Original | Odaily Planet Daily (@OdailyChina)

In the past two months, ZEC has skyrocketed from $35 to nearly $450, an increase of almost 13 times. Just six months ago, ZEC was included in Binance's second round of "vote to delist" candidate projects. How did such a coin, on the verge of being delisted, achieve an astonishing comeback and return to the spotlight in just two months?

Shielded Transactions: Achieving Optional Privacy

Before DeFi Summer, the imagination of the entire crypto world was almost entirely focused on how to "fill the gap" left by Bitcoin: digital cash, decentralized governance, or extreme expressions of decentralization. Zcash (ZEC) was born in this context.

On October 28, 2016, a team led by scientist Zooko Wilcox launched this privacy public chain, based on a fork of Bitcoin's code, with the mission of "making digital cash truly as private as cash." Unlike Bitcoin's transparent ledger, Zcash introduced zero-knowledge proof (zk-SNARKs) technology, allowing users to conduct fully shielded transactions on the blockchain.

In simple terms, zk-SNARKs allow users to prove the legitimacy of a transaction to the network without revealing any transaction details: who the sender is, who the receiver is, how much is involved, and even the transaction time can be completely hidden. This is known as "shielded transactions," where users can transfer ZEC from transparent addresses (t-addr, similar to Bitcoin's public ledger) to shielded addresses (z-addr, anonymous like cash), thus achieving "optional privacy"—satisfying regulatory compliance (such as tax reporting) while protecting sensitive transactions.

Since its launch, Zcash has undergone three iterations of privacy protocol, named Sprout, Sapling, and Orchard. Each new version introduces a new shielded pool while maintaining backward compatibility with previous versions.

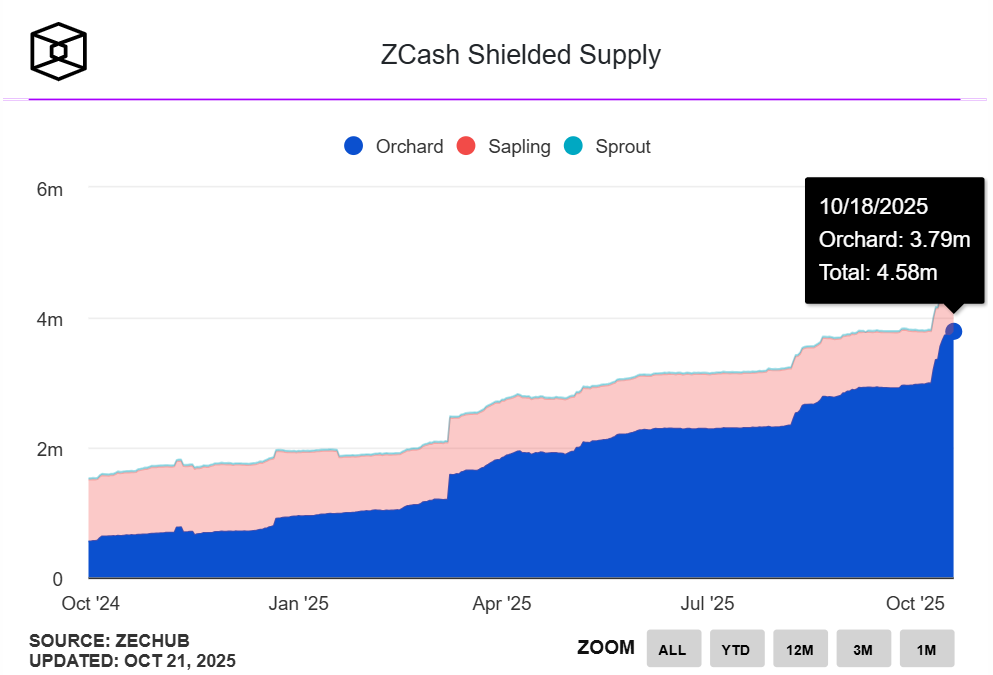

The actual adoption rate of this technology is the core support for the ZEC narrative. According to the latest ZEC shielded supply chart released by The Block, the supply of Zcash's shielded pool has exceeded 4.5 million ZEC, accounting for over 27.5% of the total circulating supply (approximately 16.34 million), reaching a historical high. In the past three weeks, we can clearly see a small peak in the supply of the shielded pool, indicating that the actual adoption rate is rising. Orchard (the latest and most secure implementation) has contributed most of the recent growth. It is reported that a shielded transaction can be verified in just a few seconds without leaking any metadata.

The chart is from The Block

Electric Coin Co. (the creator of ZEC) released a Q4 roadmap on November 1, planning to further optimize shielded features, including temporary addresses and hardware wallet integration to enhance usability. Additionally, cross-chain privacy upgrades and DEX access expansion may further lower the entry barrier and drive up the adoption rate.

Surge in Privacy Demand: The "Counterforce" Under Regulatory Shadows

If the data above reveals the results, the question is: why did it explode at this moment?

On October 14, the U.S. Department of Justice announced criminal charges against Chen Zhi, the founder of the Cambodian Prince Group, and sought to confiscate 127,271 BTC under his control, valued at approximately $15 billion, making it the largest Bitcoin judicial confiscation case in the world.

From a regulatory perspective, this is a "great victory" for the rule of law; but from a crypto perspective, it once again validates the "pseudo-anonymity" of Bitcoin. Even without cracking encryption algorithms, the U.S. government can still complete the "judicial transfer" of assets through legal procedures. Through on-chain tracking and international cooperation, law enforcement agencies identified Bitcoin scattered across multiple addresses, all controlled by Chen Zhi. The court subsequently issued a seizure order, legally transferring these assets to addresses controlled by the U.S. government, entering judicial custody, awaiting a final civil forfeiture judgment.

We must face a reality—the gray market has always been the invisible main force behind the adoption rate of privacy coins. While they are not the only users of ZEC, they are indeed the core driving force behind on-chain privacy demand. As regulatory pressure tightens, the gray market's space for survival becomes narrower, and they may be more urgently turning to privacy fortresses like ZEC, attempting to evade tracking through the "digital black box" constructed by zk-SNARKs technology, achieving secretive fund flows.

However, the resurgence of privacy is not limited to the "gray world." On September 14, the Ethereum Foundation released an end-to-end privacy roadmap, attempting to transform privacy from a marginalized hedging tool into a public infrastructure. The roadmap focuses on three main directions: privacy writing, making on-chain privacy operations as efficient as public operations; privacy reading, allowing access to blockchain data without exposing identity and intent; and privacy proof, ensuring that the generation and verification processes are fast and secure. The team is developing an experimental L2 design called PlasmaFold, which is set to debut at the Argentina Devconnect conference on November 17, and advance privacy RPC services. Additionally, a report titled "2025 Privacy Voting Status" will be released, exploring DeFi protocols and privacy computing projects that balance privacy and compliance.

Ethereum co-founder Vitalik Buterin also encourages developers to actively participate in the entrepreneurship, underlying research, and application practice of zero-knowledge proof (ZK) and homomorphic encryption (FHE) technologies, believing that "when ZK and FHE reach the same level of popularity, the real blockchain revolution will begin." In the future, ZK will not only be used for scaling and privacy but will also enhance decentralization, "Five years from now, people will no longer ask why to use ZK, but rather why not to add ZK."

As the second-largest blockchain globally, Ethereum is also building comprehensive privacy protection, with its original "Privacy and Scalability Exploration Team" renamed to "Ethereum Privacy Steward" (PSE), shifting its focus from speculative exploration to solving practical problems and optimizing ecological outcomes.

This trend also indicates that the rise of ZEC may not be a coincidence driven by speculative sentiment, but rather a signal of the resurgence of privacy demand, laying the groundwork for the rise of other privacy tokens.

Halving Expectations and Celebrity Endorsements: The Scarcity Narrative Engine Ignited

On the price front, ZEC's rise is also inseparable from another traditional narrative—halving expectations.

ZEC's third halving is expected to occur in November 2025, at which point the miner's reward will drop from 1.5625 ZEC per block to 0.78125 ZEC. This change means that the speed of new coin issuance will significantly decrease, and the inflation rate will drop from about 8% to 4%. This design follows Bitcoin's monetary logic—a "technological monetary tightening policy" that does not rely on central banks but is automatically executed by algorithms. Within the framework of periodic scarcity, the market will naturally price in the future "supply reduction."

Throughout the history of cryptocurrencies, the market has responded enthusiastically to the narrative chain of "supply halving → increased scarcity → value reassessment," as evidenced by ZEC's last halving. Its last halving on November 18, 2020, saw the price rise from $50 two months before the halving to a peak of $370 six months after. If this time cycle is replicated, has ZEC's rise only just begun?

At the same time, the celebrity effect has always been a powerful price booster in the crypto industry. Notable investor Naval Ravikant began publicly endorsing ZEC when it was around $80, calling it "Bitcoin's insurance policy"; BitMEX co-founder Arthur Hayes stated on social media, "Nothing can stop this train," and suggested that ZEC's price could rise to $10,000; Helius Exchange founder @0xMert_ and Placeholder partner Chris Burniske, among other crypto industry OGs, have also voiced support for ZEC.

Driven by this "narrative complex," ZEC has regained attention and reestablished its presence. In the process of mutual reinforcement between narrative and price, it is gradually completing its return from "marginal legacy" to "narrative hub."

Contract Structure: The "Game Curve" Between Retail and Whales

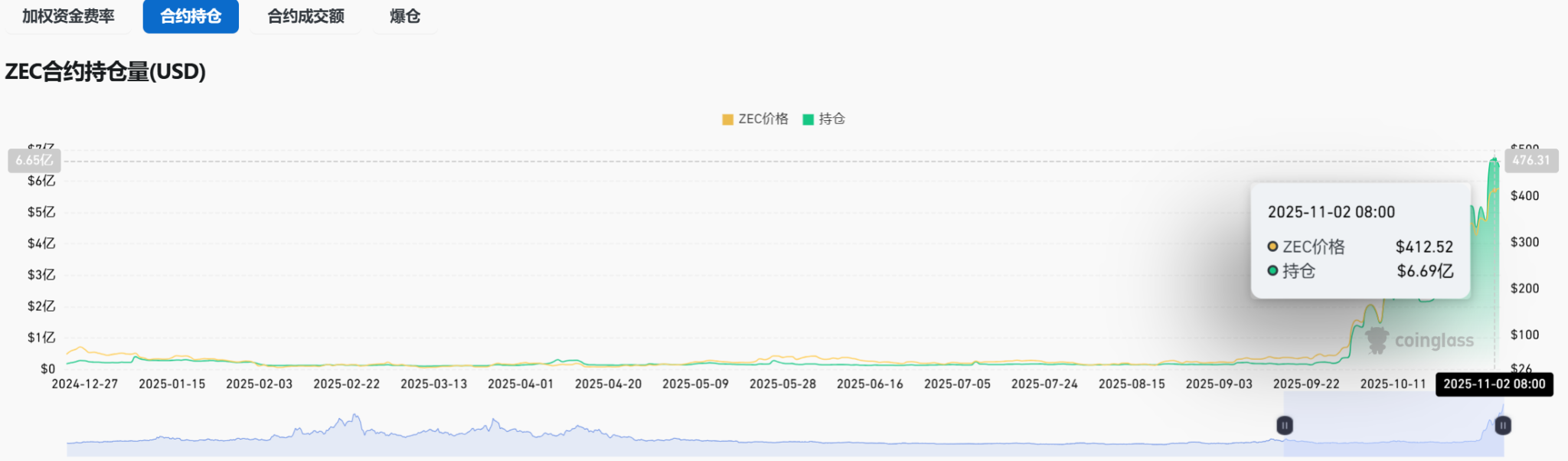

According to Coinglass data, ZEC contract open interest surged in October. As ZEC's price broke through $400, the total contract open interest across the network exceeded $600 million, reaching a historical high; among them, Binance's contract open interest reached $213 million, and Hyperliquid's contract open interest reached $138 million.

ZEC contract data shows that the current long-short open interest ratio has reached 0.5, indicating that the market currently has a strong short sentiment, while the funding rate has remained negative since October 22 (maintaining around -0.18 to -0.2), meaning shorts are "paying interest" to longs.

Here, we can pay attention to two data points, active buy-sell volume (difference) and active buy-sell count (difference). Active buy-sell volume (difference) is a net value indicator that reflects the net inflow/outflow direction of active funds in the contract market. Active buy-sell count (difference) is a counting indicator that focuses on the "activity" of trades and the number of participants.

In ZEC's contract data performance, we can clearly see that since October, the inflow of funds has exceeded the outflow, indicating that a large number of contracts are still lingering in the market. On October 26 and October 31, the active buy-sell volume (difference) and active buy-sell count (difference) showed a significant divergence, with an increase in selling frequency but a noticeable increase in fund inflow. In this case, can we interpret it as a signal of "retail exiting, whales entering"? Of course, the rise in ZEC's price has provided the best proof.

And now, we still do not see large-scale fund outflows.

Epilogue: The Restoration of Privacy

ZEC's explosive rise proves that privacy has never been a narrative that has been completely abandoned; it has merely been temporarily submerged by the waves of regulation and compliance. Currently, this nostalgic sentiment is making a comeback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。