Today's homework is a bit simpler. In fact, there hasn't been any essential change. With several hawkish statements from Federal Reserve officials today, the rise in U.S. stocks has been somewhat retracted. When the market opened in the evening, the Nasdaq briefly rose over 1%, but by the close, it was only up 0.48%. Even so, it almost recovered the losses from yesterday, indicating that investors have begun to accept the reality that there may not be an interest rate cut in December.

Tech stocks remain the target of investors' enthusiasm, with both Amazon and Tesla performing well today. It's hard to imagine that Amazon rose nearly 10% today, while the overall QQQ increased by almost 0.5%. Although the VIX, which represents the fear index, saw a slight uptick, it closed at 17.44, indicating that investor sentiment remains very stable. The correlation between U.S. stocks, especially tech stocks, and $BTC remains high, and with the rebound in U.S. stocks today, Bitcoin returned to $110,000.

While it cannot be said that BTC has emerged from its predicament, the correlation has stabilized BTC somewhat. Many friends have compared BTC's gains, which have fallen below those of many U.S. stocks. This is unavoidable, as BTC has not had its own narrative for a long time, and strategic reserves have not been mentioned by Trump in a while. Without an independent narrative, naturally, the attention it receives will decrease, which is the biggest dilemma in the cryptocurrency field right now.

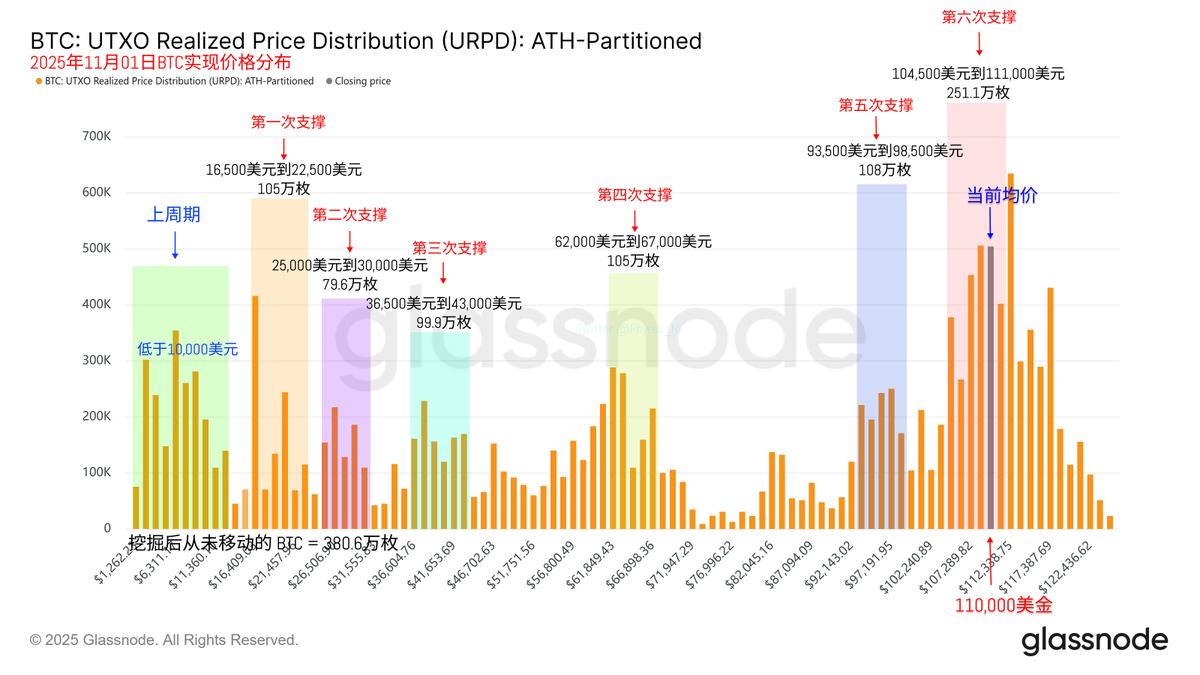

Looking back at Bitcoin's data, the turnover rate is still high. Although there has been a slight decrease, it still indicates that short-term investors are quite nervous, showing some panic regarding their holdings of $BTC, especially as loss-making investors have increased their selling pressure. Tomorrow is the weekend again, and today's rebound has had some effect on repairing sentiment. Let's see if the turnover rate can decrease next week.

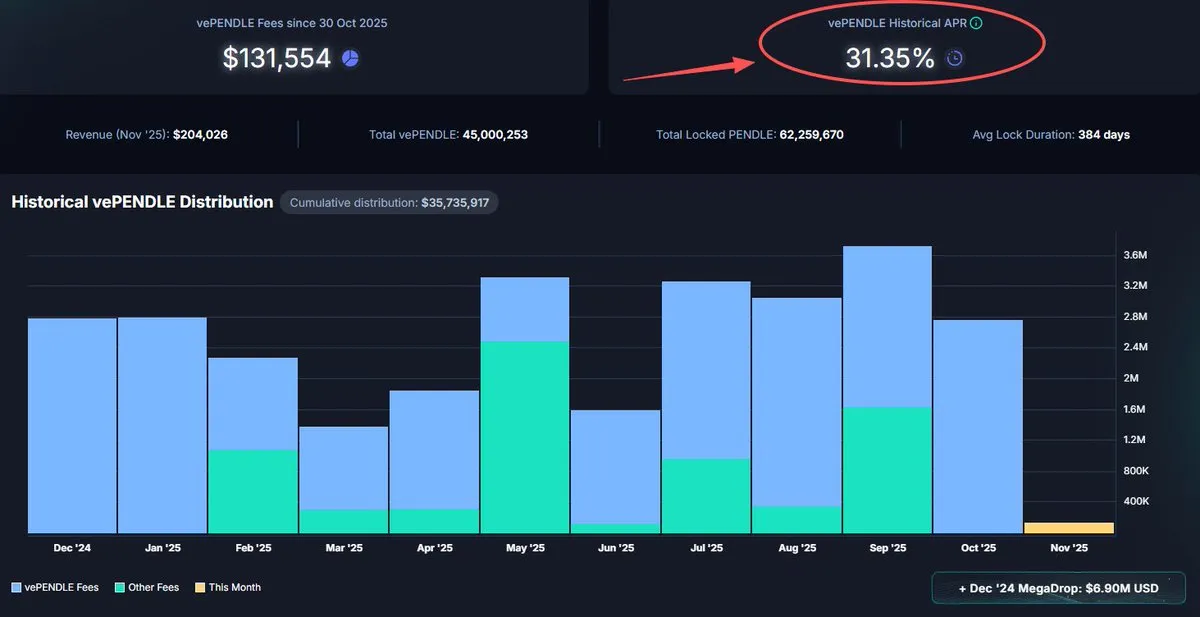

Although short-term investor sentiment is not very good, the chip structure shows that most investors remain very stable. The support between $104,500 and $111,000 is also very solid, and recent downward spikes have demonstrated the strength of this position.

Therefore, as long as there is no systemic risk in U.S. stocks, tech stocks can still maintain their bubble, and BTC's current trend should not be too bad.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。