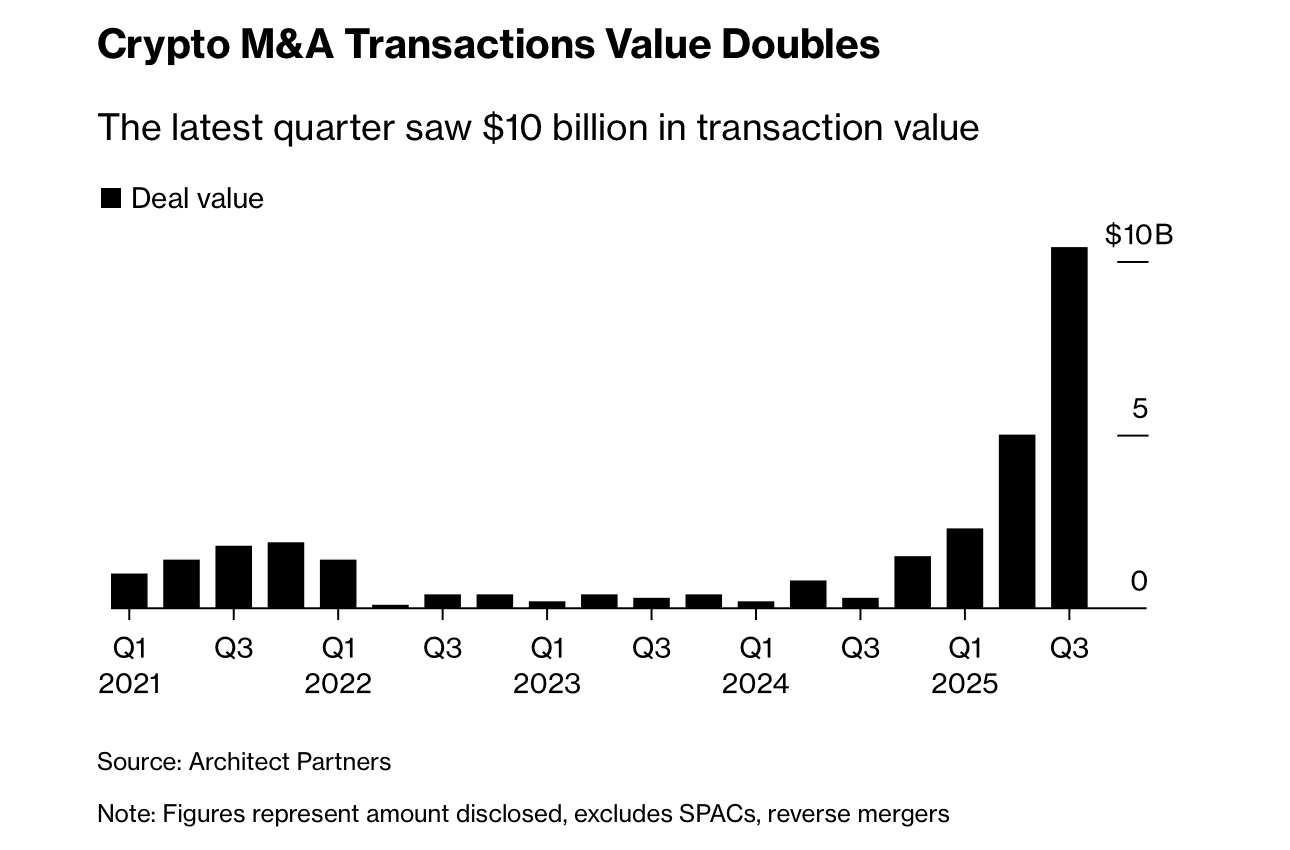

Bloomberg’s Isabelle Lee and Suvashree Ghosh report the spike marks the first time crypto mergers and acquisitions (M&A) have crossed the $10 billion mark, signaling the sector’s shift from scrappy startups to major financial players. The deals, tracked by Architect Partners, include Falconx’s acquisition of 21shares, Ripple’s $2 billion purchase of GTreasury, and Coinbase’s $2.9 billion buyout of Deribit.

Screenshot source: Bloomberg.

Analysts say easing U.S. regulations under President Trump have paved the way for consolidation as firms race to secure market share before the big banks move in. Traditional giants like Goldman Sachs and Citigroup are eyeing the action, while crypto firms rush to scale before the window closes.

- What did the report say about crypto M&A?

Bloomberg said crypto M&A hit $10 billion in Q3 2025, a thirty-fold jump year-over-year. - Which companies drove the surge?

Falconx, Ripple, and Coinbase led billion-dollar deals that fueled the M&A boom. - Why is crypto M&A growing so fast?

Regulatory easing and Wall Street’s growing interest have accelerated consolidation. - What’s next for the sector?

Analysts expect more large-scale mergers as crypto firms rush to compete with traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。