Trump Linked American Bitcoin Expands Mining and Treasury Holdings

Is the Trump-linked Bitcoin mining firm rush marking the next big wave of corporate accumulation?

Major BTC Purchase

Trump Linked American Bitcoin has taken another big step in its crypto journey. They bought 1,414 BTC, worth nearly $163 million, pushing its total Bitcoin holdings to around 3,865 BTC, valued at about $445 million.

The organisation, co-founded by Eric Trump and Donald Trump Jr., has been expanding fast since it began operations earlier this year. It aims to become one of the largest mining and accumulation firms for the largest cryptocurrency in the United States.

How the Company Was Formed

The company was created in March after mining giant Hut 8 exchanged its mining hardware for a major stake in the new company. This helped the firm combine large-scale mining power with direct BTC ownership.

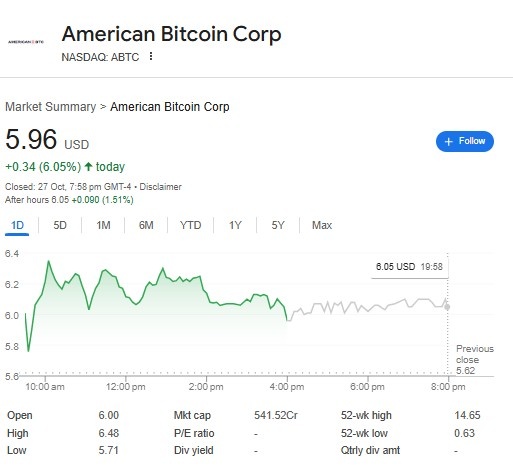

In September, American Bitcoin went public on Nasdaq under the ticker “ABTC” , following its merger with Gryphon Digital Mining. Its launch registered high demand, with stocks rising more than 16% on the initial day, indicative of increasing enthusiasm about the Trump-associated initiative.

Focus on "Bitcoin Per Share"

Something that distinguishes this firm is that it is transparent. The company has come up with a new measurement known as " Satoshis per Share ", which indicates the amount of the cryptocurrency that backs every share of its stock.

According to Eric Trump, who serves as the company’s Chief Strategy Officer, this measure is key to understanding the real value behind each investor’s share. “We believe one of the most important signs of success is how much BTC supports every share,” he said.

By sharing these updates regularly, the company hopes to attract long-term investors who believe in crypto’s growth and want to hold shares in a firm directly tied to it.

The Advantage of Mining and Accumulation

Unlike companies that only buy this digital asset from the market, it also mines its own coins. This gives it a cost advantage, allowing it to acquire BTC at lower prices while keeping more control over its production.

The combined model helps the company grow its reserves steadily, even when the Bitcoin price becomes volatile. Executive Chair Asher Genoot explained that this approach allows them to keep a better average cost per BTC than their competitors.

Market Impact and Future Plans

The company’s recent purchase places it among the top 25 public holders of this digital asset worldwide. With the prices of this cryptocurrency gaining strength again, many see this as a confident bet on the asset’s long-term future.

Trump Linked American Bitcoin plans to continue expanding its operations and will share regular updates on its Satoshis per Share to maintain transparency with shareholders.

Source: Google Finance

American Bitcoin Corp (NASDAQ: ABTC) closed at $5.96, up 6.05% on October 27. The stock reached a high of $6.48 and a low of $5.71, with a market cap of $541.52 million.

Final Thoughts

As the firm continues to grow, it’s becoming a symbol of how traditional business and political names are stepping deeper into the crypto world.

Whether this model becomes the next big trend in corporate BTC investment remains to be seen but for now, it’s clear that Trump Linked crypto firm is just getting started.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。