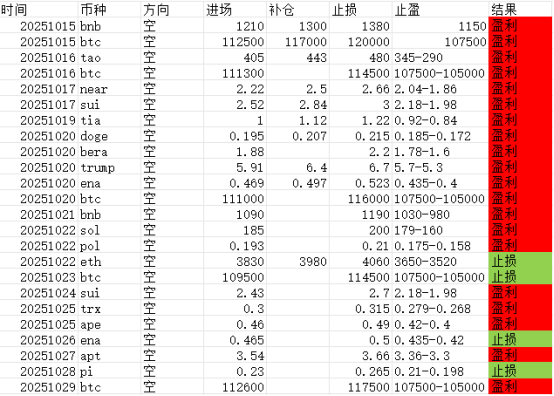

Today is the first day of November, marking a new beginning and a new journey for us. Looking back at last month, we incurred losses on four trades since we started shorting. This month, we will continue to bring you exciting analyses and ideas.

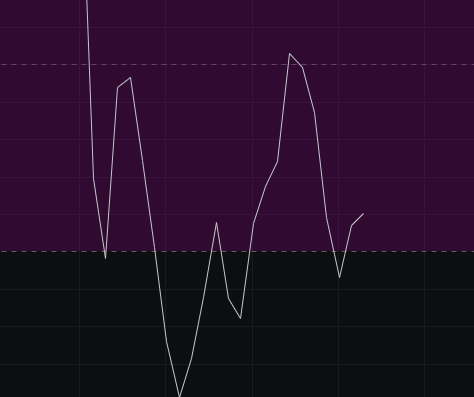

From the MACD perspective, the energy bars are currently contracting, and both the fast and slow lines are tending to flatten out. This indicates that the MACD is about to choose a direction, so we will wait a few days for a clear direction before entering.

Looking at the CCI, it is slightly above -100. Although there has been an increase in the past two days, the overall trend remains weak, so there is no need to look for long positions here.

From the OBV perspective, although there has been a rebound in the market over the past two days, the inflow in OBV is not significant and has not reached a reversal point, so we are also bearish on the OBV.

In terms of KDJ, although there has been an increase in the past two days after the KDJ death cross, the KDJ is still trending downwards, indicating a weak market. Therefore, we will continue to maintain a bearish outlook.

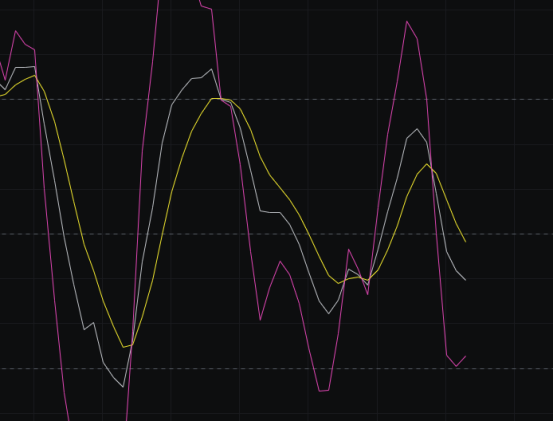

Looking at the MFI and RSI, both indicators show an upward attacking pattern, but the strength is very weak. Whether they can continue to rise will need to be observed over the next few days.

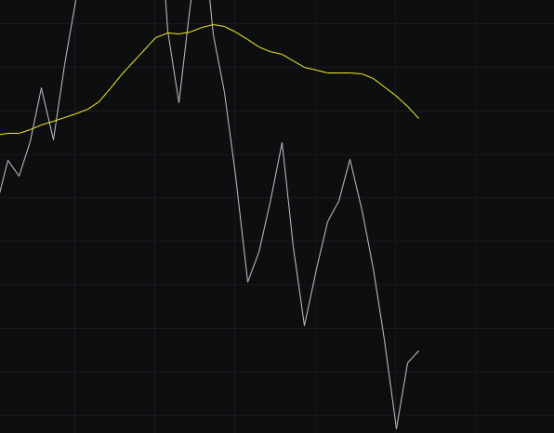

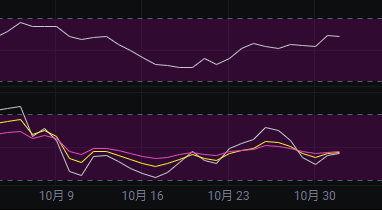

From the moving averages perspective, the 30-day moving average continues to press down, and the market is being suppressed by the BBI. If the market continues to develop, it may hover around the BBI in the coming days before choosing a final direction.

Looking at the Bollinger Bands, today the bands have narrowed slightly, which aligns with the market's operational logic. In the next two days, we will see if the market can stay above the middle band. If it can, there is a possibility of reaching the upper band; if not, it is likely to hit the lower band.

In summary: Although the market has seen an increase in the past two days, it has entered a narrow range, and overall, there will not be much volatility. The target for the bears this week remains to break below 109,000, with today's resistance seen at 110,000-112,000 and support at 109,000-107,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。