The role of cryptocurrency in Argentina has undergone a qualitative change.

Written by: Maria Clara Cobo

Translated by: Luffy, Foresight News

Bitcoin sign outside a cryptocurrency exchange in Buenos Aires

As the midterm elections approach, Argentine President Javier Milei tightens foreign exchange controls to support the peso exchange rate, while citizens like Ruben López are turning to cryptocurrency to protect their savings.

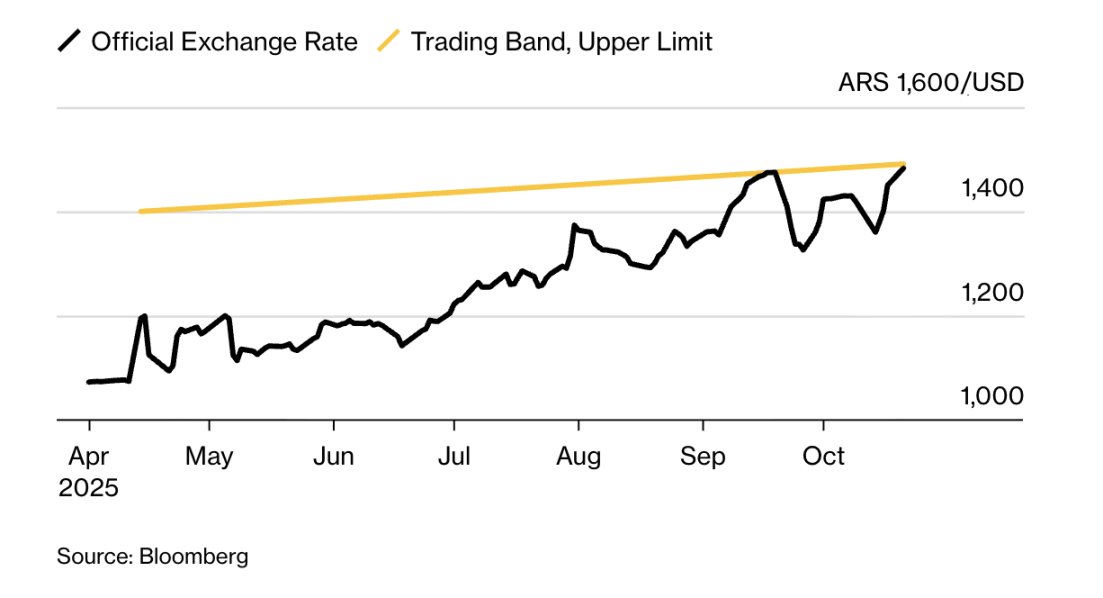

A new strategy has emerged: using stablecoins pegged 1:1 to the dollar to leverage the difference between the official exchange rate and the parallel market rate, with the peso currently valued about 7% higher under the official rate than in the parallel market. Cryptocurrency brokers state that the trading process is as follows: first, buy dollars, immediately exchange them for stablecoins; then, exchange the stablecoins for pesos at the cheaper parallel market rate. This arbitrage operation, known as "rulo," can quickly earn up to 4% profit per transaction.

On October 17, Milei at a campaign rally in Buenos Aires

"I do this trade every day," says stockbroker López from Buenos Aires, who uses cryptocurrency to hedge against inflation.

This cryptocurrency operation reflects a shift in how the Argentine public is responding to a new round of economic turmoil. Ahead of the October 26 elections, Argentina is depleting its dollar reserves to boost the peso and prevent the exchange rate from breaking through the trading range. Even with significant support from the U.S., investors still expect the peso to further depreciate after the elections.

The Argentine central bank recently introduced new regulations prohibiting citizens from reselling dollars within 90 days to curb rapid arbitrage trading, and the "rulo" arbitrage model almost immediately emerged. On October 9, trading platform Ripio reported that "the trading volume of stablecoins against pesos surged 40% in a single week," attributing it to "users profiting from exchange rate fluctuations and market opportunities."

For some Argentines, such operations are indeed necessary. After all, the country has defaulted on its debt three times this century. When Milei was elected in 2023, he promised to end these financial predicaments. He has achieved some results, such as reducing the annual inflation rate from nearly 300% to about 30%; however, the peso exchange rate continues to depreciate significantly, partly due to the currency devaluation policy implemented when Milei took office, and partly due to recent investor concerns about the elections.

Peso exchange rate nearing the upper limit of the trading range

The phenomenon of "rulo" arbitrage indicates that the role of cryptocurrency in Argentina has undergone a qualitative change: from a novelty that intrigued the public, including Milei himself, to a financial tool for protecting savings. In the U.S., cryptocurrencies are often used as speculative tools; however, in Latin America, they have become a choice for seeking stability. In countries like Argentina, Venezuela, and Bolivia, crypto technology helps people evade the triple pressures of "currency volatility, high inflation, and strict foreign exchange controls."

"We provide users with channels to buy cryptocurrency with pesos or dollars and then sell for profit—this is our daily business," says Manuel Beaudroit, CEO of local cryptocurrency exchange Belo. "Clearly, the exchange rate difference can yield considerable profits." He mentioned that in recent weeks, traders could earn 3%-4% per transaction, but also cautioned that "such levels of profit are very rare."

Cryptocurrency exchange services outside a store in La Paz, Bolivia

Other exchanges have seen similar situations. Another local platform, Lemon Cash, reported that on October 1, the day the Argentine central bank's 90-day dollar sales ban took effect, its total cryptocurrency trading volume (including buying, selling, and exchanging) surged by 50% compared to the average level.

"Stablecoins are undoubtedly a tool for obtaining cheaper dollars," pointed out Julián Colombo, head of the Argentine region for another trading platform, Bitso. "Cryptocurrency is still in a regulatory gray area, and the government has not yet clarified how to regulate stablecoins or limit their liquidity, which has created conditions for the rise of 'rulo' arbitrage."

However, the growth in stablecoin trading is not solely due to arbitrage. As Milei's government faces critical elections and the economy comes under pressure again, many Argentines are also using cryptocurrency as a tool to hedge against the potential further depreciation of the peso.

"Inflation and political uncertainty have made us more conservative, so I have no peso savings or investments, only using pesos for daily expenses," says Nicole Connor, head of the "Cryptocurrency Women Alliance" in Argentina. "All my savings are in cryptocurrency and stablecoins, and I try to earn returns through them."

Exchange rate sign inside a store in Buenos Aires

Nevertheless, cryptocurrency operations are not without risks. In Argentina, stock market trading is tax-free, but profits from cryptocurrency trading are subject to a tax of up to 15%; moreover, frequent trading may attract the attention of banks, which often require proof of the source of funds for users making large transfers repeatedly.

However, analysts believe that as the economic difficulties persist, Argentina's reliance on stablecoins may deepen; across Latin America, more and more people are using such tools to protect their assets against fiscal turmoil and electoral shocks.

"Stablecoins will always exist," says stockbroker López. "The dollar occupies an important place in Argentine society and daily life because it is our safe haven against currency risk."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。