At @0xfluid, we have a very simple approach - the safety of users above all. Especially the safety of the lenders, who are the most passive party. With this approach for the past 7 years, we have never lost a single $ of user funds.

I happen to have a lot of conversations with all kinds of new stablecoins that come to us and say they have big demand, and they will deploy backing to Fluid if we list them.

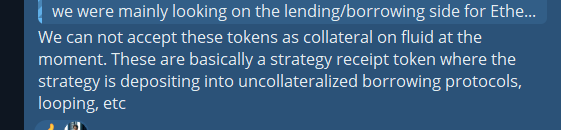

Every time we decline these offers and see how competitors get hundreds of millions or even billions of new TVL, but every time we know that this will not last long, these markets will collapse, and users will lose their money yet again.

And after each collapse, the permissionless lending markets say that they are just an infra, and I totally agree with that, except for the fact that they promote and incentivize these markets aggressively. This is a direct endorsement, especially in the eyes of a regular user.

If you want to use the most advanced protocol on Ethereum (or Solana!), with the least amount of collaterals among major lending markets, go to Fluid/@jup_lend. $6B (well, as the market keeps crashing, it's closer to $5B now) of users' funds chose us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。