A second rate cut this year was a practical certainty based on the probability reflected by the CME Fedwatch Tool just minutes before Federal Reserve Chairman Jerome Powell delivered his customary Federal Open Market Committee (FOMC) press conference on Wednesday afternoon. What was unexpected was Powell’s remarks about possibly skipping a highly anticipated December rate reduction. The chairman’s quip was enough to briefly send bitcoin tumbling to $109.8K even though Powell had also just announced a 25 basis-point interest rate cut.

“A further reduction at the December meeting is not a foregone conclusion,” Powell explained. “We haven’t made a decision about December and we’re going to be looking at the data that we have and how that affects the outlook.”

Six weeks ago, the Fed made an about-face on interest rate policy following dismal jobs data that revealed a surprisingly weak employment landscape. After holding rates steady for most of 2025, the central bank finally decided to cut rates on September 17. Following that rate reduction, the Fed’s “dot plot,” a chart displaying interest rate projections by members of the FOMC and each of the Federal Reserve Bank presidents, showed a general expectation of rate reductions all the way into 2027.

And thus, Wednesday’s rate cut was just a step in the direction most economists expected the Fed to embark on for the next year or two, barring some unforeseen event. But it seems Powell put the kibosh on that projected path, revealing that a third rate cut in December is not guaranteed, and that he is taking a wait-and-see approach before leaning one way or the other. Bitcoin wasn’t the only asset that reacted negatively to Powell’s comments; stocks, which had been enjoying a week of bullish momentum, also reversed course from green to red, with the Dow shedding nearly 200 points in the wake of Powell’s press conference.

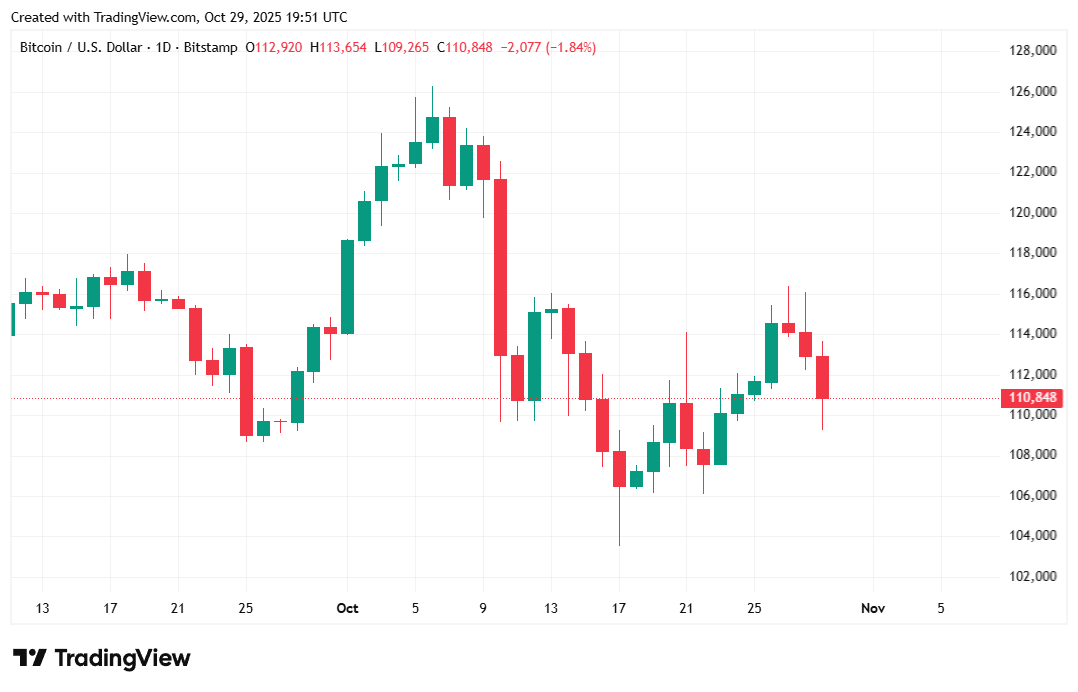

Bitcoin was trading at $110,403.84 at the time of reporting, a 3.02% decrease since Tuesday afternoon, according to Coinmarketcap data. Weekly performance, however, was still positive, with BTC up 3.3% over seven days. The digital asset’s price has fluctuated between $109,368.72 and $113,685.54 since yesterday.

( BTC price / Trading View)

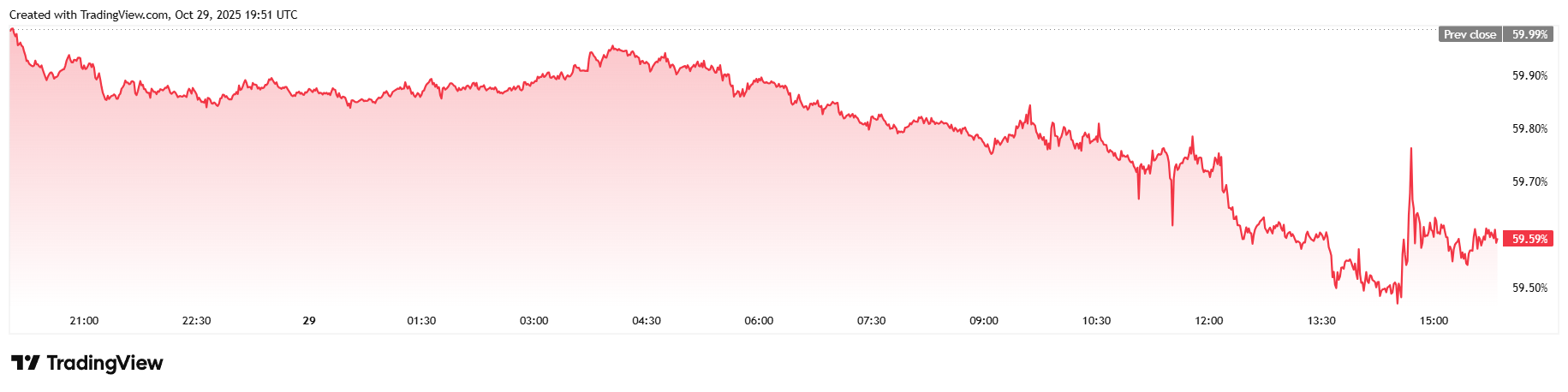

Twenty-four-hour trading volume rose 22% to $68.22 billion and market capitalization naturally mimicked price, also shedding 3% to reach $2.22 trillion. Bitcoin dominance fell to 59.59% since Tuesday, a decrease of roughly 0.65%.

( BTC dominance / Trading View)

Total value of bitcoin futures open interest was down 0.84% at $73.94 billion, according to data from Coinglass. Liquidations nearly quadrupled over 24 hours, coming in at $261.44 million. Long investors were responsible for the bulk of casualties, losing $214.29 million in margin. The remaining $47.16 million in liquidations came from overly bearish short sellers.

- Why did Bitcoin drop below $110K?

Fed Chair Jerome Powell hinted that a December rate cut “is not a foregone conclusion,” spooking markets. - What did the Fed do this week?

The central bank delivered its second 25 basis-point rate cut of 2025, as widely expected. - How did markets react to Powell’s comments?

Bitcoin and stocks both slipped, with the Dow losing nearly 200 points after his press conference. - What’s next for rate policy? Powell says future cuts will depend on incoming economic data, signaling a more cautious Fed outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。