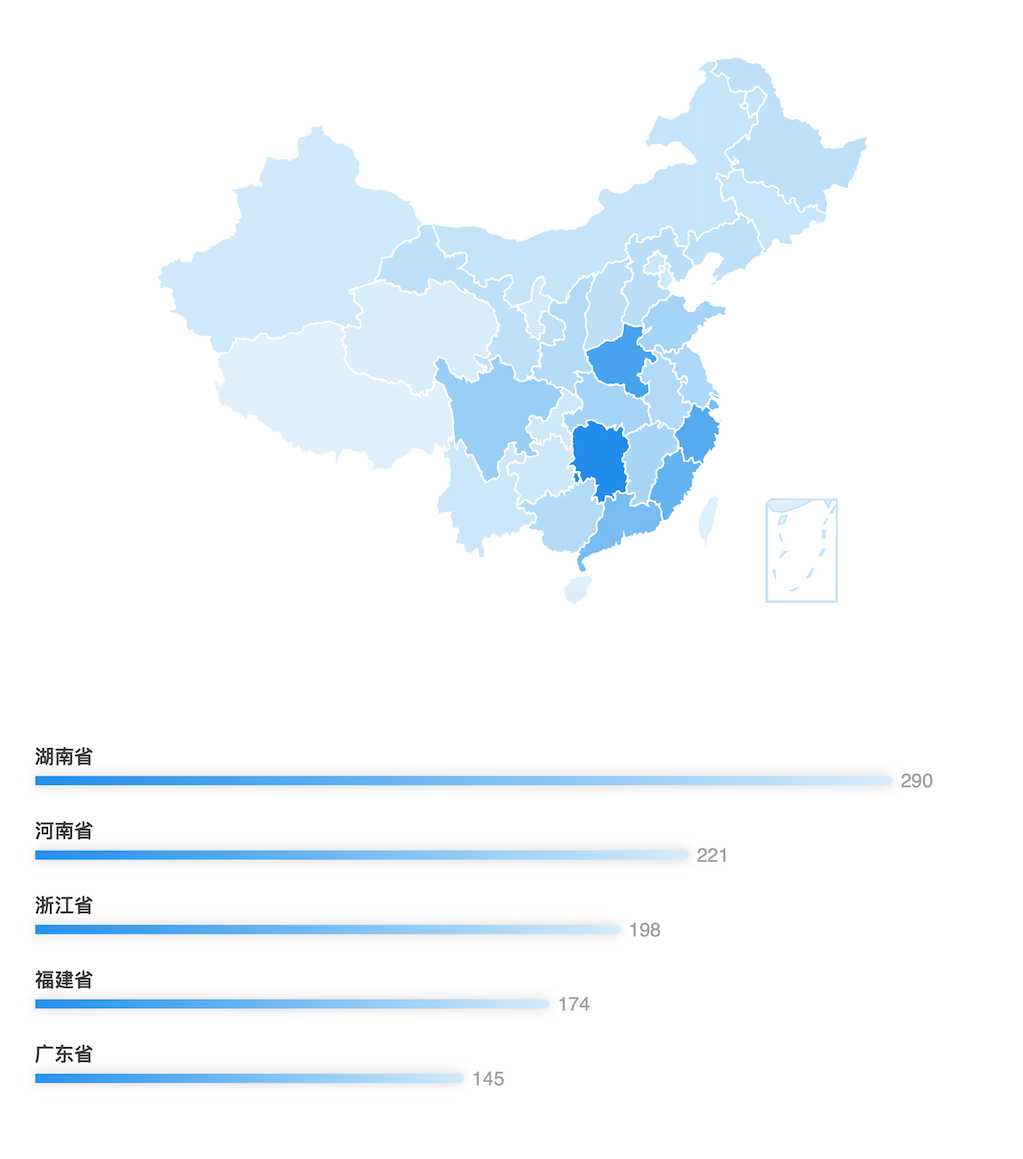

In all publicly available cases, Hunan Province has the highest number of cases involved, followed by Henan Province, then Zhejiang Province, with Fujian Province and Guangdong Province closely following.

Since 2013, a series of regulatory policies have been introduced in our country regarding various risks derived from trading and investing in virtual currencies such as Bitcoin. Under increasingly stringent regulatory policies, activities related to virtual currency trading and investment have not ceased; rather, they have shifted from public to private and from domestic to overseas. In this process, many illegal actors have emerged. In particular, in recent years, illegal activities disguised as virtual currency issuance but aimed at fraud have become rampant. Additionally, due to the anonymity and lack of national boundaries in the circulation of virtual currencies, virtual currencies themselves have also become a new tool for money laundering crimes. It can be said that crimes involving virtual currencies have become the most typical and prominent issue in the field of blockchain crime and even in the field of cybercrime, revealing the criminal risks present in the issuance and trading processes of virtual currencies for the OTC market and a wide range of investors.

After in-depth analysis of cases involving virtual currency crimes in our country from 2019 to 2024, our team has summarized the "White Paper on the Adjudication of Criminal Cases Involving Virtual Currencies in the Past Five Years." At the same time, combined with significant and representative cases in judicial practice and our team's case handling experience over the past two years, we propose targeted defense strategies and compliance opinions for the frequently occurring types of virtual currency crimes.

I. Overall Analysis of Criminal Cases Involving Virtual Currencies in the Past Five Years

(A) Source of Case Data and Analysis Method

To understand the adjudication of criminal cases involving virtual currencies in judicial practice, this article will use statistical analysis of judgment documents to analyze relevant practical cases. At the same time, relevant data will be presented in tabular form for comparative categorization. This search used "virtual currency," "criminal," and "first-instance judgment" as keywords, retrieving publicly available cases involving virtual currency crimes nationwide from 2019 to 2024 through the alpha legal database, resulting in a total of 2,206 judgment documents. Due to limitations in sample size and statistical methods, the data statistics and analysis conclusions in this report may have certain errors and are for reference only.

(B) Case Quantity Statistics

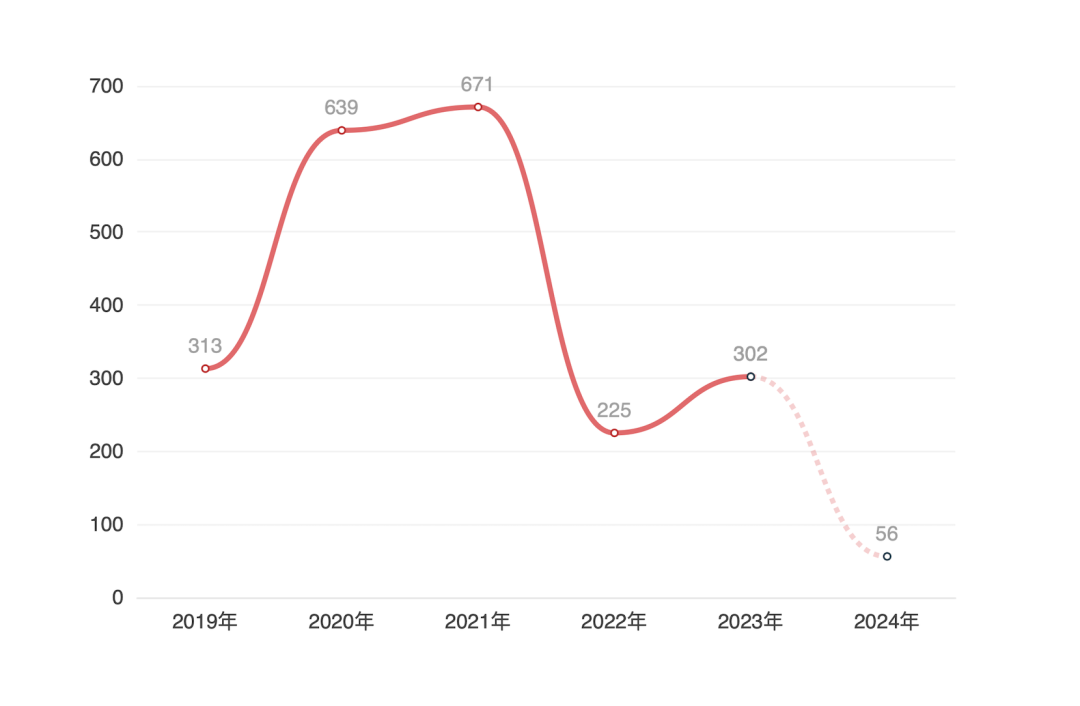

As of June 10, 2024, the Westlaw database has publicly recorded 2,206 criminal cases involving virtual currencies from 2019 to 2024. From 2019 to 2021, the number of criminal cases involving virtual currencies increased year by year, peaking in 2021. The number of cases in 2022 significantly decreased compared to the previous year, and there was a slight increase in 2023, but compared to the number of publicly available cases before 2021, it still shows a downward trend. It can be speculated that, on one hand, this is due to the increasingly severe crackdown on activities related to virtual currencies in recent years. Under the high-pressure regulatory background, the public's awareness of the legal and criminal risks in the issuance and trading of virtual currencies has also increased, leading to a reduction in related issuance and trading activities or a shift to more covert forms, such as operating overseas, making it more difficult to track down individuals, gather evidence, and trace funds, resulting in a decrease in crime numbers. On the other hand, due to the litigation process of recent criminal cases involving virtual currencies, the documents from the past two years will be published in the following year or even longer.

(C) Geographic Distribution of Cases

The 2,206 publicly available criminal cases involving virtual currencies have been organized by region. Among all publicly available cases, Hunan Province has the highest number of cases, followed by Henan Province, then Zhejiang Province, with Fujian Province and Guangdong Province closely following. It is evident that Henan Province, the Pearl River Delta, and the Yangtze River Delta are high-incidence areas for criminal cases involving virtual currencies.

(D) Current Situation of China's Crackdown on Crimes Involving Virtual Currencies

Since the release of the "Notice on Preventing Bitcoin Risks" in December 2013, Bitcoin has been clearly defined as a non-official currency that does not have legal tender status and is not a true currency, but rather a specific virtual commodity. For more than a decade, this view has been maintained regarding the basic attributes of virtual currencies in our country. Subsequently, regulatory authorities have issued a series of regulatory documents. Among them, the most authoritative and important regulatory policy regarding virtual currencies in China is the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading and Speculation" jointly issued by ten ministries including the Supreme Court, the Supreme People's Procuratorate, the Ministry of Public Security, and the People's Bank of China on September 15, 2021 (commonly referred to in practice as the "9.24 Notice"). The 9.24 Notice clearly states:

Virtual currencies such as Bitcoin, Ethereum, and Tether are not official currencies, do not have legal tender status, and cannot be circulated and used as currency in the market;

Activities related to virtual currencies are considered illegal financial activities, and those constituting crimes will be held criminally liable according to law. This specifically includes: conducting exchange services between legal currencies and virtual currencies, exchanges between virtual currencies, buying and selling virtual currencies as a central counterparty, providing information intermediary and pricing services for virtual currency trading, token issuance financing, and trading of virtual currency derivatives. This provision has become the core of whether the judicial handling of virtual currencies may involve illegal or even criminal activities;

Foreign exchanges providing services to residents in China are considered illegal financial activities;

Residents in China bear the risks of investing in virtual currencies, and if investment activities are suspected of undermining financial order or endangering financial security, they must bear legal responsibility.

In particular, in recent years, the anonymity and convenience of virtual currencies have made them an ideal tool for illegal actors to launder money, transfer funds, and conduct cross-border operations, intertwining with crimes such as telecom fraud, online gambling, and drug trafficking, posing a serious threat to financial order and social security. On December 11, 2023, the Supreme People's Procuratorate and the State Administration of Foreign Exchange jointly issued eight typical cases of punishing illegal foreign exchange crimes, mainly involving illegal business operations of foreign exchange, fraudulently purchasing foreign exchange, and related charges involving assisting information network crime activities, fraudulently obtaining export tax rebates, and issuing false VAT invoices. Among them, using virtual currencies as a medium to achieve the exchange of RMB and foreign exchange has become a frequently occurring and prominent mode of illegal foreign exchange trading activities in recent years.

At a press conference held by the Supreme People's Procuratorate of China in 2024, Ge Xiaoyan, a member of the Party Leadership Group and Deputy Chief Prosecutor, stated that current cybercrime is accompanied by new technologies and new business formats, with the black and gray industries accelerating their iteration and upgrade. New types of cybercrime using the metaverse, blockchain, and binary futures platforms as gimmicks are continuously emerging, with virtual currencies becoming an important breeding ground for the proliferation and facilitation of cybercrime.

In addition, the head of the Inspection Division of the State Administration of Foreign Exchange stated that the Central Financial Work Conference emphasized that risk prevention and control should be regarded as the eternal theme of financial work. In the next step, the State Administration of Foreign Exchange will earnestly implement the deployment and requirements of the Central Financial Work Conference, strictly enforce the law, and dare to take a stand, maintaining a high-pressure crackdown on illegal cross-border financial activities.

II. Adjudication of Criminal Cases Involving Virtual Currencies in the Past Five Years

(A) Analysis of the Causes of Criminal Cases Involving Virtual Currencies

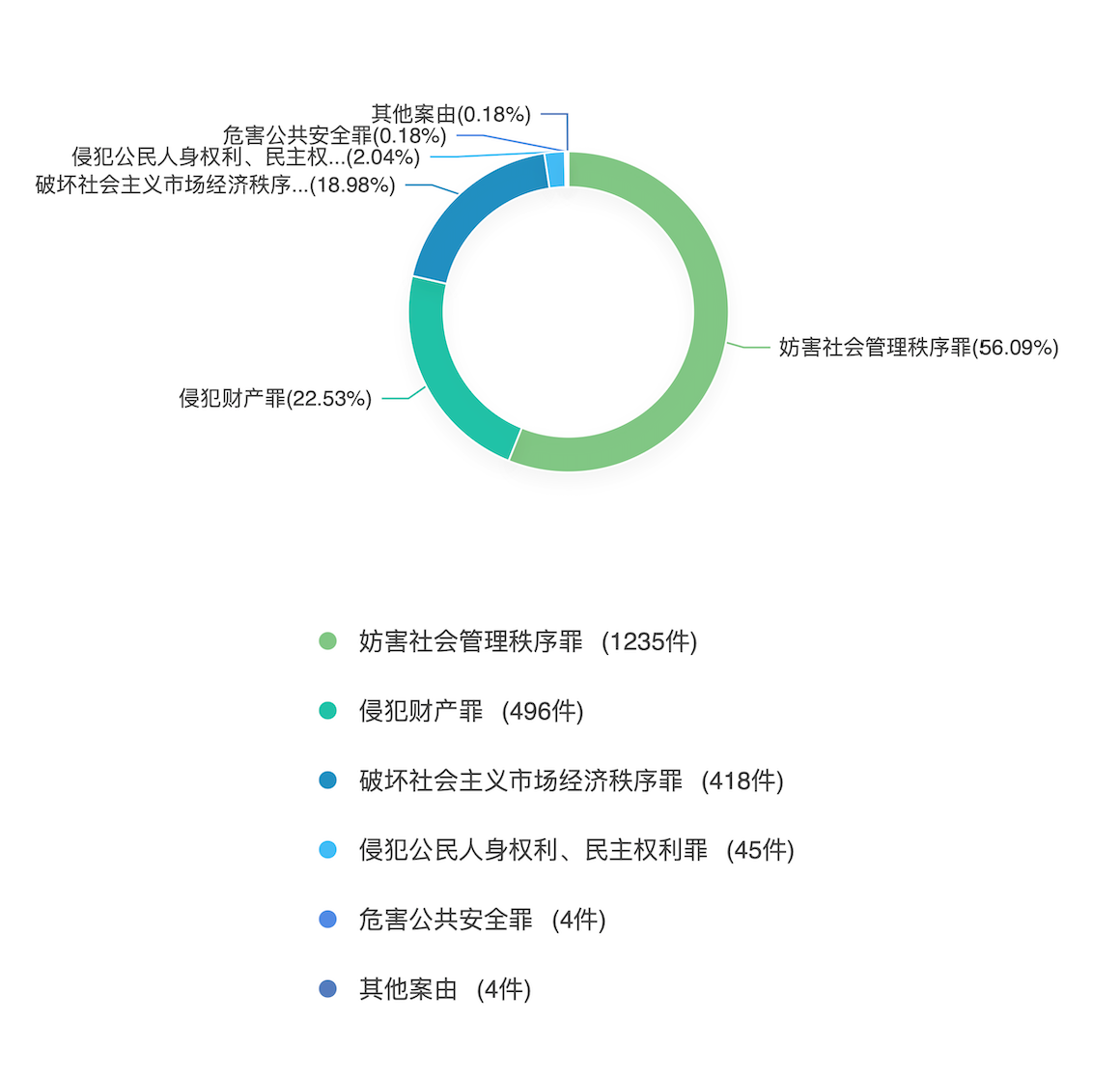

From the perspective of the causes of criminal cases involving virtual currencies, crimes related to virtual currencies are widely distributed in areas such as obstructing social management order, infringing property rights, and disrupting the socialist market economic order, mainly involving crimes such as fraud, concealing and disguising criminal proceeds, crimes of proceeds from crime, organizing and leading pyramid schemes, operating casinos, theft, illegally absorbing public deposits, fundraising fraud, illegally obtaining data from computer information systems, illegal business operations, and money laundering.

(B) Trial Duration

In terms of trial duration, the vast majority of cases have a trial duration of within 90 days, with very few cases exceeding 365 days, and the average trial duration is 97 days.

(C) Amount Involved in Cases

Regarding the amount involved in cases, there are 109 cases with amounts ranging from 1 million to 5 million yuan, accounting for 18.35% of the total number of cases, while cases with amounts exceeding 5 million yuan account for 25.59% of the total number of cases, which is the highest proportion. It can be seen that criminal cases involving virtual currencies often involve large amounts.

(D) Distribution of Penalties

Through the retrieval and statistics of 2,206 criminal cases involving virtual currencies in the past five years, five cases were sentenced to life imprisonment, while the majority of cases were sentenced to fixed-term imprisonment and fines, accounting for over 90% of the total number of cases, with a small number receiving detention penalties. Overall, the penalties for criminal cases involving virtual currencies are relatively severe.

III. Analysis of Charges and Controversies in Criminal Cases Involving Virtual Currencies

Regarding the types of criminal cases involving virtual currencies, from the current judicial practice, they can be roughly divided into three categories: using virtual currencies as tools to commit other crimes, illegally issuing virtual currencies, and illegally obtaining virtual currencies. Specifically:

(A) Using Virtual Currencies as Tools to Commit Other Crimes

- Money Laundering

In recent years, various crimes involving virtual currencies have shown a high incidence, especially money laundering crimes involving virtual currencies. According to monitoring data from Chengdu Chain Security [Blockchain Security Situation Awareness Platform], global money laundering involving virtual currencies exceeded 27.366 billion yuan in 2023. Additionally, in a recent investigation of the world's largest money laundering case, British police seized over 61,000 bitcoins, valued at approximately 3.4 billion pounds.

Similarly, the issue of virtual currency abuse has also attracted significant attention from the government and regulatory agencies in China. Due to its anonymity and convenience, virtual currency has become an ideal tool for illegal actors to launder money, transfer funds, and conduct cross-border operations. These illegal activities intertwine with crimes such as telecom fraud, online gambling, and drug trafficking, posing a serious threat to financial order and social security.

From the common methods of virtual currency money laundering, in recent years, the virtual currency money laundering industry chain has shown an increasingly obvious trend of corporate operation. To more effectively clean and conceal illicit funds, illegal platforms such as underground banks, fourth-party payment, third-party guarantee platforms, as well as various technical means such as coin mixing, cross-chain transactions, currency exchanges, privacy coins, and DeFi have been widely used in virtual currency money laundering activities, making the methods and paths more complex.

In China, the crime of money laundering as stipulated in Article 191 of the Criminal Law is classified as a special type of money laundering crime, with certain restrictions on upstream crimes. Only the proceeds and benefits derived from drug crimes, organized crime with a mafia nature, terrorist activities, smuggling crimes, corruption and bribery crimes, crimes that disrupt financial management order, and financial fraud crimes can be recognized as the objects of money laundering crimes. The subjects of the crime include both entities and individuals. The Eleventh Amendment to the Criminal Law has also added that self-money laundering can be independently recognized as a money laundering crime, further expanding the scope of application of the money laundering crime. Specifically, common methods of virtual currency money laundering can be divided into three steps: placement of illicit funds, layering process, and integration and withdrawal.

Placement of illicit funds: The process in which criminals transfer illicit funds to a third-party platform or merchant for money laundering is called placement. In this step, criminals register accounts on the platform using false identity information, purchase virtual currencies, and inject illegal proceeds into the money laundering channels.

Layering process: Criminals utilize the anonymity of virtual currencies to conduct multi-layered and complex transactions on the platform, dispersing and exchanging illicit funds among multiple accounts to conceal the nature of the illegally obtained funds.

Integration and withdrawal: After multiple transfers and laundering, the virtual currencies held by criminals are relatively "safe." They consolidate or disperse these virtual currencies to different wallet address accounts and withdraw them, thus completing the money laundering process.

Additionally, the subjective aspect of the money laundering crime can be divided into two types: "self-money laundering" and "third-party money laundering." In the case of "self-money laundering," there is no issue of proving subjective elements, but in the case of "third-party money laundering," it is still necessary to prove the establishment of subjective elements.

According to the Supreme Court's "Interpretation on Several Issues Concerning the Application of Law in the Trial of Criminal Cases such as Money Laundering," the two high courts' "Interpretation on Several Issues Concerning the Application of Law in Criminal Cases Involving Illegal Use of Information Networks and Assisting Information Network Criminal Activities," and the two high courts and one ministry's "Opinions on Several Issues Concerning the Application of Law in Criminal Cases such as Telecom Network Fraud (II)," when the following objective behaviors or facts are present in virtual currency transactions involving illegal funds, it may be presumed that there exists a subjective state of knowledge.

(1) Illegal use, sale of accounts, and information. For example, frequently handling, using, or selling bank cards, Alipay, or WeChat accounts for compensation; registering companies without actual operations, selling company business licenses, public accounts, and other company information; obtaining phone cards under false identities and using or selling them in bulk for profit. These accounts and information are used for virtual currency money laundering transactions.

(2) Transactions using accounts of unspecified multiple individuals or accounts not belonging to oneself. By advertising or through referrals, daily recruitment of unspecified individuals as "straw men" or "card farmers," providing Alipay, WeChat accounts, bank cards, and personal identification information, using multiple "straw men" accounts to receive upstream criminal funds, and then transferring the funds to others by purchasing virtual currencies and gifting them.

(3) Converting property or cashing out through virtual currencies at obviously unreasonable prices or "fees." Using the market price of virtual currencies such as Bitcoin and "USDT" as a benchmark, obtaining fees or selling prices significantly higher than the market reasonable price, and purchasing Bitcoin with upstream criminal proceeds transferred to designated accounts of criminals.

(4) Frequent testing of related accounts, with abnormal speed of fund circulation. Daily conducting small transfer tests on held bank cards to ensure that the bank cards have not been frozen by relevant authorities; quickly purchasing virtual currencies or rapidly transferring to designated accounts after receiving funds to avoid seizure of the funds.

(5) Frequently adopting measures such as covert internet access, encrypted communication, and data destruction to evade supervision or investigation. Long-term frequent destruction of electronic data on mobile phones and computers; using false identities, frequently changing transaction locations, IP addresses, and SIM cards; separating personnel from equipment and installing surveillance cameras; using encrypted communication with upstream buyers and related personnel to evade supervision and investigation.

(6) Providing programs, tools, or other technical support specifically for illegal activities, assisting in the illegal establishment of fourth-party payment platforms and virtual currency investment trading platforms; specifically helping others unfreeze frozen WeChat accounts; providing proxy software to hide real IP addresses to others.

(7) Obvious abnormalities during transactions, or continuing to participate in transactions after complaints or warnings. After a bank card suspected of criminal activity is frozen by judicial authorities, continuing to change bank cards or using other methods for virtual currency transactions to evade investigation; failing to stop related activities after reports and warnings regarding virtual currency promotion and information platforms.

- Illegal Business Operations

The foreign exchange market is an important component of China's financial market. Legally combating illegal buying and selling of foreign exchange and other illegal activities, preventing and resolving external shock risks, and maintaining the stable operation of the foreign exchange market are crucial for safeguarding national financial security. Currently, cross-border matching-type illegal buying and selling of foreign exchange, as one of the typical forms of illegal foreign exchange transactions, presents many difficulties in investigation and classification due to its professionalism, concealment, and diversity, disrupting the normal order of the foreign exchange market and undermining the stable development of China's financial order.

On December 11, 2023, the Supreme People's Procuratorate and the State Administration of Foreign Exchange jointly released eight typical cases of punishing illegal foreign exchange crimes, mainly involving illegal business operations (illegal buying and selling of foreign exchange) and fraudulently purchasing foreign exchange, with related charges including assisting information network criminal activities, fraudulently obtaining export tax rebates, and issuing false VAT invoices. Among them, using virtual currencies as a medium to achieve the exchange of RMB and foreign exchange has become a frequent and prominent mode of illegal foreign exchange trading activities in recent years.

Currently, the typical method of illegal foreign exchange trading cases is "matching." In such cases, the perpetrator usually collects RMB from clients within the country and then deposits an equivalent amount of foreign exchange into the client's designated overseas bank account, achieving a one-way circulation of funds between domestic and foreign. On the surface, both parties do not directly engage in the buying and selling of RMB and foreign exchange, but in reality, they have completed the act of buying and selling foreign exchange. Common situations include cross-border (overseas) payment, where criminals collude with foreign individuals, enterprises, or institutions, or use bank accounts opened overseas to assist others in cross-border remittance and fund transfer activities. These underground banks are referred to as "matching-type" underground banks, where funds achieve one-way circulation between domestic and foreign without physical movement, usually achieving "two-location balance" in the form of reconciliation. In this model, RMB and foreign currencies do not undergo physical cross-border circulation, and on the surface, funds circulate unidirectionally between domestic and foreign. However, such activities essentially constitute disguised foreign exchange trading behaviors, which still pose a risk of disrupting the normal order of the foreign exchange market.

In response, among the eight typical cases of punishing illegal foreign exchange crimes jointly issued by the Supreme People's Procuratorate and the State Administration of Foreign Exchange on December 11, 2023, two cases involved this new type of matching exchange model.

Typical Case One

From February 2019 to April 2020, Zhao organized Zhao Peng, Zhou Kai, and others to provide exchange and payment services for foreign currency dirhams and RMB in the UAE and domestically. The gang collected cash dirhams in Dubai, UAE, while transferring the corresponding RMB to the designated domestic RMB accounts of the other party, and then used the dirhams to purchase "Tether" (USDT, a stablecoin pegged to the US dollar) locally, and then immediately sold the purchased Tether illegally through domestic gangs to reacquire RMB, thus forming a cycle of fund circulation between domestic and foreign. Through exchange rate differences, the gang could earn over 2% profit on each foreign currency transaction. Investigations revealed that Zhao and others exchanged over 43.85 million RMB from March to April 2019, with total profits exceeding 870,000 RMB.

On March 24, 2022, the People's Court of Xihu District, Hangzhou City, Zhejiang Province, sentenced Zhao to seven years in prison for illegal business operations and imposed a fine of 2.3 million RMB; Zhao Peng was sentenced to four years in prison and fined 450,000 RMB; Zhou Kai was sentenced to two years and six months in prison and fined 250,000 RMB.

Typical Significance

Using virtual currencies as a medium to achieve the exchange of RMB and foreign exchange constitutes illegal business operations. The perpetrator uses virtual currencies as a medium to earn profits from exchange rate differences by providing cross-border exchange and payment services, which is a circumvention of national foreign exchange regulations through the conversion of "foreign exchange—virtual currency—RMB," and should be held criminally liable for illegal business operations.

Typical Case Two

From January 2018 to September 2021, Chen Guo, Guo Zhao, and others built websites such as "TW711 platform" and "Fire Speed platform," using virtual currency Tether as a medium to provide clients with foreign currency and RMB exchange services. Exchange clients would place orders under the website's value storage and payment service sections and pay foreign currency to the designated overseas accounts of the website. The website would purchase Tether with the aforementioned foreign currency overseas, and then Fan would sell it through illegal channels to obtain RMB, which would then be paid to the designated domestic third-party payment platform accounts of clients at the agreed exchange rate, earning profits from exchange rate differences and service fees. The website illegally exchanged over 220 million RMB.

On June 27, 2022, the People's Court of Baoshan District, Shanghai, sentenced Guo Zhao to five years in prison for illegal business operations and imposed a fine of 200,000 RMB; Fan was sentenced to three years and three months in prison and fined 50,000 RMB; Zhan was sentenced to one year and six months in prison for assisting information network criminal activities and fined 5,000 RMB; Liang was sentenced to ten months in prison and fined 2,000 RMB.

Typical Significance

In China, virtual currencies do not have the same legal status as legal tender, but using virtual currencies as a medium to indirectly achieve illegal exchanges between domestic and foreign currencies is an important link in the chain of illegal foreign exchange trading crimes and should be punished according to law. If the provider of virtual currency colludes with individuals engaged in illegal foreign exchange trading beforehand, or knowingly assists others in illegal foreign exchange trading through virtual currency transactions, they constitute a joint crime of illegal business operations. If the provider of virtual currency trading services only has a general understanding of the criminal behavior they are assisting and does not specifically recognize that they are aiding illegal foreign exchange trading, they may be held criminally liable for assisting information network criminal activities.

In fact, since the People's Bank of China and other five departments issued the "Notice on Preventing Bitcoin Risks" in 2013, relevant departments in China have successively introduced regulations to prevent risks associated with token issuance and financing. In 2021, the People's Bank of China and ten departments issued the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading and Speculation," which clearly stated that virtual currencies do not have the same legal status as legal tender, and related business activities are considered illegal financial activities. Using virtual currencies as a trading medium to achieve the conversion of foreign exchange and RMB, including exchanging RMB for virtual currencies, then converting virtual currencies into foreign currencies, or exchanging foreign currencies for virtual currencies and then converting virtual currencies back into RMB, constitutes disguised foreign exchange trading behavior.

In terms of criminal recognition, according to Article 4 of the Standing Committee of the National People's Congress's "Decision on Punishing Crimes of Fraudulently Purchasing Foreign Exchange, Evading Foreign Exchange, and Illegal Buying and Selling of Foreign Exchange" and Article 225 of the Criminal Law, as well as Article 2 of the Supreme Court and Supreme People's Procuratorate's "Interpretation on Several Issues Concerning the Application of Law in Criminal Cases Involving Illegal Engagement in Fund Payment and Settlement Business and Illegal Buying and Selling of Foreign Exchange" in 2019, behaviors that constitute disguised foreign exchange trading and disrupt the order of the financial market, if serious, will be classified as illegal business operations. Therefore, circumventing national foreign exchange regulations and using virtual currencies as a trading medium to indirectly achieve the conversion of foreign exchange and RMB, if serious, will constitute illegal business operations. However, in specific determinations, it is also necessary to consider whether domestic and foreign operators are acting for profit, whether they are engaged in continuous business activities, and whether there is substantial exchange between RMB and foreign currencies, among other relevant subjective and objective facts, to comprehensively judge whether a crime has been established.

Furthermore, depending on whether the cross-border transfer of funds involves related criminal proceeds and their generated benefits, the act of using virtual currencies as a trading medium for cross-border fund transfers may also violate money laundering crimes, concealing or disguising criminal proceeds, and crimes related to proceeds from crime. If it simultaneously violates illegal business operations, it will be convicted and punished according to the more severe provisions.

(2) Crimes of Illegal Issuance of Virtual Currency

- Crime of Illegal Absorption of Public Deposits

The crime of illegal absorption of public deposits as defined by China's Criminal Law refers to the act of absorbing funds from the public (including entities and individuals) in violation of national financial management laws, thereby disrupting financial order. It is primarily defined from four aspects regarding the illegal absorption of public deposits or disguised absorption of public deposits:

(1) Absorbing funds without the approval of relevant authorities or by using a legitimate business form;

(2) Publicly promoting through media, promotional meetings, flyers, mobile text messages, etc.;

(3) Promising to repay principal and interest or provide returns in monetary, physical, equity, or other forms within a certain period;

(4) Absorbing funds from the public, i.e., from unspecified social targets.

Of course, in virtual currency issuance activities, the funds raised by the issuer from the public are usually not legal tender but mainstream virtual currencies such as Bitcoin, Ethereum, and Tether. Generally, the legal interest in recognizing the crime of illegal absorption of public deposits is based on the monetary monopoly of commercial banks. It seems that only when the object of the criminal act points to real currency will it infringe upon the monetary monopoly of commercial banks, thus posing a serious risk to the security of financial order. However, in virtual currency issuance activities, the Bitcoin, Ethereum, and other virtual currencies raised from the public clearly do not possess the attributes of legal tender, making it difficult to classify them as objects regulated by the crime of illegal absorption of public deposits.

In actual issuance activities, there usually includes the exchange process where investors purchase mainstream virtual currencies from currency merchants using RMB. The reason for choosing mainstream virtual currencies as fundraising targets is partly because virtual currencies do not have legal tender status in most countries, making them tools to evade regulation. On the other hand, Bitcoin, Ethereum, and Ripple are currently the three largest digital tokens by market capitalization, while Tether is pegged to the US dollar, making it the most traded and relatively stable virtual currency. These mainstream virtual currencies have relatively small price fluctuations and high consensus, allowing them to be exchanged for legal tender in many countries. The development and operation of security token issuance projects require funding, and based on the stability and convertibility of these mainstream currencies, security token issuance projects can convert the raised virtual currencies back into legal tender to pay for related operating expenses. Therefore, these mainstream virtual currencies essentially serve as intermediaries in virtual currency issuance activities, while the fundraising targets ultimately still need to be based on legal tender. These virtual currencies are essentially disguised vehicles for the flow of funds. Thus, the act of absorbing mainstream virtual currencies from the public may still potentially violate the crime of illegal absorption of public deposits.

- Crime of Fundraising Fraud

The elements constituting the crime of fundraising fraud not only include the purpose of illegal possession but also require the use of fraudulent means for illegal fundraising. In practice, project parties often use project points or self-created "air coins" as promotional targets, but the essence is to see whether they use high returns as bait to attract public investment. From an objective perspective, this is mainly reflected in the following aspects:

First, the virtual currency promoted by the project party may not be a real virtual currency and may not even be considered a counterfeit coin (non-mainstream coin). However, the project party often fabricates facts, packages a high-profile foreign technical team, and boasts about the potential commercial value, while in reality, there is no actual operation or business related to the virtual currency.

Second, the temptation of high returns is a common tactic. By airdropping "candies," i.e., giving away virtual currencies of actual value upon registration, they quickly attract new users.

Finally, manipulating virtual currency prices to gain profits. Project parties often set up their own trading platforms and artificially inflate trading through technical means, creating a false appearance of trading prosperity to attract participants to invest. At the same time, they use backend technology to manipulate price trends and set up "mouse warehouses." They control trading volumes, causing prices to rise first to attract a large number of investors. Then, they manipulate the trading prices to continuously drop until the price is far below the purchase price of participants, thus obtaining huge profits.

From a subjective intent perspective, the virtual currency promoted by such project parties is not a real virtual currency based on blockchain technology but merely a tool to achieve illegal fundraising purposes. This pseudo-virtual currency usually does not go on exchanges, lacks technical value, has no trading value, and cannot be commercially realized; it is merely a tool for the project party to control the fund pool. Such project parties aim for illegal possession, use fraudulent means, lure with high returns, and deceive unspecified targets through public promotion, fully meeting the constitutive elements of the crime of fundraising fraud.

- Crime of Organizing Pyramid Selling Activities

Taking the virtual currency pyramid selling case "Plus Token," involving an amount of 14.8 billion yuan, as an example, the platform divides members into five levels: ordinary members, big clients, celebrities, experts, and founders, categorizing them based on the number of referrals and investment amounts. The platform claims to have a "smart dog brick-moving" function (i.e., using arbitrage trading to earn price differences) to attract members under the guise of providing currency appreciation services. The entry threshold includes paying a currency worth over 500 USD as an entry fee and activating the "smart dog" to obtain platform benefits.

Members form an upper and lower line hierarchy based on the order of referrals, and the platform provides rebates based on the number of lower-level members developed and the amount of investment funds through three methods: smart brick-moving income, link income, and executive income. In reality, these rebate methods are directly or indirectly based on the number of personnel developed and the amount paid. Therefore, the behaviors of charging entry fees, developing lower-level members, and calculating rewards by levels in this case closely align with the provisions of Article 224-1 of the Criminal Law regarding organizing and leading pyramid selling activities, leading both levels of courts in Jiangsu to recognize the establishment of the crime of organizing and leading pyramid selling activities.

Specifically, according to Article 224-1 of the Criminal Law, the elements constituting the crime of organizing and leading pyramid selling activities include the following:

(1) Under the guise of selling goods, providing services, or other business activities, requiring participants to pay fees or purchase goods or services to obtain membership qualifications and forming levels in a certain order.

(2) Directly or indirectly using the number of personnel developed as the basis for compensation or rebates, enticing or coercing participants to continue developing others to join, defrauding property, and disrupting economic and social order.

(3) According to Article 78 of the "Regulations on the Standards for Filing and Prosecution of Criminal Cases (II)" issued by the Supreme People's Procuratorate and the Ministry of Public Security, it is required that the number of individuals suspected of organizing and leading pyramid selling activities exceeds thirty and that the levels exceed three.

In practice, as China strengthens its regulation of virtual currencies, many cryptocurrency projects adopt internet mediation and community marketing methods to evade regulatory crackdowns, promoting through referrals and level-based rebates. These behaviors align with the basic characteristics of the crime of organizing and leading pyramid selling activities:

(1) Deceptiveness: The business activities promoted by the project party are essentially a facade of blockchain or virtual currency, with promised or paid returns to members often coming from the entry fees paid by members.

(2) Compensation method: Directly or indirectly using the number of personnel developed as the basis for compensation or rebates. Participants of the project party develop personnel, requiring those developed to continuously recruit others to join, forming an upper and lower line relationship, and calculating and paying rewards to the upper line based on the number of lower-level developments.

(3) Organizational structure: Hierarchical. Generally, different levels are formed based on the order of joining and the number of personnel developed, creating a pyramid structure with a broad base and a narrow top.

(3) Crimes of Illegal Acquisition of Virtual Currency

There has been considerable debate regarding whether the crime of illegally acquiring virtual currency, especially the theft of Bitcoin, should be regulated as theft or as the crime of illegally obtaining data from computer information systems, both in judicial practice and academia. In 2022, an article titled "Criminal Qualification of Illegally Stealing Bitcoin" was published in the national legal journal "China Prosecutor," which is overseen by the Supreme People's Procuratorate and hosted by the National Prosecutors College. The article ultimately concluded: "If after September 2021, it cannot be regulated as a property crime, and due to the means and actions not being evaluated by other crimes such as illegally obtaining data from computer information systems, it cannot be recognized as a crime."

In fact, there has not been a consensus on the property attributes of virtual currencies in practice. For example, in a high-quality case published on May 5, 2022, by the Shanghai High People's Court's public account "Pudong Tianping," it was clearly stated that Bitcoin, as virtual property, possesses property attributes and is subject to the legal rules of property rights. In the judgment of that case, the legal attribute of Bitcoin was recognized as a primary premise for the application of compulsory enforcement laws. The first instance held that Bitcoin has characteristics of value, scarcity, and disposability, thus possessing the characteristics of an object of rights, meeting the constitutive requirements of virtual property. Regarding the legal attributes of Bitcoin, the Shanghai High Court analyzed that there is much debate in academia regarding the legal attributes of Bitcoin, and the essence of these debates is to find a basis for recognition from traditional civil rights theory. However, under the discussion of multiple theories, it is impossible to legally recognize Bitcoin, thus seeking answers from judicial practice.

In this regard, the Shanghai High Court cited several cases in judicial practice that recognized Bitcoin as virtual property. For example, in the case of Wu vs. Shanghai Yaozhi Network Technology Co., Ltd. and Zhejiang Taobao Network Co., Ltd. regarding online infringement liability [ (2019) Zhe 0192 Min Chu 1626 ], in the case of Li vs. Brandon Smith and Yan regarding property damage compensation [ (2019) Hu 01 Min Zhong 13689 ], and in the case of Chen vs. Zhang regarding return disputes [ (2020) Su 1183 Min Chu 3825 ], the courts held that Bitcoin is generated through "mining," requiring the purchase and maintenance of related specialized equipment and payment for electricity costs to obtain it. At the same time, it can generate economic benefits and possesses value; secondly, the total amount of Bitcoin is algorithmically limited to 21 million, indicating scarcity; finally, Bitcoin holders can possess, use, benefit from, and dispose of Bitcoin, making it disposably compliant with the constitutive requirements of virtual property. The Shanghai High Court believes that "in judicial practice, courts adopt a pragmatic attitude and do not make direct judgments on the legal nature of virtual property. Because it has certain economic value and meets property attributes, it is thus protected under property rights legal rules."

In civil cases, in the "Guiding Case No. 199" released by the Supreme People's Court on December 27, 2022, the Supreme People's Court confirmed that in this case, "the arbitration ruling ordering the respondent to compensate in US dollars equivalent to Bitcoin, and then converting the US dollars into RMB, constitutes a disguised support for the exchange transaction between Bitcoin and legal tender, violating national regulations on financial supervision of virtual currencies and contravening public interest, thus the people's court should rule to revoke the arbitration ruling."

Additionally, in a recent report by The Paper titled "The First Criminal Case Involving Virtual Currency Issuance Sparks Controversy: Does Withdrawing Liquidity After Issuing Virtual Currency Constitute Fraud?" it detailed a series of actions by a senior student who was sentenced to four and a half years in prison for fraud after issuing virtual currency and withdrawing liquidity. In this case, the first-instance court found that the perpetrator constituted fraud, which essentially supported the exchange transaction between virtual currency and legal tender, acknowledging the property attributes of virtual currency.

(4) Other Crimes

In a judgment published by the Intermediate People's Court of Zhuzhou City, Hunan Province in December 2021, it was found that from December 2018 to February 2019, Li was employed by a company in Shenzhen. He purchased a certain amount of USDT (Tether) on Huobi and then transferred it to the "pex" order-taking platform for resale. When Li listed the USDT for sale on the pex platform, the price was about 2 cents higher than the purchase price on Huobi, allowing him to profit from the price difference. During this process, several of Li's bank cards used for receiving payments were gradually frozen by the police, and his company was also liquidated. However, Li did not stop his reselling activities and later recruited three others to continue reselling Tether on the pex platform. After police intervention, the four suspects truthfully confessed the real reasons behind their "money-making secrets." The reason some were willing to invest in purchasing Tether from a less well-known and more expensive platform was that their funds were illegal and unregulated. Each time virtual currency was withdrawn, the bank cards receiving the funds could be frozen by the police due to the illegal nature of the funds. However, due to the substantial profits from reselling Tether, the four decided to take the risk. After verification by law enforcement, it was found that the more than twenty bank cards used by Li and the others had a unilateral transaction flow of over 38 million yuan, with the victims' illicit funds totaling over 300,000 yuan flowing into Li and the others' bank accounts, resulting in a total profit of 107,200 yuan for the four. The court convicted the four of "aiding information network criminal activities."

According to Article 287-2 of the Criminal Law, the crime of aiding information network criminal activities refers to knowingly providing internet access, server hosting, network storage, communication transmission, and other technical support for others committing crimes using information networks, or providing assistance such as advertising promotion and payment settlement. In serious cases, the punishment is imprisonment for up to three years or criminal detention, and a fine may also be imposed.

Furthermore, according to Article 12 of the "Interpretation of Several Issues Concerning the Application of Law in Handling Criminal Cases Involving Illegal Use of Information Networks and Aiding Information Network Criminal Activities" issued by the Supreme People's Court and the Supreme People's Procuratorate, if a person knowingly provides assistance to others committing crimes using information networks and meets any of the following circumstances, it should be recognized as "serious circumstances" as stipulated in the first paragraph of Article 287-2 of the Criminal Law:

(1) Providing assistance to three or more subjects;

(2) The payment settlement amount exceeds 200,000 yuan;

(3) Providing funds exceeding 50,000 yuan through advertising or other means;

(4) Illegal gains exceed 10,000 yuan;

(5) Having been administratively punished for illegal use of information networks, aiding information network criminal activities, or harming the security of computer information systems within two years, and then aiding information network criminal activities again;

(6) The crime committed by the aided subject results in serious consequences;

(7) Other serious circumstances.

In this case, Li and others used personal identity information to open multiple bank cards, trading Tether on the pex platform and receiving RMB. Although the virtual currency prices on the pex platform were higher than on other platforms and were easily influenced by illegal funds, they still chose to trade on that platform. When encountering fraudsters as trading counterparts, they sold Tether and directly provided their bank accounts to the victims, becoming the primary receiving accounts for the illicit funds. In this context, whether Li and others' actions should be classified as payment settlement actions is debatable.

Article 3 of the "Payment Settlement Measures (Yin Fa [1997] No. 393)" defines payment settlement, but the act of buying and selling virtual currency is not included. Additionally, the judgment document did not adequately explain the legal basis for classifying virtual currency trading as "payment settlement." However, in judicial practice, there may be a tendency for judicial authorities to expand the interpretation of payment settlement actions.

Regarding the establishment of the crime of aiding information network criminal activities, the key lies in whether the actor "knowingly" or "should have known." Article 11 of the "Interpretation of Several Issues Concerning the Application of Law in Handling Criminal Cases Involving Illegal Use of Information Networks and Aiding Information Network Criminal Activities" clarifies the circumstances for determining "knowing." Based on the facts of the case, although the trading platform chosen by Li and others is not mainstream, this alone does not indicate that their behavior is abnormal. Moreover, the transaction fees they charged were not unusual. However, after being informed that the platform involved illegal funds and that the company could not operate normally, Li and others continued to trade, and they did not stop trading even after their bank cards were frozen. These actions may constitute "knowing."

Additionally, in practice, the distinction between the crime of aiding information network criminal activities and the crime of concealing or disguising criminal proceeds is also a highly controversial issue. In judicial practice, it is crucial to distinguish between the application of the crime of aiding information network criminal activities and the crime of concealing or disguising criminal proceeds. Specifically, the following points are key to differentiating these two crimes:

First, from the perspective of the object and method of the act. The crime of aiding information network criminal activities does not require that the funds assisted are criminal proceeds; it emphasizes providing assistance to upstream crimes, focusing on the nature of the assistance itself rather than the nature of the funds. In contrast, the crime of concealing or disguising criminal proceeds requires the actor to engage in specific actions such as assisting others in transferring, cashing out, or moving property. The crime of aiding information network criminal activities typically manifests as providing assistance such as bank cards, while the crime of concealing or disguising criminal proceeds involves targeted and purposeful actions to hide or transfer property.

Second, in terms of subjective awareness. The crime of aiding information network criminal activities does not require the actor to have specific knowledge of whether the upstream crime constitutes a criminal act; it is sufficient for the actor to recognize that the assisted subject is engaged in illegal activities. In contrast, the crime of concealing or disguising criminal proceeds requires the actor to know that the funds are criminal proceeds and to engage in hiding or transferring them. Here, the actor does not need to have a clear understanding of the specific crime of the upstream act, but only a general awareness of it.

Finally, regarding the timing of providing assistance. The crime of concealing or disguising criminal proceeds often occurs after the criminal act has ended, i.e., when the proceeds of the upstream crime reach the actor, who then engages in hiding or transferring actions. In contrast, the crime of aiding information network criminal activities involves assistance before or during the act. However, using the timing of the act as a distinguishing criterion may raise questions, as the actor may provide payment settlement assistance without a clear understanding of the upstream crime's circumstances. Therefore, it is necessary to comprehensively consider factors such as the actor's level of subjective awareness, the object of the act, the method of the act, and the timing to make an accurate judgment.

IV. Risk Prevention Reminders and Compliance Suggestions

In summary, due to the unclear nature of virtual currencies and the diversity of their application scenarios, there are numerous and ongoing disputes regarding the crimes involved. In recent years, especially in the fields of money laundering and foreign exchange crimes, virtual currencies have gradually become a new type of criminal tool. On the other hand, many criminals exploit the public's limited understanding of virtual currencies and their expectations of high returns to continuously create new scams, severely harming citizens' property security. Therefore, in recent years, China has shown a clear trend of tightening regulation on digital currencies and cracking down on related crimes.

In this context, as investors, standing at the forefront of the digital age, we find it difficult to accurately determine whether digital currencies are valuable products of the new technology of blockchain or yet another problematic financial method under the backdrop of informatization. However, every investor and every enterprise should clearly recognize the legal risks behind digital currencies, especially being vigilant about related criminal liabilities, and strictly comply with relevant laws and regulations. Only in this way can risks be reduced and stable growth achieved in investment operations.

As platform operators and currency merchants, to effectively avoid money laundering risks, merchants can take a series of measures to ensure that the transactions conducted are legal and genuine digital currency transactions. These measures include requiring buyers to provide real transaction records from recent months, ensuring that funds remain in the account for a longer period rather than being quickly deposited and withdrawn. Additionally, merchants can require buyers to provide KYC (Know Your Customer) information, save WeChat chat records, and conduct online transfers.

Through these measures, merchants can avoid transactions involving "straw men," thus completing genuine digital currency transactions. Even if there is an influx of illicit funds, they can quickly assist law enforcement in solving cases and identifying the real criminals, avoiding being mistakenly regarded as individuals aiding criminals in money laundering.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。