Written by: Deng Tong, Golden Finance

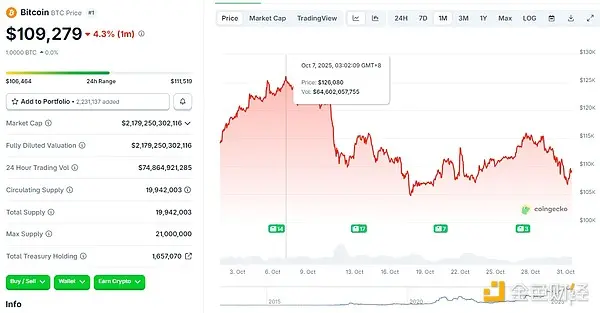

Recently, the cryptocurrency market has continued to be sluggish. Since the "1011 crash," BTC and other cryptocurrencies have not been able to recover their losses. As of the time of writing, BTC is priced at $109,279, down 13.33% from the monthly high of $126,080 on October 7.

At the same time, DAT (Digital Asset Treasury) companies, which were once in the spotlight due to favorable cryptocurrency market conditions, have suddenly cooled off due to market changes. This article focuses on the current situation of those once-popular DATs, exploring the voices supporting and opposing DATs, and looking at the future paths for DATs.

1. Current Status of Leading DAT Companies

Since the rise of DATs, companies from various industries have shifted to cryptocurrency treasury reserves. Unsurprisingly, each company that underwent this transformation experienced a brief surge in stock prices after announcing the news, followed by a return to previous levels for most companies.

1. Strategy

Strategy is the most notable DAT company in the industry. Before August 2020, Strategy was a giant in traditional business intelligence software, providing data analysis, report generation, and visualization platforms for enterprise clients. Its business model was typical of a B2B software company, generating revenue through software sales, licensing, and subscription services. Strategy's stock price had long fluctuated between $120 and $140.

After transforming into a DAT company, the company's strategic focus shifted from smart software to the operation and management of Bitcoin treasury, continuously buying BTC while also strengthening its treasury strategy through bond issuance and other means.

Currently, Strategy holds 640,808 BTC, valued at $7.024 billion, accounting for 3.051% of the circulating supply of 21 million BTC.

As of October 30, Strategy's total asset scale has surpassed that of fast-food giant McDonald's; on October 29, the Swiss National Bank disclosed that it holds $213 million worth of Strategy stock, reportedly managing assets totaling $10.5 trillion. However, even with such favorable circumstances, Strategy's stock price remains below its previous highs.

In November last year, Strategy's stock price reached a peak of $473.83. On October 6 of this year, its stock price hit a monthly high of $359.69, but following the 1011 crash that swept through the crypto market, Strategy's stock price has also declined, reporting $254.57 at the time of writing, down 29.23% from the monthly high.

Thus, Strategy's stock price has recently mirrored BTC's movements, rising and falling together. However, its stock price has corrected nearly 30%, a decline significantly greater than BTC's approximately 13%, with the volatility exceeding twice that of BTC.

2. Marathon Digital Holdings Inc.

Marathon Digital Holdings Inc. was formerly known as Marathon Patent Group. Its core business involves acquiring and managing various patents, generating revenue through licensing and litigation. After its transformation in 2020, it became a Bitcoin mining company, focusing all efforts on building mining sites, deploying mining machines, and increasing hash power to earn Bitcoin block rewards. This has made it a provider of infrastructure for the Bitcoin network, with the company's revenue directly linked to Bitcoin prices and hash power.

Through this transformation, Marathon has jumped from an obscure micro-cap company to a Nasdaq star and industry giant, gaining unprecedented market attention and financing capabilities. Moreover, before Bitcoin mining was completely monopolized by giants, Marathon quickly captured market share through aggressive capital operations, establishing itself as a leader in the mining industry.

Currently, Marathon holds 52,850 BTC, valued at $579 million, accounting for 0.252% of the circulating supply of 21 million BTC.

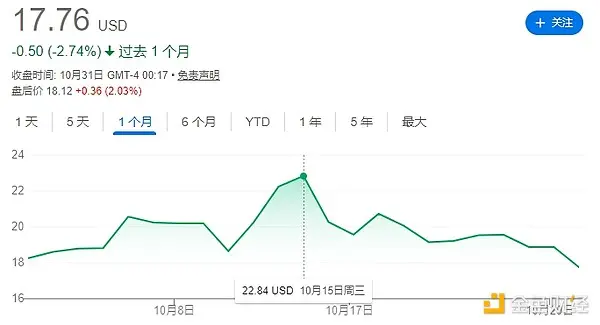

During the bull market in 2021, Marathon's stock price climbed to nearly $80, then gradually fell, fluctuating around $20 for most of the time. On October 15, MARA reached a monthly high of $22.84, but with the recent overall sluggishness in the crypto market, MARA is currently reported at $17.76, down 22.24% from the monthly high. Its decline is also greater than BTC's 13% correction.

3. Metaplanet Inc.

Metaplanet is referred to as the "Japanese version of Strategy." Before its transformation, Metaplanet's core business was hotel services and management, primarily targeting domestic tourists in Japan. On May 13, 2024, Metaplanet announced that it had declared a strategic transformation in financial management, adopting Bitcoin as its strategic reserve asset to cope with Japan's ongoing economic pressures, particularly high government debt levels, long-term negative real interest rates, and the resulting weakness of the yen.

After the transformation, Metaplanet emulated Strategy, converting its treasury assets from the continuously depreciating yen (affected by Japan's ultra-low interest rates and currency depreciation) into Bitcoin, using it as a means to hedge against inflation and currency devaluation. Bitcoin has become the largest and most important asset on Metaplanet's balance sheet.

Currently, Metaplanet holds 20,136 BTC, valued at $221 million, accounting for 0.096% of the circulating supply of 21 million BTC.

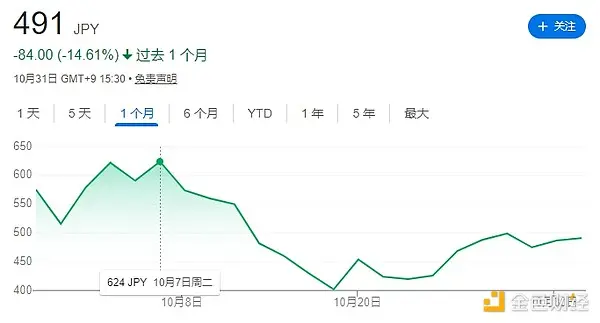

In June of this year, Metaplanet's stock price peaked at 1,895 yen, then continued to decline. On October 7, Metaplanet's stock price reached a monthly high of 624 yen, but has since primarily trended downward, reporting 491 yen at the time of writing, down 21.31% from the monthly high. Its decline is also greater than BTC's 13% correction.

4. Coinbase Global, Inc.

On April 14, 2021, Coinbase went public, an event widely regarded as a milestone for the cryptocurrency industry, marking a key step toward mainstream financial acceptance.

Currently, Coinbase holds 11,776 BTC, valued at $129 million, accounting for 0.056% of the circulating supply of 21 million BTC.

Since Coinbase does not involve the issue of transitioning from traditional industries to the crypto industry, its stock price has the clearest relationship with the crypto bull and bear markets.

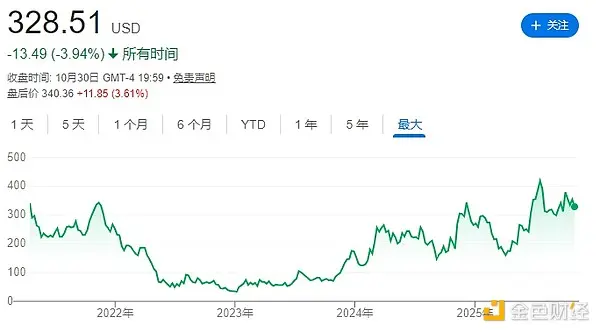

In November 2021, BTC reached a new high of nearly $70,000, and the crypto market was thriving. COIN also peaked at $357, capturing widespread attention. However, in 2022, the crypto industry faced a series of adverse events, such as the LUNA collapse and the FTX bankruptcy, leading to a crypto winter, and COIN subsequently fell below $50. Its stock price has remained sluggish in 2023, hovering below $100. In 2024, due to a shift in U.S. regulatory policies, the SEC approved several Bitcoin spot ETFs, with Coinbase selected as the custodian for the majority of these ETFs, significantly boosting COIN's stock price. In July of this year, COIN climbed to a high of $419.78.

On October 8, COIN reached a monthly high of $387.27, but following the 1011 crash, COIN also fell, reporting $328.51 at the time of writing, down 15.17% from the monthly high, which is relatively close to BTC's 13% decline.

2. Analysis of the Relationship Between DAT Company Stock Prices and BTC Prices

In the short term, regardless of BTC's price at the time, as long as a company announces a transformation, its stock price generally experiences an upward trend. However, after the transformation, stock prices are significantly influenced by the cryptocurrency market. As seen with the first three companies mentioned, during the 1011 crash, the decline in their stock prices from their peaks has been greater than BTC's decline.

In the long term, taking Coinbase as an example: since its IPO in 2021, the correlation between COIN's stock price and the shifts in the crypto bull and bear markets has been strong. When the crypto market is in a bull cycle, COIN's price is at a high level, while during bear markets, COIN consistently hovers at low points.

Therefore, the fate of DAT companies is deeply tied to the bull and bear markets of Bitcoin. When the crypto market is favorable, they can "soar" alongside it, but in unfavorable conditions, they face the dual pressures of "falling coin prices" and "rigid operating costs," potentially leading to massive losses and plummeting stock prices.

3. The Debate on DAT: A Double-Edged Sword

Chris Perkins, president of Coinfund, claimed in an article for Forbes that the summer of 2025 will be "an unforgettable summer for DATs." Indeed, in the summer of 2025, we have seen numerous announcements from traditional companies about starting cryptocurrency treasury reserves, but the debate surrounding DATs has never ceased.

Compared to traditional company investments, DAT companies have their unique characteristics: they are both publicly traded companies and capital market instruments that allow direct investment in specific digital assets. For investors, this provides an extremely attractive alternative, eliminating the need to directly hold the asset or invest through exchange-traded funds. Investing in DATs is seen as a high beta, high leverage asset investment approach, allowing investors to gain greater exposure through a familiar equity structure.

This model is built on a "positive feedback loop," which can lead to rapid wealth growth when conditions are favorable. When cryptocurrency asset prices rise, the equity value of DATs often trades at a significant premium to their net asset value (NAV). This premium allows companies to issue stock at prices above NAV to raise new funds, typically through at-the-market (ATM) offerings. The proceeds from these stock issuances are then used to purchase more digital assets, thereby increasing the per-share asset value for existing investors. This positive feedback loop can become a powerful growth engine, but it is also fragile, highly dependent on market sentiment and the sustained upward trend of asset prices.

Investors optimistic about DATs believe that there is still significant room for development in the future:

First, regulatory transparency is steadily improving. As governments around the world, including the United States, establish more standardized frameworks for digital assets, institutional confidence is also increasing. Meanwhile, regulators are gradually moving away from a cautious stance, actively exploring how to integrate digital assets into the existing financial system, thereby creating a more predictable environment for corporate operations and investor participation.

Second, the widespread shift of institutional investors towards digital assets is undeniable. A survey conducted by Ernst & Young in 2025 showed that the vast majority of institutional investors expect to increase their allocation to digital assets, primarily aiming for portfolio diversification.

Finally, the unique advantages of digital assets—such as faster settlement speeds, lower financing costs, and higher transparency—make them an ideal choice for corporate financial executives looking to optimize cash management and unlock value beyond traditional financial instruments.

Critics argue that DATs carry significant risks: a feedback loop driven by trading premiums. This model works well when the market is in a sustained upward trend, but it can quickly fail once market sentiment reverses. A sharp drop in premiums could trigger a negative feedback loop, making it difficult for companies to raise funds without significantly diluting equity or incurring high-cost debt.

For struggling companies, becoming a DAT is a way to rebrand, leverage the growing cryptocurrency market, and raise new funds. However, many DAT companies that lack significant operational income heavily rely on capital market financing. Once the market declines, their ability to repay or refinance these debts becomes a major concern. Additionally, an excessive focus on asset appreciation may lead investors and management to overlook the hidden costs of holding these assets. Beyond the initial capital investment, there are ongoing expenses such as custody, security, compliance, and risk management. Like any financial market, the digital asset market is also volatile, necessitating a robust risk framework, sound governance, and excellent operations to guard against fraud and cyber threats.

4. The Future of DATs

Tom Lee, chairman of BitMine, pointed out that as more DATs enter the public market, many DATs are trading below their net asset value, which is the value of their underlying cryptocurrency holdings. "If this is not a bubble bursting, then what would a bubble bursting look like?"

David Duong, head of investment research at Coinbase, and Colin Basco, a Coinbase researcher, noted in a report that publicly traded companies buying cryptocurrencies are entering a "player-to-player" phase, where companies will compete more fiercely for investor funds, potentially driving up cryptocurrency market prices. "The days of easy profits and guaranteed mNAV (multiple of net asset value) premiums are over."

Early participants like the large Bitcoin holding company Strategy "enjoyed a considerable premium," but "competition, execution risks, and regulatory constraints have led to a compression of mNAV." "The scarcity premium that early adopters enjoyed has disappeared," and now cryptocurrency assets "have reached a critical turning point." In the current competitive market environment, the success of financial companies "increasingly depends on execution, differentiation, and timing, rather than simply replicating Strategy's approach."

After the waves have settled, the DAT companies that remain are likely to be those that can demonstrate a clear and robust business model, rather than merely relying on market sentiment and leveraged operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。