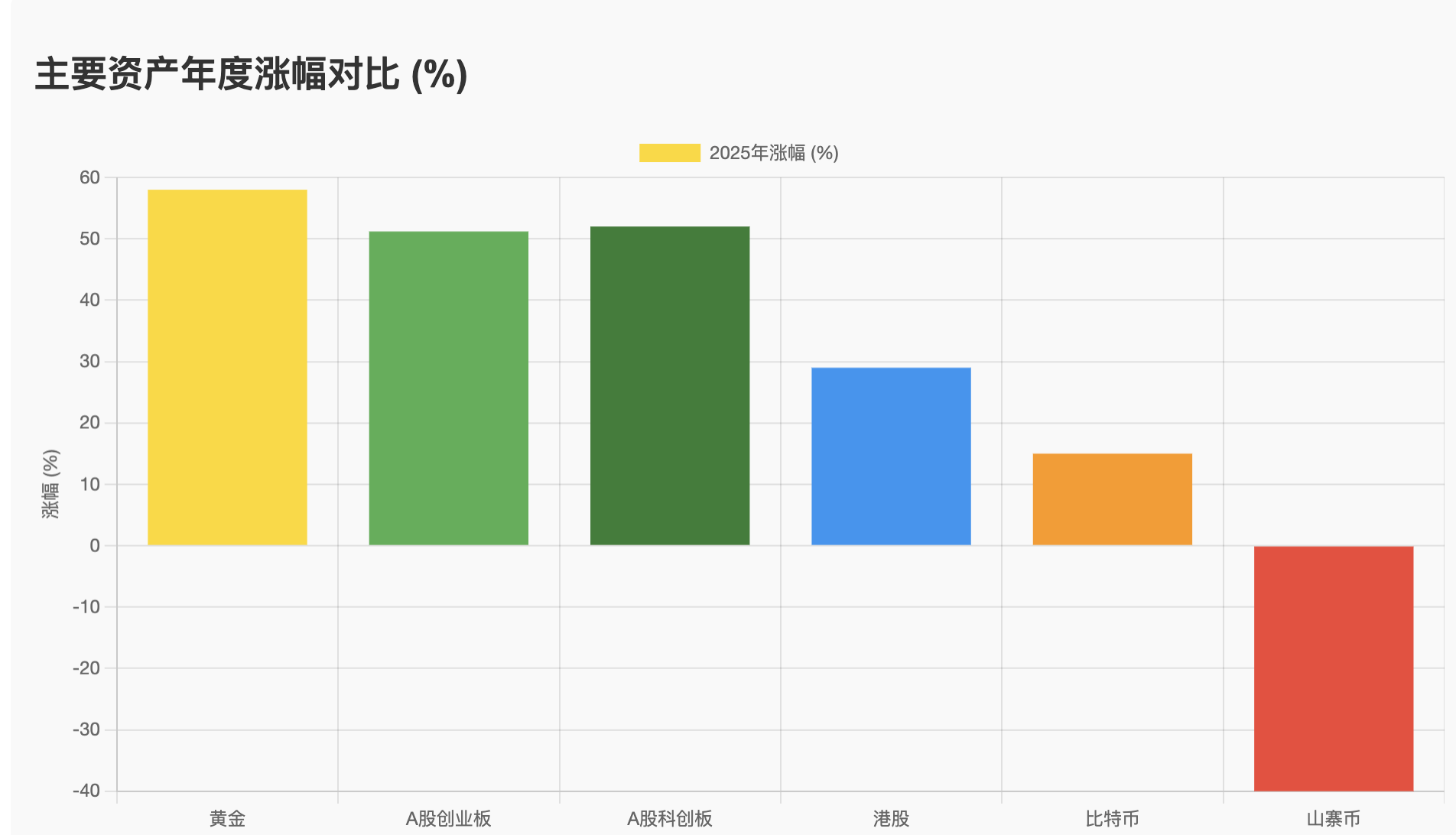

Traditional Assets Surge 58%, Bitcoin Only 15% — A Calm Review Under the Tilt of Capital Balance

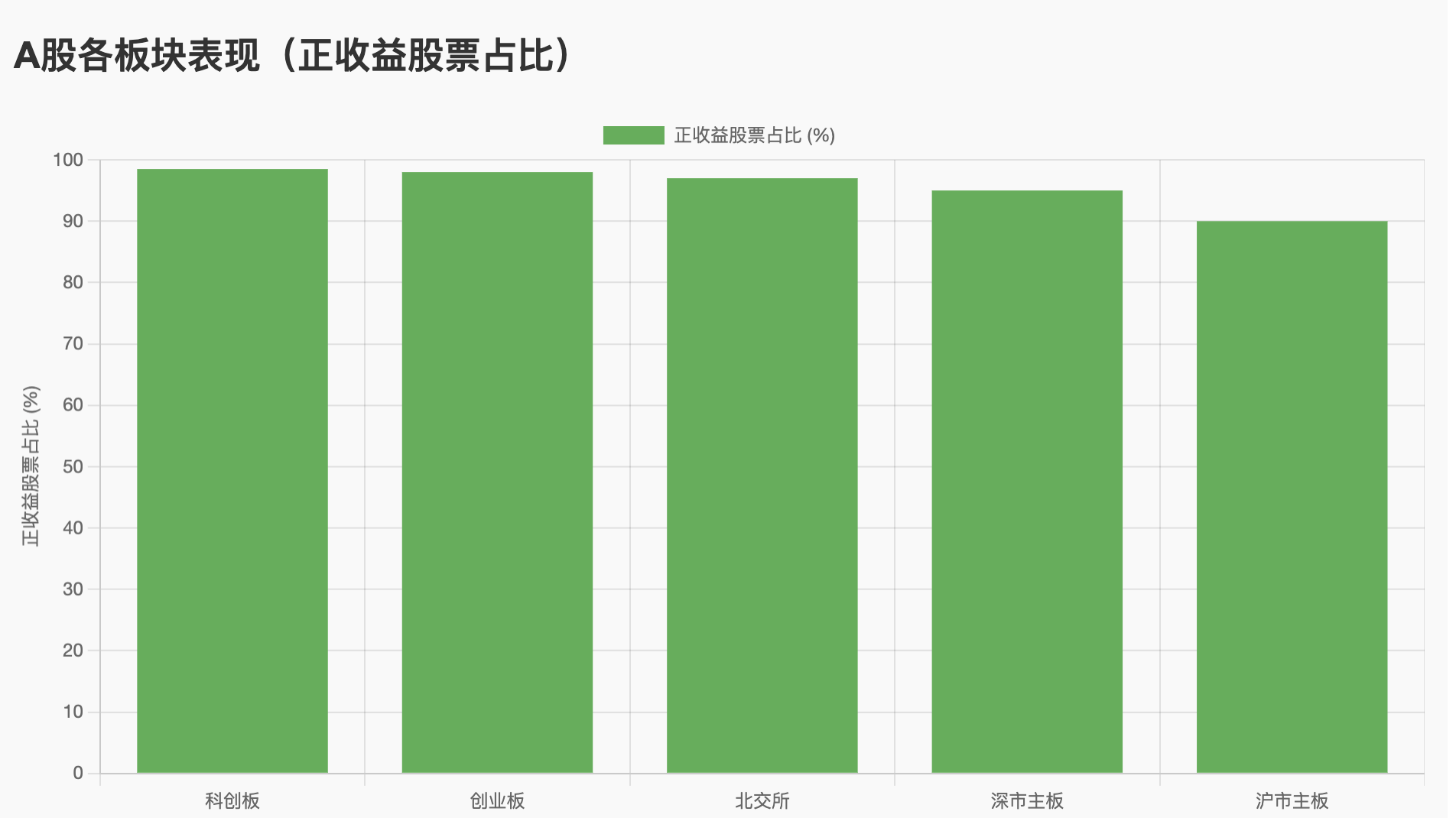

In 2025, global capital markets experienced diversified development trends. The cryptocurrency market was once referred to as a year where "making money was extremely difficult," while traditional stock markets, especially China's A-share market, showed more substantial returns for investors.

Overall, the weakness in the cryptocurrency market stands in stark contrast to the highs in traditional stock markets and Hong Kong stocks.

Data shows that in the third quarter of 2025, the global spot trading volume of digital currencies decreased by 32% year-on-year, indicating a clear downward trend in the activity of the entire cryptocurrency market.

Moreover, with the reduction in investor participation, the volatility of the cryptocurrency market has narrowed, and capital inflows have weakened. Some investors even stated, "By this year, I have no desire to even open the trading platform."

From the perspective of investor psychology, 2025 became a turning point for the cryptocurrency market. After years of frenzy, cryptocurrency investors gradually realized the high risks and structural flaws of the market. Compared to the previous irrational pursuit of wealth, liquidity in the market began to decline, and retail investors exited en masse. Industry observers believe that "a market without a main storyline" is the biggest dilemma faced by cryptocurrencies in 2025.

Nevertheless, the downturn in the cryptocurrency market is not a global disaster. Some blockchain projects that are integrated with real industries still have development potential, while stablecoins and certain areas based on DeFi (decentralized finance) have shown resilience. However, the overall lack of confidence in the market has become an undeniable phenomenon.

Core Conclusions (Key Points First)

- 2025 is not the end of the crypto market, but a period of value reconstruction after the "faith bubble" burst.

- The 58%+ surge in traditional assets is not a zero-sum crushing, but an inevitable phase of macro liquidity returning to the real economy.

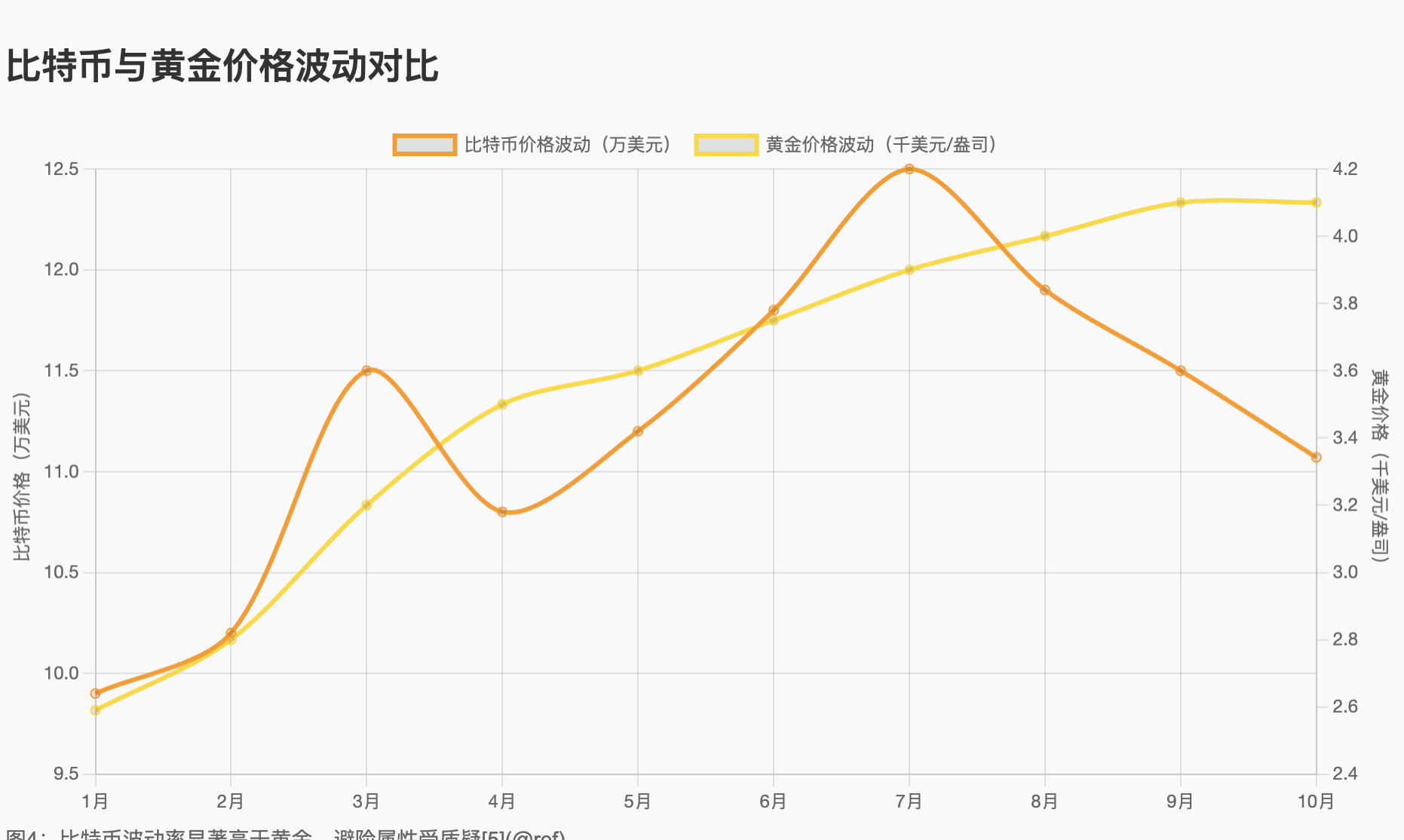

- The 15% increase in Bitcoin is not a sign of asset failure, but a painful return from "speculative premium" to "underlying value."

- Industry reshuffling has begun: pseudo-innovation is out, real applications are in, and 2026–2028 will welcome the "real economy binding bull market."

I. Data Collision: Two Markets in 2025 — Ice and Fire

II. Is the Crypto Market "Cooling"? The Truth is Three Layers of Filters are at Work

Filter 1: Speculators Exiting (Healthy De-leveraging)

- Retail Investor Profile: Entered the market from 2021 to 2023, leveraged 10–50 times, chasing highs and cutting losses.

- 2025 Status: Exited after liquidation, on-chain active addresses ↓41%.

- Positive Signal: Average holding period increased from 37 days to 180 days, with the proportion of long-term holders rising to 62% (Glassnode).

Filter 2: Air Projects Going to Zero (Clearing Pseudo-Innovation)

- Death List: 90% of Meme, GameFi, and Metaverse projects went to zero.

- Survivors: L2 public chains (Arbitrum/Optimism TVL +35%), RWA protocols (Ondo/BlackRock BUIDL scale of $5 billion).

- Conclusion: Capital votes with its feet; technology must serve the real economy.

Filter 3: Institutions Repricing (From Beta to Alpha)

III. The Crypto Market is Quietly "Evolving": Six Major Real Economy Binding Tracks (2026 Inflection Point)

IV. The "Hidden Alpha" of Bitcoin's 15% Increase

V. Investor Action Guide: The Last Wave of Entry Window Before 2026

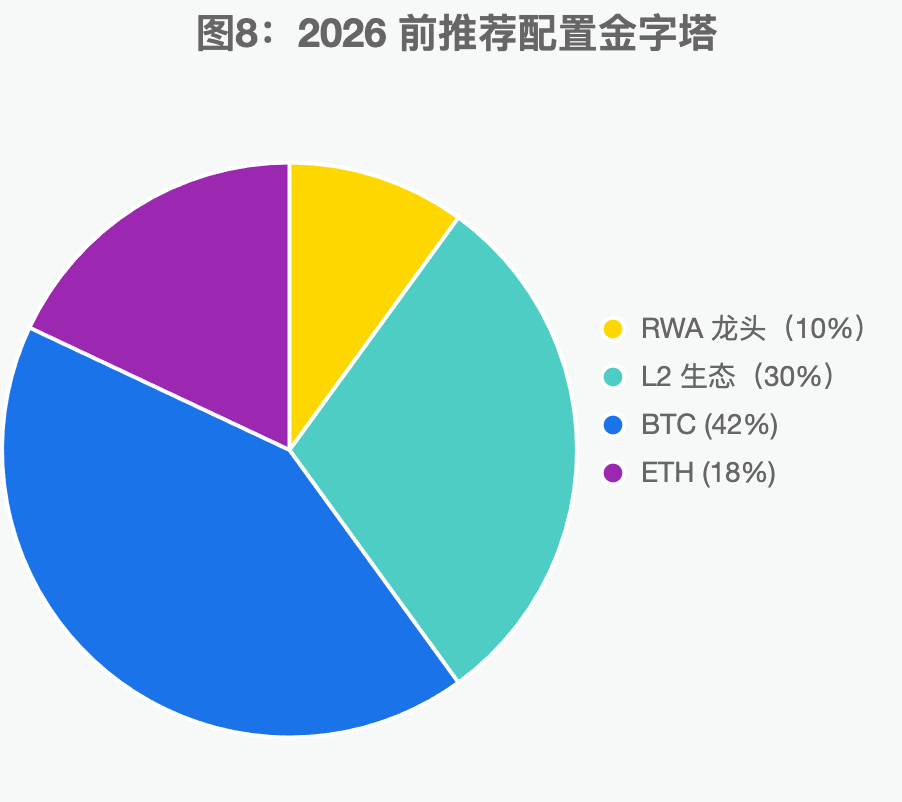

A. Asset Allocation Pyramid (Recommended Proportions)

Top Layer (10%): RWA Leaders (Ondo, MANTRA)

Middle Layer (30%): L2 Ecosystem (ARB, OP, ZK)

Bottom Layer (60%): BTC (42%) + ETH (18%)

B. Three "Anti-Fragile" Principles

- Only invest in on-chain protocols with cash flow (staking annualized > treasury yield).

- Prioritize regulatory compliant tracks (projects with licenses in Hong Kong/Singapore).

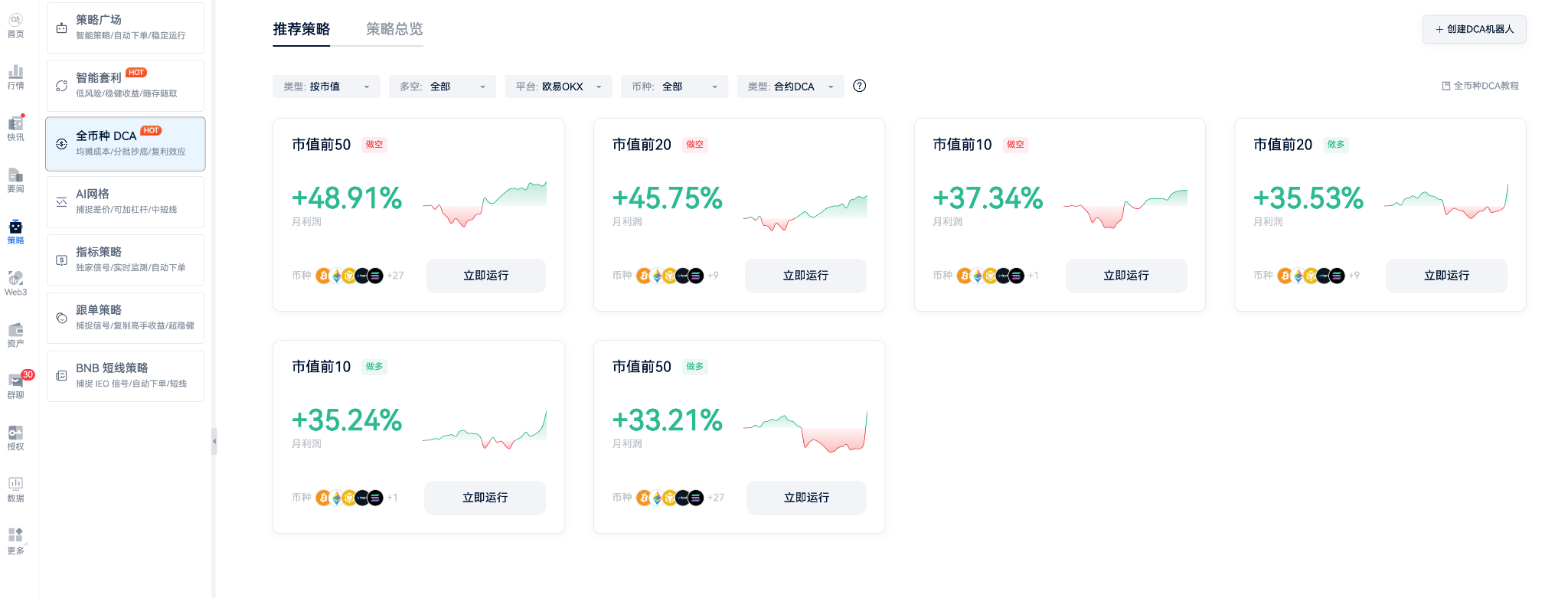

- Use dollar-cost averaging (DCA) instead of going all in.

AiCoin has steadily supported DCA for all cryptocurrencies for over a year, passing the test of the market, with positive feedback coming from visible high returns.

The characteristics and advantages of the all-coin DCA strategy compared to traditional Martingale strategies, the DCA strategy launched by AiCoin has the following advantages:

- One-click investment, automatic profit

- Monitoring covers all cryptocurrencies, automatically capturing opening opportunities for any cryptocurrency

- Pioneering sector-based investment, achieving a basket of blue-chip coins

- Big data backtesting of profit effects, easily selecting the optimal strategy

Open the link to read the tutorial: Automatic Profit-Making Tool — All-Coin DCA Launched - AiCoin

https://www.aicoin.com/article/414099.html

VI. Conclusion: 2025 is the "Coming of Age" for the Crypto Market

The 58% surge in traditional assets is not a tombstone for the crypto market, but a backdrop for the industry's growth.

In 2025, the crypto market exchanged a "faith collapse" for:

- Cleaner Participants (speculators exited, builders rose)

- Clearer Narratives (from "moon" to "real efficiency")

- Stronger Foundations (L2, RWA, AI infrastructure in place)

The next bull market will no longer rely on "storytelling," but on "delivering results." The crypto market has not cooled down; it has finally learned — to build roads in winter, so it can run wildly in spring.

Report Sources: Glassnode, Chainalysis, BlackRock ETF Report, Hong Kong Monetary Authority RWA White Paper, EU CBAM Regulation Draft

Join our community to discuss and grow stronger together!

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group Chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。