The human heart is hard to measure, and the Chinese people look to the West with hope.

Author: Zuo Ye

The theory of randomness originated in gambling, and geometry naturally falls short compared to the ancient Greek sages.

The expression of quantifying uncertainty became the original proposition of probability theory, which is also the biggest difference between prediction markets and casinos. If you look through the documentation of PolyMarket, its defense argues that casinos have a house edge, and from the perspective of the law of large numbers, anyone who gambles for a long time will inevitably lose.

Prediction markets are a two-way game of PVP. Polymarket neither charges users deposit and withdrawal fees nor takes a cut from orders, completely avoiding its own disturbance to randomness.

But that’s not enough; PVP alone is insufficient to make Market Price = Probability. Expectation is also needed; only quantifiable expected returns can cover speculative costs, allowing prediction markets to break free from the constraints of casinos and become pure financial products.

Entertainment to Death: Odds

All authority, whether political or journalistic, is merely a digital representation of gains and losses.

The monopoly on information does not come from obscuring sources but from monopolizing their channels of dissemination.

Modern journalism originated from wartime censorship during World War II. Schramm established communication studies as an independent discipline, incorporating qualitative and quantitative methods from sociology and statistics, while journalistic professionalism became the industry's unbreakable shield.

At the same time, with the continuous expansion of the voter base (women, Black people, young people), polls began to genuinely influence the futures of political figures. How to infer the overall tendencies of voters from a smaller sample space became a commercially profitable endeavor, needed by the media, political parties, and even opponents.

However, polls and news have long been a B2B business model, where media sells the attention of users/the public to enterprises, meaning users are merely a link in the sale and cannot profit from concentrated consciousness and tendencies. This is akin to the anger directed at platforms in the decentralized movement.

Invasion of privacy is just a pretext; the key is that platforms don’t pay.

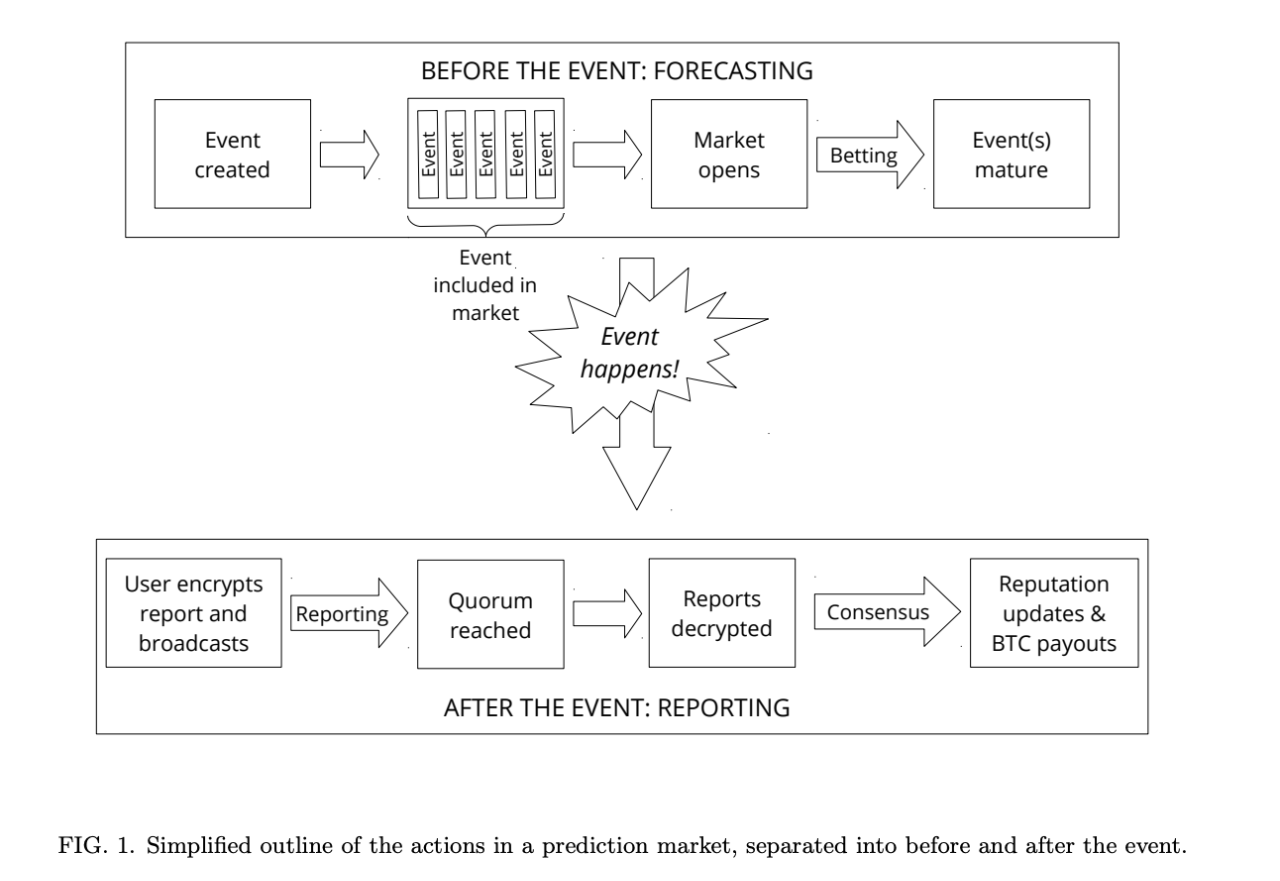

By 2014 at the latest, academia was already contemplating how to combine blockchain and prediction markets to escape the traditional centralized platform's house edge model. Vitalik recalls that the first generation of prediction markets, Augur v1, was born in 2015, embodying this ideological shift.

Unfortunately, the Augur v1 white paper was built on a Bitcoin sidechain, and Ethereum at that time was not yet capable of supporting large-scale applications on-chain. Augur's "excessive pursuit" of decentralization also kept it lingering among niche groups, unable to create positive externalities, ultimately fading into obscurity.

Image caption: Augur v1 design

Image source: @AugurProject

By 2020, during the DeFi Summer, beyond DEXs and lending, figures like Jeff from Hyperliquid and Shayne Coplan from Polymarket were attempting a new generation of prediction markets, utilizing Ethereum + L2 + governance centralization. Technological advancements made efficiency no longer an issue; the lack of a sufficient consumer base was the real dilemma.

When the time comes, the world will unite.

• The global lockdown in 2020 led people worldwide to adopt an online lifestyle, which naturally included prediction markets;

• The 2022 World Cup brought a cyclical peak in global gambling activities, with the global online betting market size reaching $100 billion, a significant portion contributed by the World Cup;

• The 2024 presidential election, with Trump's excessive antics creating dramatic twists, will see a global frenzy where even 1% of the traffic is a windfall for Polymarket.

After the election, Polymarket maintained its share in a stable situation through continuous financing, ongoing discounts (free), and constant entry into the sports market, similar to how Hyperliquid maintained its market share post-token launch. Polymarket has already passed its most dangerous moment.

The upcoming 2026 World Cup will be a decisive battle for whether Polymarket can grow into a giant in the online prediction market, as the political uncertainty is far too strong compared to the safer, high-yield sports activities.

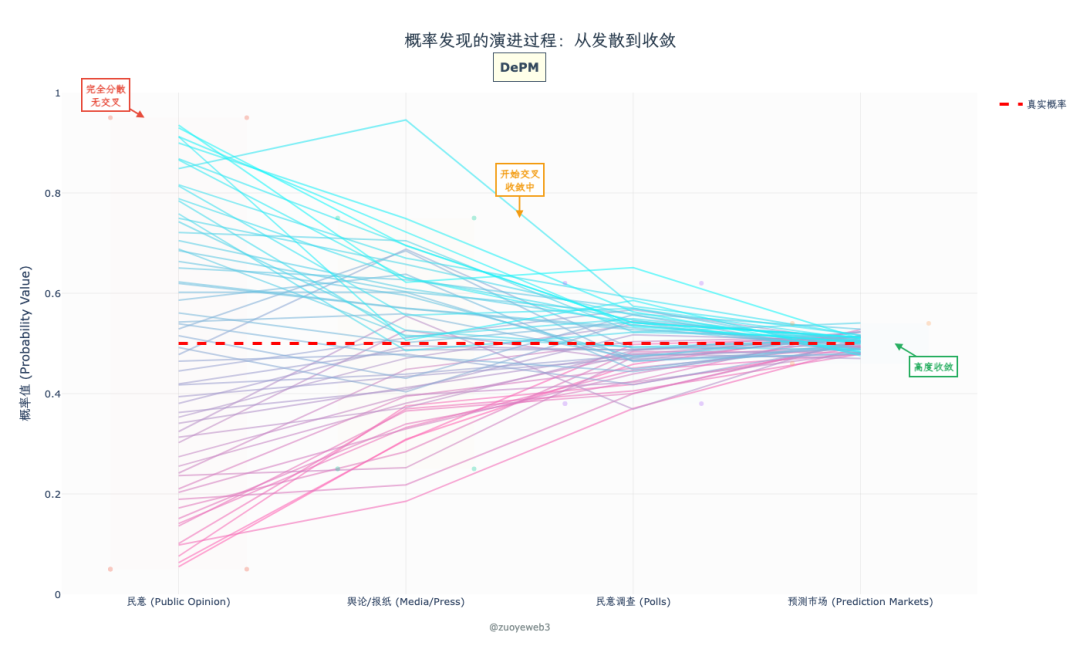

Image caption: Prediction ≠ Gambling

Image source: @zuoyeweb3

Here, it is important to explain why prediction markets are efficient. Taking Trump's campaign as an example, the total sample space consists of 240 million American voters, but in reality, only 150-160 million will vote (effective sample space). Outside the fixed red and blue states, the true determination of the presidency comes from a few swing states, which can further be subdivided into different swing counties.

Thus, polling in swing states is crucial, and mainstream polling organizations like Gallup will design more "scientific and reasonable" sampling methods for research, as it is impossible to survey all voters. Inferring the overall from a small sample becomes a significant challenge.

The paradox here is that there are always a critical few who can influence the choices of the majority, and prediction markets can continuously study the parameters of sampled data, allowing for higher probability bets before the actual results occur.

In other words, it is not that prediction markets have a higher sampling ability; rather, they continuously correct the parameters derived from sampling, and anyone's opinion will be reflected in real-time odds.

This means that Polymarket is a kind of "cluster algorithm," continuously sampling the highest probability value from discrete data and cross-validating it with the final results to improve accuracy.

Odds represent long/short, divergence/convergence pricing. In Polymarket's market, events are the basic unit, and each standard contract is minted as 1 USDC, corresponding to Yes + No = 1. For example, a 0.5 Yes must have a corresponding 0.5 No.

Assuming Alice and Bob's buy prices are 0.1 Yes and 0.1 No respectively, and the current market price is 0.5:

• If Alice believes the future probability will exceed 0.5, when the final result is revealed, Alice nets 0.9U;

• If Bob believes the future probability will not exceed 0.5 and sells that share, Bob locks in a profit of 0.5U in advance, netting 0.4U.

Of course, the generation of initial prices and price fluctuations require the participation of market makers, and Polymarket allows for mechanisms similar to CLOB used in Perp DEX, also supporting limit orders and other more complex strategies.

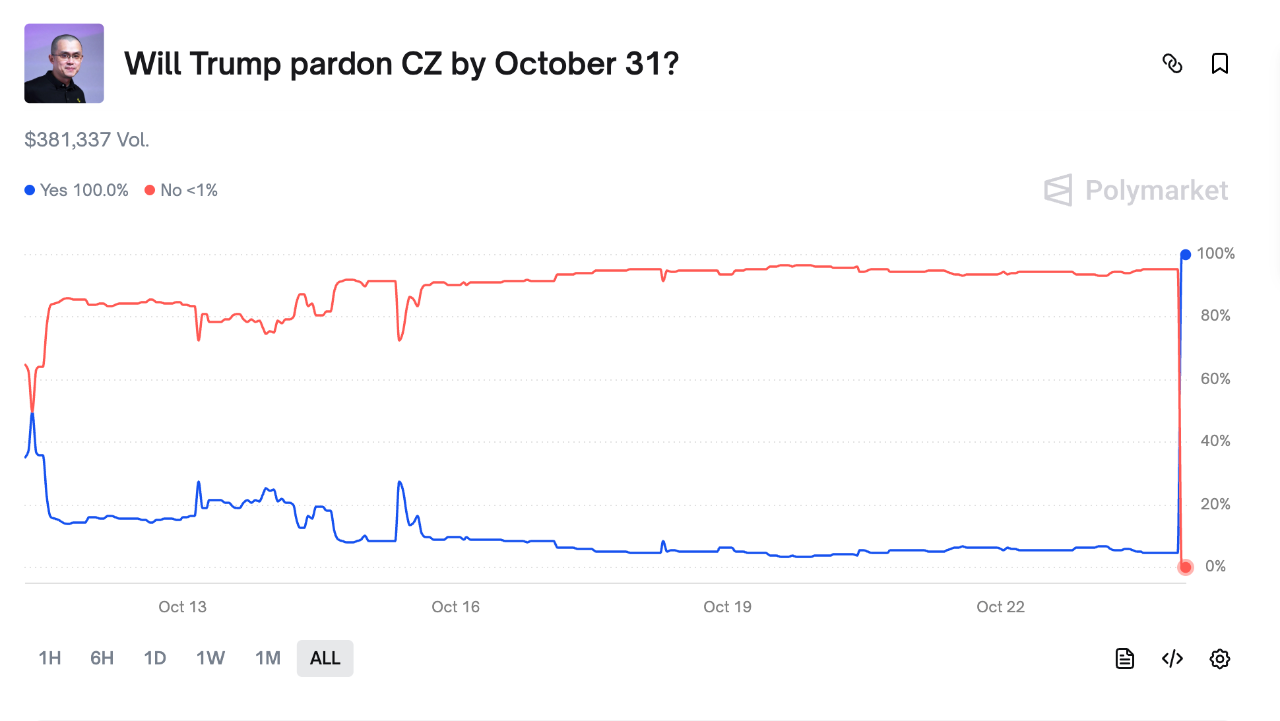

The mechanism of Polymarket is not complicated; the total is 1, and the price difference between Yes and No and 1 is its profit margin. For example, a 93% probability represents 0.93 Yes + 0.07 No = 1 USDC. If it ultimately reverses to No, then 0.93 becomes the profit from the upset.

Image caption: Upset Timing

Image source: @Polymarket

After placing a bet, users can buy/sell at any time, becoming part of the market's liquidity, which is a more efficient market-making method than "buy and hold." Yes/No are each other's sources of profit/loss, creating an extreme PvP market where the platform only needs to facilitate fairness.

Of course, regarding oracles and governance, the opening and closing of markets, and the adjudication of contentious events, this article will not delve into many details. Generally, Polymarket is an internet-commercialized prediction product that just happens to use blockchain and stablecoin technology, with little relation to decentralization.

Entertainment Lies in People, Not Events

The spread of monopolies is largely the result of a conspiracy between organized capital and organized labor.

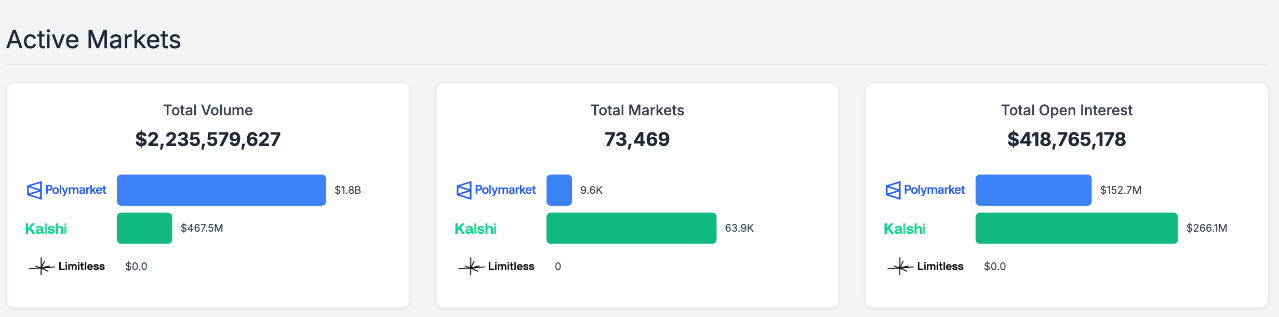

Polymarket's current three main pillars are political elections (U.S.), news events, and sports. Its biggest competitor, Kalshi, focuses on compliance and collaborates with Robinhood, Jupiter, etc., emphasizing that even if they don't make money, they still want to gain traffic.

Image caption: Data Comparison

Image source: @poly_data

Among many emerging prediction markets, most aim to become the Blur of OpenSea, attracting retail participation through expected airdrops to complete their token issuance, with almost no possibility of directly competing with Polymarket or Kalshi.

This has little to do with compliance; Polymarket's compliance is a pricing issue, while Hyperliquid's compliance is a significant problem, as their liquidity is not even on the same scale.

Ultimately, U.S. elections represent a niche market unique to the U.S., while sports are a global mass market. Polymarket represents the usage preferences of young Americans; fragmented individuals may not place bets but still watch esports live streams, yet this does not prevent them from betting on ball games.

Before Polymarket, Kalshi, and the NFL collaborated, the NBA had already partnered with DraftKings and FanDuel for sports betting in 2023. Besides the New York Stock Exchange's parent company investing in Polymarket, FanDuel has also collaborated with CME, and organized capital has already taken action.

The enforcement against NBA match-fixing is merely the noise from the Supreme Court granting "sports betting" legal status in 2018, and it cannot hinder the steps of PL and Kalshi. Unfortunately, the scale of sports betting is limited and its future uncertain.

This is akin to the predicament of Eastern Moutai; the virtualization and fragmentation of young people is an irreversible trend, and events are seen as boring old gambling. Beyond liking or disliking Trump, there exists a vast population that does not pay attention to him.

Not only do they defend Shanghai in cyberspace, but American youth also sing lines from "Zero Dark Thirty," even though they may not intersect in reality.

Beyond generational emotions, casinos and the black market are the least of prediction markets' problems. With a valuation of $15 billion for Polymarket and $12 billion for Kalshi, they have already reached peak valuations.

Organized capital only invests in certain political, news, and sports activities. What else will the youth gathered in cyberspace be interested in? That is the future of prediction markets.

Do not try to understand Generation Z; create space for Generation Z. Old marketing strategies will backfire.

Organized labor does not necessarily only have economic value demands, or rather, what is the most expensive thing in the 21st century?

It is emotional value, the projection of one's emotional needs. For example, the pursuit of an overseas identity is a testament to the excessive success of the household registration system, so successful that some people suffer from its aftereffects. The success of family planning is not reflected in the decline of marriage rates, but in the fact that young people actively choose to become the last generation, believing this to be rebellion rather than compliance.

Atomized individuals have not diminished their emotional needs for the collective; instead, they grow in secrecy. Look at the crowded conferences, where what is heard is not the panels but the real interactions of lonely individuals.

Globally, the only figures that can engage young people collectively, investing their energy and finances, are entertainment figures. Note that it is not entertainment events, but entertainment figures. For instance, in the case of Taylor Swift's pre-marital testing, if we connect Xiaohongshu and Instagram, the conversion rate would absolutely outperform that of Trump.

Moreover, during the peak of a star's popularity, their drama is routine. Fan wars, unfollowing and retaliating, are akin to the evergreen nature of Disney film merchandise; stars can create a secondary market.

This is not a fantasy; the financialization of entertainment participation has become a global consensus. The film and television whirlwind sells T-shirts, MrBeast registers MrBeast Finance, G.E.M. Tang invests in AI startups, and Kanye sells memes.

This is safer than stars selling NFTs or pumping prices; people are betting on individuals, and even insider information becomes part of the market because people inherently have their own thoughts, and the core is that fans do not care.

K-pop fan wars have long been the norm, with the emphasis on winning being paramount. Economic losses and gains are not important; satisfying one's emotional value is what matters most. Prediction markets can be a financial projection of fan economy.

One could even build more advanced hedging strategies based on this. If someone buys No before a movie is released, it is equivalent to hedging against the public opinion risk of their brother/sister. After all, whether it is good or not and whether it can make money has already begun to show signs during the filming process.

Financial entertainment is not about becoming entertaining; it is already highly entertaining. In a fragmented world, some cheer for prediction markets getting licenses, some debate that prediction markets are not gambling, and some are already looking for new markets.

The Trump family has invested in Polymarket, while outsiders are still entangled in doubts. It would be more practical to make some money together.

Conclusion

The end of globalization is the gradual decoupling of goods and services, and we are now entering the service trade phase. However, Homo sapiens are inherently drawn to crowds. If we merely "localize" the U.S. elections to Thailand's elections, it actually holds little significance and instead shrinks market capacity.

Seeking consensus in a fractured world can lead to unique characteristics, especially for Chinese entrepreneurs. Politics and sports are both high-risk choices, and underground operations will always face bottlenecks. The entertainment industry, on the other hand, is the entry point that minimizes risks.

CZ may face inquiries from the Western world due to his Chinese identity, but at least predicting the size of Kim Kardashian's buttocks will not threaten national security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。