The complete formula for financial freedom is: Choose emerging tracks × Build infrastructure × Establish a moat × Wait for giants to acquire

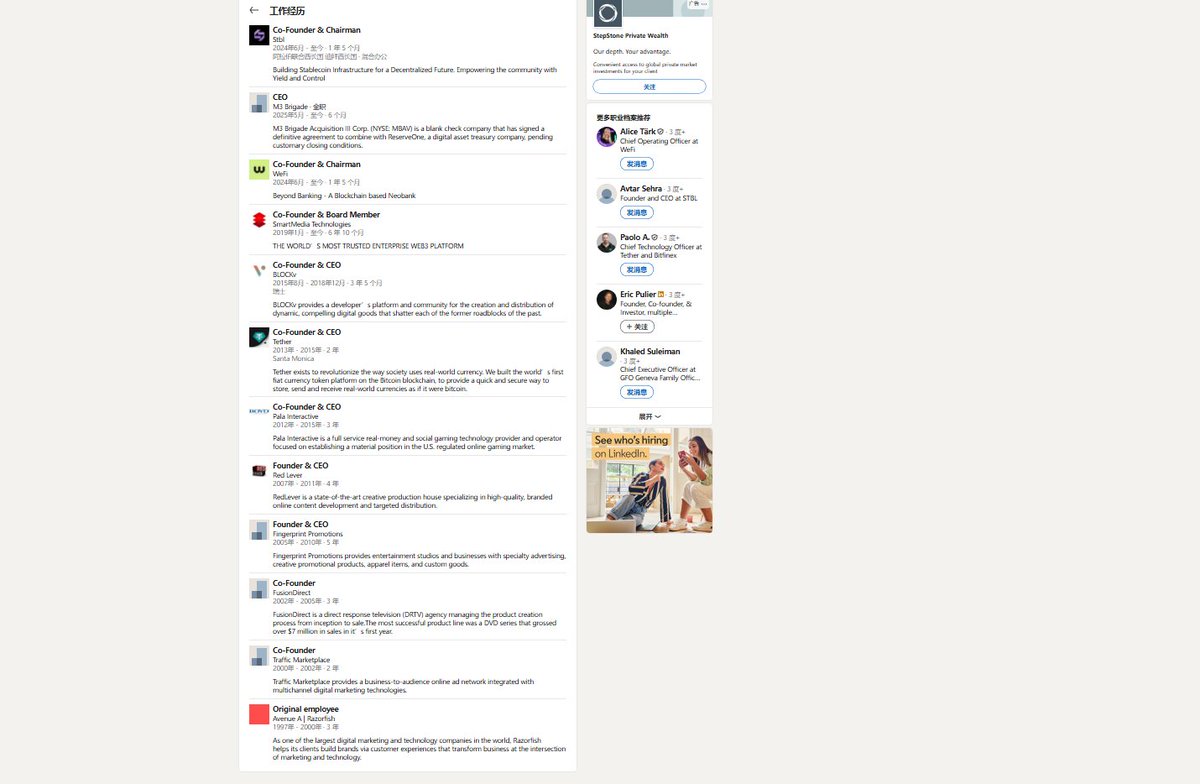

Taking @Reeve_Collins as an example, this serial entrepreneur who founded 11 companies in 25 years and is the founder of STBL has a fixed pattern in his success trajectory:

Internet Era → Build digital advertising infrastructure

Blockchain Era → Build DeFi infrastructure

1/ Internet Experience

Collins joined Avenue A in 1997—one of the earliest internet advertising companies in the world.

At that time, he was just an ordinary employee who had just graduated, but he caught the peak of the internet bubble.

The company's IPO valuation was $6.6 billion.

He keenly captured the opportunity window of the new track of digital advertising, and subsequently, Collins founded 4 companies, all in the internet marketing/digital advertising space, which can be seen as a repetition of the successful experience from his first job.

2/ Crypto Entrepreneurship

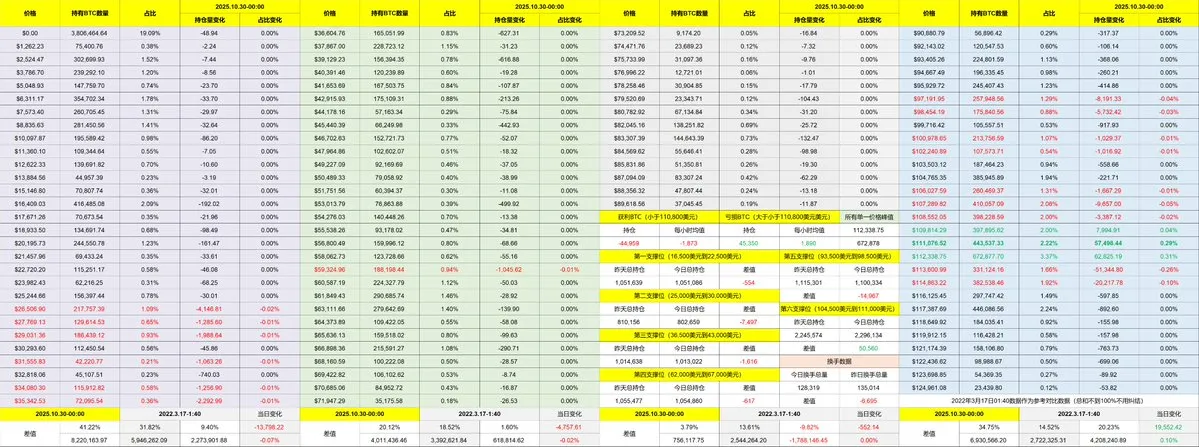

In 2013, Collins keenly identified the infrastructure opportunity in blockchain and co-founded Tether.

At that time, Bitcoin had just emerged from the early geek circle, and the DeFi ecosystem was far from mature. The market urgently needed a stable value anchoring tool.

Two years later, he chose to exit Tether and began his continuous entrepreneurship in the crypto industry, struggling in the NFT and DeFi lending tracks, neither of which was very successful.

In 2024, he founded the stablecoin yield protocol @stbl_official, returning to his entrepreneurial roots.

Traditional stablecoin model: Users collateralize assets, and the issuer earns profits.

STBL model: Profits return to users, and the protocol only charges a service fee.

Users collateralize RWA assets like U.S. Treasury bonds to mint USST while also earning YLD tokens to capture profits. This profit separation mechanism allows users to maintain liquidity while not giving up their rights to profits.

From the perspective of infrastructure, stablecoin 2.0 is indeed a direction worth paying attention to. This time, will the story be different?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。