Author: Stacy Muur

Translation: Chopper, Foresight News

Tria is a non-custodial new banking application that allows users to spend, trade, and earn on over 100 chains, with zero gas fees and no need for mnemonic phrases. It will launch its "Contribution-Based Sale Round" on November 3 at Legion's Nozomi.

Tria Investment Logic

The core logic of Tria is simple. It is expected that by 2030, on-chain transaction volume will approach $100 trillion, but the bottleneck in the industry is not yield or liquidity, but usability.

The monthly settlement volume of stablecoins has exceeded $1.1 trillion, surpassing Visa and Mastercard, yet most people still cannot use cryptocurrencies in everyday scenarios. Tria addresses this issue through a cross-chain abstracted new banking solution: it retains non-custodial characteristics while hiding the technical complexities of cryptocurrencies.

The highlights of Tria's product include:

- Spending: Supports Visa card payments in over 150 countries, with cashback rates up to 6%, and zero fees for deposits/withdrawals/payments/foreign exchange transactions;

- Earnings: Idle assets can earn up to 15% annualized returns, with the ability to automatically pay bills with earnings;

- Trading: One interface covers over 100 chains, with built-in AI narrative tracking functionality — supported by BestPath AVS technology.

- After 11 weeks of closed testing: Revenue of $1.2 million, transaction volume of $15 million, 20,000 users, and 4,400 alliance members; average revenue per user is $105 (about twice that of Phantom). BestPath has been adopted by over 70 protocols (such as Arbitrum, Polygon, Injective, Sentient) and covers more than 250,000 users through integration.

Tria enables cryptocurrencies to achieve "use and go," demonstrating innovation in several areas.

- BestPath AVS (Intent Market): Solvers, relayers, liquidity routers, and fast finality layers compete to match the optimal execution path for each transaction. The system scores based on cost, speed, and security, ensuring optimal settlement without the need for cross-chain bridges;

- Unchained (AVS Layer 2 → Layer 1): An EVM-compatible, consumer-facing execution environment that will be upgraded to a Layer 1 network in the future — optimized specifically for payment and agent interaction scenarios;

- Multi-virtual machine support: Compatible with EVM, SVM, IBC, Move, BTC, providing a single software development kit (SDK) for a "chain-agnostic" user experience.

Tria's ultimate goal is to build a "chain-agnostic" financial operating system that retains non-custodial characteristics, simplifies the usage process, and achieves mainstream user adoption at scale.

Support from Nozomi

Tria is not just a product launch; it is also a typical case of Nozomi's "fair, compliant, contribution-based" model.

Unlike traditional sales that are "only for venture capitalists and overvalued," Nozomi adopts a "Legion scoring" mechanism to allocate participation qualifications based on on-chain activity, community contributions, influence, and expertise.

How to allocate sale quotas?

- Purchase any Tria card using a discount code (enjoy a 20% discount) to gain access to locked quota channels;

- Complete KYC certification on Legion;

- Submit a priority quota form;

- Actively using the card can unlock airdrops. (Note: Currently, over $30 million in funds are interested, and the sale is likely to be oversubscribed.)

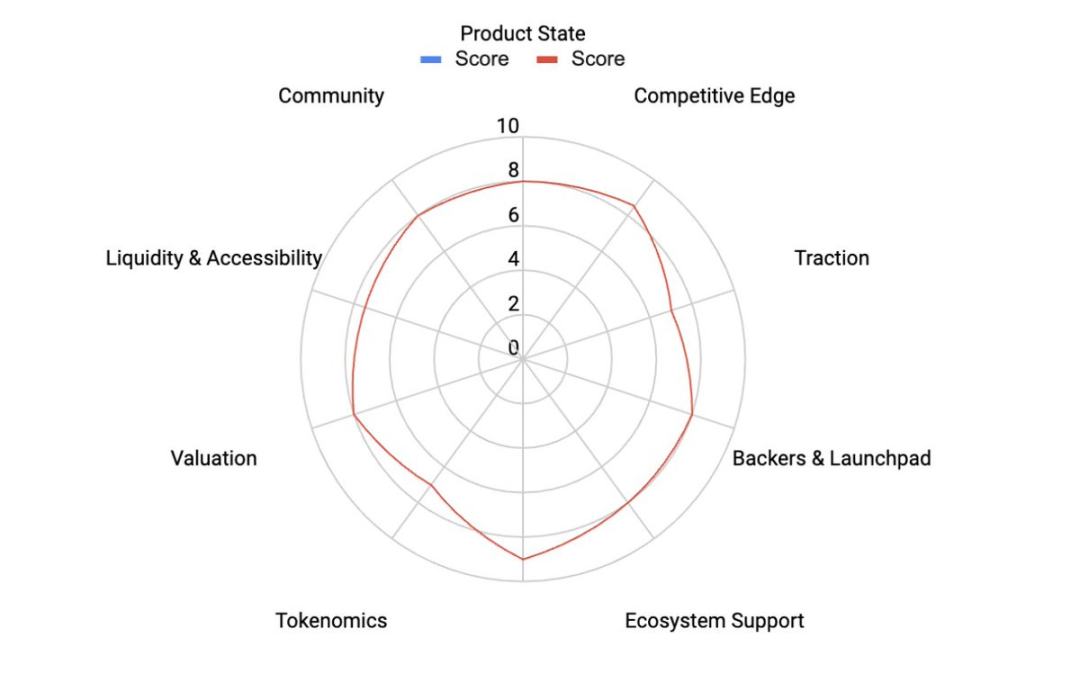

My Evaluation Framework

The Muur Score framework focuses on the core dimensions of the project: product, token design, user growth, investors, and market environment, and weights the scores by importance.

For Tria, the evaluation dimensions include:

- Product: Chain-agnostic new banking experience, BestPath AVS + Unchained infrastructure, closed testing data;

- Token economics: Functional use, allocation/unlocking mechanisms, issuance valuation;

- Community and narrative: Alliance promotion network, natural dissemination heat, trends in new banking/intent layer tracks;

- Distribution model: Legion's contribution-based sale mechanism, card locking quota channels.

Overall score: 8.21/10. Tria has real revenue, clear differentiated advantages, and a collaborative distribution model, but there are still uncertainties in scaling compliance, liquidity management, and multi-virtual machine routing at the execution level.

Token Economics

Tria will launch its community sale round on November 3 through the Legion platform. The fully diluted valuation (FDV) for this round of sales is divided into two tiers: $100 million (30% unlock) or $200 million (60% unlock). The unlocking mechanism consists of a 2-month lock-up period + 6 months of linear unlocking.

The uses of the TRIA token include:

- Settlement for BestPath and the new banking ecosystem;

- Payment of fee discounts (gas fees/transaction fees/card fees);

- Staking to become "Pathfinders";

- Distribution of ecosystem rewards, governance voting;

- Structured buyback and burn of protocol revenue.

The token generation event (TGE) is planned for the fourth quarter of 2025.

Token economics assessment

- Functional use: 9/10 — indispensable demand support on both the consumer and infrastructure sides;

- Structural design: 7/10 — balanced lock-up period and unlocking rhythm, pending complete unlocking curve and audit report;

- Valuation level: 8/10 — $100-200 million FDV is undervalued compared to similar payment/infrastructure projects.

- Liquidity: No score before TGE; trading is expected to begin after the Legion sale, with market makers providing deep liquidity.

Risk Warning

Tria's business prospects face the following challenges:

- Compliance risk: High difficulty in completing compliance filings for card/deposit channels in over 150 countries;

- Execution risk: High complexity in simultaneously advancing consumer banking services and multi-virtual machine infrastructure;

- Competition risk: Custodial new banks may quickly imitate its functions, requiring continuous maintenance of user experience and fee advantages;

- Liquidity risk: Short-term liquidity after launch depends on the allocation situation of the Legion sale, unlocking rhythm, and market maker depth.

Valuation Reference

FDVs for similar payment/consumer infrastructure projects typically range from $350 million to $1 billion after launch, and most have weak revenue before launch.

Tria is priced at a $100-200 million FDV, which, while benchmarking high-potential TGE infrastructure projects, already has real revenue and users, and the token has dual uses on the consumer and infrastructure sides, making its valuation particularly attractive.

Even capturing just a tiny fraction of Revolut's scale (for example, 1% of its $40 trillion annual transaction volume) would mean billions of on-chain transaction volume routed through BestPath/Unchained, indicating significant growth potential.

Conclusion

Catalyst: November 3 Legion sale, with over $30 million in funds already interested before launch;

Core mechanism: BestPath AVS provides the lowest cost and fastest cross-chain execution; Unchained gradually upgrades from AVS Layer 2 to Layer 1;

Sale rules: Purchase Tria cards to lock quotas, card levels at $20/$90/$225; active use can earn airdrops; priority forms must be submitted;

Risk warning: Compliance pressure in over 150 countries, token liquidity after launch, and the complexity of simultaneously advancing consumer and infrastructure businesses.

My score: 8.21/10. If Tria can maintain revenue growth momentum during the public testing phase and successfully achieve global compliance filings, it may become the "Revolut moment" in the crypto space, while also adding another benchmark case for Legion's contribution-based sale model.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。