Selected News

GIGGLE continues to rise, briefly breaking $143, with a 24-hour increase of 178%

Bitcoin rebounds, breaking $102,000, with a 24-hour decline narrowing to 4.7%

The U.S. government "shutdown" enters its 36th day, setting a record for the longest in history

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content into English:

[PEPE]

Today's discussions around PEPE mainly focus on significant market activity and notable purchases. A new Chinese whale has been actively acquiring Plush Pepe NFTs, spending millions to support the price, while another noteworthy purchase was Plush Pepe #1442, which was sold for 9718 TON. Additionally, a savvy whale that previously profited from PEPE has made a substantial investment in ASTER. Despite the overall bearish sentiment in the crypto market, PEPE remains a hot topic due to these high-profile transactions.

[STREAM]

STREAM Finance has become the center of discussion today due to significant losses of $93 million caused by external fund managers, leading to frozen deposits and withdrawals, and a decline in the value of its stablecoin xUSD. This incident has raised concerns about the broader DeFi ecosystem's exposure to STREAM's financial troubles, with other protocols like Morpho, Euler, and Silo potentially affected by contagion risks. This situation has sparked a debate about the importance of risk management practices and transparency in DeFi operations.

[MORPHO]

Today's discussions around MORPHO mainly focus on the aftermath of the Stream Finance collapse, which has led to a rigorous examination of the curator model used by Morpho. The event highlights the risks associated with high-yield vaults and the importance of risk management in DeFi. Despite the negative sentiment, some tweets defended Morpho's isolated market model, emphasizing that it prevented broader contagion. Discussions also touched on the need for curators to have better transparency and accountability, as well as the potential for responsible expansion in DeFi.

[LINK]

Today, Chainlink (LINK) is in the spotlight due to several significant announcements and developments. The launch of the Chainlink Runtime Environment (CRE) and Chainlink Confidential Computing has been highlighted as key innovations that enable private smart contracts and enhance on-chain finance. UBS successfully executed the first on-chain tokenized fund redemption using Chainlink's digital transfer agent, marking a milestone for blockchain infrastructure. Additionally, Tradeweb partnered with Chainlink to publish U.S. Treasury data on-chain via DataLink, further advancing institutional tokenization efforts. Despite these positive developments, concerns remain about a $1 million vulnerability in the Moonwell protocol caused by Chainlink oracle failures.

[MOMENTUM]

Momentum (MMT) is gaining attention today due to its listing on several major exchanges, including Binance, Bybit, and OKX. The token's launch is marked by various trading opportunities, airdrop claims, and investor protection features. The community is excited about the project's potential, with discussions emphasizing its innovative DeFi mechanisms, such as the ve(3,3) model and its strategic partnerships. The token's performance, trading incentives, and future growth prospects are key topics driving the buzz around MMT.

Featured Articles

In the first week of November, sentiment in the crypto circle is very poor. Bitcoin has dropped to a lower point than the "10.11" crash, failing to hold the $100,000 mark and even falling below $99,000, marking a new low in the past six months, while Ethereum dipped to $3,000. The total liquidation amount across the network exceeded $2 billion in 24 hours, with long positions losing $1.63 billion and shorts losing $400 million.

The U.S. government shutdown has officially entered a record 36th day. In the past two days, global financial markets have plummeted. The Nasdaq, Bitcoin, tech stocks, the Nikkei index, and even safe-haven assets like U.S. Treasuries and gold have not been spared. Panic sentiment is spreading in the market, while politicians in Washington continue to argue over the budget. Is there a connection between the U.S. government shutdown and the decline in global financial markets? The answer is beginning to emerge.

On-Chain Data

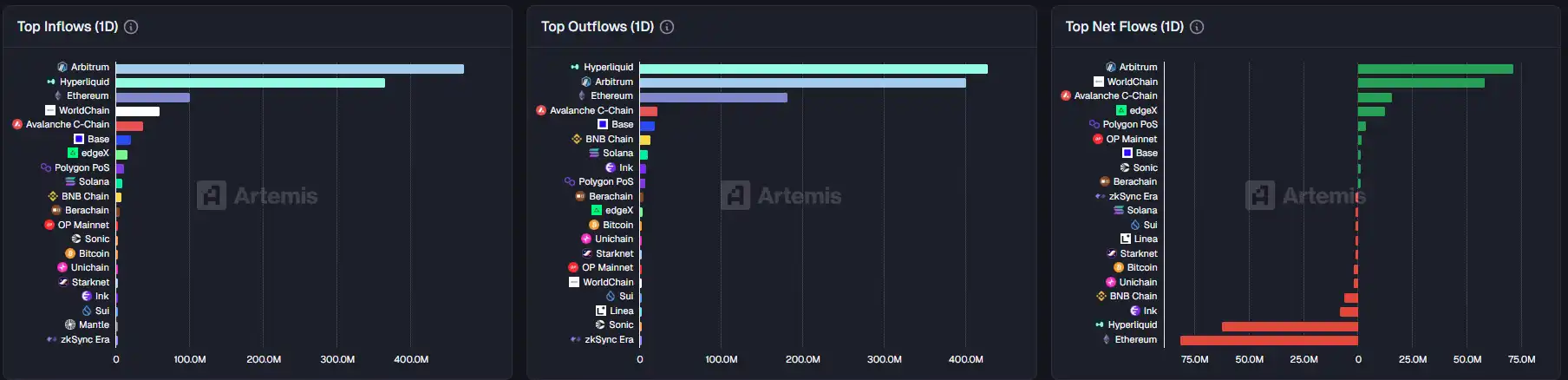

On-chain capital flow situation for the week of November 5

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。