Binance HODLer announced the 48th project DoubleZero $2Z, which means 2Z is now available on the spot market. Users who purchase with BNB for capital preservation and earn coins (fixed-term and/or flexible) or on-chain earning products will receive an airdrop allocation.

On July 24, Solana released its latest roadmap, clearly aiming to achieve the goal of The Internet Capital Markets, which is to become a liquidity center for on-chain and real-world assets.

To achieve this goal, Solana's core developers have clearly divided their responsibilities to work together. Among them, Jito and Anza are responsible for the Block Assembly Market (BAM), while the main focus of this article, DoubleZero, and Anza are responsible for IBRL (Increase Bandwidth Reduce Latency), along with the new consensus mechanism Alpenglow.

As mentioned above, the core goal of DoubleZero is to increase the bandwidth of the Solana network and reduce latency, primarily through two methods—deploying proprietary bandwidth hardware or integrating idle bandwidth; optimizing the public chain transaction data flow.

Firstly, DoubleZero can integrate idle bandwidth resources from enterprises and institutions to supply Solana, thereby improving network speed.

Secondly, it is responsible for traffic filtering, signature verification, and spam protection. This separates the filtering and verification tasks from the public chain nodes, allowing nodes to focus on transaction packaging, block production, and execution, thus achieving scalability.

Why do this? It starts with the work of Solana node validators. The work of validators includes two basic steps: producing blocks and reaching consensus on blocks.

Block production begins when a massive amount of unfiltered data floods into the validators. Validators need to first perform deduplication, filtering, and signature verification to reduce the candidate transaction pool, then select valid transactions to package into blocks and broadcast them to other validators for consensus.

Other validators either approve the block and add it to the chain or reject it and wait for the next block.

The problem lies here. The system's performance bottleneck increasingly appears in the communication between validators—mainly due to bandwidth limitations and latency fluctuations, rather than the computational capabilities of the validators themselves. Therefore, to break through performance limits, the key is to optimize data flow.

This is precisely the core issue that DoubleZero aims to solve, integrating the fiber optic lines contributed by various parties into a synchronized network that can filter out spam, enhance bandwidth, reduce latency, and eliminate jitter in communication.

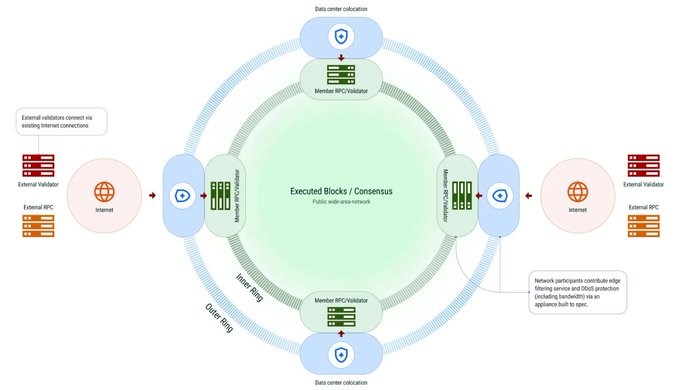

From an architectural perspective, DoubleZero consists of two key components: network device hardware and bandwidth resources deployed across the network. Together, they form a mesh network, known as the DoubleZero network.

Devices on the DoubleZero network perform two core functions:

1) Integrate the data links contributed by individuals and organizations;

2) Responsible for traffic filtering, signature verification, and spam protection.

Through this design, filtering and verification are separated from transaction packaging, block production, and execution, creating a parallel and protected transaction flow that allows node operators to optimize network operational efficiency.

To understand it in a more intuitive way, the DoubleZero network architecture can be seen as two concentric rings: the outer entry/exit ring and the inner data flow ring.

The outer ring connects to the public internet, where DoubleZero deploys high-performance hardware to defend against DDoS attacks, verify signatures, and filter duplicate transactions.

The servers on the inner ring utilize this filtered traffic to reach consensus through dedicated bandwidth lines with optimal routing. Ultimately, this achieves speed scalability for the Solana network.

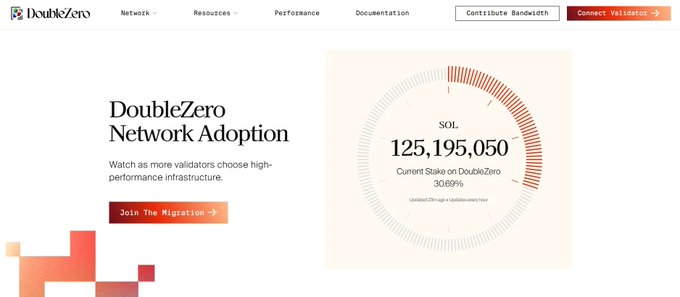

After the mainnet launch, 30.69% of staked $SOL has already connected to DoubleZero. This performance is quite impressive.

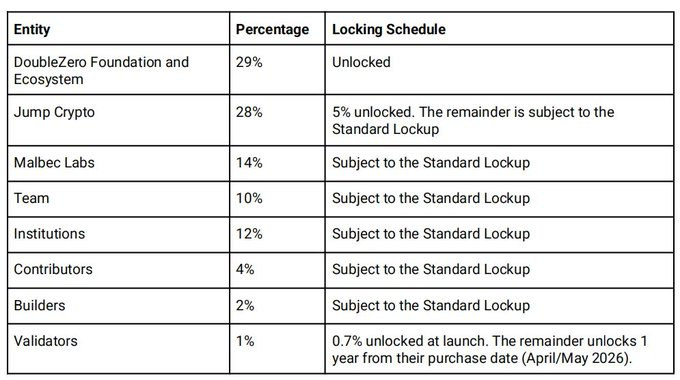

The token economic model is shown in the figure below. In fact, the Foundation, Jump Crypto, Malbec Labs, Team, Contributors, and Builders account for 87% of the total token supply, which is primarily the team itself. Only 12% is allocated to institutions and Validators for external distribution.

The only issue is that as an infrastructure project, the FDV is bound to be relatively high. At a price of 0.2315, the FDV reaches $2.315 billion, with a market cap of $803 million.

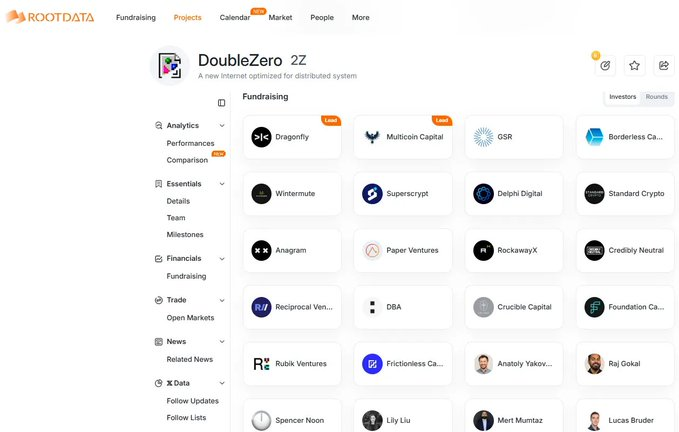

The investors are shown in the figure below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。