Why MET Airdrop Gone Wrong? Meteora Price Crash on Ben Chow Scam?

The Meteora airdrop was one of the most talked-about events on Solana. People were excited, waiting for the new Solana DEX to go live. But what happened next shocked everyone.

On October 24, 2025, just hours after launch, the Meteora Price Crash wiped out around 35% of its value. Now investors are asking is it even legit or another pump and dump token. Let’s uncover it

From Promising $MET Airdrop to Sudden Freefall

It is a decentralized exchange (DEX) made for the Solana blockchain. It was built to make DeFi trading faster, safer, and more flexible. The project got a lot of attention because of its Meteora airdrop listing date , and strong tokenomics.

The token started trading on Jupiter, Moonshot, Phantom, Binance Alpha, and OKX Wallet, and later on Bybit and OKX CEX at 2 PM UTC. It opened at $0.6904, but the asset price crashed to $0.5783, and then settled near $0.571.

Even with the fall, its market cap stayed around $277.65 million, and its 24-hour trading volume jumped by 843,092% to $33.06 million, which means a lot of people are buying and selling the asset.

Why Is Meteora Going Down Today?

As per my research and analysis being a crypto expert, the Meteora Price Crash happened because of many things happening at once.

The global crypto market was already scared because of the U.S. government shutdown and Donald Trump’s speech that was expected later in the day.

The Crypto Fear and Greed Index fell to 27, showing Extreme Fear. This made many traders sell their altcoins, resulting in a $MET crash.

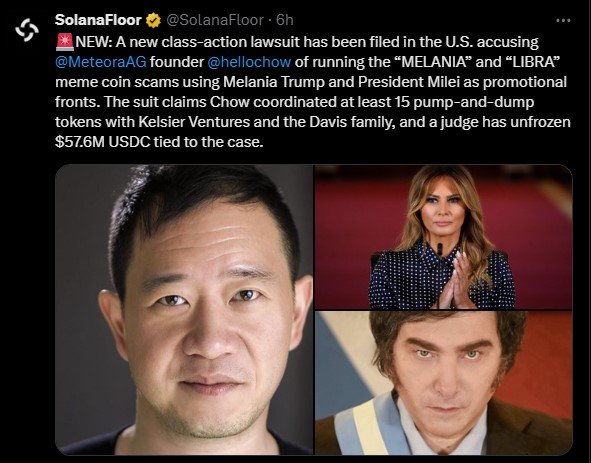

Then came the biggest shock in the altcoin market, a class-action lawsuit in the U.S. against Meteora founder BenChow scam . He was accused of running meme coin scams with tokens called “MELANIA” and “LIBRA.”

The case says he worked with Kelsier Ventures and the Davis family to make more than 15 pump-and-dump tokens.

As per SolanaFloor official X post , a U.S. judge has unfrozen $57.6 million USDC linked to the HelloChow scam. After this news broke, panic selling hit the asset hard, and the token price collapsed even more.

This was one of the major reasons behind the price crash.

Technical Chart Signals: Can $MET Recover?

Right now, $MET price is trading near $0.571, and TradingView chart still show weakness:

-

RSI (49.7 is neutral, which means no clear trend for now.

-

MACD is showing bearish momentum

-

Volatility: Very high — the price keeps changing fast.

In short, traders are confused as trading volume is increasing but price is falling hard. Some think the token will bounce back, while others believe it could fall again.

$MET Price Prediction 2025: Hope or Another Pump-and-Dump?

Top cryptocurrency analyst of in Coingabbar suggest 3 simple views of where might the token go next:

-

Short Term: May stay between $0.52–$0.58 until the market cools down.

-

Mid Term: Can fall below $0.50 if the lawsuit gets worse or trading volume decreases.

-

Long Term (2025): Depends on how the official team handles things. If the team is honest and builds strong partnerships, the price prediction can turn positive again. But if the issues continue, it might just be another pump-and-dump token.

Conclusion

From the big $MET airdrop listing date to today’s sudden crash, the token has had a rollercoaster ride. The HelloChow scam case has made people lose faith, asking is Meteora crypto legit or not? but the project still has a chance to prove itself.

If the team clears the case and brings updates that build trust, the Meteora price crash can reverse. But until then, investors are likely to stay careful and watch the upcoming moves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。