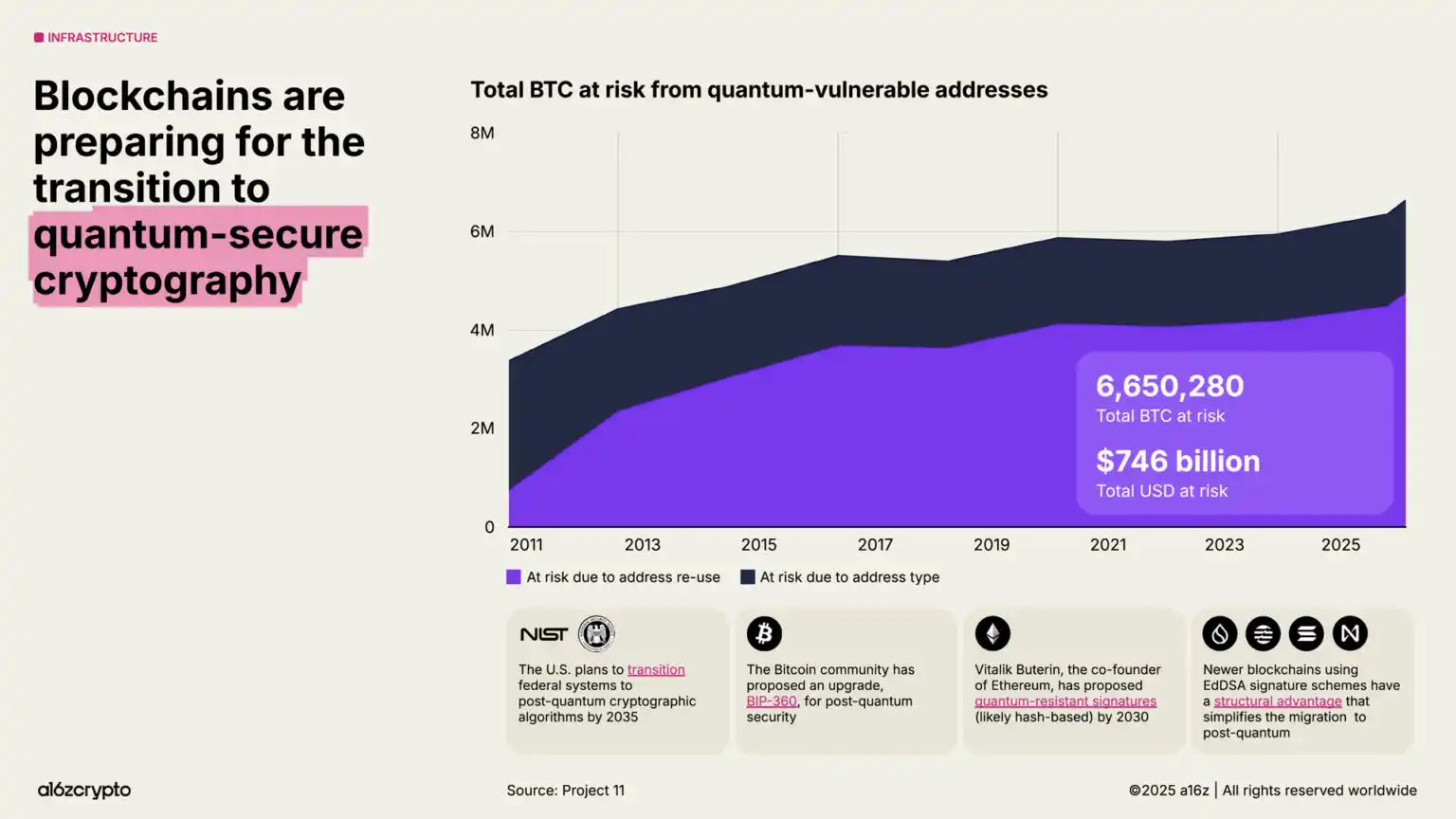

Meanwhile, blockchain is accelerating its roadmap for quantum resistance. Currently, approximately $750 billion worth of Bitcoin is stored in addresses vulnerable to future quantum attacks. The U.S. government plans to transition federal systems to quantum-resistant cryptographic algorithms by 2035.

7. Deep Integration of Crypto and AI Technologies

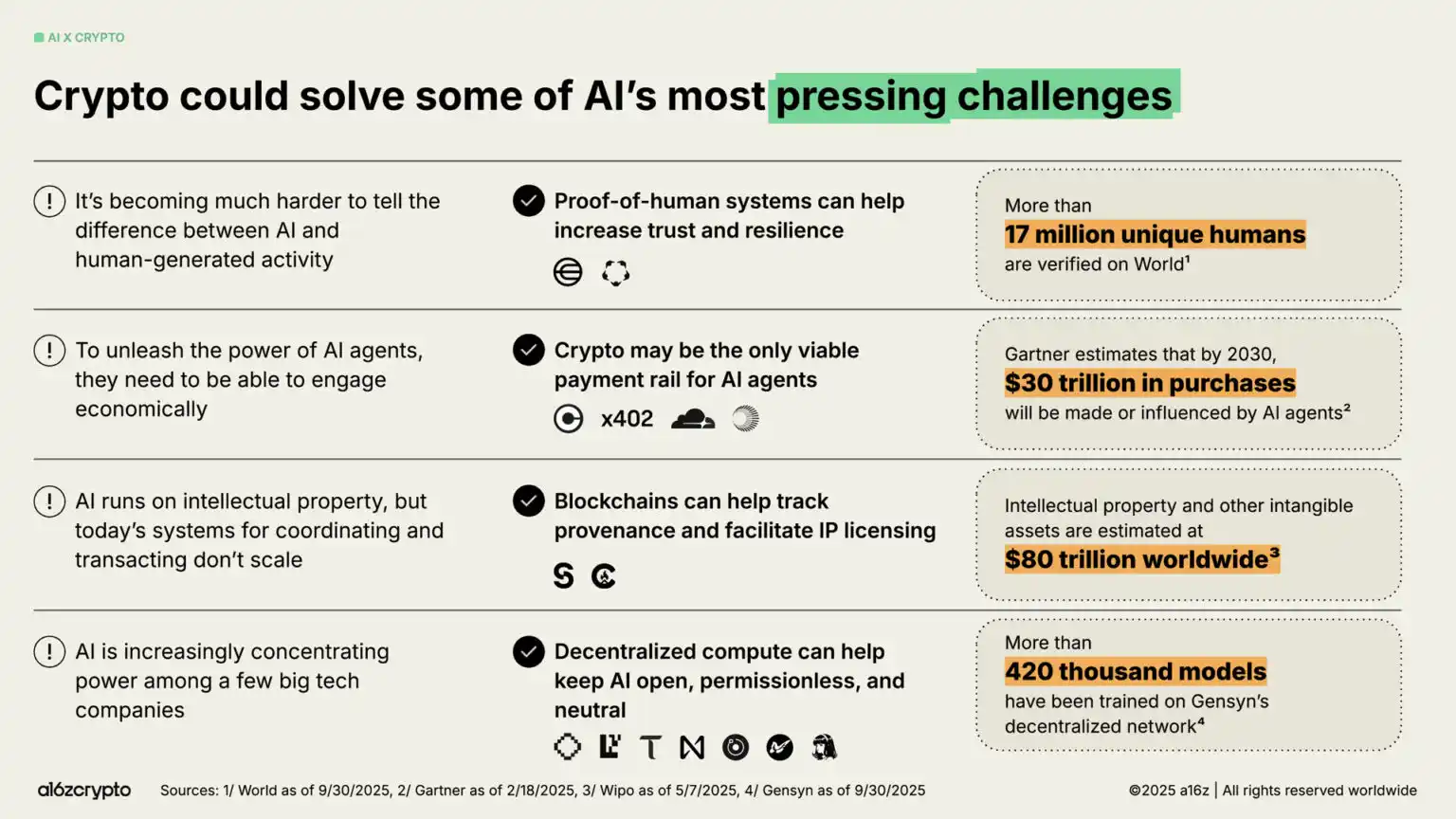

Among many technological advancements, the launch of ChatGPT in 2022 brought AI into the public spotlight—this also presents clear opportunities for the crypto sector. From tracing provenance and IP licensing to providing payment channels for agents, crypto technology could be the answer to the most pressing challenges in the AI field.

Decentralized identity systems like Worldcoin, which have verified over 17 million users, can provide "proof of humanity" and help distinguish real users from bots.

Emerging protocol standards like x402 are becoming potential financial infrastructures for autonomous AI agents, assisting them in micro-payments, API calls, and settlement without intermediaries—Gartner predicts that the economic scale of such systems could reach $30 trillion by 2030.

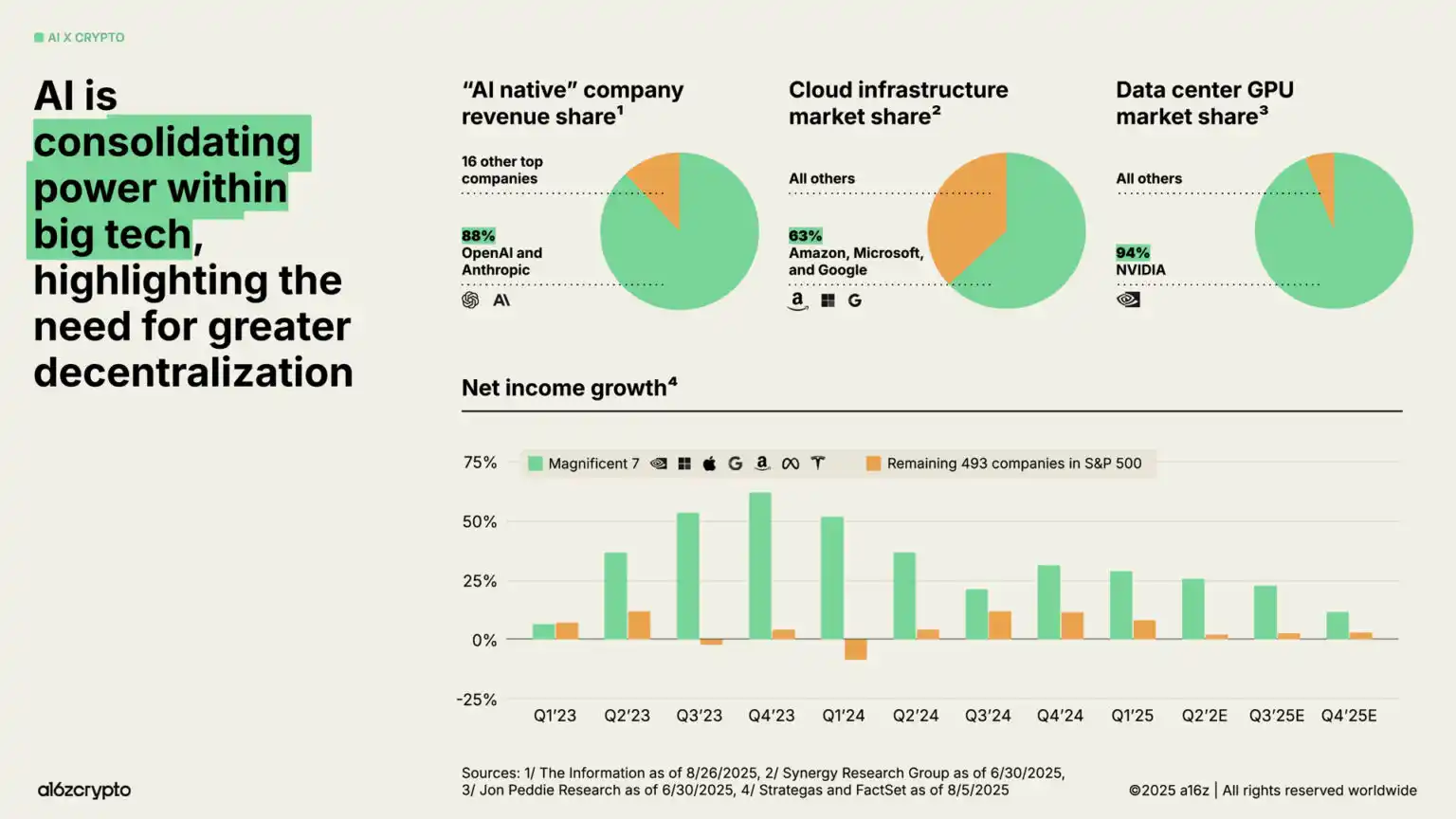

At the same time, the computational layer of AI is consolidating around a few tech giants, raising concerns about centralization and censorship. Currently, only OpenAI and Anthropic control 88% of "AI-native" enterprise revenue, while Amazon, Microsoft, and Google hold 63% of the cloud infrastructure market, and Nvidia commands 94% of the data center GPU market. This imbalance has allowed the "Big Seven" companies to achieve double-digit net profit growth for several consecutive quarters, while the remaining 493 companies in the S&P 500 have generally failed to outpace inflation in profit growth.

Blockchain technology provides a counterbalance to the centralizing forces emerging in AI systems.

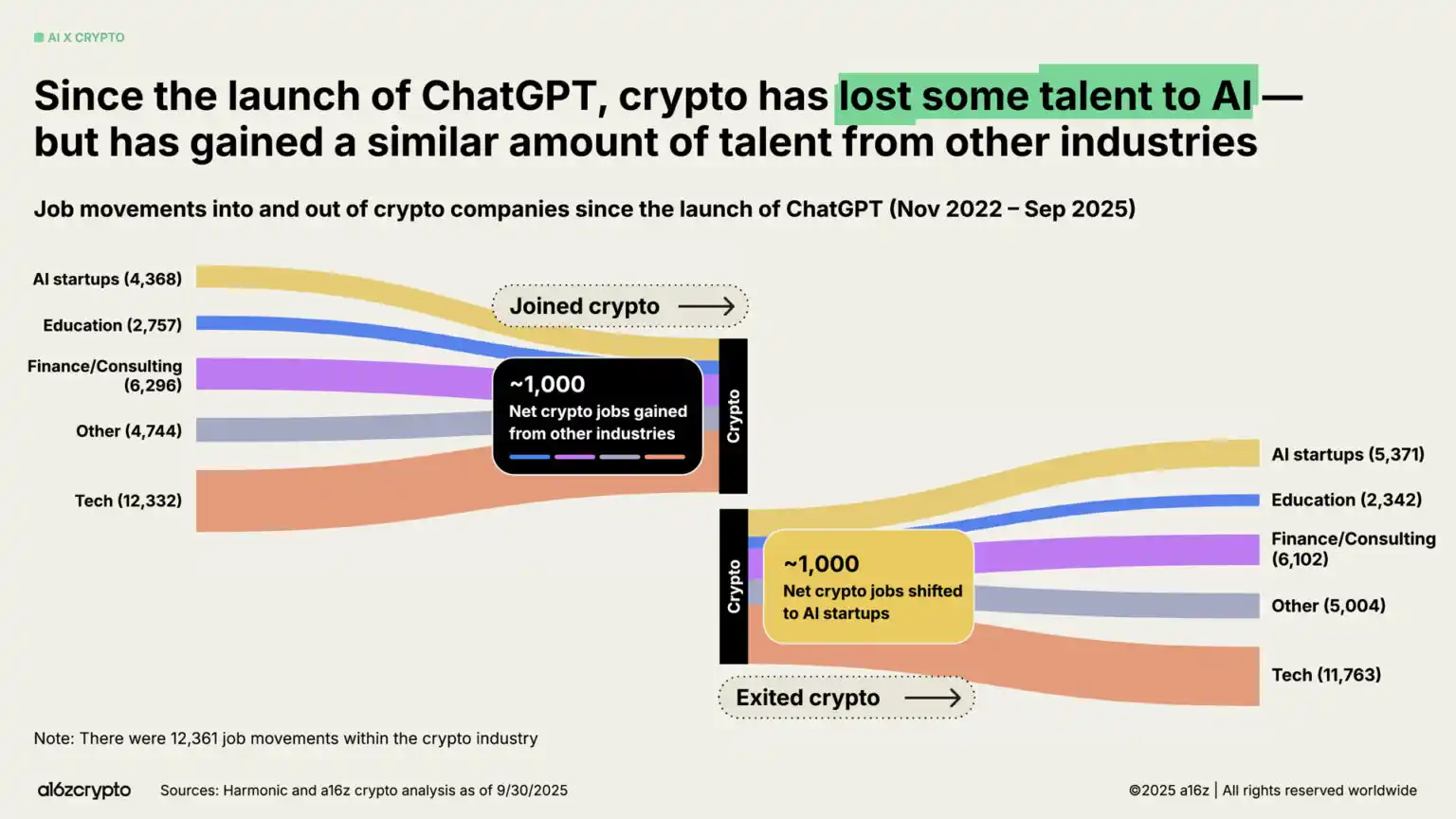

Amid the AI boom, some crypto builders have shifted focus. Our analysis shows that since the release of ChatGPT, about 1,000 jobs have moved from the crypto industry to the AI sector. However, this loss has been offset by an equal number of builders from traditional finance, technology, and other fields entering the crypto industry.

8. Future Outlook

What stage are we currently in? As regulatory frameworks become increasingly clear, the path for tokens to generate real revenue through fees is becoming evident. The adoption of crypto by traditional finance and fintech will continue to accelerate; stablecoins will upgrade traditional financial systems and promote global financial inclusion; new products will lead the next wave of users into the on-chain world.

We have the infrastructure and distribution networks in place and are expected to soon gain regulatory certainty that will drive technology mainstreaming. Now is the time to upgrade the financial system, rebuild global payment channels, and construct the ideal form of the internet.

After seventeen years of development, the crypto industry is bidding farewell to its adolescence and entering maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。