What fundamental narratives can drive Bitcoin prices to continue rising strongly in the future?

Cryptographic technology innovation? Continuous easing of fundamentals? I think there’s nothing left…

From the hype around ETFs to realization, from the hype around interest rate cuts to implementation.

From the inscriptions in the BTC ecosystem to the memes in the SOL ecosystem, to the final wrap-up of the BSC chain…

It's like waves crashing one after another, leaving a mess behind…

In fact, looking at these waves, the wealth effect is also rapidly diminishing.

The shift from PVE to PVP is intensifying, all are fast-paced games.

Since the implementation of the BTC ETF, $62.3 billion has flowed in.

The ETH ETF has seen $14.6 billion flow in so far.

The speed of capital inflow has reached an all-time high.

But in the upcoming medium-term phase of 1 to 2 years, can it support even larger inflows?

Continuous interest rate cuts? Hot money inflow?

That depends on whether Trump can replace Powell, it’s not that simple.

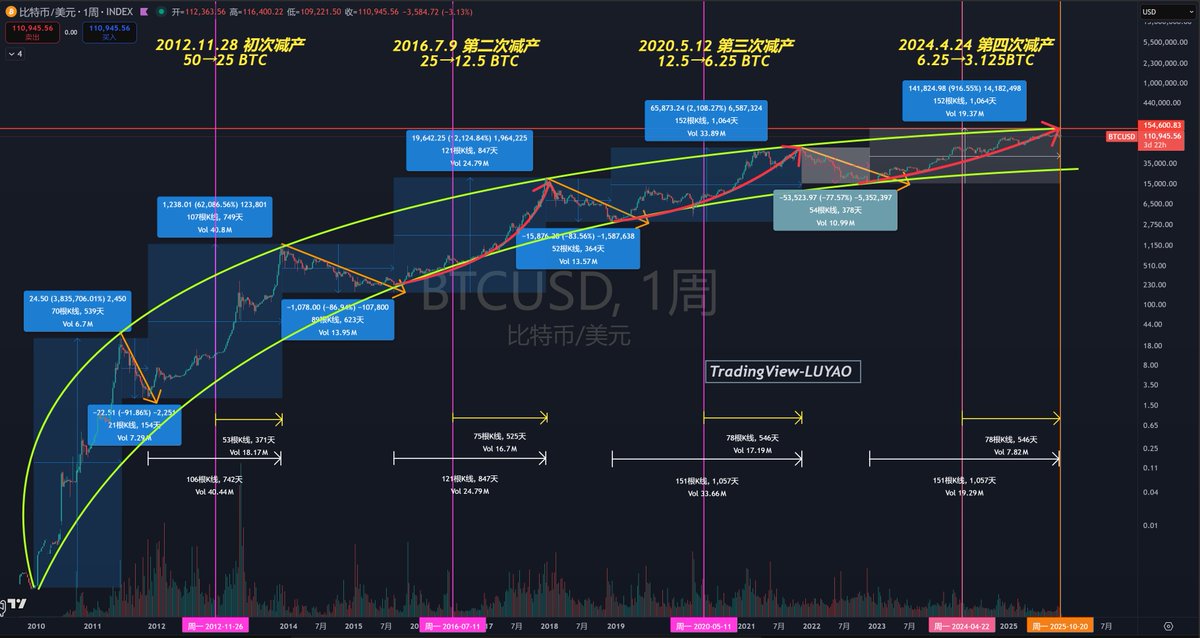

Is the Bitcoin halving four-year cycle still in play? Not necessarily.

But it’s clear we have entered the final phase after the halving.

I once believed in a $150,000 Bitcoin.

But time will always provide the best answer.

Either the price reaches it, or the time comes.

Since the time has come, the price doesn’t necessarily have to reach it.

The candlestick chart presents itself in time and space.

It will never be that perfect.

If you haven’t made much money by 2025,

Then you really should prepare a defensive strategy, rather than continue to take risks.

There hasn’t been a moment when market liquidity was sufficient to allow P to win over others.

Let alone the high probability of a major market shake-up and low volatility in 2026.

A "bear market" doesn’t necessarily mean a continuous decline, like Bitcoin dropping from $120,000 to $65,000 or even $20,000.

It could also manifest with low volatility over time.

Due to changes in the market crowd and the arrival of ETFs,

Perhaps it will oscillate between $120,000 and $100,000 for half a year,

Drop to a range of $70,000 to $100,000 and oscillate for another half year,

Finally oscillating between $120,000 and $70,000 for another half year.

A year and a half could pass like this.

In the on-chain world, from once seeing a 100X golden dog appear in a month,

To seeing one appear every three months, until it takes half a year to see one.

The result of PVP is that continuous sitting still is hard to endure, missing out on the occasional unexpected opportunity.

Whether or not there is a four-year cycle theory for Bitcoin halving,

Whether or not there is a global hot money tide guided by the Federal Reserve's monetary policy,

Capital tides rise and fall, the cycle continues.

It’s just a different approach, more complex.

But, the "bear market" is the best time for learning and accumulation.

If you want to reap greater wealth in the next wave,

Continuous learning, staying in the market, taking appropriate breaks, and maintaining a moderate sensitivity is the best state.

Remember, surviving is the key to seeing tomorrow's sun.

😉😉😉

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。