Author: Nancy, PANews

On November 5, Hong Kong-listed company New Fire Technology (1611.HK) held a product launch event at the Grand Hyatt Hotel in Hong Kong, officially announcing the launch of its new international business brand Bitfire and establishing a global licensed trading service matrix, marking a key step in its internationalization and compliance process.

This matrix will leverage the company's advantages in compliant operations and centralized services, focusing on four core business modules: the Bitfire Exchanges cluster, modeled after the compliant Japanese exchange BitTrade; the private banking-level digital asset management product Bitfire Prime; the Bitfire Hub, which collaborates with local exchanges; and the DAT Plus service aimed at top-tier assets. From this perspective, New Fire Technology targets high-net-worth and institutional clients, attempting to build a full-chain service covering compliant digital asset trading, OTC bulk trading, custody, and asset management, with an emphasis on professionalism, customization, and compliance. This strategic layout is logically similar to the model of Galaxy Digital. It is worth mentioning that BitTrade is currently initiating a round of independent financing.

In this context, PANews interviewed New Fire Technology's Executive Director and CEO, Weng Xiaoqi. During the interview, Weng introduced Bitfire's differentiated licensing strategy and shared insights on the evolution of exchanges, crypto compliance, and emerging sectors like DAT, as well as discussing his personal career transition. Regarding the market outlook, he believes that future bull and bear cycles will become more complex, but the cryptocurrency market has not yet entered a bear market; rather, it is in a consolidation phase.

Compliance is the Only Direction Forward, Adopting a "Direct + Joint Venture" Strategy to Build the Exchange Matrix

Global crypto assets are entering a rapid popularization phase. The latest data shows that the number of crypto holders has surpassed 600 million, and New Fire Research Institute predicts that this number will exceed 1 billion in the next three years. However, at the same time, the crypto trading industry is undergoing a profound structural transformation.

"In the past, the 'three major exchanges' often referred to offshore platforms. But in recent years, the entire industry landscape is changing rapidly, which can be summarized into two development directions, or two quadrants: one is decentralization, and the other is licensing," Weng Xiaoqi pointed out during the interview.

He further noted that in the direction of licensing, exchanges are gradually moving from early unlicensed operations to compliance and regulatory frameworks. For example, mainstream licensed exchanges in Hong Kong, such as HashKey, OSL, and New Fire's BitTrade, are representatives of this trend. The development pace of licensed exchanges may be slower, but they offer higher security and long-term stability, which is the main theme of the future compliant market.

At the same time, another important path is decentralization. Platforms like Hyperliquid, Uniswap, and Aster, which have risen in the past two years, represent the disintermediation and protocolization of trading models, which is another innovative direction. Additionally, some "light trading venues" are emerging. For instance, the Bitcoin and Ethereum ETFs in the United States can be seen as lightweight trading tools that provide compliant trading channels for on-site investors. If viewed as "alternative exchanges," their market inflow scale is comparable to traditional giants like Binance.

From a macro perspective, Weng Xiaoqi pointed out that the survival space for offshore exchanges is gradually shrinking. In the past, countries' regulations were developed slowly, exploring and formulating rules one by one. In the coming years, global digital asset regulation will exhibit a "building block effect," where regulatory practices in one region can be directly referenced or reused by others, accelerating the global regulatory pace through cumulative transmission of regulatory experience. As various countries' regulatory frameworks are gradually improved, offshore models face increasing restrictions and bans due to a lack of compliant channels. Compliance has become an irreversible trend in the industry. For New Fire, as a listed company and licensed entity, compliance is the only way forward. Although it was once one of the world's leading offshore exchanges, it is now more focused on the licensed field. For example, it assisted in creating Hong Kong's first licensed exchange, HashKey, and has rich experience in the licensed trading sector.

To this end, New Fire Technology will adopt an exchange model in regions with large populations (e.g., Japan, with a population of over 100 million). This model is the "heaviest" tier in New Fire's strategy, requiring the application for licenses and project initiation, which takes a longer time but can cover a broad customer base.

As such, New Fire Technology completed the acquisition of the compliant Japanese crypto exchange BitTrade (formerly Huobi Japan) in May 2025. Currently, BitTrade not only holds the record for "historically the highest trading volume" among local digital asset exchanges but also ranks among the top 5 in comprehensive trading in Japan (according to CoinGecko's ranking data on November 5). As of the end of September, the growth rate of customer asset scale reached 31%, solidifying the company's position in the overseas market.

Moreover, BitTrade has achieved a profit of 663 million yen, providing a replicable model for future expansion into other densely populated markets (such as Europe, the Middle East, and South America). Bitfire will actively build a global licensed trading matrix based on BitTrade.

Weng Xiaoqi also added that in terms of direct layout, the initially planned key regions include Europe, the Middle East, and South America. This decision is still in a dynamic evaluation stage, and New Fire Technology will determine which markets are suitable for direct operation and which are more suitable for joint ventures based on global market scanning results. For example, in South Korea, they have established connections with local partners who have local bank accounts and compliance foundations, and formal cooperation is expected to commence within the next year. For partners in different regions, the company has developed a standardized evaluation and consultation mechanism to ensure the robustness and efficiency of its global layout.

For other countries and regions, New Fire Technology will adopt the joint venture cooperation model Bitfire Hub. Currently, New Fire Technology has reached cooperation intentions with several licensed legal entities, which will provide technical and operational support, while the partners will invest and provide compliance qualifications. Through this approach, they can fully leverage their advantages in operations and security to achieve a win-win situation.

Launching Bitfire Prime in Hong Kong, Targeting High-Net-Worth Clients with a Lightweight Private Banking Model

In regions that are relatively sparsely populated but have a high concentration of funds (such as Hong Kong and Singapore), New Fire Technology adopts a lightweight private banking model.

Weng Xiaoqi told PANews, due to the limited number of local residents, the market size is insufficient to support the construction of a complete exchange, but the high-net-worth client group is concentrated, and the capital density is high. By providing precise services to thousands of high-net-worth clients, New Fire Technology can effectively capture the market, with lower operational costs and faster responses.

In August of this year, New Fire Technology announced a strategic upgrade to create the world's first "private banking-level digital asset management" product, aimed at providing full-process digital asset management services for high-net-worth clients. At this brand upgrade launch event, New Fire Technology officially introduced its flagship product, Bitfire Prime APP 1.0, which offers comprehensive one-stop services from concierge-style account opening, trading, custody, asset management, investment banking to trust services.

“ This product is very distinctive. Most mainstream exchange apps on the market are aimed at retail users and lean towards self-service trading. However, the Hong Kong market is primarily composed of financial institutions and high-net-worth clients, who often do not operate accounts themselves but require assistance from professional teams,” Weng Xiaoqi explained to PANews.

He further introduced that Bitfire Prime is specifically designed for high-net-worth clients, with each client assigned a dedicated digital asset manager providing tailored personalized services. The account opening process is flexible and efficient, with options for on-site or in-store processing, averaging just 3.25 days to complete, faster than typical virtual asset service providers; the membership threshold is based on Hong Kong's Professional Investor (PI) standard, requiring traditional investment assets of over 8 million HKD; each client has a dedicated community where they can receive real-time market updates and interpretations from the team daily; users only need to confirm trading instructions within the app, and the manager executes them on their behalf, ensuring convenience and security throughout the process. Additionally, Bitfire Prime offers exclusive banking channels and large deposit and withdrawal services, one-stop asset management and investment banking services, and supports a variety of asset management products and virtual asset trusts. Clients can even set up wills and inheritance arrangements within the trust accounts.

On the trading platform side, Bitfire Prime collaborates with licensed exchanges such as HashKey and OSL, and has obtained Hong Kong's licenses No. 1, 4, 9, and trust licenses, sufficient to support existing business operations. As for whether to apply for the No. 7 securities trading license, the company is currently evaluating. In the future, if clients have higher compliance needs, New Fire Technology will consider applying for licenses independently or through partnerships to match market rhythms.

Weng Xiaoqi pointed out that through this service system, the private banking-level digital asset manager achieves a one-stop solution from account opening, trading, custody, asset management to trust services. Especially with the next bull market approaching, New Fire Technology hopes to help more high-net-worth individuals enter the crypto asset market easily, safely, and compliantly.

Since the product launch, New Fire Technology's business has grown rapidly. Weng Xiaoqi disclosed at the launch event that the high-net-worth client base has expanded rapidly, with the number of institutional accounts increasing eightfold, and over 130 new accounts opened, including more than 50 institutional clients. The company expects the overall asset management scale to grow from 40 million USD to 500 million USD within three months, achieving approximately 12-fold growth.

He admitted that the reason New Fire Technology was able to launch this product in a short time is due to clear positioning and flexible pacing. “If we had followed the traditional path of applying for licenses before starting the business, it would have taken at least two years. Instead, we chose to complete the product upgrade under the existing compliance framework in the form of a 'lightweight trading platform.' These businesses have actually existed for a long time; they just lacked clear positioning. Now, through the concept of 'private banking-level managers,' we have clarified the story.”

Weng Xiaoqi believes that this model is essentially similar to ETFs or DAT (Digital Asset Treasury Companies), both representing a new generation of compliant, lightweight digital asset trading venues. “Today's exchanges are no longer limited to traditional offshore models. The industry form is rapidly evolving, and we focus on the real needs of clients. Wherever the users are, we will be there, customizing the most suitable products and services for them.”

Staking as the Core Advantage of Ethereum DAT, Competition Relies on Four Winning Factors

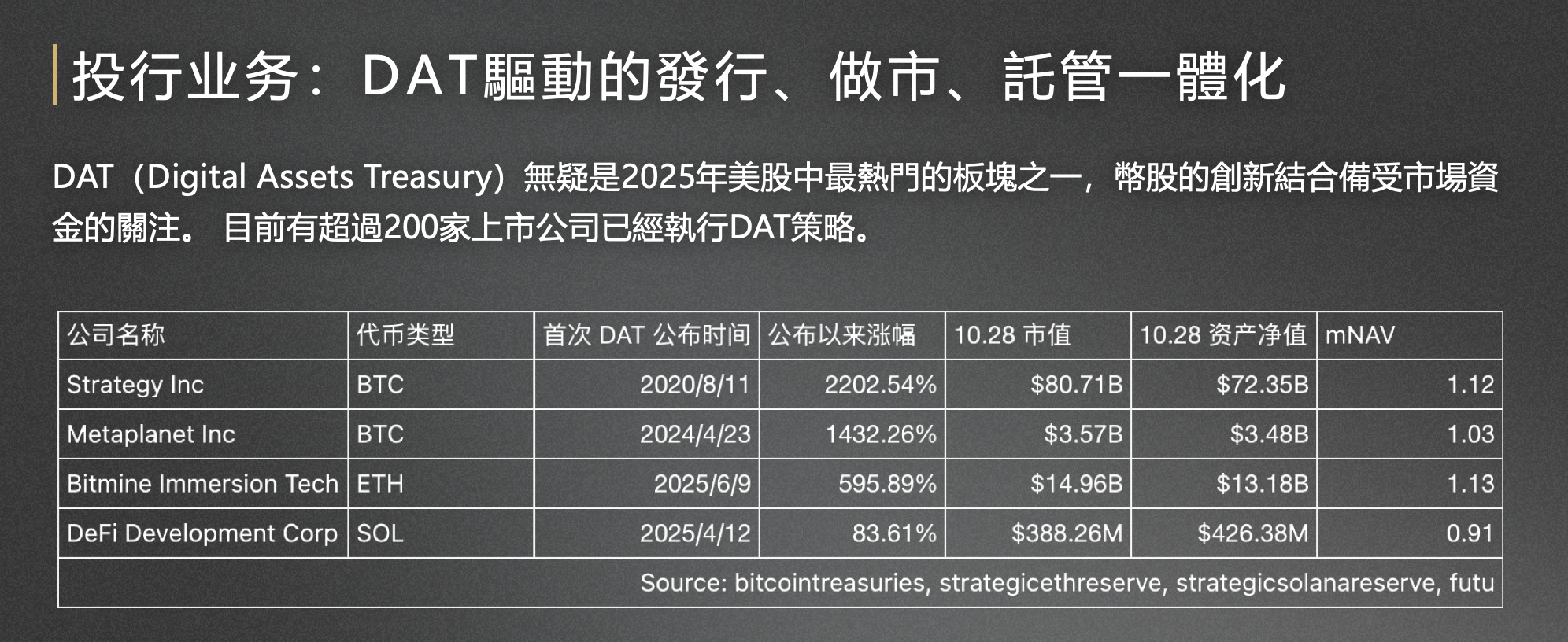

In recent years, DAT strategies have gradually become one of the hottest sectors in the U.S. stock market, attracting significant attention from market funds. Represented by Bitcoin, Ethereum, and Solana, DAT innovatively combines the coin-stock model, providing investors with a new asset allocation option.

New Fire Technology's upcoming DAT Plus plans to integrate mainstream cryptocurrencies in an investment banking model, achieving integrated management of issuance, custody, and asset management.

“DAT is gradually becoming a more flexible and efficient investment tool than ETFs. In terms of capital utilization, liquidity, and integration with traditional capital markets, DAT shows significant advantages. As Wanxiang Blockchain Chairman Xiao Feng once stated, ‘ETFs are good, but DATs are better.’ The emergence of DAT marks a new stage in crypto finance, as it not only addresses the limitations of ETFs but also promotes the deepening of asset tokenization and the integration with capital markets,” Weng Xiaoqi stated.

Currently, New Fire Technology is focusing on preparing an Ethereum DAT company, but the specific launch time still needs to observe the impact of market fluctuations on DAT. He pointed out that if the existing DAT collapses under market shocks, this model would be falsified; however, the leading DAT products remain stable, with mNAV hovering around 1, and there has been no serious decoupling phenomenon. If it can withstand this round of adjustments, the DAT model will be tested and will have more confidence in future development.

The reason for choosing Ethereum over Bitcoin, Weng Xiaoqi explained, is that Ethereum has a broader base among Asian users, and many of the early initiators involved in Ethereum's development are also Asian teams. Additionally, Bitcoin already has a mature ETF strategy, and the differentiated value of adding DAT is limited. The core advantage of Ethereum DAT lies in staking returns. ETFs are constrained by regulatory requirements, typically unable to allocate more than 50% of their assets to staking, which limits overall returns. In contrast, Ethereum DAT can allocate staking more flexibly, resulting in higher returns, which is its core value distinguishing it from ETFs.

Currently, DAT has already advanced in the European and American markets, but it has not yet become widespread in Asia. Weng Xiaoqi believes that launching DAT by leading Asian teams targeting the Asian market will be easier to gain trust and participation. In contrast, KOLs (Key Opinion Leaders) from Europe and the U.S. (such as Tom Lee) have limited influence in Asia, and investors may adopt a wait-and-see attitude. Additionally, regulation is also a factor; for example, Hong Kong has strict requirements for DAT companies, limiting their capital expansion capabilities, while the U.S. market is more flexible, which is why many funds choose to go to the U.S. stock market to develop DAT.

In Weng Xiaoqi's view, to become a leading DAT player, several factors need to work together: (1) A fair and just initiation structure: Some DAT initiators in the European and American markets retain excessive profits, which can easily lose retail investor trust and limit scale development; (2) The initiator's appeal and financial strength: The scale should exceed 500 million USD to support subsequent expansion; (3) Team and market communication ability: Frontline representatives need to accurately tell the project story to attract the target audience; (4) Market factors: Market conditions have a huge impact on fundraising effectiveness, with fundraising difficulties being starkly different in bull and bear markets, and market conditions sometimes even determine the success or failure of DAT.

Customized Virtual Asset Trust Solutions for Family Clients

As virtual assets become more widespread globally, an increasing number of high-net-worth individuals are beginning to pay attention to the security management and wealth inheritance of digital assets. The traditional trust system is relatively mature in legal theory, but it still faces many practical challenges when dealing with virtual assets, such as asset security, ease of inheritance, and tax compliance.

According to Weng Xiaoqi, New Fire Technology's trust solutions have several significant differences in design philosophy and execution mechanisms compared to traditional trusts:

· Customized for virtual asset scenarios: Traditional trusts mainly target physical or fiat assets such as cash, real estate, and equity, while the characteristics of virtual assets, such as private key management, on-chain records, and anonymity, create unique challenges in inheritance and custody. New Fire combines legal compliance with regulatory mechanisms from financial institutions to achieve secure custody and compliant inheritance of virtual assets;

· Optimizing asset inheritance and tax structure: New Fire's trust solutions not only focus on asset security but also use flexible trust structures to achieve identity isolation and tax optimization for clients, allowing virtual assets to be inherited steadily under legal and compliant conditions;

· Addressing common industry pain points: In the past, many people have tried various ways to "inherit" their virtual currencies—some wrote their private keys on paper to leave for family, which poses significant risks; others kept them in exchange accounts, but could not avoid issues like complex operations or privacy leaks. These methods are neither safe nor professional. New Fire's solution institutionalizes and legalizes the design, ensuring that virtual assets are securely managed both during life and after death, avoiding asset losses due to operational errors or insufficient understanding;

· Licensed trust institution guarantee: New Fire itself holds a trust license, which gives our virtual asset trust solutions legality and operability. During the business advancement process, New Fire Technology has overcome multiple obstacles in compensation structure, system design, and more, ensuring that the solutions can be effectively implemented.

Comprehensive Vision is the Biggest Challenge, Future Bull and Bear Cycle Factors More Complex

“I am like a chef walking into a kitchen, seeing what ingredients are available, and immediately starting to cook; the important thing is action,” Weng Xiaoqi stated in the interview. After leaving HashKey for family reasons at the end of last year, he joined New Fire Technology in August this year and launched a series of products in just two months, demonstrating his consistent execution ability and agile style.

Recalling his time at Huobi, Weng Xiaoqi said, “When we took office, we made a commitment that if we did not achieve our goals, we would resign voluntarily. Quick action and strong execution were the impressions we left in the industry.” At HashKey, he was also able to quickly drive the team to implement new products and strategies, allowing the company to rapidly turn around and become the market leader. Now, as one of the main shareholders of New Fire Technology, Weng Xiaoqi sees this as his last entrepreneurial venture, fully leveraging his rich experience and rapid implementation capabilities.

When discussing the reasons for joining New Fire Technology, Weng Xiaoqi stated in the interview, “We all believe that the Asian market still has great potential, and there are many market demands that remain unmet. In the past, Asia was the center of the crypto industry, but with policy changes, the industry focus has shifted to Europe and the U.S. Now, with increased global investment in Web3, we hope to make a memorable contribution to the Asian market, represented by Hong Kong.” He added that New Fire Technology itself is one of the earliest Web3 concept stocks in Hong Kong, with a long history, and Xiao Feng believes that the next round of industry development will use listed companies as vehicles, with capital and power participating in cryptocurrency businesses through listed companies, thus encouraging Weng Xiaoqi to join New Fire and use the licensed business platform to promote industry development.

Regarding the differences between New Fire Technology and the original exchange business model, Weng Xiaoqi believes that the biggest challenge is the need for a more comprehensive vision. “In the past, I only focused on industry development and Web3 business; now I must develop the business in conjunction with the rules of licensed operations.” His systematic experience accumulated during his time at HashKey enables New Fire Technology to quickly implement licensed operations. He keenly judges that the global trend towards compliance is irreversible, the space for offshore exchanges will gradually shrink, and decentralized exchanges and new types of exchanges may become alternatives. Weng Xiaoqi has also transformed from an industry expert into a key figure capable of integrating traditional finance (TradFi) with crypto business, while promoting a fully licensed, global financial group strategy. This is a new proposition and may also be a global challenge, but New Fire Technology has the best foundational conditions to respond.

When discussing the relationship between Avenir Capital and New Fire Technology, Weng Xiaoqi pointed out in the interview that Avenir Capital is the family office established by Li Lin, which later extended into new business layouts based on this foundation. For example, they are currently also promoting exchange business targeting institutional clients. In contrast, New Fire Technology is more focused on serving retail users. The two have a complementary rather than competitive relationship in terms of business direction. For instance, in asset management, we will collaborate with Avenir's family office team; in the future, they will focus on expanding global institutional exchange business, while we will concentrate on building licensed exchanges for the retail end.” Weng Xiaoqi emphasized that New Fire Technology and Avenir Capital are organically complementary in business direction and resource synergy. Li Lin is both the founder of Avenir and the largest shareholder of New Fire, but New Fire operates independently in specific business operations.

Regarding the layout of RWA (Real World Asset Tokenization) and stablecoin business, Weng Xiaoqi stated that in terms of stablecoins, New Fire Technology will not issue them directly but will provide custody, purchase, and exchange services. The RWA business currently has few market cases and is showing clear signs of a bubble, so New Fire will temporarily observe and prioritize the implementation of existing confirmed businesses, considering strategic expansion only after the market matures.

Additionally, when discussing the current market situation, Weng Xiaoqi believes that the cryptocurrency market has not yet entered a bear market but is in a consolidation phase. He pointed out that Ethereum has risen too quickly and needs to adjust its support levels; macro factors such as interest rate cuts, sovereign funds, and financial institutions entering the market provide support. At the same time, the 1011 incident led to approximately 40 billion USD in liquidations, causing a short-term decline in liquidity, and the market needs time to recover. He believes that the bull and bear cycles are no longer as clearly defined as in the past four years, and the factors influencing future bull and bear markets will be more complex, including the entry of traditional financial capital and changes in macro policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。