Today's homework is much easier to write, and market sentiment is starting to stabilize. There are mainly two things: one is that the top leaders of China and the United States will meet in Malaysia on October 30, and the outcome of the meeting will directly affect the tariffs on November 1. It is highly likely that there will be a TACO. The weekly report has also analyzed this; although everyone is talking tough, high tariffs are not good for either China or the U.S., especially for the current Chinese side, which will face greater troubles. Trump's goal is to open up more rare earth resources.

The other thing is that Trump has pardoned CZ. We discussed this issue earlier today. For CZ, the biggest advantage may be the ability to re-enter Binance's operations legally and compliantly. Although this is not closely related to the market, it can be seen that the U.S. government is still willing to continue to retreat in the cryptocurrency space. Of course, one reason is that the Trump family is making money happily in this market.

Next week's key events are also very clear, starting with the Federal Reserve's interest rate meeting and Powell's speech in the early hours of the 30th, followed by the China-U.S. talks at an unknown time on the 30th, and the core PCE data on the 31st seems less important now. The two parties should also discuss the issue of resuming operations after the shutdown next week.

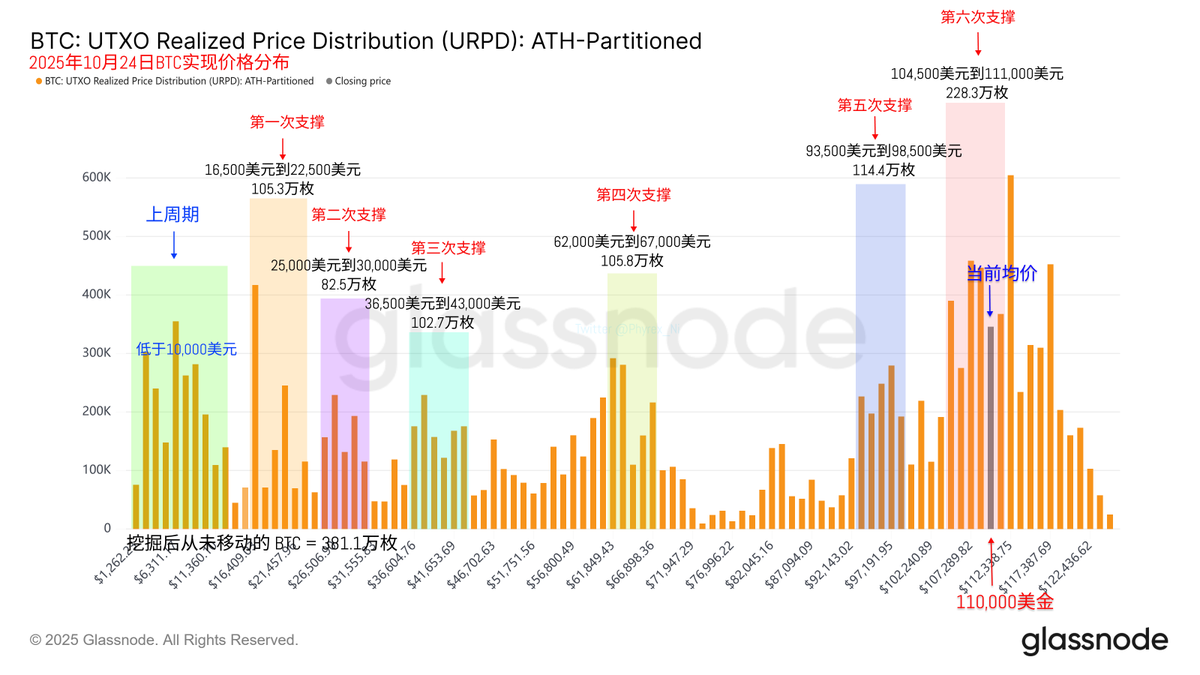

Looking back at Bitcoin's data, the turnover rate has started to decrease significantly, indicating that some investors' panic is fading. With the rebound in the price of $BTC, the sentiment of loss-making investors is gradually improving. Recently, those who exited the market are mainly short-term investors who bought in at the bottom over the past few days. Although the CPI data released on Thursday night is not very important, it should still have an impact on the market.

The expectation for this CPI is an increase, but the interpretation should be that it is a one-time increase caused by tariffs, which will not have a significant impact on the Federal Reserve's interest rate cut in October. However, friends should be prepared for the possibility of increased volatility.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。