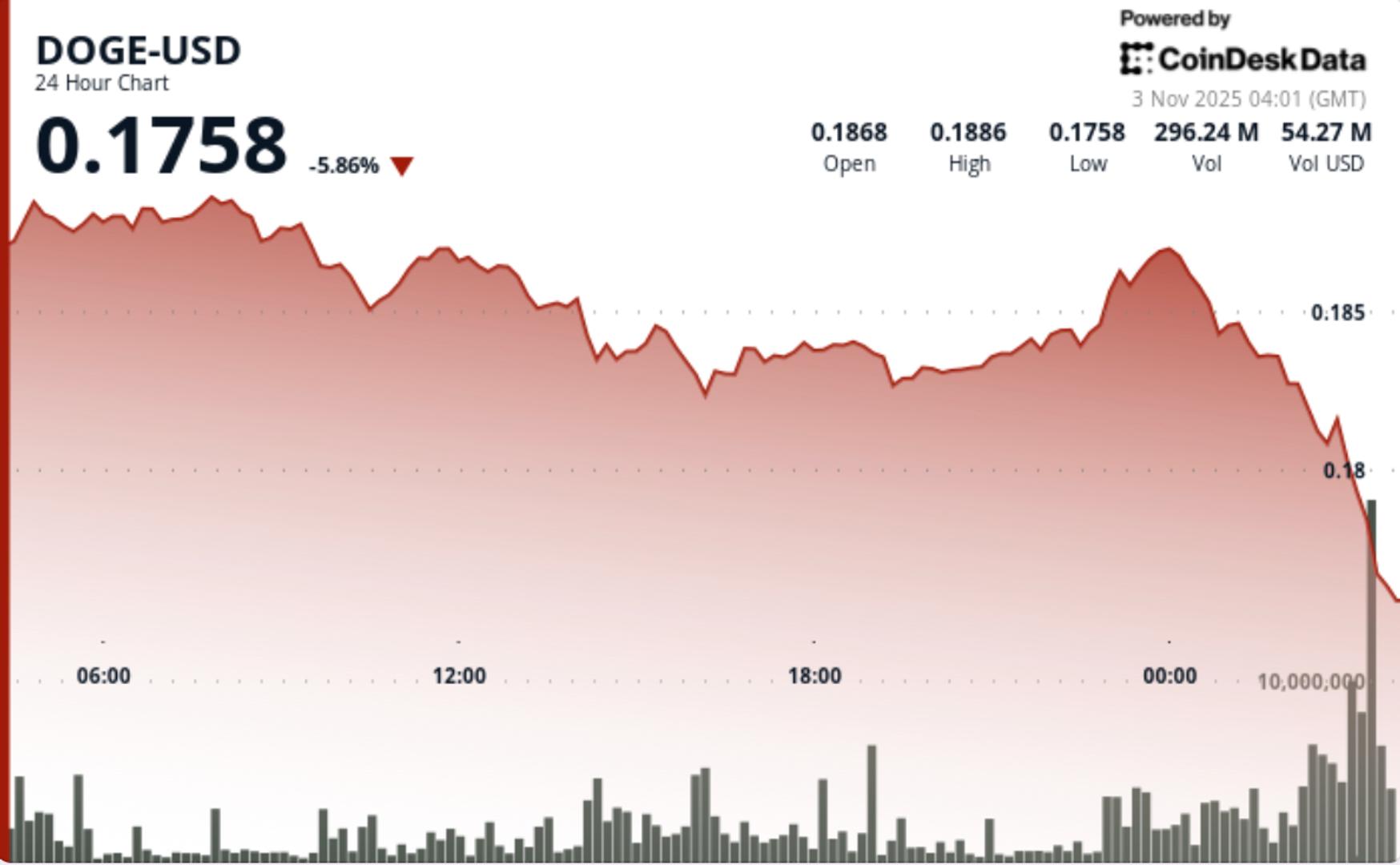

Dogecoin slipped 2.3% to $0.1827 during Tuesday’s trading session, breaking decisively below key support at $0.1830 as whale distribution accelerated and long-term holders began exiting positions.

The decline came amid a deteriorating technical backdrop and increased selling activity across large wallets.

News Background

DOGE dropped from $0.1870 to $0.1827 across the 24-hour window, carving out a $0.0070 range that marked its third consecutive session of lower highs.

Price Action Summary

The decline followed three failed recovery attempts above $0.1860, solidifying resistance at that level. Heavy distribution persisted throughout the U.S. trading window as algorithmic activity amplified sell pressure.

While short-term traders attempted to defend $0.1830, long-term wallet data showed a sharp behavioral shift — a clear rotation from accumulation to liquidation.

On-chain metrics confirmed the move: 440 million DOGE were offloaded by mid-tier whales (holding 10M-100M tokens) over a 72-hour period. The Hodler Net Position Change metric recorded 22 million DOGE outflows, a 36% reversal from prior accumulation trends and the largest drawdown in nearly a month.

Technical Analysis

Dogecoin’s technical structure has transitioned into a confirmed bearish trend following the breach of $0.1830 support. A “death-cross” pattern between the 50-day and 200-day EMAs formed in late October, while the 100-day EMA is on track for a similar cross — both reinforcing downside bias.

Cost-basis analysis places heavy liquidity between $0.177-$0.179, where roughly 3.78 billion tokens are concentrated. This area now represents the next critical defense zone for bulls.

Meanwhile, volume analysis highlights sustained institutional activity: the 274.3M turnover spike and subsequent 15.5M burst during the selloff suggest distribution may be entering its final stage before potential base formation.

What Traders Should Watch

DOGE trades in a vulnerable position following the breakdown. The $0.1830-$0.1850 band remains the immediate pivot zone, while failure to defend $0.177 could trigger a move toward $0.14 — the next meaningful liquidity pocket.

Analysts warn that only a sustained reclaim of $0.1860 accompanied by above-average volume would negate the current bearish setup. Until then, traders are treating short-term rallies as exit opportunities rather than trend reversals.

Whale activity remains the key watchpoint: any sharp decline in large-transaction counts would signal the end of the distribution phase and the start of potential accumulation near cost-basis support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。