Author: a16zcrypto

Translation: Baihua Blockchain

As we begin to look back at 2025, here are five indicators that defined the industry this year, from stablecoin trading volume to developer activity and blockchain throughput.

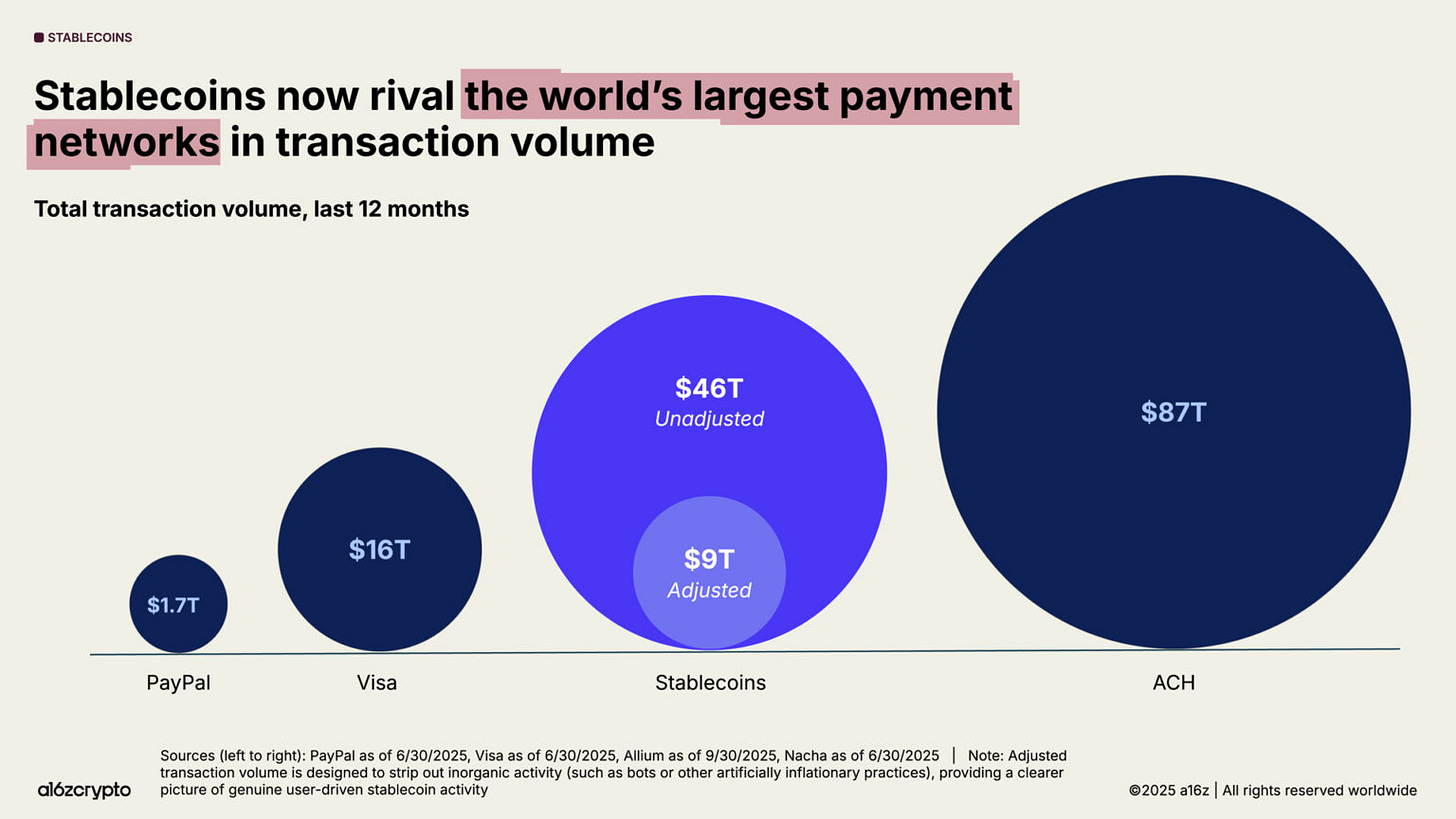

Stablecoin Trading Volume Reaches Trillions of Dollars

Stablecoins have become a global macroeconomic force.

Last year, their total trading volume reached $46 trillion, a year-on-year increase of 106%. This is nearly three times the volume of Visa and is approaching the scale of the ACH network that supports the entire U.S. banking system.

While these are not direct comparisons, the massive trading volume highlights the scale of this trend. (The figures for stablecoins primarily represent financial flows rather than retail payments through credit cards and other networks.)

A better way to measure organic activity is to look at adjusted stablecoin trading volume, which filters out bots and other artificially inflated activities. On this basis, stablecoin trading volume over the past 12 months reached $9 trillion. This is more than five times PayPal's throughput.

Notably, stablecoin trading volume is now largely uncorrelated with broader cryptocurrency trading volume, indicating that stablecoins have found organic use cases and product-market fit outside of crypto market activities.

So, why has the scale and popularity of stablecoins grown so rapidly? Data and Fund Strategy Director Daren Matsuoka explains:

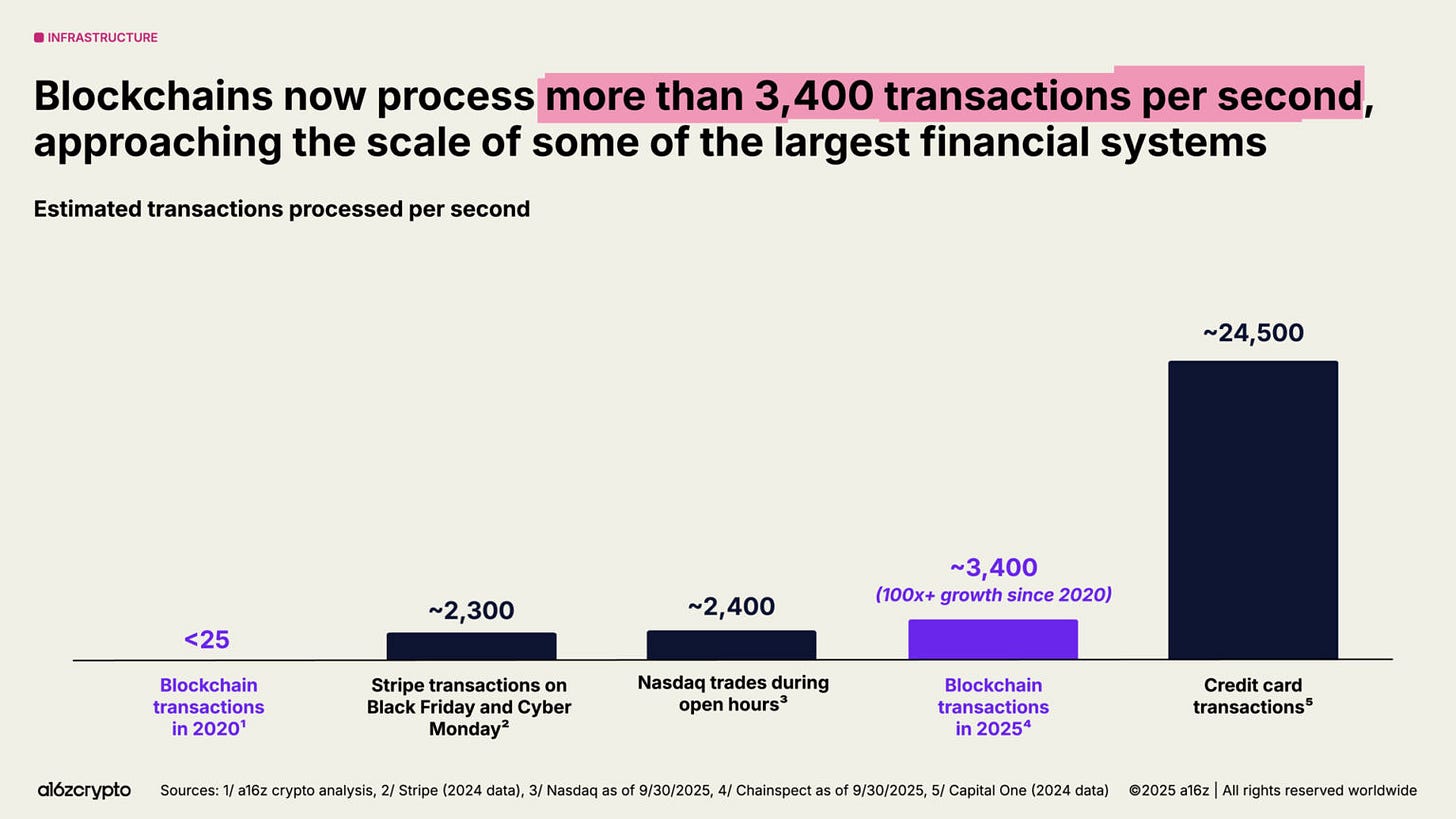

Blockchains Can Process Over 3,400 Transactions Per Second

In just five years, the total transaction throughput of major blockchain networks has increased by more than 100 times.

At that time, blockchains processed fewer than 25 transactions per second. Now they process 3,400 transactions per second, comparable to Stripe's global throughput on "Black Friday"—at a cost that is only a fraction of what it used to be.

Solana's high-performance, low-cost block space now supports a variety of applications, from DePIN projects to NFT markets, with its native applications generating $3 billion in revenue over the past year.

As Ethereum continues to execute its scaling roadmap, much of its economic activity is migrating to L2 (Layer 2 networks). The average transaction cost on L2 has dropped from about $24 in 2021 to now less than 1 cent.

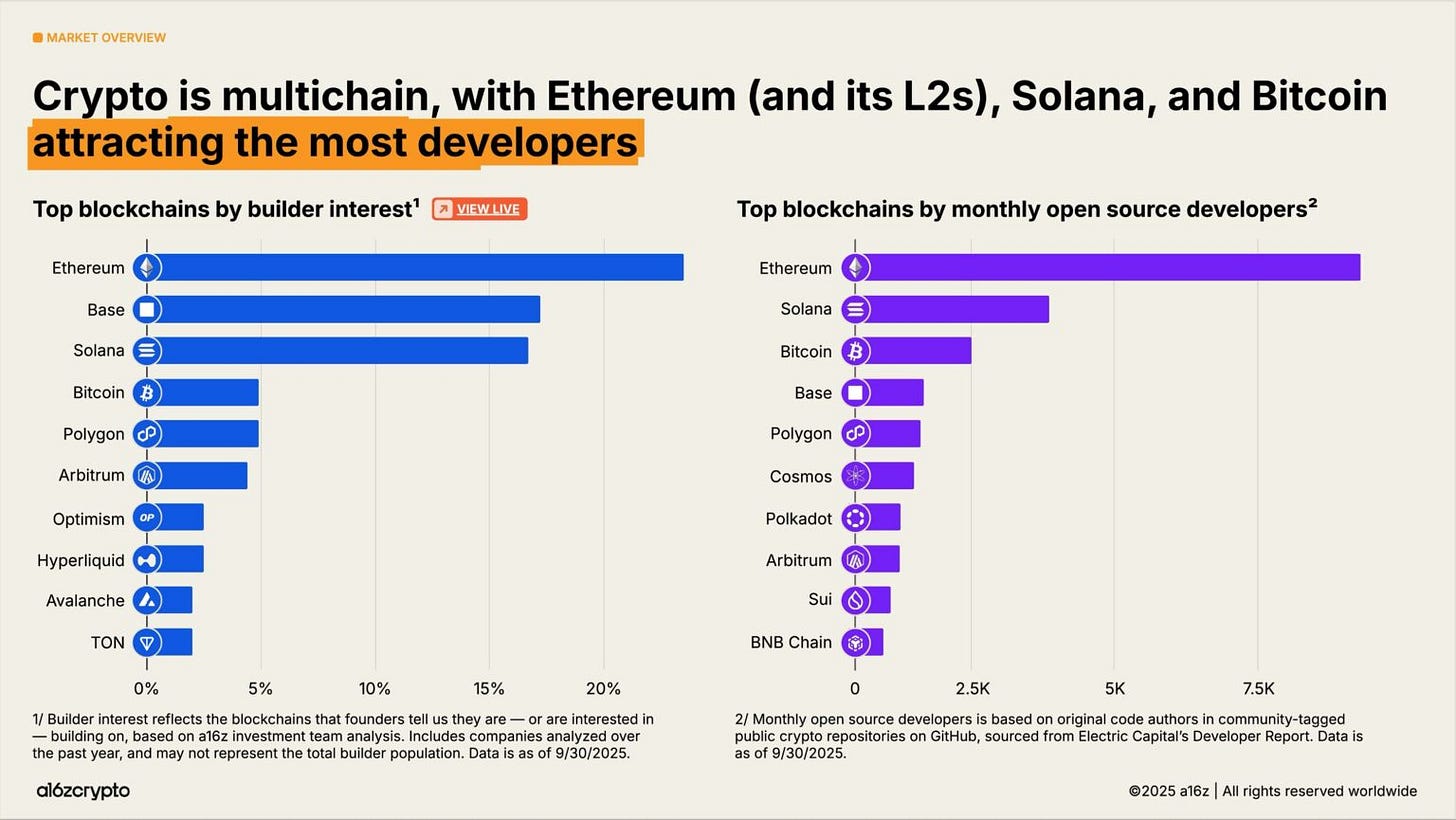

Ethereum, Solana, Bitcoin, and Base Attracting the Most Developers

In 2025, Ethereum and its L2 are the preferred destinations for new builders.

Meanwhile, Solana is one of the fastest-growing ecosystems, with builder interest increasing by 78% over the past two years. This analysis from the a16z crypto investment team reflects the number of founders who tell us they are building or interested in building on which ecosystem.

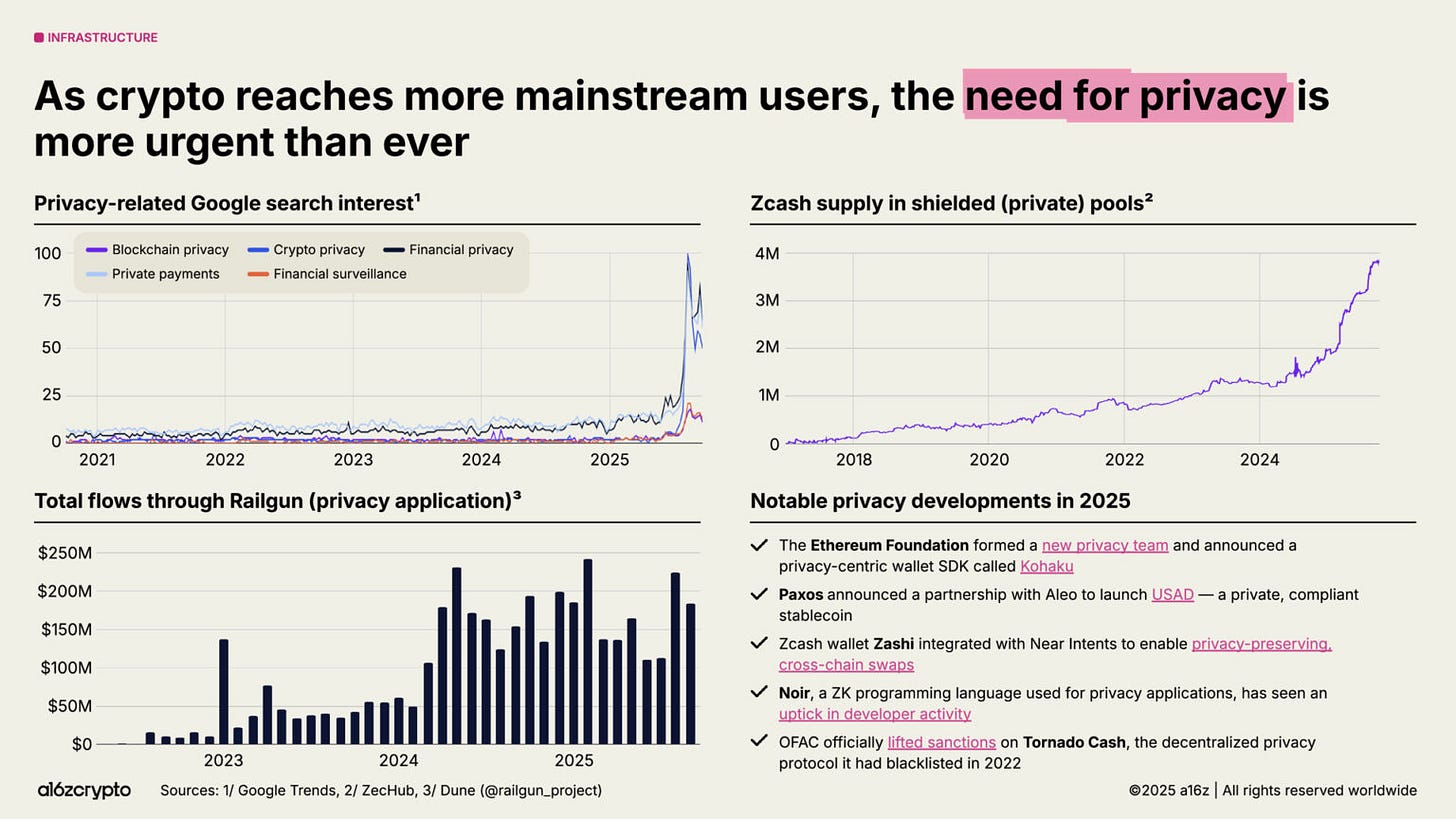

Users Need More Privacy

Here are some indicators of (user) interest and (market) momentum growth:

In 2025, Google search volume related to crypto privacy surged

The supply of Zcash's shielded pool grew to nearly 4 million ZEC

Railgun's monthly transaction volume exceeded $200 million

The Ethereum Foundation established a new privacy team

Paxos partnered with Aleo to launch a compliant privacy stablecoin (USAD)

The U.S. Office of Foreign Assets Control (OFAC) lifted sanctions on the decentralized privacy protocol Tornado Cash

We expect this trend to gain more momentum as cryptocurrencies continue to go mainstream. For more, see a16z crypto CTO Eddy Lazzarin explain why blockchain privacy is more urgent than ever:

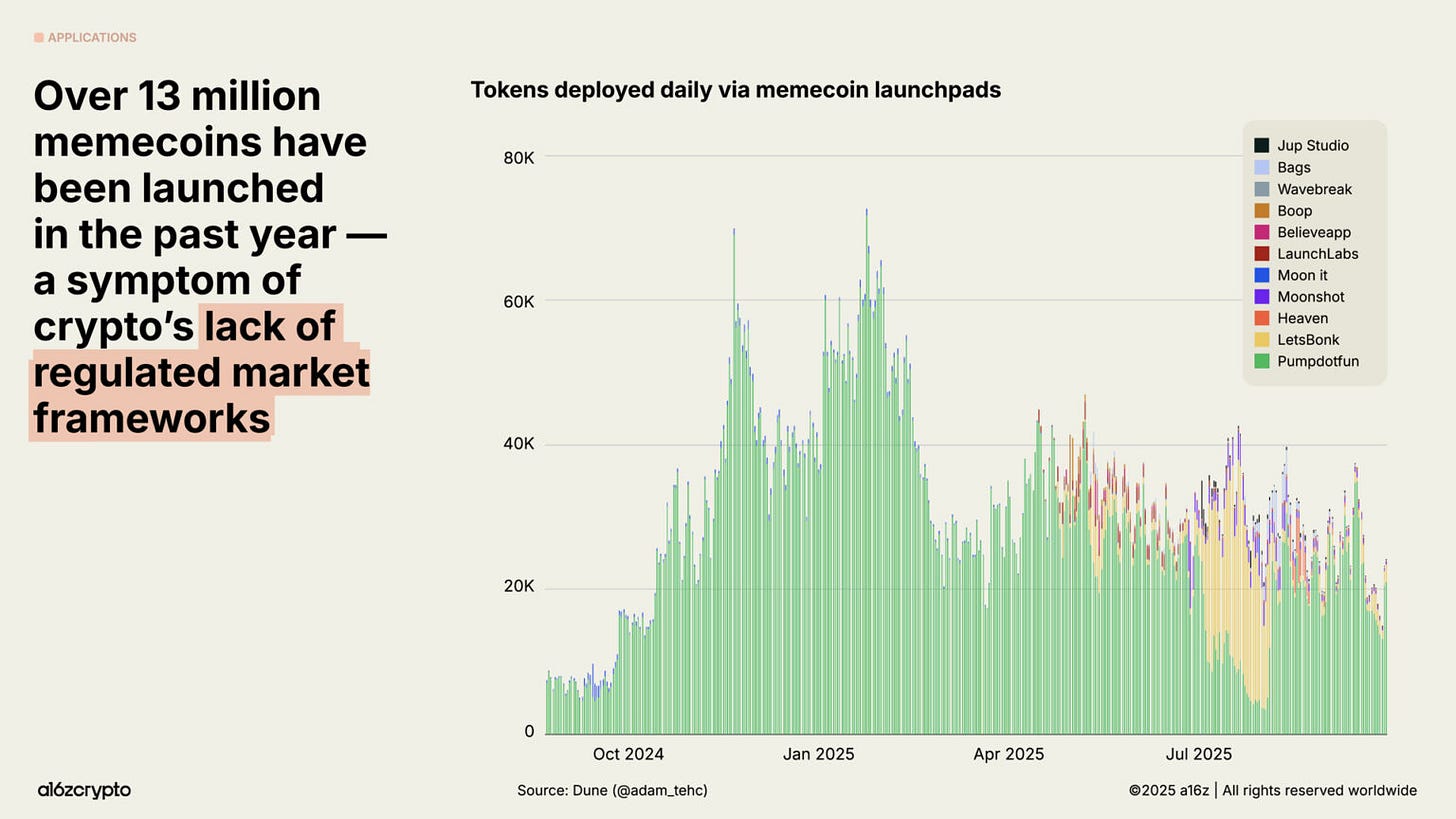

13 Million Memecoins Launched in the Past Year

Last year, over 13 million memecoins were launched on the Solana memecoin launch platform.

The lack of regulatory clarity in the U.S. may have fueled this surge. During the last (U.S.) administration, launching a memecoin might have seemed safer than starting a crypto company or creating a productive token.

In recent months, this trend seems to be cooling: the issuance of (new coins) in September was down 56% compared to January.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。