Author: J1N, Techub News

After the "Black Friday" on October 11, the market initially thought the storm had passed. Unexpectedly, on "Black Tuesday" on November 4, many were ruthlessly harvested once again.

From cryptocurrencies to U.S. stocks, from BTC to AI, there was a widespread crash. In such an extreme market, what should have been a space for trading strategies and data games gradually turned into a "copy trading game." The addresses on Hyperliquid, once hailed as "smart money," fell back to earth.

The Hyperliquid smart money leaderboard became a new deity for retail investors, and the media and celebrities amplified its significance.

Some people refreshed the leaderboard, some wrote long articles analyzing the "smart money logic," and some simply said, "Don't look at on-chain data, just see what they are buying."

Thus, when "smart money" entered the market, retail investors rushed to follow; when "smart money" fled, they all rushed to sell.

Rational analysis was replaced by emotion, and independent judgment was hijacked by "follow-the-trend signals."

In this market, investors coined a new term for them: roller coaster teams.

Source: X

The "roller coaster" of smart money, the "toll" for retail investors

Investing is inherently brutal: even if you can win 14 times in a row, just one mistake can lead to a 100% loss.

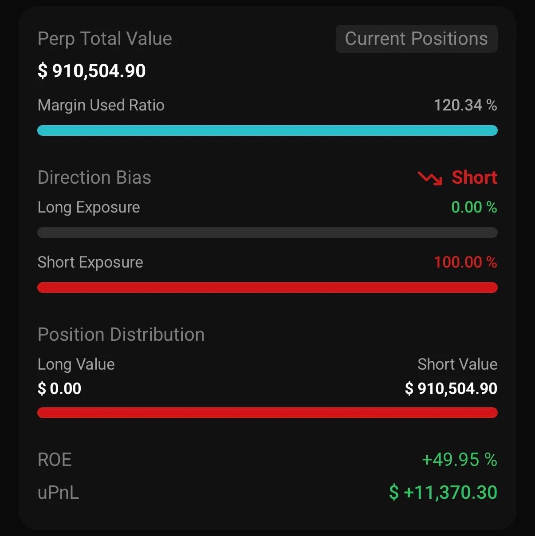

Recently, an anonymous whale who had a 100% win rate with 14 consecutive wins on Hyperliquid was forced to liquidate. He made $15.83 million from 14 consecutive wins but lost $44.67 million in one operation: a total loss of $44.67 million (including the $15.83 million profit from the 14 wins + $28.76 million principal). This trading cycle lasted 21 days, starting with precise shorting and then going long on October 14, peaking in profit on October 28. In just one week, due to concentrated leverage, market corrections, and the chain reaction of counter-trend positions, all his profits and principal evaporated this morning.

Source: Hyperbot

Another member of the team, James Wynn, turned $6 million in principal into $48 million in profit in just two months by using "large positions + high leverage + high frequency" on Hyperliquid, at one point holding over $1 billion in positions.

Due to frequent large position operations, he made headlines on social media multiple times. He even earned $36 million in one month, being seen as the "embodiment of talent and luck." However, his aggressive style ultimately cost him dearly, as one liquidation swallowed $100 million.

Source: Hyperbot

In stark contrast to the previous two, "Rolling Warehouse Guy" started with just $125,000 in principal and, through a rolling strategy of adding positions based on unrealized gains, pushed profits to a peak of $43 million, achieving an astonishing profit multiplier of 344 times.

However, a dramatic scene unfolded: he, who should have stood at the peak, returned to square one after two waves of market impact, first retracting from $43 million in profit to $6.86 million, and then sliding from $9.19 million to a current loss of $670,000.

Source: Hyperbot

Their methods and principal amounts varied, but the outcomes were strikingly similar: all had achieved tens of millions or even over a hundred million in massive profits, only to ultimately lose everything due to a single counter-trend operation. Each whale represents a tragic cycle of massive funds going from peak to zero.

These addresses are seen as "gathering places for experts," but in reality, they are just more thoroughly observed and tracked.

When you only see the surface of the teams making money, while ignoring the underlying structure of their losses, it's easy to fall into a logical trap. Ultimately, several key factors are at play: first, leverage amplifies risk. Teams often use several times or even dozens of times leverage, which magnifies profits but also losses. Second, every operation you make is monitored by the leaderboard, tracked by the media, and copied by retail investors, turning "private advantages" into "public strategies." Followers, arbitrageurs, and imitators swarm in, quickly diluting any original advantage. Third, liquidity and market sentiment are insufficient. In extreme market conditions, strategy reversals, capital withdrawals, and liquidations overlap; if a whale misses a chance to reduce positions, it can drag the entire team down. Fourth, when "following the trend" exceeds "logic," teams can make the same mistakes as retail investors: adding positions to resist declines, unwilling to stop losses, insisting on following trends, and betting on emotions.

This is not fundamentally a difference between teams and retail investors; their models are similar, with the only difference being the scale of principal and leverage. Teams are merely "retail investors with slightly larger funds." From this, we can see that the "ever-winning" legends on the leaderboard often end up as textbooks for "total losses."

Influencers flood the screens, media hype: turning "smart money" into a myth

Hyperliquid has always provided a highly transparent leaderboard, including trader profit rankings, popular position rankings, and statistics on large addresses. Initially, these were just tools for traders to observe: to see which strategies were performing and which positions were changing. But when leaderboard profits continued to win and were reported by the media and cited by Twitter influencers, it transcended the realm of tools and transformed into market signals.

A wallet on the leaderboard continuously profits, and an address is labeled "smart money," instantly becoming a hot topic. Analysts write: "This whale made $2.6 million in one go" and "This address netted $15 million in ten days." This is data disclosure, but retail investors see it as "he made money, I should follow."

Media headlines often read "Rolling Warehouse Guy's precise long and short operations," "100% 14 consecutive wins whale," "smart money master makes a fortune"… Once packaged as "top traders," the leaderboard is no longer cold data but becomes a belief. This belief generates several times the following. To the extent that the market jokes: "Don't look at the candlestick charts, look at the leaderboard; whatever the leaderboard buys, you just follow." Although it's a joke, it accurately depicts the current market mentality. Rational analysis has been replaced by "whoever is on the leaderboard has a chance." A celebrity's tweet: "Just look at smart money" is immediately retweeted, and a media report: "On-chain data shows smart money is bottom-fishing," leads to retail investors entering the market the next minute, and the following minute, liquidations occur. This cycle means the leaderboard is no longer just an observation tool but becomes a driving force in the market. When the media/influencers team up with the leaderboard, the flood of information leads retail investors to mistakenly believe that following "smart money" guarantees easy profits, completely ignoring the deadly risks behind high-leverage trading.

From on-chain analysis to "only looking at the leaderboard"

In 2023-2024, on-chain data analysis was once mainstream. Observing wallet inflows, exchange outflows, capital paths, and the ratio of large holders to retail investors still had information asymmetry. Some could observe in advance that "certain addresses are migrating funds" or "certain contract positions are abnormal," allowing for early positioning. Now, with more tools available, the threshold for on-chain analysis has lowered, and information asymmetry has been compressed. Meanwhile, a shortcut has emerged: look at the leaderboard. You no longer dig deep into "why capital is flowing in" or "why positions are changing," but simply look at who is entering and exiting on the leaderboard. The result: on-chain data has shifted from "finding logic" to "watching popularity."

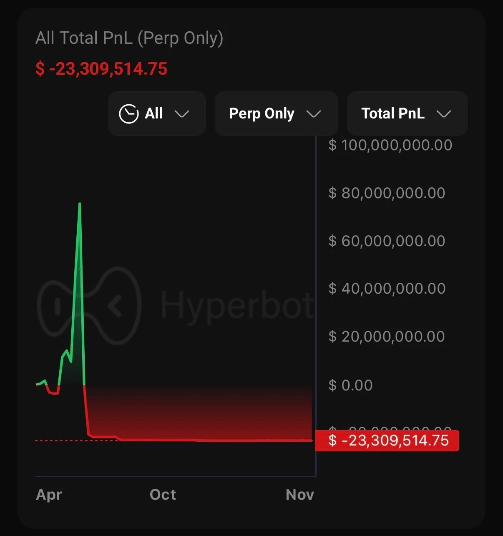

Source: Hyperbot

It's easy to overlook that a whale's buying does not mean you should buy; a whale's selling does not mean you should sell. When you treat "trading based on the leaderboard" as a strategy rather than "understanding the logic behind the leaderboard," you become a blind follower. More dangerously, when most people are focused on the same leaderboard, signals become congested, arbitraged, and backfired. The speed at which smart money strategies fail is faster than you might think.

Even K-lines that AI cannot comprehend, how can there be eternal profit masters?

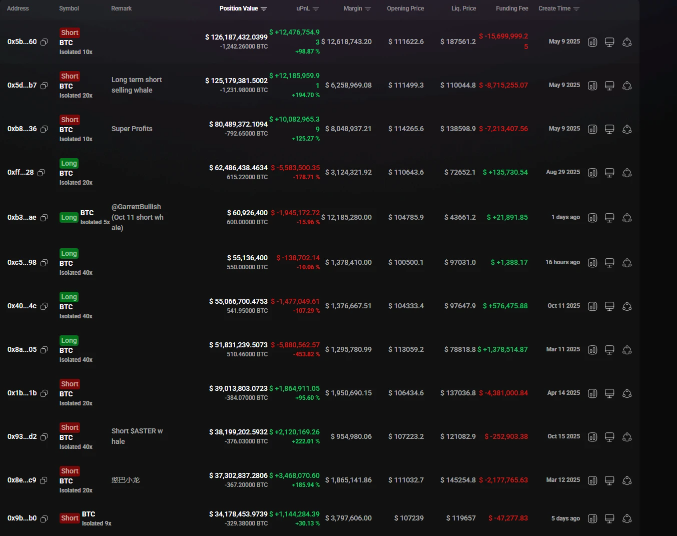

Meanwhile, the recently popular AI trading competition has seen six participating AI models perform poorly in simulated trading over the past two weeks, with total assets shrinking by nearly 30%, resulting in a total loss of about $16,827. Only Qwen3 Max and DeepSeek Chat V3.1 achieved profits, while the other four models all incurred losses.

Source: X

A popular saying on Twitter goes: "If even AI cannot understand K-lines, it's normal for me to lose." This statement is worth reflecting on: if we rely on signals based on "who buys," "who builds positions," and "who else is on the leaderboard," while ignoring changes in market sentiment and structure, then even seemingly intelligent models can fail. AI or algorithms can process vast amounts of data, automatically place orders, and respond quickly, but they also have prerequisites: stable structures, clear logic, and historical references. When the market structure changes to "on-chain data is visible at a glance, a bunch of people are all looking in the same direction to copy homework, operating blindly based on emotions, and in the end, everyone rushes to buy and sell, causing market makers to lose their footing, leading to liquidity exhaustion," the model's failure speed is extremely fast. You will find that even teams can flip, AI can get lost, let alone ordinary retail investors.

It seems that the saying "Investing has risks; enter the market with caution" applies equally to AI.

The market gives you, and it will eventually take back

The story of the roller coaster teams is not the first, nor will it be the last. The market has never been won by "who is smarter," but by who can remain clear-headed amidst the waves of emotion. When you find that everyone is focused on the same leaderboard, it may be a precursor to being harvested.

When we blindly follow so-called "smart money," when we are intoxicated by celebrity effects and media frenzy, when we forget the most basic risk control in investing, we have already doomed ourselves to failure. The cryptocurrency market may be full of opportunities, but opportunities are always reserved for those who remain rational, respect data, and know when to stop. I hope the tragedy of the roller coaster teams can awaken every market participant: in this market, true "smart money" is not someone else's trading address, but one's own calm mind and restrained heart.

Winning streaks can rely on skill and luck, but survival always depends on restraint. When everyone is obsessed with the upward curve, the outcome is often already written beneath the leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。