This is a year where "everything is rising," but the cryptocurrency market is recognized as "extremely difficult to make money" this year.

Compared to the past few years, 2025 feels like a rare "auspicious year." The Nasdaq in the US stock market has reached new highs, core assets in the A-shares have rebounded, gold has refreshed historical price levels, and commodities have collectively rebounded, with almost all markets on the rise.

Only in the cryptocurrency market, even with Bitcoin reaching a historical high of $120,000, many people complain that this is the "most difficult year to make money" in the crypto space. A friend mentioned their family's investment operations this year, saying, "This year, trading cryptocurrencies in terms of returns is completely inferior to my mom trading A-shares."

A-shares: A once-in-a-decade main uptrend

"This year, both my family's and my own A-share accounts have a win rate of 100%." Professor Cai, who has researched and taught the A-share market for over twenty years at a university in Hangzhou, told Rhythm BlockBeats.

"The stock market is performing strongly, and most investors are making profits. Compared to previous years, making money in the stock market this year is relatively much easier. As long as you don't chase high prices and avoid buying delisted stocks, you can basically make a profit regardless of what you buy; it's just a matter of how much you earn."

If Professor Cai's experience is the "intuition of an old hand," then the data from his students is even more convincing: "Many of the students I communicate with have made a lot of money. Those who traded over twenty stocks have a win rate of 100%."

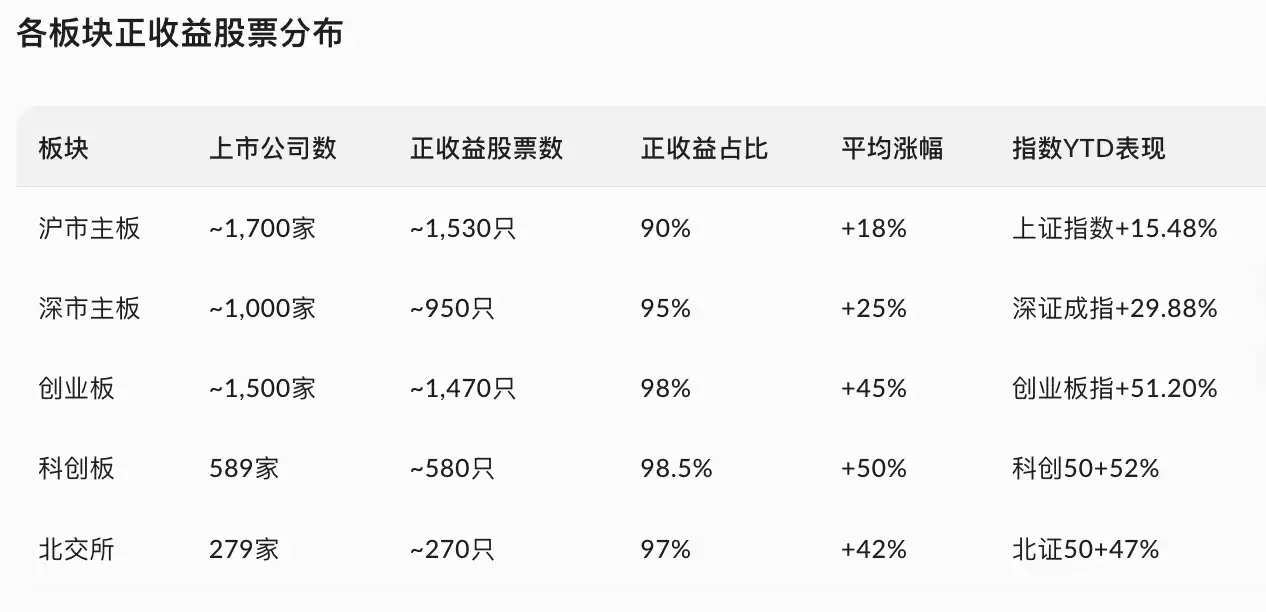

Data also confirms this "broad rise" trend.

In the first three quarters of this year, according to China's most mainstream industry classification standards, among the 31 sectors under the Shenwan first-level industry classification, as many as 28 sectors have achieved growth, accounting for over 90%. Wind data shows that the proportion of stocks that have risen this year exceeds 80%, with as many as 448 stocks doubling in price.

"This year's A-share market has another characteristic: both volume and price are rising. Not only is the upward performance good, but the trading volume is also very high, especially in the third quarter, where the trading volume exceeded 2 trillion yuan for several consecutive trading days," said Zhuo Chen, an investor who has been trading A-shares for many years, summarizing to Rhythm BlockBeats.

Compared to the main board market, the growth in the ChiNext and Sci-Tech Innovation Board is even more vigorous.

"This year, the artificial intelligence sector is leading the rise, so the corresponding indices related to the dual innovation board, such as the ChiNext Index and the Sci-Tech 50, have all risen over 50% this year," Zhuo Chen said.

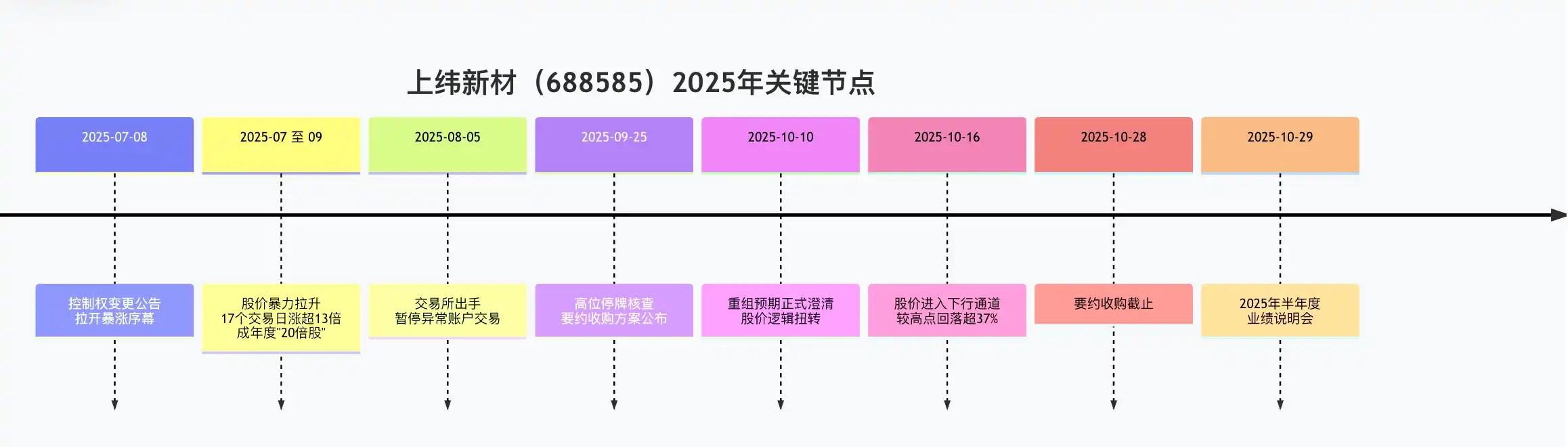

A representative stock is "Shangwei New Materials," which has become the first "20x stock" in the A-share market this year.

"This was originally a chemical company on the Sci-Tech Innovation Board, and the reason for the rise is that the controlling shareholder changed to Zhiyuan Hengyue, a company closely related to Zhiyuan Robotics, stepping into the artificial intelligence sector."

Rhythm BlockBeats Note: Zhiyuan Robotics is a star company in the "embodied intelligence" track, co-founded by Huawei's former "genius boy" Peng Zhihui (Zhihui Jun) and former vice president Deng Taihua.

This news ignited the market's imagination. On social media, headlines like "Zhiyuan Robotics backdoor listing" and "A-share version of Nvidia" emerged endlessly. Although the company clarified multiple times that there were no asset restructuring plans in the short term, the sentiment had already been ignited.

In just 17 trading days, the stock price skyrocketed from single digits, increasing by more than 13 times. As of September 25, Shangwei New Materials had a cumulative increase of over 2030% this year, becoming the first "20x stock" in the A-share market for 2025.

In Professor Cai's view, the crazy rise in the A-share market this year is not unusual.

"It just means that after a lot of declines, it has to rise. From a time cycle perspective, the A-share market experiences a bull market roughly every ten years; last year was a transition from bear to bull, and this year is precisely the main uptrend year of the bull market," Professor Cai said.

In the bull market of 2005, the Shanghai Composite Index rose from 998 in 2004 to 6124 in 2007; in the bull market of 2015, the index rose from 1849 in 2013 to 5178 in 2015. The intervals between these two bull markets are roughly ten years, and now another decade has passed.

"Moreover, this year, almost all overseas markets have performed exceptionally well," Professor Cai added, "from Japan to Germany, the UK, India, the US, Canada, and other major markets, all have reached historical highs."

Hong Kong Stocks: Even Elephants Can Turn Around

Before looking at the US stock market, let's first take a look at the Hong Kong stock market.

As of the time of writing, the Hang Seng Index has accumulated a rise of nearly 29% this year, briefly breaking through 26,000 points in September, reaching a four-year high.

Tech giants have once again become the main players in this round of market activity. The internet sector, represented by Alibaba, Tencent, Meituan, and Xiaomi, has led the way, driving the Hang Seng Tech Index upward.

They say "it's hard for elephants to turn around," but this year's market is indeed a bit of an exception.

For instance, many people were not initially optimistic about Alibaba's rise. After all, it had fallen sharply in recent years, almost becoming synonymous with the sluggishness of Chinese concept stocks.

However, since the beginning of the year, Alibaba's cloud business has achieved double-digit growth for two consecutive quarters, with a year-on-year increase of 26% in the second quarter, reaching a nearly three-year high, and its AI business has maintained triple-digit growth for eight consecutive quarters. This is reflected in the stock price, which has doubled this year, making Alibaba the most dazzling presence among large companies.

On the other hand, Tencent is also not to be outdone. In the second quarter of 2025, Tencent's domestic game revenue grew by 24% year-on-year, and its advertising business also saw a 20% increase due to AI algorithm optimization. Starting from 2024, Tencent expanded its buyback scale to 112 billion Hong Kong dollars, the largest in nearly a decade. Tencent's stock price has also risen by over 50% this year, with its market value in Hong Kong returning to 6 trillion Hong Kong dollars, nearly tripling over three years.

Additionally, the most noteworthy aspect of the Hong Kong stock market this year is the profit-making effect of the IPO market.

"This year, making money from IPOs is like making a quick profit, topping what others have traded for half a year," Arez said during a conversation with Rhythm BlockBeats.

The data indeed speaks for itself.

In the first three quarters of 2025, a total of 68 new stocks were listed in the Hong Kong stock market, of which 48 rose on the first day, 4 remained flat, and only 16 fell below their issue price, resulting in a first-day drop rate of only 24%, the lowest since 2017.

Especially in the second half of the year, among the 24 new stocks listed from July to September, only 3 fell below their issue price, making the profit-making effect quite visible. Correspondingly, the first-day return rate has significantly increased—averaging 28%, nearly three times that of last year.

"The profit-making effect of IPOs in the Hong Kong stock market was already evident in the second half of 2024. For example, Mao Ge Ping's stock rose 70% on its first day, kicking off a small spring for IPOs, and this year has seen a major market," Arez mentioned.

Half a year ago, Arez also discussed with Rhythm BlockBeats that due to the poor performance of crypto projects, their studio specifically set up a Hong Kong IPO team responsible for IPO subscription projects.

"We then successively won allocations for stocks like Blukoo, Mixue, Auntie Shanghai, Ning Wang, and Ying En Biology, among others. It can be said that this year, making over 100,000 from IPOs is very easy, especially for large allocations like Ying En Biology, where one lot can earn 10,000, and many banks and brokerages can offer 10 times leverage, so the capital utilization rate is also very high," Arez said.

"Moreover, this year, there are particularly many IPOs in the A+H model, making operations very stable." Several leading A-share companies have listed in Hong Kong this year, such as CATL and Heng Rui Pharmaceutical. Since A-shares already have mature pricing, there is generally a discount range when issuing in Hong Kong, which provides a "valuation safety cushion" that significantly reduces the risk of IPOs.

"For example, the profits from subscribing to CATL's IPO feel like picking up money for free," Arez said with a smile to Rhythm BlockBeats: "Everyone knows that Hong Kong stocks are discounted, but no one expected it to be this attractive."

With the emergence of profit-making effects, the Hong Kong IPO market is even showing a trend of "universal participation." Compared to last year, the Hong Kong IPO market is noticeably more lively this year, with oversubscription rates moving from the hundreds to the thousands. "The most exaggerated was the large-scale science and technology company, which was oversubscribed nearly 8,000 times."

Statistics show that in the first three quarters of 2025, there were 68 new stocks listed in the Hong Kong stock market, of which 98% received oversubscription, and 86% of new stocks had oversubscription multiples exceeding 20 times, doubling compared to the same period last year. There were 15 stocks with oversubscription multiples exceeding 1,000, accounting for nearly a quarter.

Among them, the large-scale science and technology company had an effective subscription multiple of 7,558 times, becoming the "subscription king" of the season; Blukoo and Yinnuo Pharmaceutical followed closely, recording subscription heats of 5,999 times and 5,341 times, respectively. In this context, the Hong Kong IPO market has seemingly become a new generation of "risk-free wealth management."

Gold: Everyone is Seeking Certainty

On the other end of the capital spectrum is the soaring gold market.

Starting from $2,590 per ounce at the beginning of the year, gold reached its low point for the year on January 3 and has been on a steady upward trend since then, repeatedly hitting historical highs, currently stabilizing around $4,100, with an increase of over 58% this year.

The S&P Global Gold Mining Index has surged by 129%, becoming the strongest performing sector among all industry indices under S&P. Even silver prices have soared to their highest levels in decades, with a cumulative increase of over 70% this year.

The driving forces behind this round of precious metal bull market are not just risk aversion. The risks of a US government shutdown, continuous buying by central banks, and concerns over sovereign debt expansion—all macro narratives point in the same direction: money is seeking a safer container.

"For gold mining stocks, this is a fantastic year. They have so much cash that they don't know how to handle it," Zhuo Chen remarked during the interview.

Zijin Mining, the largest gold company by market value in the A-share market, is a representative of this feast.

As of the third quarter, the company's revenue reached 254.2 billion yuan, with a net profit of 37.864 billion yuan. If we combine the market values of A-shares and Hong Kong stocks (i.e., the total market value of A+H), Zijin Mining's total market value has exceeded 1 trillion yuan.

Source: Zijin Mining's third-quarter report

Thus, at the end of August, Zijin Mining made a huge investment to acquire 84% of Anhui Jinsan Molybdenum's equity, taking control of the world's second-largest molybdenum mine—Shapinggou Molybdenum Mine, with an annual production capacity of 10 million tons.

This transaction allows China to directly control one-third of the world's molybdenum resources.

Almost simultaneously, Zijin's "Zijin Gold International" landed on the Hong Kong Stock Exchange on September 30, doubling on its first day, becoming the second-largest IPO of the year.

Not only the A-share gold sector but also the US stock sector with the highest increase this year is undoubtedly the gold mining sector.

Data shows that since the beginning of the year, Newmont's stock price has risen by 137%, Barrick by 118%, and Agnico Eagle by 116%. In contrast, star companies in the US AI sector, such as Nvidia, have risen by 40%, Oracle by 72%, Alphabet (Google's parent company) by 30%, and Microsoft by 25%.

Although the gold sector in the US stock market has performed prominently, this is not enough to cover all the gains in the US stock market this year.

The Revival of Meme Stocks

As of late October, the three major US stock indices have all achieved gains of over 20% this year, with the S&P 500 Index reaching a historical closing record of 6,753.72 points on October 8. Nvidia's market value has surpassed $4 trillion, and Microsoft, Meta, and Apple have all set historical highs.

In addition to these mainstream US stocks, Matt, who often frequents US stock channels like Reddit's "WallStreetBets" and "StocksToBuyToday," has witnessed a new wave of meme stock revival on the forum. He shared several meme stocks from this year with Rhythm BlockBeats.

"If I had to name the biggest meme stock on the Nasdaq in the past three months, I would say it's OpenDoor, which is very similar to GameStop back in the day. It rose 245% in July, 141% in August, and 79% in September, with its stock price soaring from $0.50 to a high of $10.87, a maximum increase of 2000%." At this point, Matt's tone clearly became excited.

Interestingly, this company, which engages in instant real estate transactions, has been losing money year after year since its establishment. Its stock price fell from a peak of $35.80 per share in 2021 to $0.50 per share in June 2025, and it even received a delisting warning from Nasdaq at one point.

"The turning point occurred when a well-known investor stated on social media that OpenDoor had the potential to be a hundred-bagger, attracting a group of retail investors on Reddit called Open Army, which directly propelled the stock price to rocket heights. They hailed OpenDoor as the new meme stock and even successfully 'forced' a board restructuring."

Another meme stock that Matt recently participated in is Beyond Meat, once the "leader in plant-based meat," whose stock price soared by 1100% in just a few days. "It has also been losing money for years, and institutional short positions are very high, even reaching 80%. But the more institutions are pessimistic, the more retail investors love it; that's the power of retail investors."

Interestingly, one of the best-performing sectors in the US stock market this year is still related to crypto—but not the cryptocurrencies themselves.

Compared to the dazzling performance of "Bitcoin concept stocks," Bitcoin's rise seems relatively modest. Despite Bitcoin reaching a historical high this year, its annual increase is only about 15%.

The Slowdown in the Crypto Market

Anything with a price cannot keep rising indefinitely.

After experiencing multiple narratives, the crypto market has become a "market without a main storyline."

While traditional capital markets find new growth logic in AI, energy, and manufacturing, the crypto market remains trapped in a self-referential context.

The decline in trading volume best illustrates the problem. In Q3 2025, the global spot trading volume on centralized cryptocurrency exchanges fell by 32% year-on-year. Retail investor sentiment has been dulled, market makers are no longer active, and market depth has decreased.

On-chain funds are stagnant, token prices are flat, and project teams are at a loss for words. On social media, even the criticism of troubled trading platforms has diminished.

The crypto market, filled with myths of getting rich, has formed a "self-exploiting subject." They monitor the market 24/7 because "opportunities wait for no one"; they frantically chase airdrops, invest in meme coins, and follow trends because "if you don't work hard, you'll be eliminated"; when they lose money, they blame themselves for "not being smart enough," and when they make money, they feel "it's still not enough."

With three quarters of 2025 gone, the effort has lost its feedback, and burnout has become inevitable.

"Those who should leave have left, and those who remain don't want to gamble anymore." Arez's pessimism about the crypto market seems to represent many people. "In 2024, I will still monitor the blockchain, but this year, I don't even have the desire to open the trading platform."

This year, the crypto market has indeed lost. But what it lost was an inevitable battle within a cycle.

When the macro environment provided traditional assets with a clear upward logic, when tightening regulations increased speculative costs, and when narratives exhausted new funds no longer entered the market—the crypto market's downturn was almost predetermined.

However, this does not mean that the story of cryptocurrencies has ended.

"If you believe in China's national fortune, invest in the CSI 300; if you believe in breakthroughs in Chinese technology, invest in the Sci-Tech Innovation 50; if you believe in America's national fortune, invest in the S&P 500; if you believe in the human technological revolution, invest in the Nasdaq. If you believe humanity will eventually perish, invest in gold." This is a popular saying on Twitter recently.

Each type of asset corresponds to a belief. And the belief in the crypto market may need some new time and people to rewrite it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。