Liquidation data from the last 24 hours reveals some surprising imbalances among major cryptocurrencies: XRP traders who bet against the altcoin took a hit almost five times bigger than the longs, with a rare 404% short-to-long wipeout ratio.

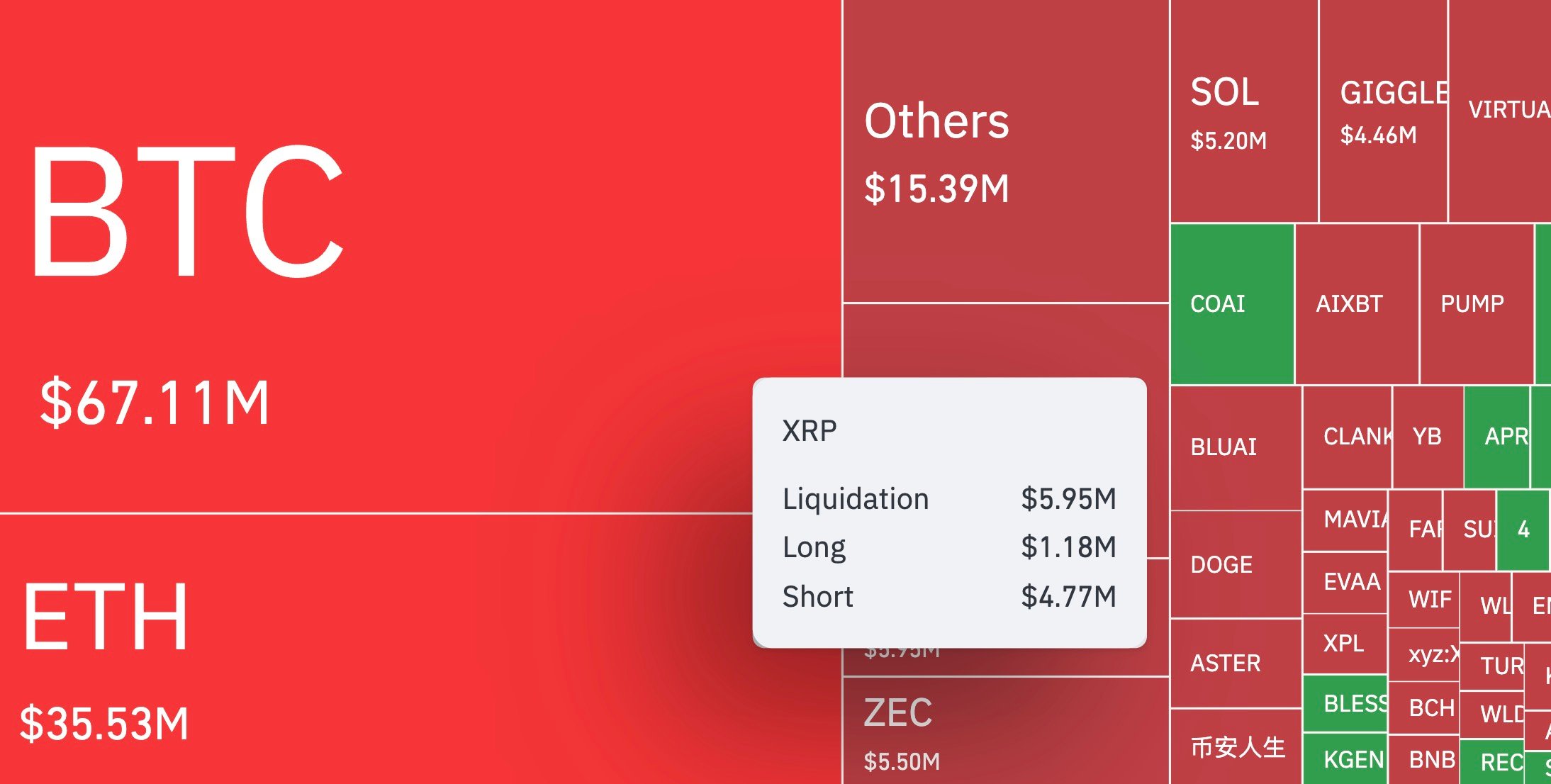

Out of $5.95 million liquidated on XRP pairs, $4.77 million came from shorts, while only $1.18 million was sucked out of leveraged longs, as per CoinGlass.

This is a bit of a shock when you look at the rest of the crypto market. Bitcoin and Ethereum were at the top with $67.11 million and $35.53 million liquidated, respectively, but mostly mixed flows. XRP's situation is different, though. Its liquidation map shows a clear story of bulls cornering short traders in a squeeze-like blockbuster of price action.

HOT Stories Michael Saylor Drops 'Orange Dot Day' Teaser: Did Strategy Buy More Bitcoin Last Week?-62% and 978,000,000 SHIB in 24 Hours: This Is Extremely Good SignMorning Crypto Report: Why Is XRP Price Up Today? Ripple CEO and President Defy Retail Fear, Cardano at Risk of 20% Death Cross CrashNew CFTC Chair Nominee Is XRP Supporter

Source: CoinGlass

On Binance, XRP/USDT bounced by 3.33% from as low as $2.57 to as high as $2.64, providing a stark explanation why the derivatives data came in the form of such aggressive washout.

Crowd gets punished, again

The way the market's been moving lately shows that bears have been trying to push the token lower, which is understandable considering the overall sentiment, but they have been getting pushed out at higher price points, which has made the upside moves on the chart bigger.

You Might Also Like

Sun, 10/26/2025 - 12:42 XRP Reaches Critical Recovery Point for $3ByArman Shirinyan

One may see this as a textbook crypto market behavior, where a crowded overleveraged trade gets punished in the most brutal and unexpected manner.

Heavy short-side imbalances in XRP liquidations are rare and often coincide with a shift in trading psychology. The market saw $216.75 million in liquidations, reflecting concentrated pressure on short sellers. This setup can extend into a further bullish rally if spot buyers continue absorbing sell pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。