Alphabet and Meta will shell out roughly $93 and $72 billion, respectively, for artificial intelligence (AI) development in 2025. Microsoft has already blown $35 billion on the rapidly advancing technology in a single quarter. These exorbitant sums, provided in Wednesday’s quarterly reports, are making Wall Street nervous, and the anxiety is showing up in the markets. The tech-heavy Nasdaq dropped nearly 300 points on Thursday, the S&P 500 was down 44 points, and the Dow was mostly flat. Bitcoin appeared to mimic equities, shedding approximately 3% over 24 hours.

(When asked if we are currently witnessing an AI bubble during a CNBC interview, Microsoft co-founder Bill Gates said, “There are a ton of these investments that will be dead ends.”)

“We want to make sure that we’re not underinvesting,” said Meta CEO Mark Zuckerberg on yesterday’s earnings call. Meta (Nasdaq: META) was down 11.63% Thursday afternoon.

Satya Nadella, CEO of Microsoft, explained that AI is driving “real world impact.” “It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead,” he said. Microsoft (Nasdaq: MSFT) was lower by 3.42% at the time of reporting.

But unlike Meta and Microsoft, Alphabet (Nasdaq: GOOG) defied the odds, climbing 3.21%, as analysts applauded the firm’s ability to turn threats from AI into opportunities, especially in the arena of web search.

“The AI search transition has been viewed as the greatest risk to Google, but additional signs that AI search is more opportunity than threat will continue to flip the narrative,” wrote JPMorgan analyst Doug Anmuth.

Many expected bitcoin’s price to stabilize after Wednesday’s rate cut and a successful trade meeting between U.S. President Donald Trump and China’s Xi Jinping. But with experts putting AI spending for the year at approximately $1.5 trillion, a bursting of the alleged bubble could have catastrophic consequences on the global economy.

“There are a ton of these investments that will be dead ends,” said Microsoft co-founder Bill Gates during a CNBC interview on Wednesday. “AI is the biggest technical thing ever in my lifetime…but you have a frenzy.”

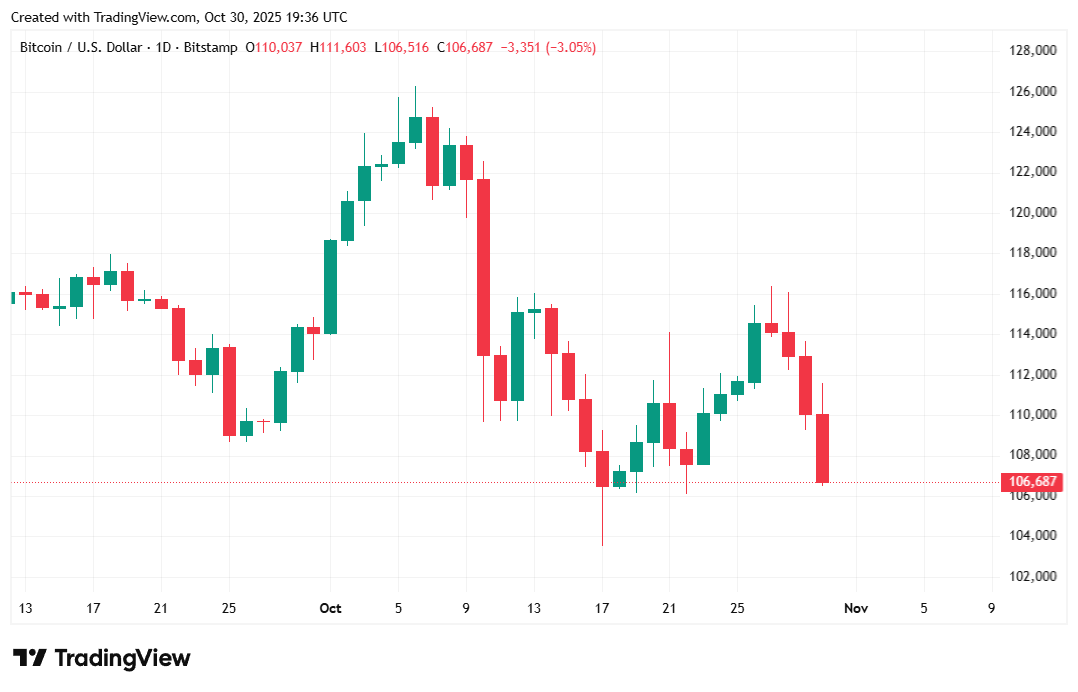

Bitcoin was priced at $107,023.50 at the time of writing, down 3.49% for the day and 3.16% for the week, Coinmarketcap data shows. The cryptocurrency peaked at $111,822.90 and bottomed out at $106,668.08 over the past 24 hours.

( BTC price / Trading View)

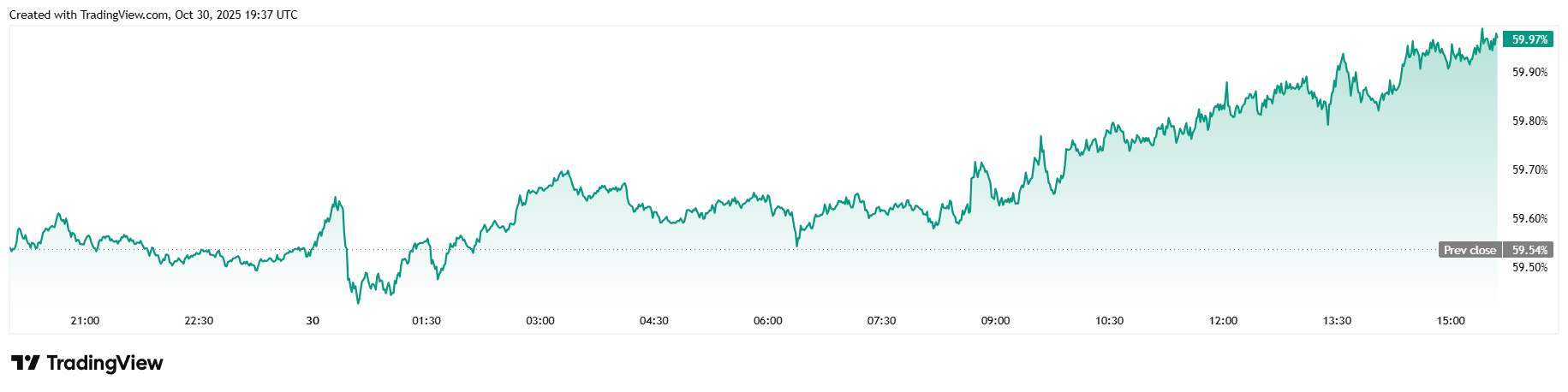

Trading volume was mostly flat at $68.11 billion, and market capitalization fell to $2.12 trillion. Bitcoin dominance was one of the few bright spots, jumping 0.73% since yesterday to 59.99%. The movement implies BTC is currently outperforming altcoins despite today’s downward trajectory.

( BTC dominance / Trading View)

Total value of bitcoin futures open interest shed 1.77% to reach $72.43 billion, according to data from Coinglass. Liquidations nearly doubled over 24 hours, totaling $391.82 million. Long investors lost $360.90 million in margin and dominated the liquidations total. The remaining $30.92 million came from overzealous short sellers.

- Why did Bitcoin fall today?

Investor anxiety over massive AI spending by tech giants triggered a broader market sell-off that pulled Bitcoin down 3%. - What’s causing the AI bubble fears?

Alphabet, Meta, and Microsoft pledged over $200 billion in AI investments for 2025, raising concerns of unsustainable valuations. - How did major tech stocks perform?

Meta plunged 11.6%, Microsoft slipped 3.4%, while Alphabet gained 3.2% after strong AI-related earnings. - What does this mean for Bitcoin’s outlook?

BTC remains tied to risk sentiment. If the AI bubble bursts, crypto could face more downside before stabilizing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。