加密市场表现

当前,加密货币总市值为 3.71 万亿美元,BTC占比 59.3%,为 2.2万亿美元。稳定币市值为3071亿美元,最近7日减少0.59%,值得注意的是,稳定币数量在本周出现负增长,其中USDT占比59.69%。

CoinMarketCap 前200的项目中,大部分下跌小部分上涨,其中:ZEC 7日涨幅58.98%,VIRTUAL 7日涨幅57.8%,DASH 7日涨幅47.23%,ZEN 7日涨幅79.8%,HNT 7日涨幅29.57%。

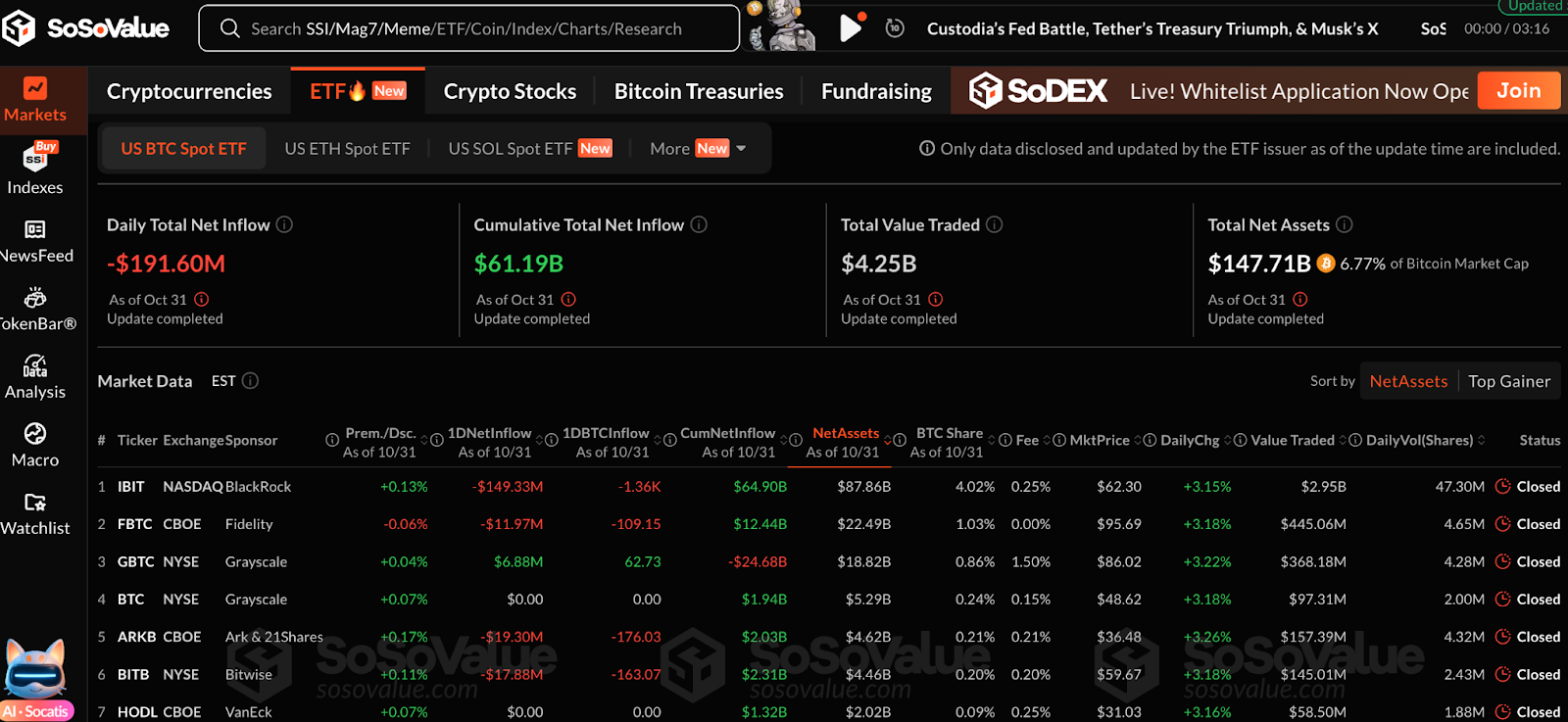

本周,美国比特币现货ETF净流出:8亿美元;美国以太坊现货ETF净流入:1640万美元。

市场预测(11月3日-11月7日):

目前RSI指数为46.56(中性区间),恐惧贪婪指数为32(指数低于上周,恐惧区间),山寨季指数为43(低于上周)。

BTC核心区间:$107,000-112,000

ETH核心区间:$3,600-4,100

SOL核心区间:$175-205

本周美联储如期降息25个基点,但鲍威尔对12月是否降息持“鹰派”态度,这对市场有一定的冲击性,部分长持者在获利了结,导致市场出现“买预期卖事实”的情况,后期应重点关注,影响利率决议的新言论及现货ETF的流入、流出状态,这是市场的核心变量,总之市场正处于关键的技术节点,下周会是一个震荡和选择方向的阶段。

对于长期投资者,核心思路是忽略短期噪音,聚焦于长期价值和趋势。

对于短期交易者,下周将是关键的技术博弈期,需要更灵活和敏锐的反应。在方向不明朗时,务必保持低杠杆甚至零杠杆,避免因剧烈波动被强制平仓。

了解现在

回顾一周大事件

1. 10 月 27 日,当地时间 10 月 26 日中美经贸团队在马来西亚首都吉隆坡结束为期两天的磋商。路透社称,这是自今年 5 月以来中美经贸团队的第五次面对面磋商。会谈结束后,美国财长贝森特在接受美媒采访时表示,经过吉隆坡为期两天的会谈,双方达成了「非常实质性的框架协议」,美方「不再考虑」对中国加征 100% 的关税;

2. 10 月 27 日,周一开盘,现货黄金跳空大幅低开 40 美元后反弹,现报 4102 美元/盎司;

3. 10 月 26 日,美泰联合声明表示,美国将维持对泰国 19% 的关税。泰国将取消约 99% 商品的关税壁垒,涵盖美国全部工业产品以及食品和农产品;

4. 10 月 28 日,GMGN 官方在社交媒体上发文表示,「针对近期有关 GMGN 遭遇黑客攻击、导致用户资金损失的虚假传闻,已立即展开全面的安全审计。现确认平台不存在任何安全问题,用户资金安全」;

5. 10 月 28 日,据官方消息,Coinbase 全球公司旗下的全资投资管理机构——Coinbase 资产管理公司(CBAM),今日宣布与资管巨头 Apollo(纽约证券交易所代码:APO)建立战略合作,共同推出基于稳定币的信贷策略方案。此举将构建连接稳定币、私募信贷与资产代币化三大领域的桥梁,旨在快速扩张的稳定币生态中开拓优质信贷机遇;

6. 10 月 29 日,据 TheBlock 报道,Visa 将在四个独立的区块链上接受四种稳定币的付款,这些稳定币可以兑换成 2 种目标法定货币,并可以再次转换为超过 25 种传统法定货币;

7. 10 月 30 日,据路透社援引知情人士报道,OpenAI 正在为 IPO 做准备,估值可能高达 1 万亿美元。知情人士透露,公司正考虑最早于 2026 年下半年向监管机构提交文件,筹资金额下限为 600 亿美元,具体估值与时机将视业务增长和市场情况而定。OpenAI CFO Sarah Friar 向部分人士表示,公司目标是在 2027 年上市;

8. 10 月 30 日,据 Axios 报道,消息人士透露,MetaMask 的母公司 Consensys 已聘请摩根大通(JPMorgan)和高盛集团(Goldman Sachs)牵头其首次公开募股(IPO)。据悉此次 IPO 最早可能在 2026 年进行,但未透露有关规模和估值的细节;

9. 10 月 31 日,以太坊基金会的研究人员已正式为其主网硬分叉(代号「Fusaka」)设定了日期。在周四的「所有核心开发者」电话会议上,以太坊基金会的研究人员表示,Fusaka 将于 12 月 3 日上线;

10. 10 月 31 日,据 CNBC 报道,Coinbase Q3 财报表现超预期,Q3 净利润从去年同期的 7550 万美元(每股 28 美分)增至 4.326 亿美元(每股 1.50 美元)。每股收益超过了伦敦证券交易所集团汇总的分析师共识预期 1.10 美元;

11. 10 月 31 日,据彭博社报道,Strategy 于美股盘后公布 Q3 财报,受其约 690 亿美元加密货币持仓升值带来的未实现收益推动,该公司当季实现净利润 28 亿美元。

宏观经济

1. 10 月 29 日,加拿大央行将基准利率下调 25 个基点至 2.25%,符合市场预期,连续第二次降息;

2. 10 月 30 日,美联储 FOMC 声明宣布将于 12 月 1 日结束资产负债表缩减。(当前为每月减持 50 亿美元美债和 350 亿美元 MBS;

3. 10 月 30 日,美联储将基准利率下调 25 个基点至 3.75%-4.00%,为连续第二次会议降息,符合市场预期;

4. 10月31日,据美联储利率观测器,12月降息25个基点的概率为60.8%。

ETF

据统计,在10月27日-10月31日期间,美国比特币现货ETF净流出:8亿美元;截止到10月31日,GBTC(灰度)共计流出:246.38亿美元,目前持有188.33亿美元,IBIT(贝莱德)目前持有884.21 亿美元。美国比特币现货ETF总市值为:1490亿美元。

美国以太坊现货ETF净流入:1640万美元。

预见未来

活动预告

1. Bitcoin MENA 将于 12 月 8 日至 9 日在阿布扎比国家展览中心 (ADNEC) 举行;

2. Solana Breakpoint 2025 将于 12 月 11 日至 13 日在阿布扎比举行。

项目进展

1. YGG Play Launchpad 平台首个上线项目为游戏 LOL Land 的游戏内忠诚度和奖励代币 LOL,将于 11 月 1 日正式上线并在 DEX 开启交易;

2. Monad 空投领取截止日期为 11 月 3 日。

重要事件

1. 纳斯达克向美 SEC 申请将 XRP、SOL、ADA、XLM 添加到加密货币指数,最终决定预计于 11 月 2 日前作出;

2. 比特币隐私钱包 Samourai Wallet 相关审判日期已定为 2025 年 11 月 3 日。

代币解锁

1. Sui(SUI)将于 11 月 1 日 解锁 4396 万枚代币,价值约1.03 亿美元,占流通量的1.21%;

2. EigenCloud(EIGEN)将于 11 月 1 日 解锁 3682 万枚代币,价值约3399万美元,占流通量的12.10%;

3. Omni Network(OMNI)将于 11 月 2 日 解锁 799 万枚代币,价值约1734万美元,占流通量的30.30%;

4. Memecoin(MEME)将于11月3日解锁34.5亿枚代币,价值约523万美元,占流通量的5.98%。

关于我们

Hotcoin Research 作为 Hotcoin 交易所的核心投研机构,致力于将专业分析转化为您的实战利器。我们通过《每周洞察》与《深度研报》为您剖析市场脉络;借助独家栏目《热币严选》(AI+专家双重筛选),为您锁定潜力资产,降低试错成本。每周,我们的研究员还会通过直播与您面对面,解读热点,预判趋势。我们相信,有温度的陪伴与专业的指引,能帮助更多投资者穿越周期,把握 Web3 的价值机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。