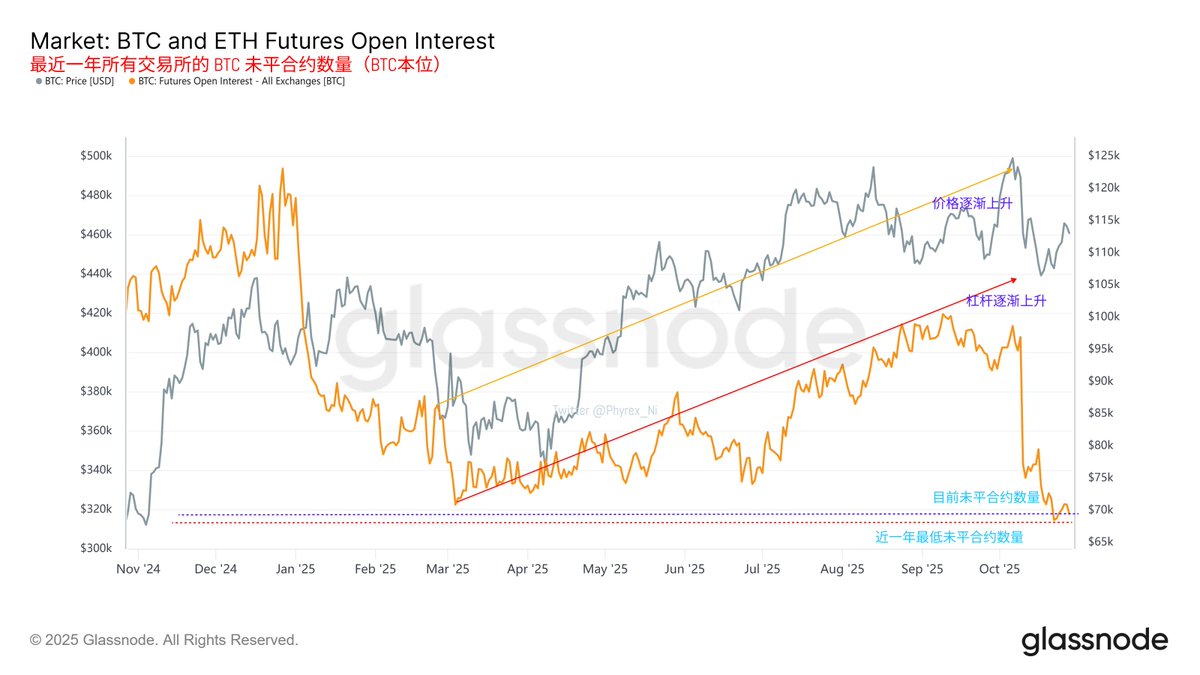

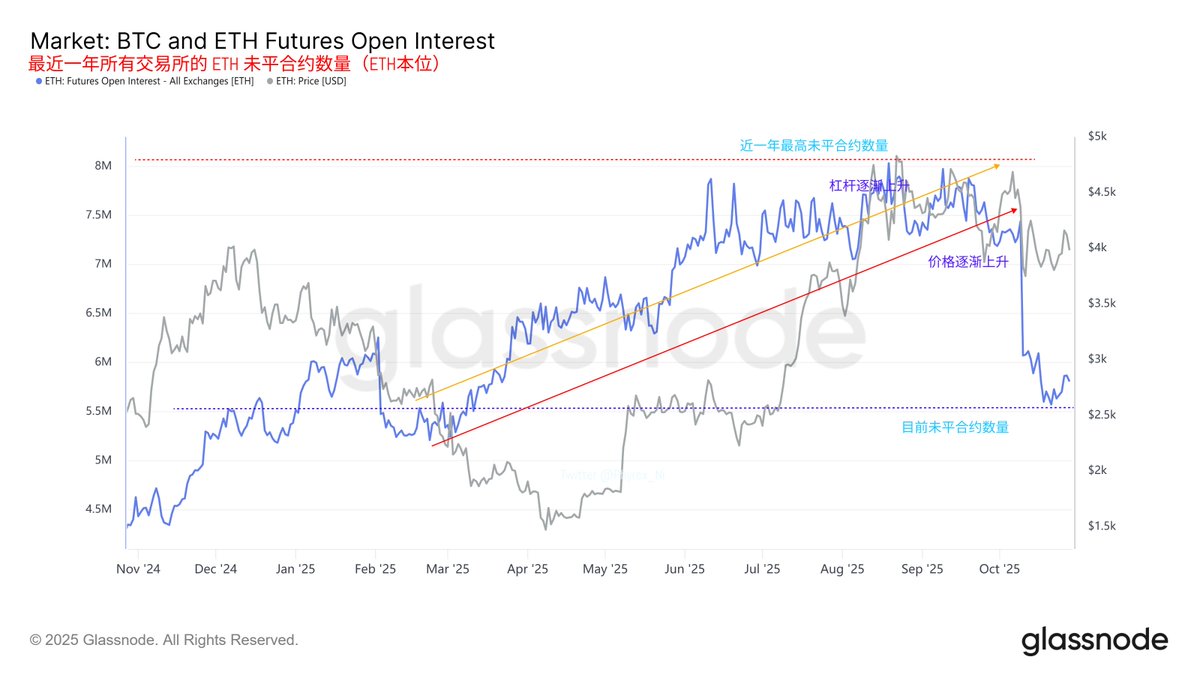

This week, the data on open contracts for $BTC and $ETH shows that the open contract data for both has started to gradually increase, but it is still at a low level, which means that the influx of funds has only just begun.

From historical experience, when prices fluctuate at high levels while open interest continues to rise, it often indicates that new long and short battles are accumulating energy. If prices rise simultaneously and open interest grows moderately, it represents that new funds are building positions in line with the trend. However, if prices consolidate or even pull back while open interest surges, it may indicate a reverse layout or a short test.

The current structure is closer to the former, with prices gradually rising, moderate leverage accumulation, and net fund inflow not yet saturated. This is usually a healthy early stage of leverage expansion, indicating that the market is still in a sustainable phase rather than at the end of speculative overheating.

In simpler terms, the current level of open interest is equivalent to the starting point of liquidity re-accumulation. If the prices of BTC and ETH can maintain a stable upward trend, while the leverage ratio in the derivatives market does not excessively inflate, there is hope for a new trend driven by spot trading and boosted by leverage.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。