In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Lin Chao has recently received the most private messages asking why the short-term market is in a sideways fluctuation range, with the market direction being extremely unclear. How should we view the future market? Today, let's discuss Lin Chao's understanding of the future trend in light of the CPI data to be released at dawn.

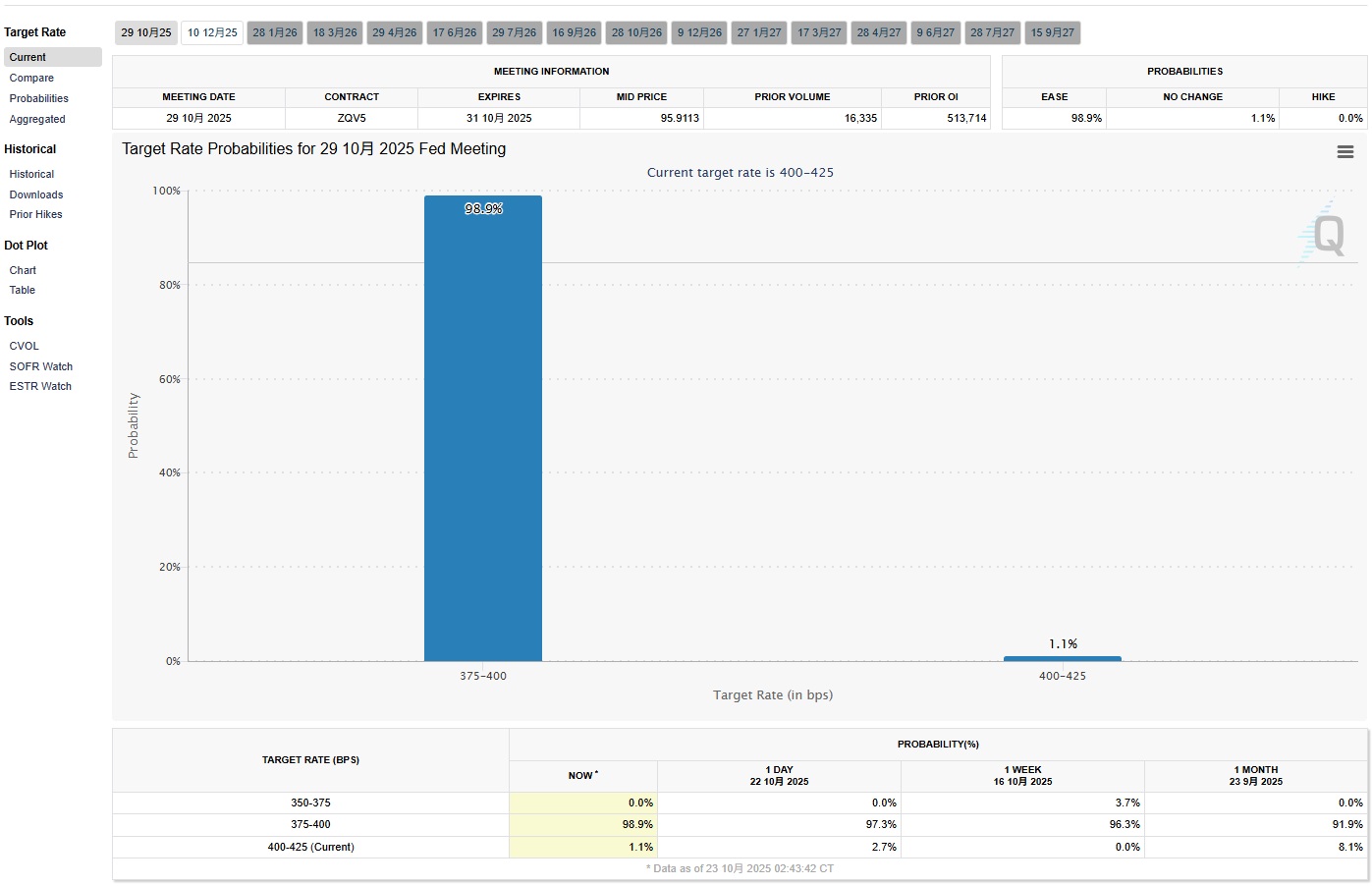

Currently, the U.S. government is still in a shutdown state, but tonight at 8:30 PM, the inflation data for September will still be released. From market expectations, the year-on-year broad inflation rate is expected to be 3.1%, which is a significant increase compared to last month, while the Cleveland Fed's expectation is 3.0%. Although inflation is rising, the market interprets this as being due to the new tariffs that started in August, which are one-time events, so inflation is likely to be one-time as well, thus having little impact on the Federal Reserve's policy. The current focus of the Federal Reserve should be on the labor market, especially during the government shutdown. Although labor data has not been released, it is likely to be unfavorable, so based on the current data, the CME gives a 98.9% probability of a rate cut in October.

Of course, this data may be adjusted downwards after the CPI data is released, but it is highly likely that the rate cut will not be affected. However, if inflation continues to rise, the Federal Reserve may be more cautious about the rate cut in December. As for core inflation, the market expectation is 3.1%, the previous value is also 3.1%, Nick's expectation is still 3.1%, and the Cleveland Fed's expectation is 3% (2.95%). Therefore, the CPI and core CPI are likely to meet expectations, and as long as they do not exceed expectations, the impact on the market will be limited.

However, if both inflation data are below expectations, it will definitely have a positive effect on market sentiment. For example, if both are 3%, the market will be pleased, as inflation is not as exaggerated. We also need to pay attention to income data, which also represents the current economic and employment situation. Overall, as long as tonight's CPI data is not excessively high, its impact on the market should be limited, and its influence on the October rate cut is also very weak.

From the current indices, market sentiment is also beginning to stabilize, mainly due to two events. One is that the top leaders of China and the U.S. will meet in Malaysia on October 30, and the outcome of the meeting will directly affect the tariffs on November 1, likely leading to a TACO. The weekly report has also analyzed this; although everyone is talking tough, high tariffs are not good for either China or the U.S., and Trump's goal is to open up more rare earth resources.

The other event is that Trump has pardoned Zhao Changpeng. Many bloggers have discussed this issue today, and Lin Chao will not elaborate further, as this matter will not have a long-term impact on the entire market, at most just a short-term emotional guidance. Simply put, the biggest advantage for Zhao Changpeng personally may be the ability to re-enter Binance's operations legally and compliantly. Although this has little to do with the market, we can conclude that the current U.S. government is still willing to continue retreating in the cryptocurrency space, and of course, the Trump family making money in this market is also one of the reasons.

Next week's key events are also clear, starting with the Federal Reserve's interest rate meeting and Powell's speech from the early morning of the 30th, followed by the unknown timing of the China-U.S. talks on the 30th, and the core PCE data on the 31st seems less important. Next week, both parties should also discuss the issue of restoring the shutdown.

Lin Chao's Summary

There is also a piece of news worth paying attention to: "JPMorgan and Bank of America strategists expect that, given the tightening of funding conditions this week, the Federal Reserve is likely to announce the end of the reduction of its balance sheet, which is about $6.6 trillion, at the October rate cut meeting, marking the end of the process of extracting liquidity from the financial market." (For the impact of balance sheet reduction, you can refer to the previous article "End of Balance Sheet Reduction, The Eve of a Comprehensive Bull Market.")

If the balance sheet reduction stops at the end of October, the entire economic cycle will progress faster than previously imagined. The current macro background is much more complex than in 2019: the tariff war is ongoing, the ceasefire between Russia and Ukraine is far from sight, the Middle East is in turmoil, and the U.S. government has just experienced a shutdown crisis, with fiscal spending needing to be increased again. Under this multiple pressure, ending QT early is actually a form of "soft rate cut." If the balance sheet reduction stops early, combined with the expected 25 basis point rate cuts in October and December, the liquidity expectations in the market this year will be much better than previously imagined.

If the expected actions align with Lin Chao's guesses, the entire rhythm will change to:

Rate cut 25BP/End of balance sheet reduction (October) → Repo operations (November) → Rate cut 25BP → Managed bond purchases (Q1 2026) → Continuation of the rate cut cycle → Risk assets regain liquidity support.

This means that the entire macro cycle's progress bar will officially transition from the "liquidity contraction" phase to the "liquidity bottom → easing" phase. At this point, we are just stuck in the last darkness before dawn.

Although the price of Bitcoin has indeed become much more expensive than before, in the face of the impending arrival of a large easing cycle, the real bull market may come in ways we have never seen or imagined. Looking back at the Bitcoin index data, the turnover rate has begun to decrease significantly, indicating that some investors' panic is fading. As the Bitcoin price index rebounds, the emotions of loss investors are gradually improving. Recently, those who exited the market are mainly short-term investors who bought the dip in the past few days. Although tonight's CPI data is not very important, it should still have an impact on the market.

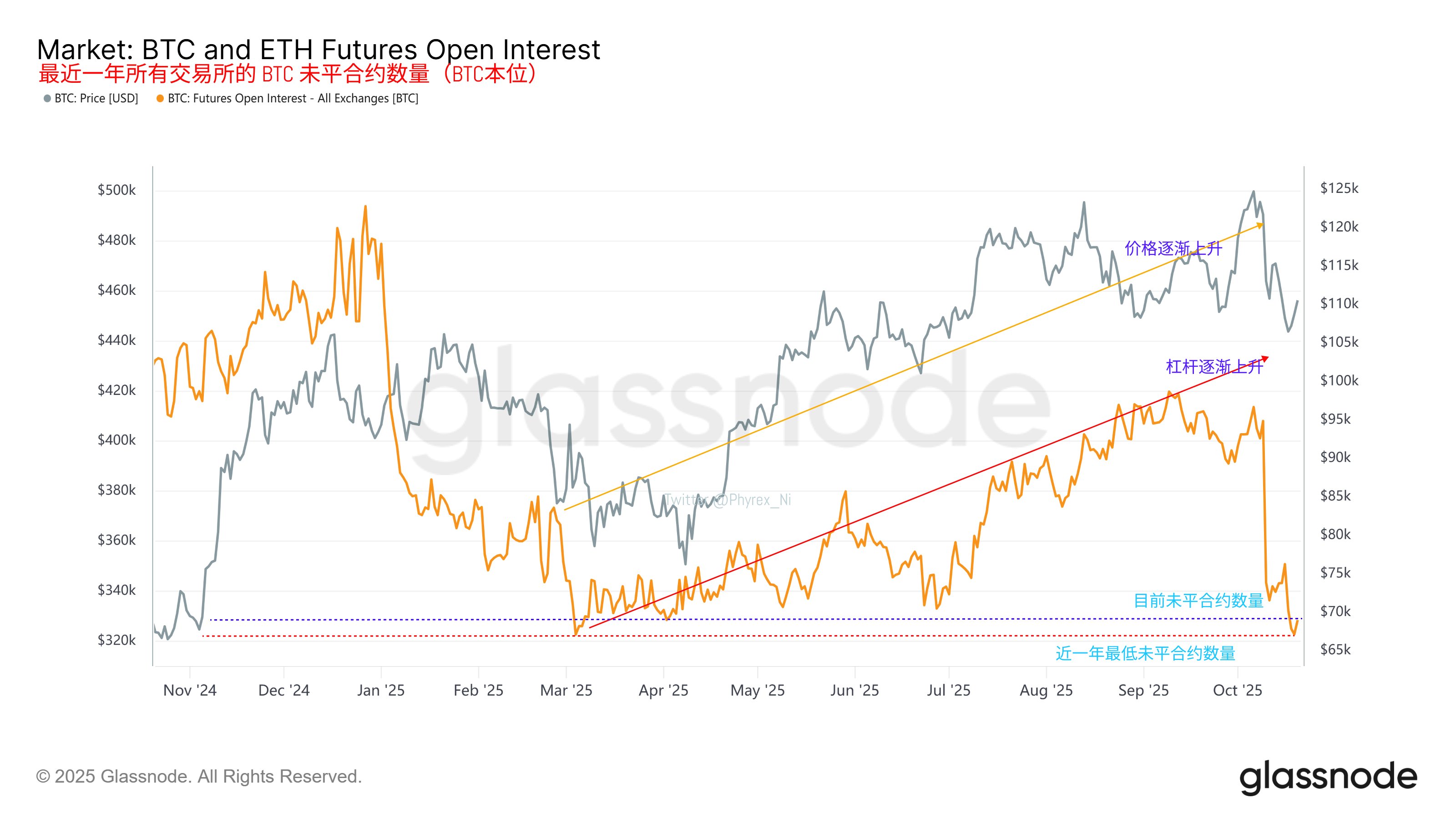

From the contract perspective, BTC has now reached the lowest point of open contracts in the past year, and leverage should be minimal. Meanwhile, ETH has reduced its leverage from one-third to half. From a historical data perspective, the lower the leverage, the more funds tend to enter, which often helps with price increases. Although from a short-term technical perspective, the Bitcoin index price still has not released stable upward signals, if the market really begins to stabilize, then profits will also be lost. For contract users pursuing extreme profits, the current short-term upward trend is still in its nascent stage, and they can attempt to establish a light position to lay a foundation in advance. But remember to control your position; never buy heavily.

If you are in a state of confusion—unable to understand technology, unable to read the market, unsure when to enter, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to buy the dip, unable to hold onto profits, missing out on market opportunities… these are common problems for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words; repeated failures are not as good as finding the right direction. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Protecting your principal and making good asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market is risky; invest with caution!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。