Author: FinTax

1. Introduction: From Regulatory Gaps to the Establishment of a Unified Framework

In 2023, the European Union officially launched the landmark Markets in Crypto-Assets Regulation (MiCAR). Against the backdrop of the gradual maturation of global crypto asset regulation, the EU introduced the MiCAR regulatory framework aimed at establishing a unified regulatory framework for crypto assets across the 27 member states, replacing the previously "fragmented" regulatory practices of individual member countries.

According to the EU legislative process, MiCAR will be implemented in phases:

- From June 30, 2024, key provisions related to stablecoins (ART and EMT sections) will officially apply;

- From December 30, 2024, the remaining provisions regarding the licensing of Crypto Asset Service Providers (CASPs), market manipulation prevention, investor protection, and other clauses will come into full effect.

The background for the introduction of MiCAR can be traced back to the "Digital Finance Strategy" proposed by the EU in 2020, which aims to balance innovation and regulation, protect investors, and maintain financial stability. Within this framework, MiCAR, along with regulations such as the Digital Operational Resilience Act (DORA), forms the core regulatory system for digital finance in the EU. More importantly, MiCAR is not merely a "risk prevention" regulation; rather, it represents the EU's intention to provide long-term legal certainty for the blockchain and crypto industry through technology-neutral legislation, making it more practically significant. The following sections will interpret the key contents of the MiCAR framework, including the definition of crypto assets and asset-referenced tokens, and analyze the impact of this framework on the European crypto market.

2. Main Contents of the MiCAR Regulatory Framework

The MiCAR regulatory system can be distinguished at two levels: crypto assets and crypto asset service providers.

2.1 Definition and Classification of Crypto Assets

Based on a technology-neutral approach, MiCAR defines "crypto assets" as "a digital representation of value or rights that can be transferred and stored electronically using distributed ledger technology (DLT) or similar technology." It categorizes crypto assets into three core types, as follows:

2.1.1 Asset-Referenced Tokens (ART)

ART is a type of cryptocurrency, distinct from Electronic Money Tokens (EMT), whose value is maintained by referencing some other value, equity, or a combination thereof. (Article 3, Section 1, Item 6 of MiCAR).

According to Articles 16 and 20 of MiCAR, entities intending to issue ART must complete an authorization process before issuance, and the issuer must be a legal entity established in the EU or an authorized entity. The authorization process must be initiated through a formal application (Article 18 of MiCAR). Additionally, the application must include a legal opinion confirming that the cryptocurrency indeed exists, falls within the definition of MiCAR, and does not qualify as an Electronic Money Token (EMT). Finally, the intended issuer must submit a cryptocurrency white paper, which can only be published after approval.

2.1.2 Electronic Money Tokens (EMT, similar to stablecoins)

The value of Electronic Money Tokens is intended to be maintained by anchoring to the value of a specific official currency, and can be viewed as stablecoins pegged to a single official currency (such as the euro, dollar, etc.), which are specifically defined and subject to particular regulation under MiCAR. According to Article 81, Section 1 of MiCAR, only credit institutions or electronic money institutions can issue Electronic Money Tokens (EMT). Additionally, since EMTs are legally classified as electronic money, issuers must also comply with the provisions of Chapters 2 and 3 of the Electronic Money Directive (EMD). MiCAR does not stipulate an authorization process for EMT issuers; they only need to notify the authorities and publish a white paper.

2.1.3 Other Cryptocurrencies

These cryptocurrencies, such as utility tokens and Bitcoin, are neither Asset-Referenced Tokens (ART) nor Electronic Money Tokens (EMT), and they do not fall within the excluded categories of crypto assets under MiCAR, typically requiring no issuance license. In principle, such cryptocurrencies still need to prepare a white paper, notify the authorities, and publicly release it, but exemptions may apply under certain conditions.

2.2 Crypto Asset Service Provider (CASP) System

MiCAR establishes a unified regulatory system for crypto asset service providers for the first time, imposing systematic regulatory requirements on Crypto Asset Service Providers (CASPs) that cover areas such as custody, trading, exchange, consulting, issuance, and transfer. The core requirements for CASPs include:

2.2.1 Unified Licensing System (passporting):

Once a CASP obtains MiCAR authorization in any member state, it can operate throughout the EU; this is known as the EU passport mechanism. The essence of MiCAR is to unify all enterprises providing crypto asset services to EU users under the CASP regulatory framework. Any CASP wishing to operate within the EU must obtain authorization in any member state and can then serve the entire EU market under the "single license" principle.

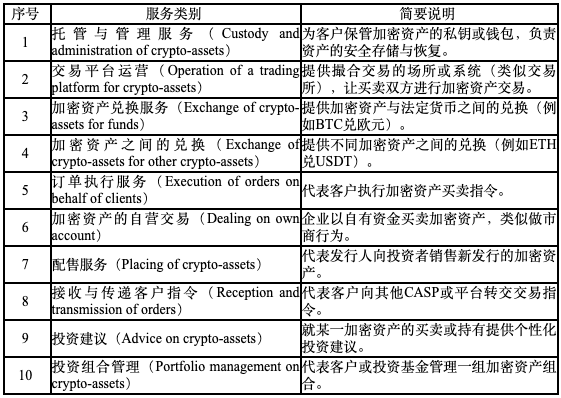

Additionally, MiCAR specifies 10 categories of service activities; any enterprise engaging in any of these activities within the EU must obtain a MiCAR license and be subject to regulatory constraints.

This classification system nearly covers all major business forms in today's crypto market, meaning that both mature large trading platforms and early-stage innovative projects providing relevant services to EU users must fall under the regulatory scope of MiCAR.

2.2.2 Transitional Arrangements:

To ensure a smooth transition, MiCAR establishes transitional provisions: CASPs that have been compliant with national laws and conducting business before December 30, 2024, are allowed to continue operating during the transition period until they obtain or are denied a MiCAR license, or at the latest, cease operations by July 1, 2026. Member states may set their own transitional periods, which may vary in length. This arrangement provides an 18-month buffer for the market, allowing regulatory authorities and industry participants ample time for institutional alignment and compliance adjustments. It also effectively addresses the previous issue of "multiple regulatory authorities" within the EU, making the regulatory environment more certain and competitively fair.

3. Impact on the Regulatory Landscape of Crypto Taxation

The introduction of MiCAR is not only an update to the regulatory system but also profoundly affects the EU's tax policy and compliance regulatory landscape.

3.1 Issuance Regulation: From White Paper Disclosure to Reserve Constraints

3.1.1 Ordinary Crypto Asset Issuance: White Paper Disclosure + Light Regulatory Model

Under the MiCAR framework, for ordinary crypto assets that do not fall under ART or EMT, regulation adopts a relatively mild approach of "disclosure-oriented, with approval as a supplement." First, the issuer must be a legally qualified company or legal entity to ensure legal traceability and accountability for its actions, allowing for accountability in case of disputes. Second, the issuing entity must draft and publish a white paper (crypto-asset white paper) in accordance with MiCAR requirements, disclosing key information, including but not limited to: issuer name, registered address, governance structure; the technical architecture, working principles, and rights mechanisms of the issued tokens; risk disclosures (e.g., smart contract risks, liquidity risks, policy risks, etc.); investor rights and obligations, fee structures, issuance/destroying mechanisms; compliance statements (e.g., "This white paper is not approved by EU regulatory authorities," to avoid misleading investors into believing it has official endorsement). Furthermore, MiCAR requires issuers to continuously update significant changes. This means that when project structures, funding arrangements, risk factors, etc., undergo changes that may affect investment decisions, the white paper should be promptly revised or modification notes disclosed to ensure that investors always have access to the latest and most accurate information.

Under this mechanism, projects do not need to undergo complex pre-approval processes, thereby lowering entry barriers and facilitating participation from innovators and small projects in the market; at the same time, the design of the information disclosure and accountability system can balance the protection of investors' right to know with maintaining market vitality.

3.1.2 Stablecoins: Strong Regulation + Rigid Reserve Constraints

In contrast to the relatively lenient issuance system mentioned above, MiCAR imposes a stringent and rigid regulatory framework on the issuance of stablecoins—namely ART and EMT—to ensure the robustness of these tokens in terms of redemption, reserves, and security.

(1) Authorization Requirements and White Paper Approval

From June 30, 2024, all projects publicly issuing ART or EMT in the EU or listed on exchanges must obtain authorization from the competent authority in their respective countries.

In the case of ART, issuers other than credit institutions must apply for MiCAR authorization and must submit a white paper during the authorization process, which must be approved by the competent authority before publication.

For EMT, the issuing entity must be a credit institution or electronic money institution (EMI), authorized under traditional electronic money directives (EMD) or other regulatory frameworks.

After the white paper is submitted, the competent authority must determine within a specified time frame whether it is complete and complies with regulatory requirements; if so, it will be approved or recorded.

MiCAR also recognizes that certain ART or EMT may be larger in scale due to their size and other factors, potentially leading to higher risks. Therefore, the European Banking Authority (EBA) will assume regulatory responsibility for the issuance functions of significant ART and some significant EMT under MiCAR.

(2) Reserves and Asset Segregation

The reserve and asset segregation system is the most critical aspect of MiCAR's regulatory design: issuers must establish a reserve asset pool that is segregated from their other assets, prioritized for ensuring the redemption requests of token holders. In other words, even if the issuer goes bankrupt, this portion of reserve assets should not be used to repay or liquidate other creditors.

The requirements for reserves in terms of composition and liquidity are also very strict:

- Reserves must be diversified and can only include highly liquid, low-risk assets (such as deposits, government bonds, high-quality covered bonds, certain money market instruments, etc.).

- Regarding the proportion of deposits in credit institutions, the EBA's draft Regulatory Technical Standards (RTS) published in 2024 suggests that at least 30% of the funds for non-significant stablecoins must be deposited in banks to ensure the underlying redemption capability. If a stablecoin is deemed significant, then 60% must be deposited. Additionally, when token holders request redemption, the issuer must be able to liquidate the reserve assets in a timely manner. (Refer to the original RTS: Article 36(1) of Regulation (EU) 2023/1114 requires issuers of asset-referenced tokens (ARTs), whether they are significant ARTs or not, to constitute and maintain a reserve of assets at all times to cover their liabilities against the holders of their issued ARTs matching the risks reflected within these liabilities. The reserve of assets is composed of the assets received when issuing the token holders and by the highly liquid financial instruments the issuer may invest in. In the case of tokens referenced to official currencies, a minimum part of the reserves should be held in the form of deposits in credit institutions (at least 30% of the amount referenced in each official currency if the token is not significant, and at least 60% if the token is significant). Upon redemption requests from token holders, the issuers should be able to liquidate the reserve assets.)

- If an ART or EMT is deemed "significant," regulators may impose higher liquidity and concentration limits, risk mitigation measures, etc.

Furthermore, if the market value of the reserve assets declines or adverse changes occur, the issuer must promptly make up the difference (i.e., conduct "rebalancing" or compensation) to ensure that the total value of the reserve assets is always ≥ the total value of the issued tokens.

Under this framework, the requirements for funding, liquidity, and operational resilience for stablecoin issuers are extremely high, significantly raising the barriers to entry. This "rigid constraint" mechanism for stablecoins aims to prevent large-scale redemption pressures, payment crises, and loss of confidence risks, thereby enhancing the security of the stablecoin system for holders and the entire financial system.

3.2 Impact of MiCAR on the Crypto Taxation System

According to Article 98 of MiCAR, the tax authorities of each member state are incorporated into the crypto asset regulatory cooperation system and must share necessary information with financial regulatory authorities (such as national financial supervisory authorities and the European Securities and Markets Authority, ESMA) to identify cross-border transactions and potential tax evasion. This means that tax authorities are formally embedded in the crypto asset regulatory chain for the first time, no longer relying on post-event investigations or voluntary declarations, but can utilize the transparency mechanisms established by MiCAR for real-time or periodic monitoring of transactions.

However, MiCAR does not directly stipulate tax collection rules but complements the EU's Directive (EU) 2023/2226, known as DAC8. DAC8 requires that starting from January 1, 2026, all Crypto Asset Service Providers (CASPs) operating within the EU must report transaction data of EU resident clients to tax authorities, including information on buying, selling, transferring, staking, airdrops, and earnings. This data will subsequently be automatically exchanged among EU member states, thereby constructing a crypto tax information sharing network covering the entire EU. Member states must complete the transposition of their national laws by December 31, 2025, to ensure the synchronized implementation of DAC8 and MiCAR.

The linkage between the two regulations signifies that the EU is forming a dual-pillar compliance system of "MiCAR regulation + DAC8 tax reporting": the former ensures compliance and transparency of trading activities through a unified licensing and disclosure mechanism, while the latter achieves a closed-loop tax collection system through data sharing mechanisms. This institutional design not only strengthens the tax authorities' ability to monitor cross-border crypto asset flows but also effectively prevents common issues such as tax arbitrage and offshore hidden accounts. Additionally, the mandatory reserve and redemption system for stablecoins mentioned earlier in MiCAR also provides quantifiable funding tracking bases for tax collection. Daily market monitoring, regular audits, and public disclosures of reserves enable regulatory authorities to accurately assess the asset backing and income sources of stablecoins, providing an objective basis for taxing interest income, investment income, and exchange rate differences.

4. Recommendations for Investors and Institutions

In the face of the systemic regulatory transformation brought about by MiCAR, European investors and crypto enterprises should adopt proactive compliance and risk management strategies.

4.1 Investor Level: Strengthening Tax Compliance and Reporting

The systemic regulatory transformation brings about a demand for automated tax compliance tools. For institutional investors with larger volumes and more complex structures, relying solely on personalized tools is no longer sufficient to meet compliance and auditing requirements; individual investors can also use such tools to record transaction and income data in real-time, facilitating the automatic generation of tax returns and improving filing efficiency and accuracy. For example, the FinTax Suite employs a modular architecture that can seamlessly integrate with mainstream ERP systems, covering key processes such as data capture, automated bookkeeping, report generation, and compliance auditing through an intelligent rules engine and multi-dimensional reporting system, helping enterprises achieve financial transparency and tax compliance in a global regulatory environment. The FinTax Suite also supports audit-ready GAAP/IFRS standard financial reports, dual accounting systems for stablecoins and fiat currencies, AI-OCR invoice recognition, and bank statement imports, providing comprehensive financial and tax management solutions for on-chain payment and high-frequency trading enterprises. Additionally, multinational investors should pay attention to the cross-border reporting requirements under DAC8, clarifying the differences in capital gains tax and value-added tax among EU member states.

4.2 Institutional Level: Preparing for MiCAR License Applications in Advance

For crypto exchanges, custodians, and wallet service providers, obtaining MiCAR authorization is a prerequisite for entering the EU market. Relevant institutions planning to enter the European market need to communicate with the regulatory authorities of EU member states in advance to clarify the length of their national transitional periods. After all, while the threshold for MiCAR authorization is high, once obtained, it grants access to the entire EU market, providing a significant competitive advantage for long-term development.

For third-country companies wishing to provide crypto asset services in the EU, they must also establish a presence within the EU and apply for CASP authorization according to MiCAR. The only exception is the so-called "reverse solicitation" scenario, where clients initiate service requests entirely based on their own proactive willingness. It is important to note that the final report released by the European Securities and Markets Authority (ESMA) regarding reverse solicitation aims to tighten the applicability of reverse solicitation under the MiCAR framework. Non-EU platforms that contact EU clients through reverse solicitation without authorization may expose investors to legal risks.

5. Conclusion: MiCAR—A Balance Between Regulation and Innovation

The introduction of MiCAR by the EU marks the transition of crypto assets in Europe from a phase of unregulated growth to a more mature and standardized mainstream financial development system. It is both a response to risks and a provision of institutionalized soil for innovation. In the coming years, the interplay between MiCAR, DAC8, DORA, and other regulations will create a more transparent, secure, and efficient crypto market. For investors, compliance is no longer a burden but a mechanism for navigating towards legality and long-term returns. For enterprises, while MiCAR sets high thresholds, it also serves as a passport to enter one of the largest crypto markets globally. For all market participants involved, the implementation of MiCAR is not only a comprehensive compliance test but also a critical window for seizing opportunities and achieving business leaps. Only by actively adapting to regulatory trends and deeply integrating compliance concepts into corporate strategy and operations can one remain invincible in the new competitive landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。