The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and I refuse any market smoke screens!

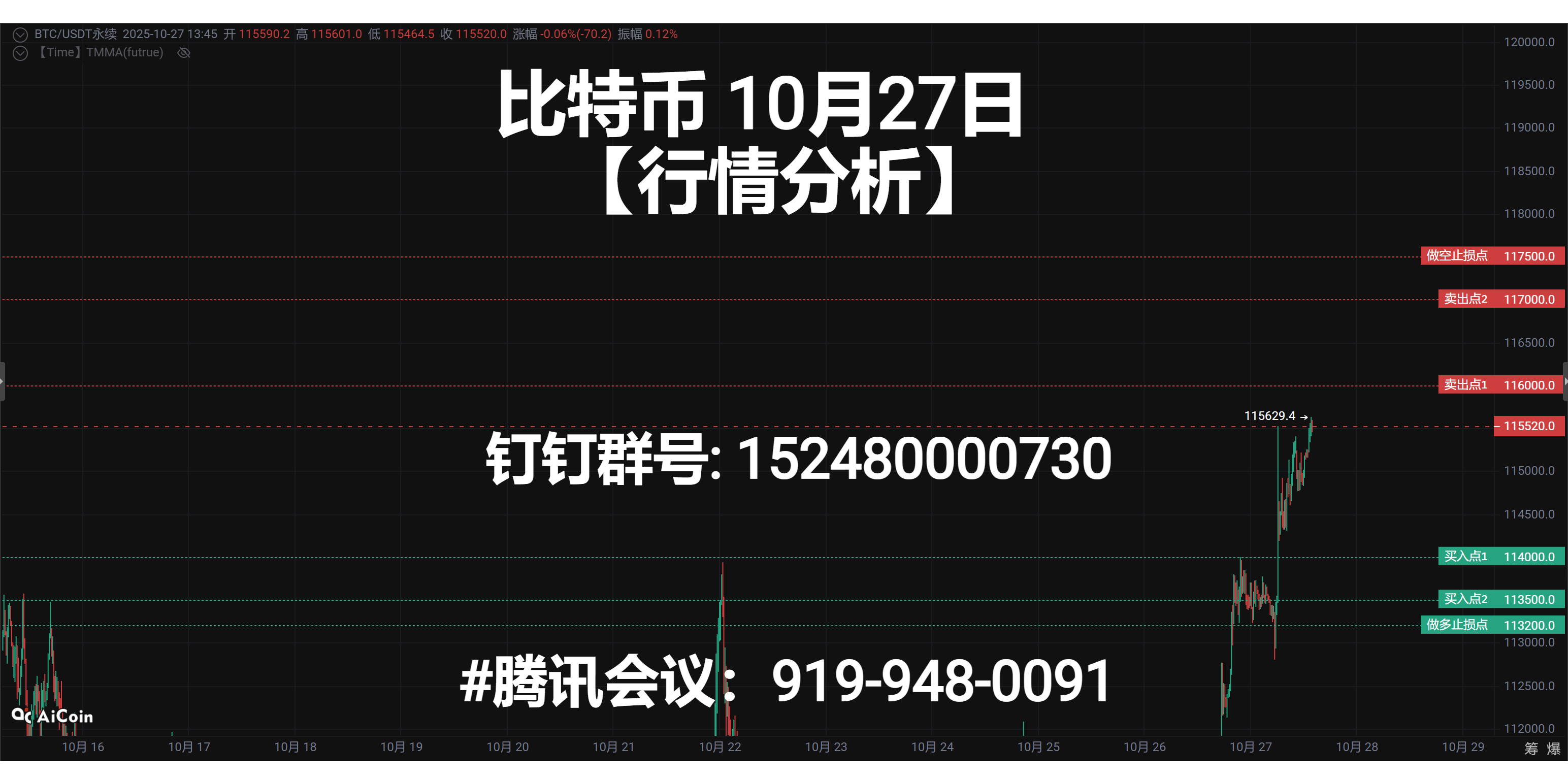

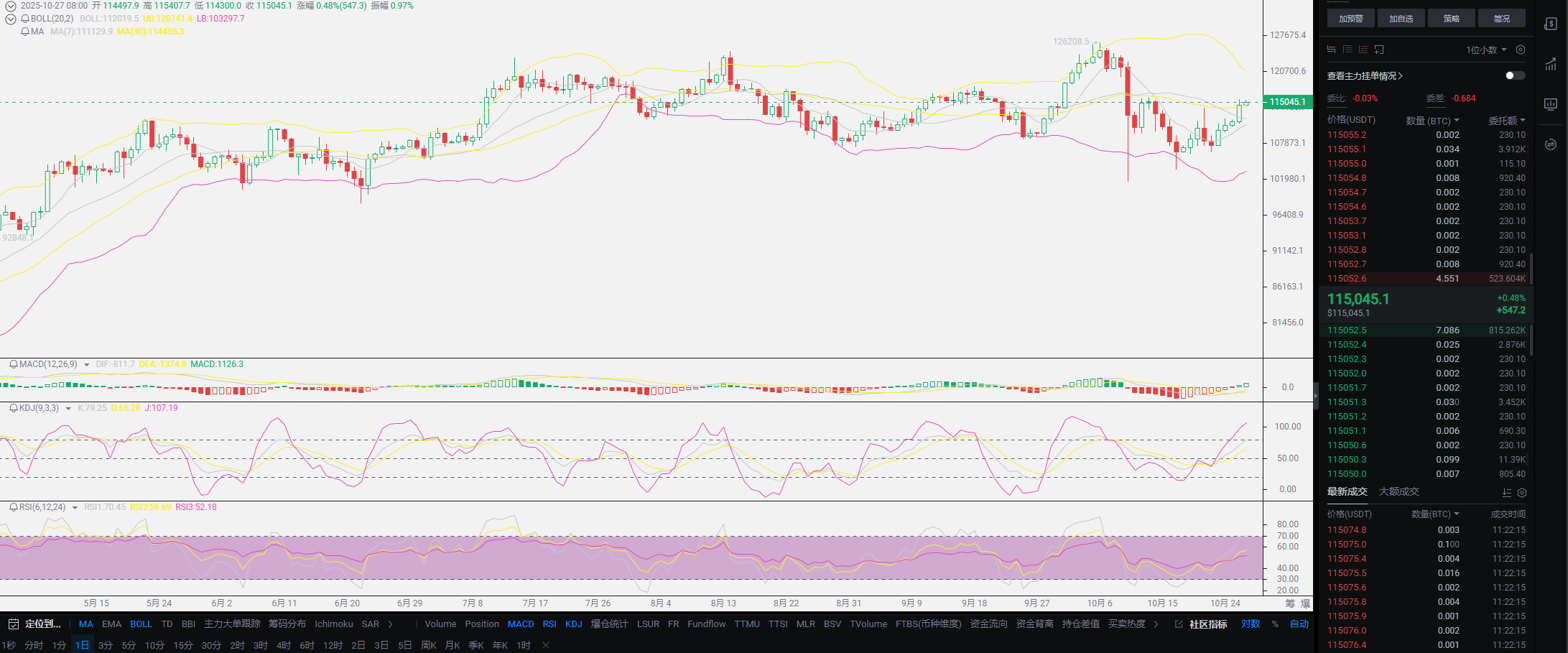

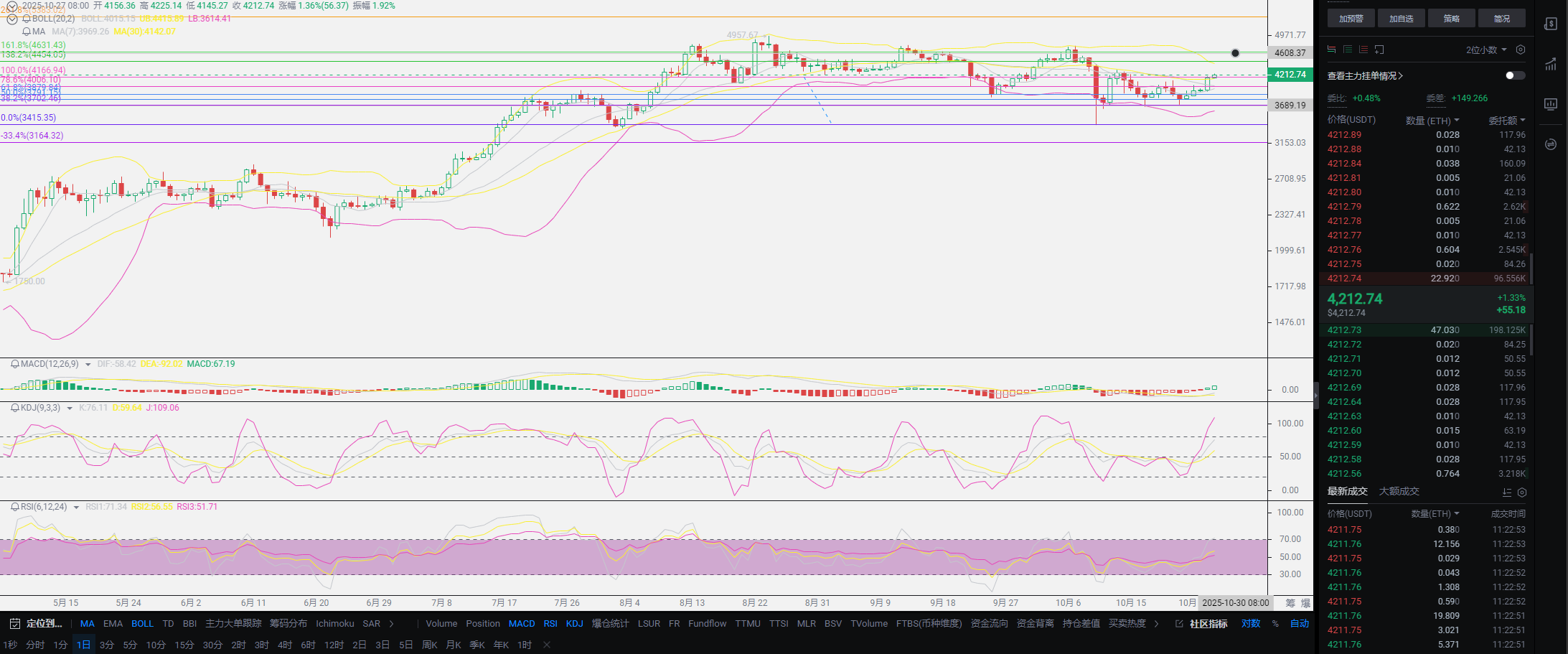

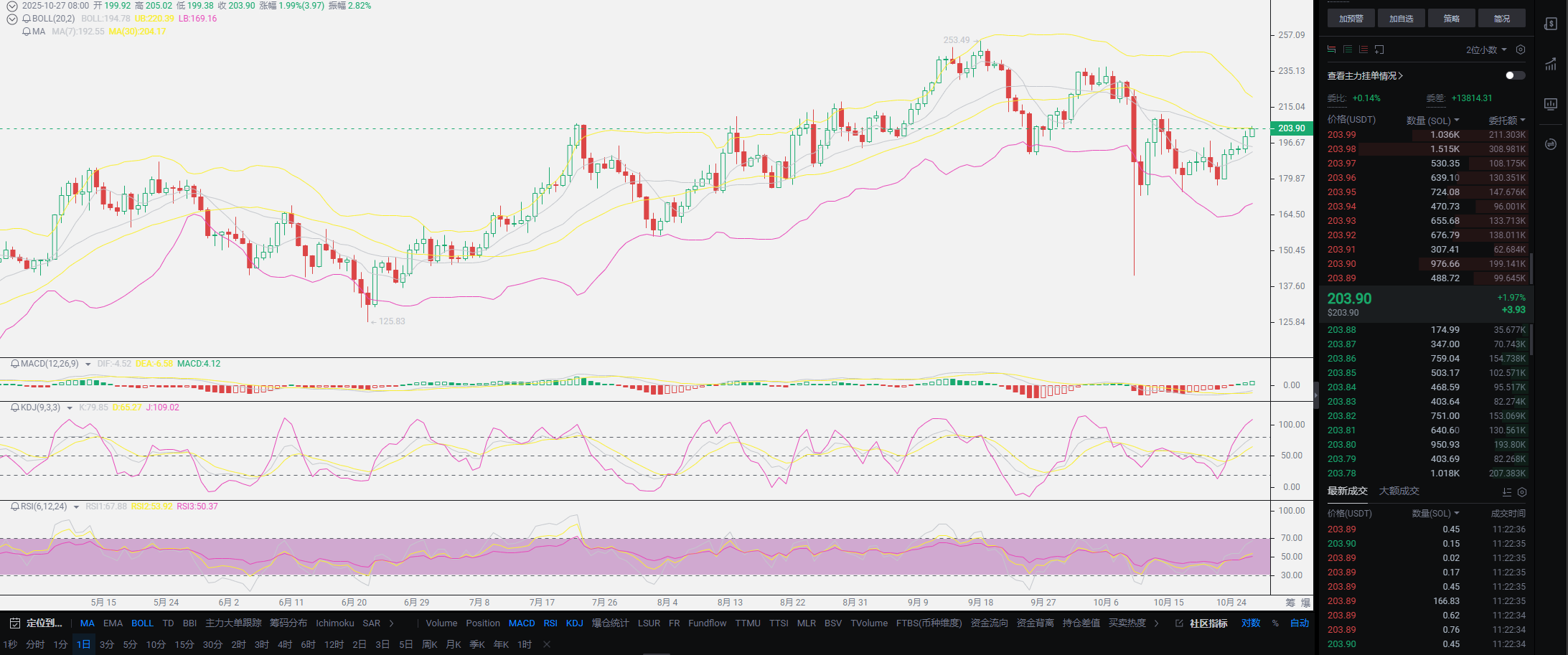

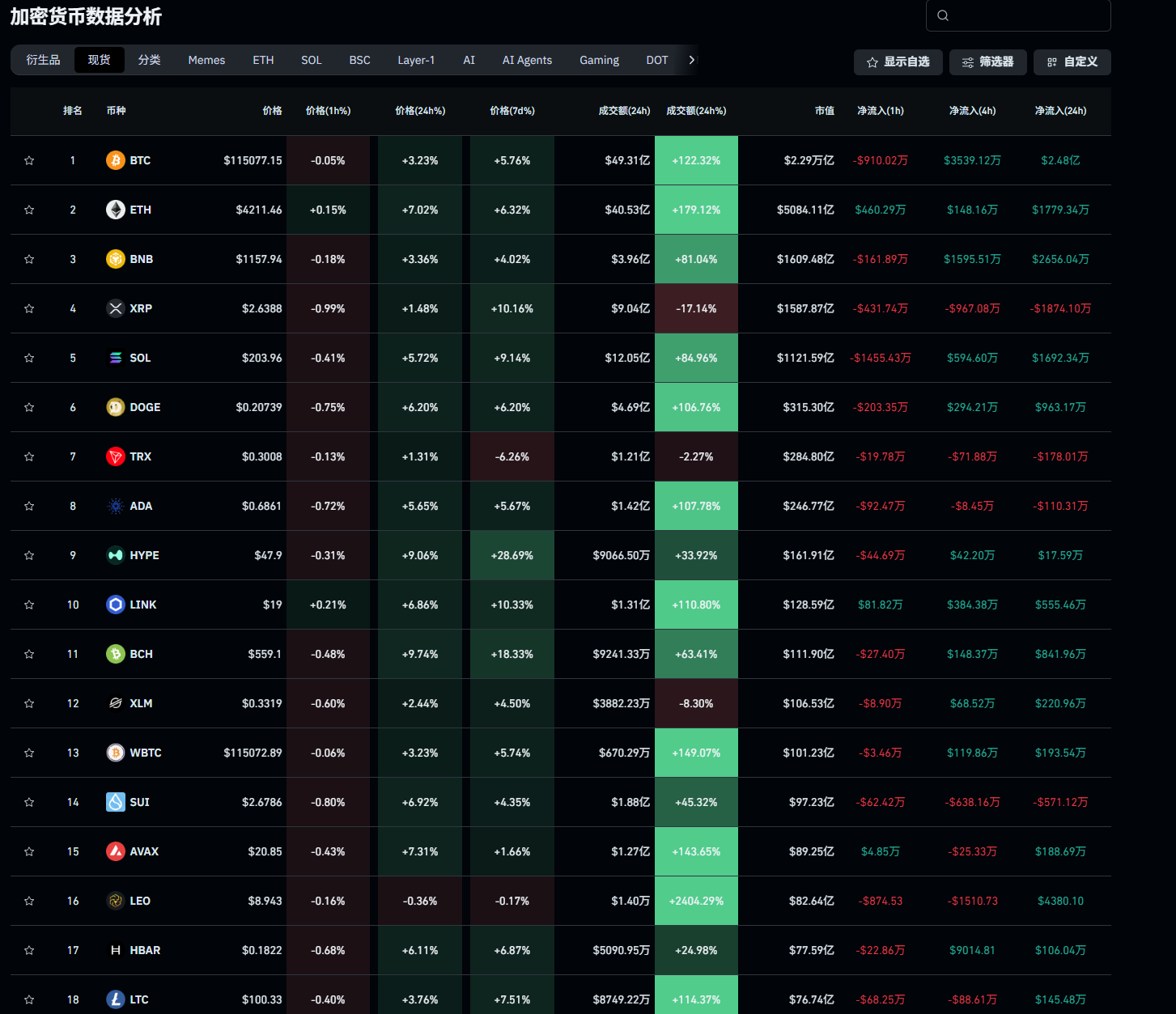

After calling for long positions for so many days, I finally saw a breakout in the market, which is a relief for me. The market has started, and it will continue to rise. After posting yesterday, I still saw many friends' private messages, so I will try to keep it brief and analyze for everyone. Yesterday, the post was at Ethereum 3939 and Bitcoin 11597, today Ethereum has reached 4201 and Bitcoin 115344. For users who listened to the advice, the current returns are already very substantial. Currently, I have no plans to exit, and I estimate I will exit on the day before or on the day of the interest rate cut. Even if there will be a decline later, it won't be lower than now, so everyone can rest assured. I am also pleased to see SOL finally back above 200. I have held it for nearly three to four months, and the returns have been hovering around this area. The exit position is not too far away, so those with SOL in the market must pay attention to my information in a timely manner.

The only disagreement I have with everyone is regarding the financial environment in the U.S. Yesterday, a fan's discussion hit the nail on the head. The earnings reports from U.S. stocks, the Federal Reserve's announced earnings and employment figures, and the recent inflation data are all extremely good. Many friends feel that the information I provide is incorrect. Generally, fans who raise such questions are mostly those who have just seen my articles or have been following for less than six months. In fact, this issue was concluded last year, and I have explained the U.S. strategy in depth. It can be said that since the month before Yellen's visit to China, U.S. data has already lost its objectivity. At this point, people might think it is just my personal speculation, but this year it was confirmed by then-President Trump, who mentioned that employment data was fabricated. You can also think about it: what information do we get from the fabrication of employment data?

The fabrication of employment data is a given fact, so inflation data will also have issues, including U.S. earnings reports; this is a chain reaction. A large part of the profit data you see comes from the tribute of various countries, which differs from the data created by the U.S. itself. If U.S. data is good and the real economy is strong, there would be no current interest rate cut cycle. This interest rate cut cycle should have ended last year; furthermore, through last year's interest rate cuts, U.S. inflation was alleviated, improving the circulation of the market economy. So why cut rates again this year? Even this week, there will be discussions about ending balance sheet reduction and preparing to inject liquidity? This also includes the already initiated reduction of reserve requirements? This series of measures cannot explain the false proposition of a strong economy! Moreover, tariffs are being imposed, and these tariffs are not just aimed at us; they are global. You can also think about the debt; it is all about debt reduction, but isn't the debt itself inflation?

You need to rely on everyone's strength to pay off debts; how can I believe the economy is still strong? A strong signal is at least that you can pay off your debts yourself. This issue is like the interest rate cut; there is no need to overthink the reasons. This series of measures is merely centered around debt reduction. The simplest indicator is to watch whether central banks around the world are continuously buying gold. Everyone knows the U.S. dollar system; the U.S. is a follower, and countries like the UK and other European nations are mainly reserving gold. This year, our mineral resources have directly decoupled from the U.S., and the legal currency is completely separated. These actions are almost all in the preparatory stage. Therefore, do not think that U.S. stock market data represents a strong economy; these cannot cover up the global decline in the real economy. I am not attacking the U.S.; the actual situation is just like this. Whether it is the impact of the pandemic or the implementation of tariffs, these will lead to a decline in the real economy.

This time, the crisis in the real economy has the greatest impact on the middle class. For the upper and lower classes, the impact is not significant. If you are in the lower class, you can farm anywhere and find work anywhere, whether it is delivery or factory work; the impact on the lower class is minimal. The reason for mentioning this line is to tell everyone that under known conditions, you must have a financial sense. Just like this interest rate cut and the beginning of ending balance sheet reduction, there is no need to discuss the reduction of reserve requirements together. As long as the above two factors emerge, it proves that next year's interest rate cuts will at least be maintained between two to three times. Currently, we will be in a long-term liquidity injection state. For the financial market, most assets linked to the U.S. dollar will appreciate, while the U.S. you hold will depreciate. Try not to hold U.S. dollars and U.S. bonds; holding gold will be better than these two.

Back to the point, many friends are puzzled as to why I am not optimistic about November. It is because the interest rate cut in December is too far away, and November will encounter traditional U.S. holidays, Black Friday, and Christmas around this time. There are also foreign exchange factors at play; it is highly likely that funds will choose to wash out before this period, and it is impossible to let retail investors exit so easily. After this interest rate cut, we still do not know how much capital it will bring. Therefore, in the short term, the focus will definitely be on the peak of this interest rate cut. If this time is still speculation on interest rate cut expectations, the subsequent momentum will not be strong. The funds have already flowed out enough for this interest rate cut. Whether it is the depth of the decline or the turnover of ancient wallets, this will deal a fatal blow to retail investors in the short term. The big players will definitely use this interest rate cut to harvest again; this is characteristic, so it is crucial to keep a clear mind at critical moments.

In summary, the market analysis from yesterday has already played out completely. This is how the financial market works; one wrong step leads to falling behind. If users who did not choose to enter yesterday are still looking for opportunities, they can only think about whether there will be a pullback today. The long positions I entered have already been given at the beginning of the article, and the exit timing will mostly revolve around the interest rate cut, exiting on the day or the day before. If you still want to enter today, my conclusion is that there will definitely be higher positions appearing later; it just depends on where you can hold the position. If I were to make a choice, having missed yesterday's entry opportunity, I definitely would not choose to enter today unless a position lower than yesterday appears, which currently seems almost impossible. I remind everyone again, when choosing contracts, I only focus on Bitcoin and Ethereum and will not enter coins like SOL; I cannot grasp these types of coins. As for the exit position for spot users, wait for my notification; I will inform everyone when it is time to exit. Currently, it is advisable to buy a little in the spot market, but contracts must be approached with caution. If you want to enter, it is best to keep in touch with me for suitable position management.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory in chess. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。