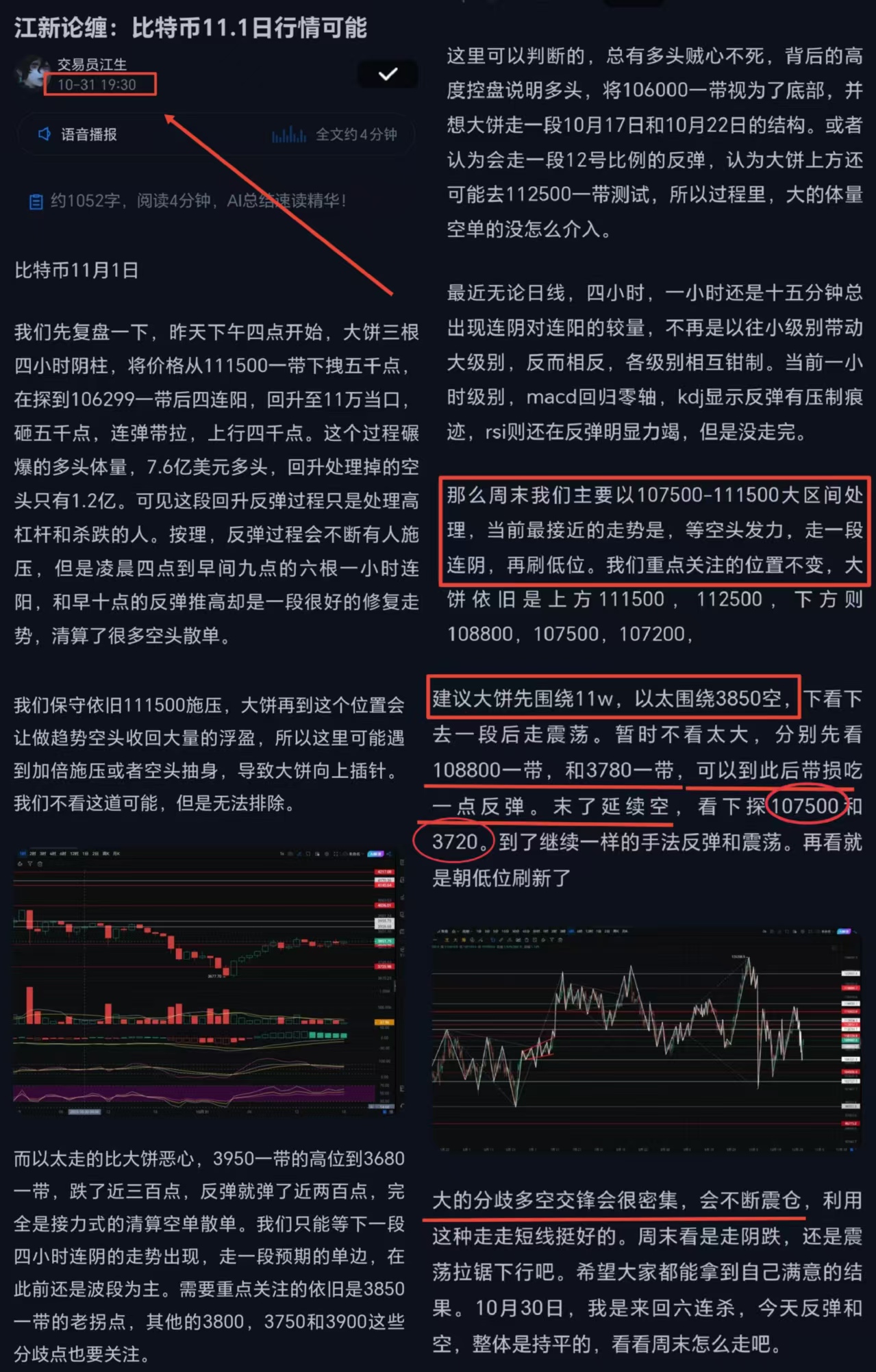

Good evening everyone, I am the old master Jiang Xin. The results given by the market should have made you think of me. A sword opens the gate to heaven, seizing countless bullish opportunities!!! Last week, I suggested entering at the 110,000 mark, looking at 107,200 in batches, while for Ethereum, I looked at 3,850 in batches down to 3,720, which has already been confirmed! The pressure at 111,500 and 3,900 has also been validated! This includes the rhythm of the downward trend and the intense confrontation between bulls and bears, as well as the process of the rebound being confirmed.

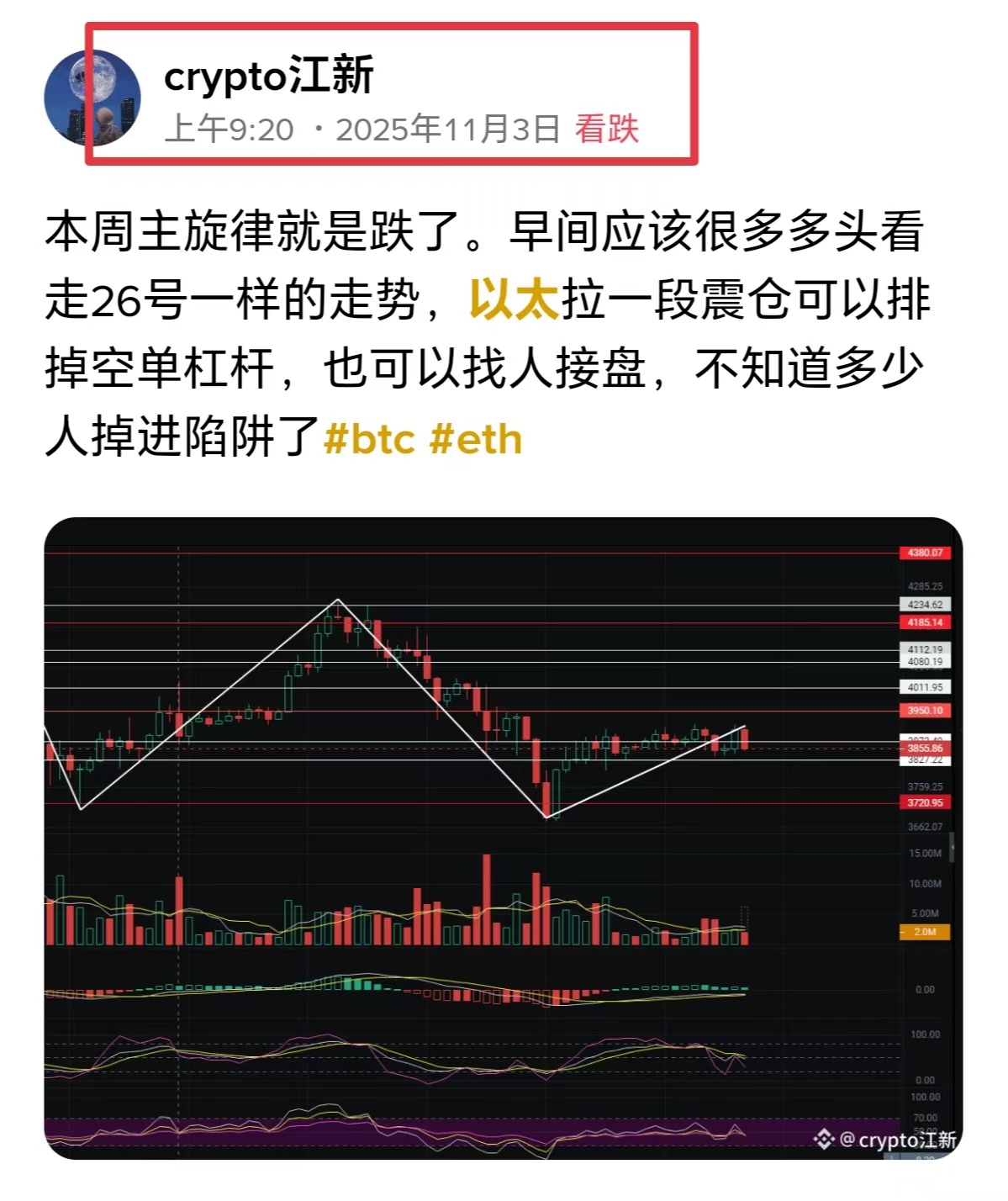

Let’s briefly review a segment. Bitcoin, after a segmented upward probe to 111,000 last Friday, faced resistance and fell back to the old turning point of 108,800. Here, it rebounded to 111,000, and on the afternoon of November 2, it oscillated narrowly around this area, with the process being quite smooth and lacking trading volume. On the afternoon of November 2, Bitcoin surged, and the MACD began to rise above water. This is where both bulls and bears started to contest around the 110,000 mark. The continuous arrangement of bears over the weekend evening indicates that the main force is unloading.

At four in the morning, the bears showed a shrinking four consecutive arrangements. From the bulls' perspective, this is a good opportunity for a second upward probe. The buy-in at seven re-tested the 110,000 mark, and the daily line almost closed positively. But can the bear main force not know this little trick? The bull main force knows to push up and unload; can the bears be unaware? However, the subsequent selling pressure cleared the long positions~ Eight bearish candles in a row, except for a big bearish K after breaking below 108,800, the subsequent downward rhythm was quite ordinary. By the time it reached 107,500, the second phase of contention began.

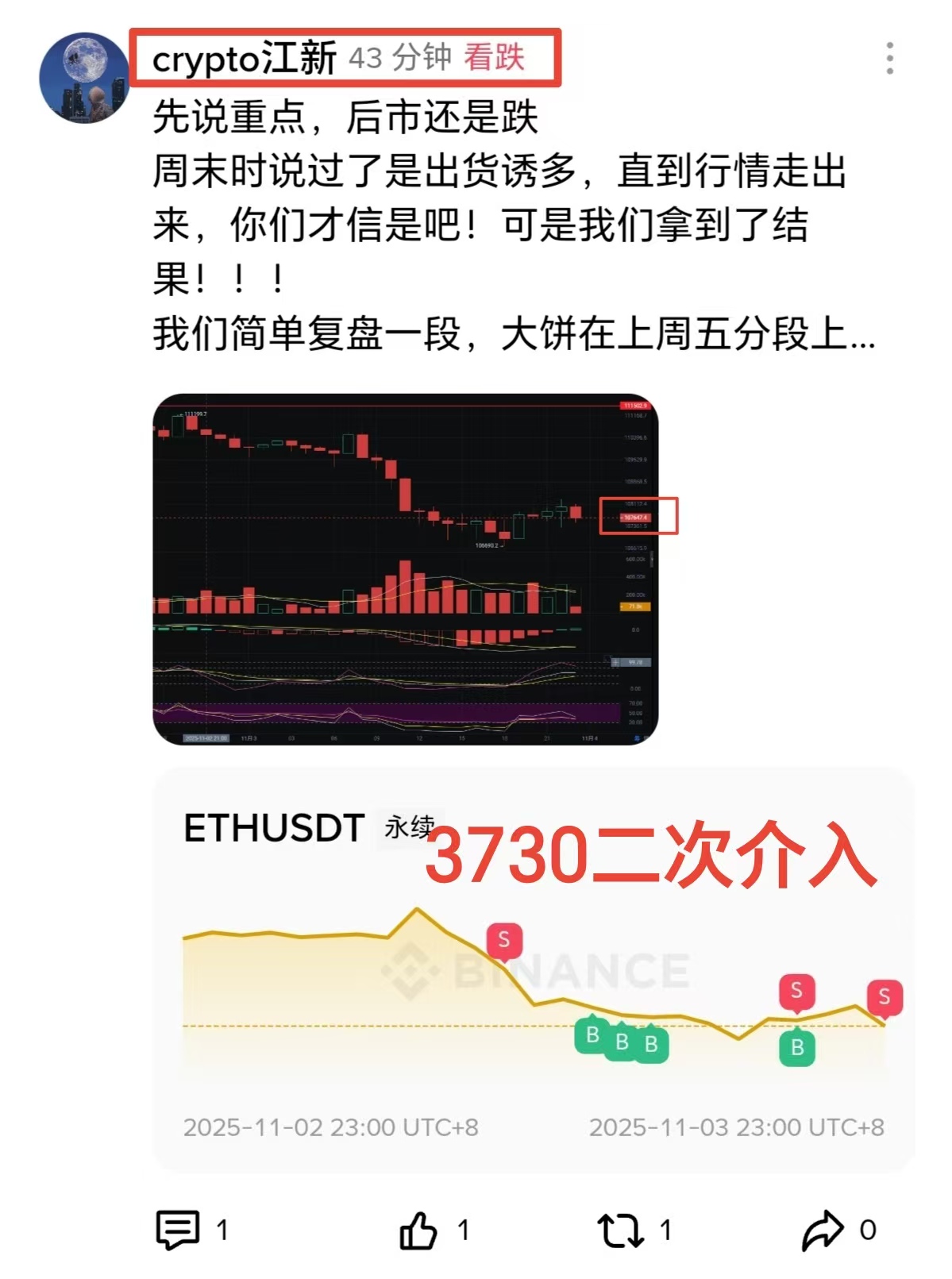

Ethereum's movements were even more pronounced. From the afternoon of November 2 to the morning of November 3, these two buying segments showed a clear top divergence in the one-hour MACD indicator. After the third resistance at 3,900, the daily line closed bearish, and the gradually increasing trading volume of the big bearish candle clearly indicated a purposeful sell-off to liquidate the bulls~ For us, this is just the result aligning with expectations. Today, Ethereum's sell-off was a mix of bullish and bearish, clearly indicating the main force is defending the price. Why wouldn’t they defend? The bulls are about to be liquidated; can they not defend or hedge?

In the intraday crypto market, 300,000 people were liquidated for 1.1 billion, with Bitcoin and Ethereum bulls both facing nearly 300 million in liquidations. Due to the rapid market movements, the writing process has already seen most of the action.

To get straight to the point, for Bitcoin, key levels to watch are 103,500, 105,500, 106,800, and 106,500. For Ethereum, focus on 3,550, 3,580, 3,650, and 3,750. It is recommended to handle trades within the large range of 103,500-108,500 for Bitcoin, and 3,520-3,720 for Ethereum. A one-hour pullback is already in progress, having completed half of its course, and the process may see a fifteen-minute oscillation.

It may also turn into a rebound, but overall, the focus should be on bearish positions. It is suggested to short lightly at 106,800, add at 107,500, and set a stop at 108,800. Be cautious with rebounds. If you want to trade, you can aim for 104,800, add at 103,800, and set a stop at 102,800. For Ethereum, lightly short at the 3,650 turning point, add at 3,720, and set a stop at 3,780. After a segment of the market completes, it is easy to see a wide test of resistance; let’s be cautious, everyone.

This morning continued the thoughts from last week regarding the future market, and in the evening, I pursued a second short at 3,730, which pushed the market down to a low of around 3,526!!!

Still the same saying, walk with giants~

Official account: Jiang Xin on Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。