The A16z crypto “State of Crypto Report 2025” indicates that an improved blockchain infrastructure has been pivotal in pushing digital assets toward the mainstream over the past year. This maturation is evidenced by several key metrics. The number of active cryptocurrency users grew by 10 million, now ranging between 40 and 70 million. Global adoption is also accelerating: mobile wallet usage, a key adoption indicator, grew fastest in emerging markets, including Argentina, Colombia, India, and Nigeria.

Conversely, developed countries led in token-related web traffic, showcasing significant investment interest. Furthermore, traditional financial institutions are increasingly engaging with crypto. Investors are favoring channels like spot cryptocurrency exchange-traded products (ETPs) and digital asset treasury (DAT) companies, which according to the report collectively now hold 10% of both bitcoin’s and ethereum’s token supplies.

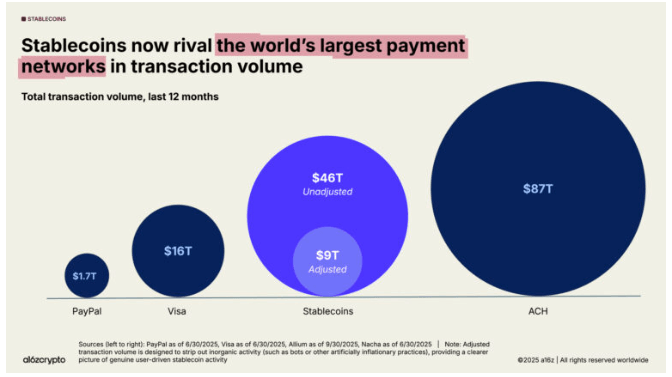

The study, meanwhile, found that stablecoins have become a major force, with their total transaction volume (unadjusted) rising by 106% to $46 trillion, a figure that now rivals the world’s largest payment networks. The monthly adjusted stablecoin transaction volume was approaching $1.25 trillion in September 2025.

Despite these metrics suggesting massive adoption, experts are divided on whether the current blockchain infrastructure is truly enterprise-ready, particularly concerning speed and cost. Some experts believe aggregate blockchain throughput remains inadequate for institutional needs. Marnix Reckman, CMO at Smardex, argues that the aggregate throughput of 3,400+ transactions per second (TPS) cited in the report is insufficient.

“Institutional players require throughput comparable to TradFi systems like Visa (up to 65,000 TPS at peak) for mission-critical operations such as high-volume payments, trading, and settlements to ensure reliability and scale,” Reckman noted.

However, Charles d’Haussy, CEO at Dydx, asserts that peak TPS is not the main bottleneck for institutions. He contends that institutions prioritize reliability and regulatory compliance over raw speed.

“Institutions care less about peak TPS and more about whether the network behaves deterministically under stress and regulatory scrutiny. In that sense, we’re entering the stage where on-chain infrastructure is ready for mission-critical use,” d’Haussy argued.

Cost-effectiveness is another major consideration. According to Wish Wu, co-founder and CEO of Pharos Network, on-chain settlement “is definitively cheaper” for institutions only if the all-in cost per transfer falls below ~$0.25–$0.50 to beat typical Automated Clearing House (ACH) costs. Experts assert that institutions generally view sub-cent transactions as the definitive threshold for blockchain to undercut traditional rails.

The A16z report points out that some layer two (L2) solutions have already reached this low-cost threshold, while stablecoins facilitate near-instant global transfers at a fraction of typical banking costs.

However, the report’s mention that major fintech companies like Stripe and Robinhood have opted to build their own blockchains has sparked further debate. Critics view this as an indictment against current public blockchains, suggesting they are not enterprise-ready.

Nevertheless, experts interviewed by Bitcoin.com News see this as a powerful vote of confidence for the underlying blockchain technology. Vardan Khachatryan, CLO at Fastex, argues that the move signifies the technology has reached a maturation point.

“Fintech giants such as Stripe and Robinhood are effectively embedding blockchain natively into their infrastructure, much like AWS did for cloud,” Khachatryan stated, even if one takes the cynical view that they are playing catch-up.

Wu, however, holds a balanced view: while it is a vote of confidence, he also sees the move as a signal that the current public infrastructure hasn’t fully matured to meet specific enterprise standards.

Meanwhile, the A16z crypto report concludes by predicting the accelerated adoption of crypto by both fintech companies and traditional financial institutions. It also projects that new consumer products will be the driving force that brings the next wave of users on-chain.

- Where is crypto adoption growing fastest? Mobile wallet usage is surging in emerging markets like Argentina, Colombia, India, and Nigeria.

- How are institutions engaging with crypto? They’re investing through ETPs and DATs, which now hold 10% of Bitcoin and Ethereum supplies.

- Are stablecoins becoming mainstream? Yes—stablecoin volume hit $46T, rivaling top global payment networks.

- Is blockchain infrastructure ready for institutions? Experts are split, citing throughput and cost as key hurdles despite growing confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。