追踪币圈实时热点、把握最佳成交机会,今天是2025年10月24日星期五,我是王毅博!各位币友早上好☀铁粉打卡👍点赞发大财🍗🍗🌹🌹

==================================

💎

💎

==================================

2025年的10月份进入倒计时一个礼拜,“停摆”闹剧进入第24天,“难产”下的CPI数据实在“憋”不下去了,周四美股三大指数集体收涨,纳指涨0.89%,标普500指数涨0.58%,道指涨0.31%。今日将要发布的美国9月CPI报告可能会显示通胀持续顽固,货币市场正在为美联储下周的降息做准备。美联储可能更关注劳动力市场,我们预计周五的CPI不会对下周美联储的决定产生太大影响。我们可能会在今年看到两次降息,分别在10月和12月。据CME“美联储观察”:美联储10月降息25个基点的概率为98.3%,维持利率不变的概率为1.7%。美联储12月累计降息50个基点的概率为93.4%,关注毅博获取最新动态。

==================================

💎

💎

==================================

在宏观面利好预期升温的背景下,昨日加密货币市场整体呈现震荡上行的修复格局,比特币与以太坊虽均走出反弹走势,但强度分化明显。当前市场正处于关键节点,叠加周五交易时段的潜在波动风险以及CPI报告、美联储政策等重磅消息催化,多空博弈或进一步加剧,需重点关注关键价位突破情况及消息面动向。

【比特币:震荡上行遇阻,中枢整理待突破】

比特币昨日全程维持震荡上行的修复形态,早盘触及106631美金的低点后便开启震荡攀升模式。随着买盘逐步发力,午盘时段最高冲至110262美金,不过在此位置遭遇明显承压,行情随即转入回落调整。晚盘阶段,价格最低下探至108685美金一线,该位置形成有效支撑后,多头再度组织反攻,最高攀升至111250美金附近,刷新日内高点后再度回落。截至目前,比特币在109500美金上下维持震荡整理。

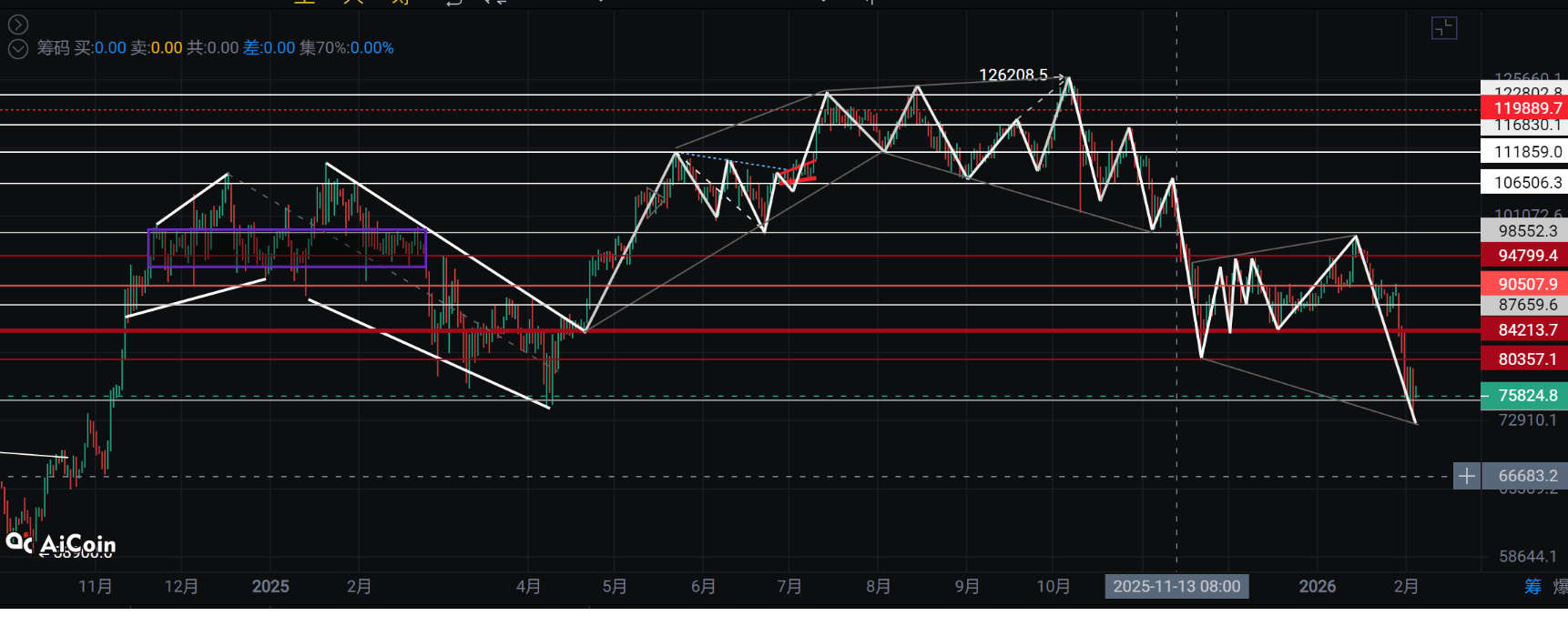

从技术面来看,当前行情正运行于4小时级别通道的中枢位置,这一区域既是短期多空力量的平衡地带,也是后续趋势形成的关键分水岭。若想确立明确的多头趋势,比特币必须强势站上4小时级别通道上轨及122000美金整数关口上方,届时才能打开更大的上行空间。若无法实现有效突破,则行情大概率将继续在现有通道内维持区间震荡,反复测试上下轨支撑阻力。

值得注意的是,今日恰逢周五,“黑色星期五”会来吗?当前市场不仅要面对周末前的资金调仓压力,更要迎接美国9月CPI报告的考验。虽然我们预判CPI数据对美联储10月降息决定影响有限,但数据公布前后的市场情绪波动仍不可小觑。后续需密切跟踪临盘资金动向,同时高度关注消息面变化,任何重磅消息都可能打破当前的震荡平衡格局。

【以太坊:联动反弹偏弱,中轨压制成关键】

与比特币相比,以太坊昨日虽同样联动大盘走出反弹趋势,但整体走势相对偏弱。早间价格触及3706美金的低点后开启反弹,白盘时段维持震荡上行节奏,午后最高测试3902美金位置,随后因动能不足开启回落。晚盘阶段,价格最低插针至3806美金,短暂调整后再度反弹,最高冲至3935美金一线,创下日内高点后再度承压回落。凌晨时段,价格最低回落至3815美金,之后开启小幅反弹,目前在3850美金附近运行。

技术面表现上,以太坊当前处于4小时级别通道的中下轨区间,呈现明显的弱势运行特征。近期多次尝试向上冲击关键阻力,但均未能形成有效破位,显示上方抛压相对沉重。对于后续走势,4小时级别通道中轨3920美金的突破情况至关重要,若能实现实体破位并站稳该位置,有望带动行情向通道上轨发起冲击;若始终无法突破中轨压制,则需继续关注下方3700美金低点与中轨之间的区间震荡格局,警惕弱势下探支撑的风险。

总结与操作提示

整体来看,在美联储降息预期这一宏观利好的支撑下,昨日市场呈现修复态势,但两大主流币种表现分化,比特币相对强势但未破关键阻力,以太坊则受限于中轨压制表现偏弱。当前市场均处于技术面的关键节点,而今日CPI报告的发布或将成为短期趋势的“催化剂”,方向尚未明确。

操作层面,建议投资者保持谨慎,避免盲目追高。对于比特币,重点关注108685美金支撑及111250美金阻力的突破情况,若突破111250美金可轻仓跟进,跌破108685美金则需警惕回调风险;以太坊需聚焦3800美金支撑与3920美金阻力的攻防,破位前以区间震荡思路对待。

特别提醒,今日CPI报告发布前后波动可能加剧,叠加“黑色星期五”的潜在风险,务必做好风险控制,设置合理止损止盈。同时密切关注美联储政策动态及美股联动效应,关注毅博,随时获取最新行情解读和操作提示!

=================================

💎

💎

==================================

如果你正处于迷茫之中——不懂技术、不会看盘、不知何时进场、不会止损、不懂止盈、胡乱加仓、抄底被套、守不住利润、错过行情……这些都是散户常见的问题。但没关系,我可以帮助你建立正确的交易思维。千言万语不如一次盈利,屡战屡败不如找到正确的方向。与其频繁操作,不如精准出击,让每一单都更有价值。如果你需要实盘指导,可以扫描文章下方的二维码,关注我的公众号。行情瞬息万变,受审核时效性影响,后续走势以实盘实时布局为准。期待与你一起在市场中稳步前行。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。