Written by: Eric, Foresight News

The reason for the collapse of xUSD issuer Stream Finance was finally clarified yesterday. The Delta neutral strategy incurred losses on collateral assets due to ADL during extreme market conditions, leading to risks accumulated from entrusting funds to third parties for off-chain operations and using cyclical leverage strategies. After third-party losses approached $100 million, it culminated in insolvency.

In an article translated by the author in 2023, Columbia Business School professor Austin Campbell argued that the USDe issued by Ethena is not a stablecoin, but rather a share of a structured financial product from Ethena.

The decoupling of xUSD itself has also impacted many DeFi strategies based on this "stablecoin" and some lending positions that used xUSD as collateral. The strategy of maintaining stable collateral value through Delta neutral strategies, or even slowly appreciating it, has been hit hard by extreme market conditions and operational opacity.

What is even more concerning is that we find the xUSD incident may not be the end of this story.

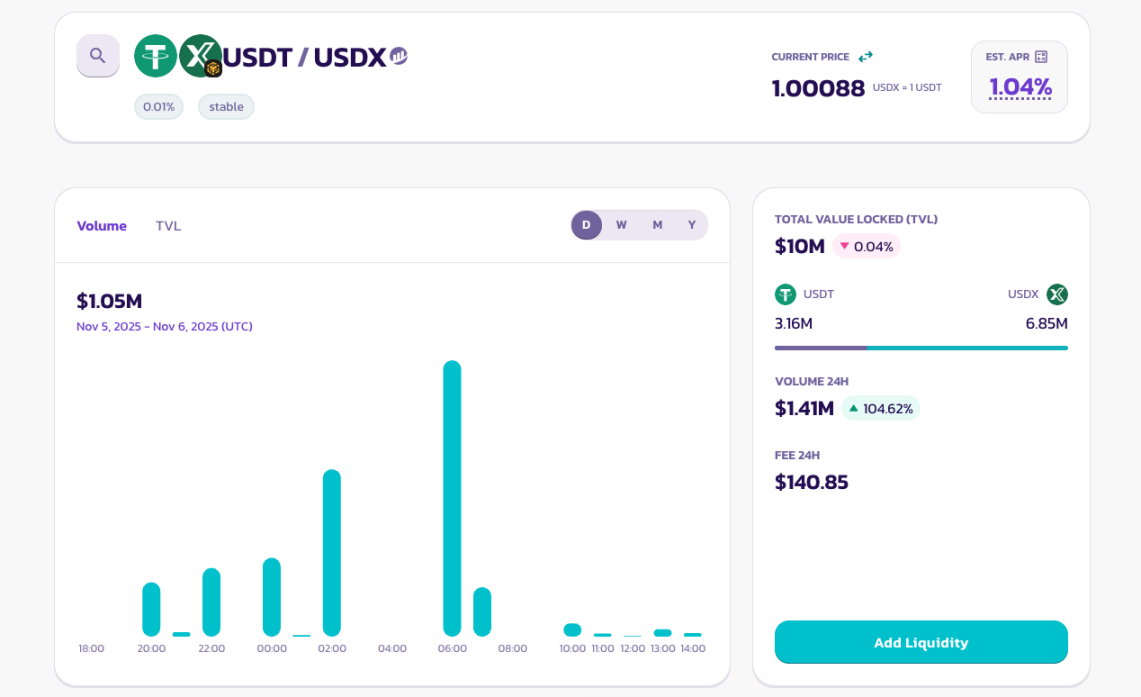

All USDX that can be borrowed has been borrowed out

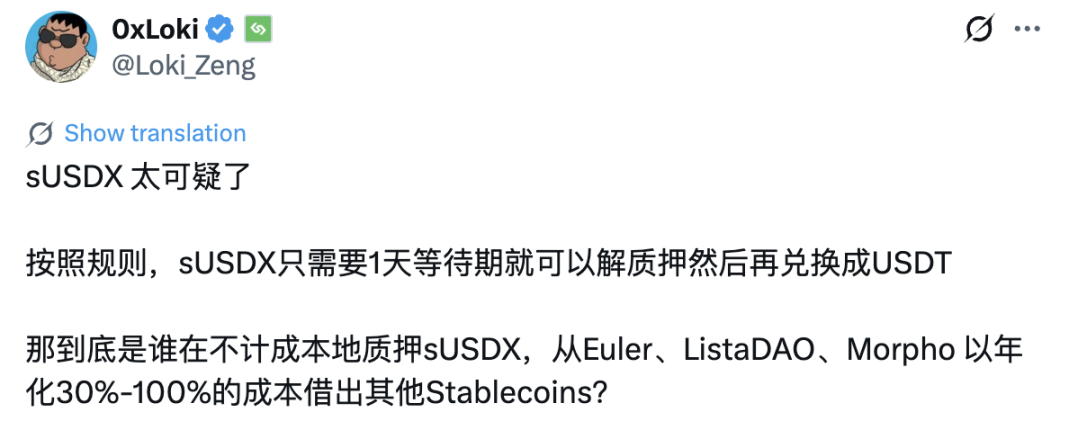

A user named 0xLoki tweeted last night that what originally required just a day to redeem the stablecoin used to mint sUSDX has now been ignored by addresses that drained all pools on Euler that could use USDX and sUSDX as collateral, despite an annualized interest rate of over 30%.

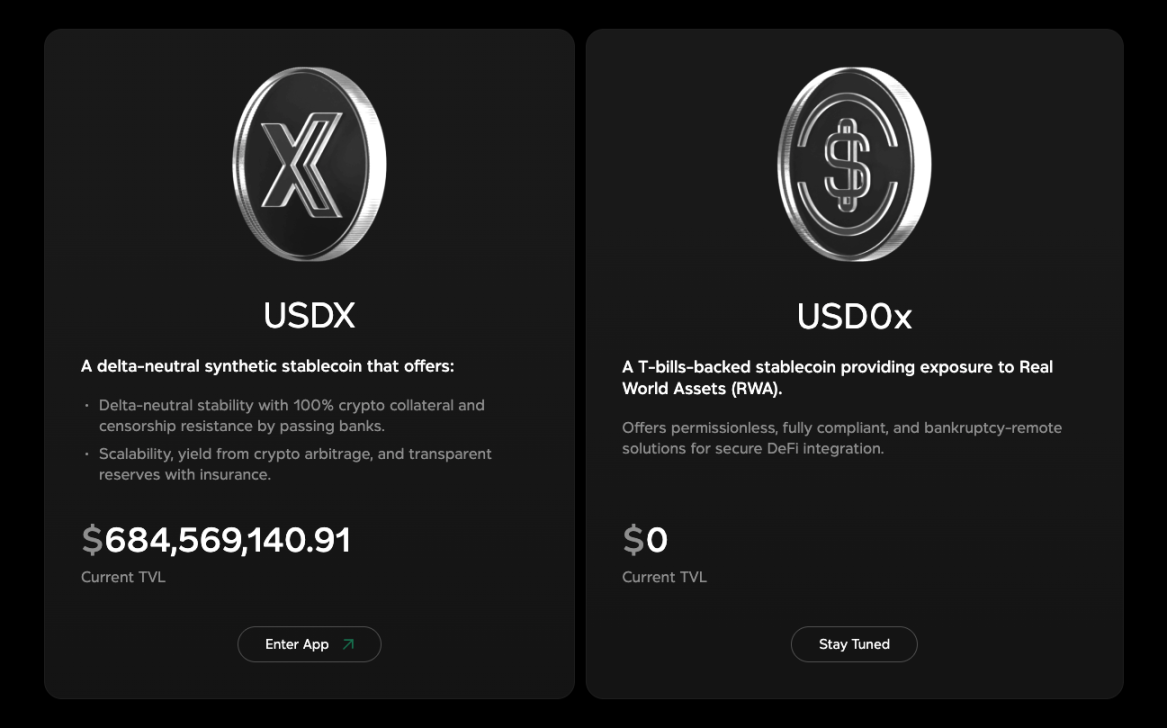

Here’s a brief introduction for friends unfamiliar with USDX. USDX is a stablecoin issued by usdx.money, which announced a $450 million financing at a $275 million valuation at the end of last year. The issuance model of USDX is almost identical to that of Ethena, also employing a Delta neutral strategy, where users staking USDX can earn short funding rate returns. Unlike Ethena, usdx.money not only operates with Bitcoin and Ethereum but also allows the use of some altcoins as the main strategy. While this amplifies returns, it also increases risks.

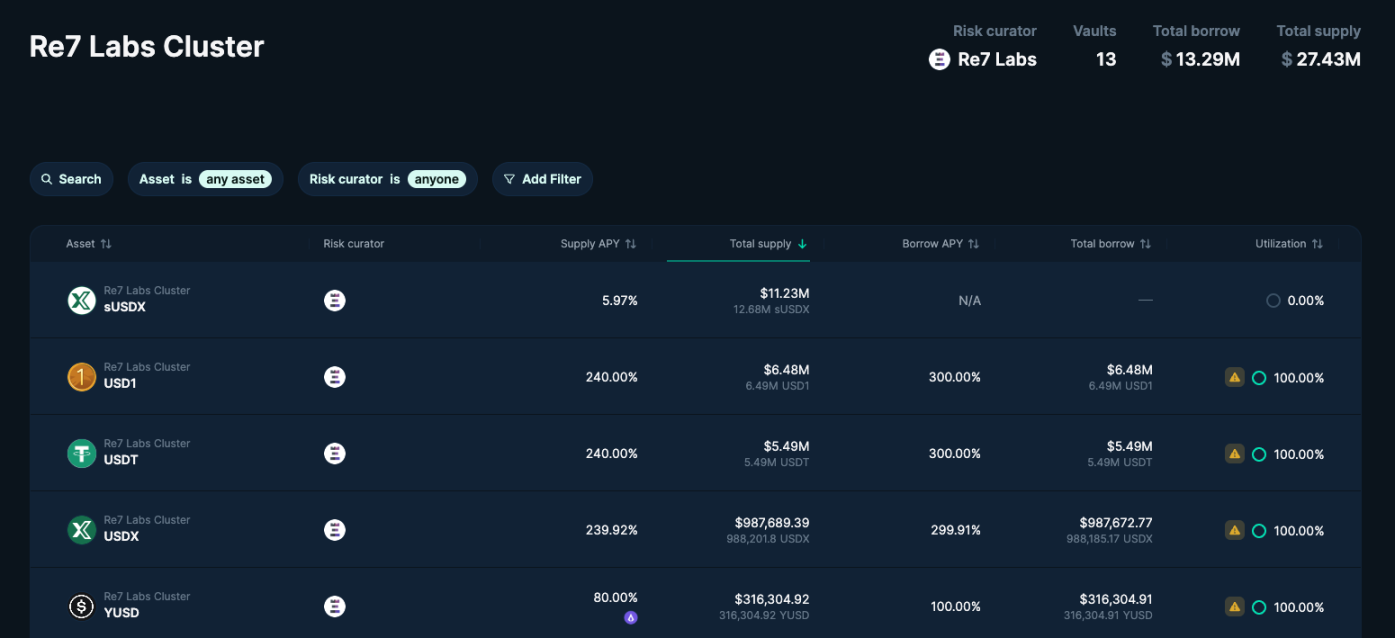

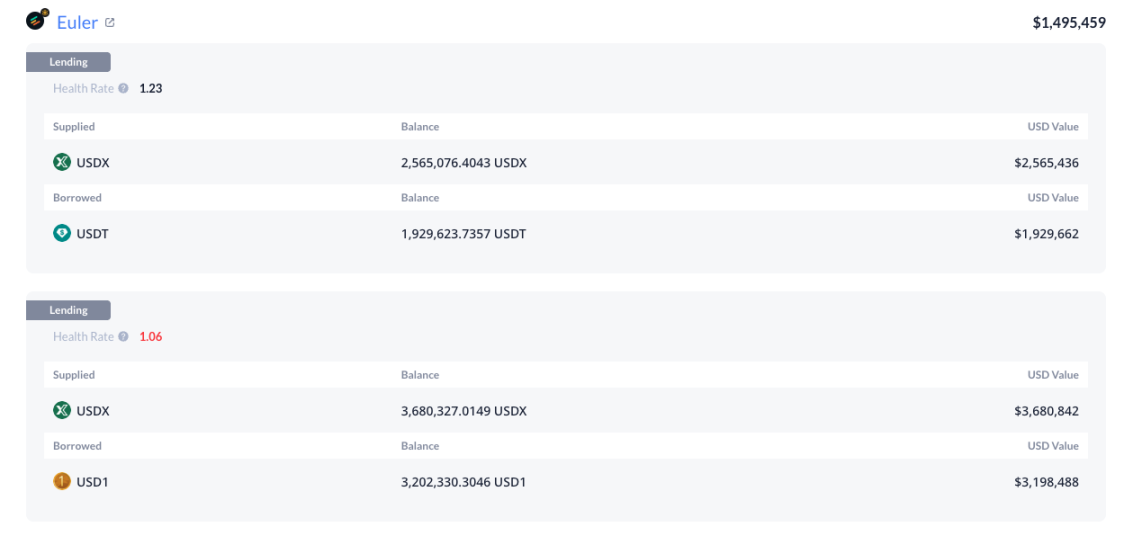

According to my verification, last night’s data from Euler showed that the only lending cluster on the platform supporting USDX and sUSDX as collateral, Re7 Labs Cluster, had all assets including USDT, YUSD, USD1, and even WBNB and BTCB completely borrowed out.

The pools on Lista DAO that allow borrowing USDT and USD1 using USDX and sUSDX have also been drained. The borrowing rate for the treasury borrowing USDT against sUSDX exceeded 800% at the time of writing, and if borrowers continue to choose not to repay, this rate will continue to soar until forced liquidation occurs.

Additionally, 0xLoki mentioned in the tweet that there are corresponding lending pools on Morpho and Silo, but as of the time of writing, I could not find relevant information, possibly because the platform has removed the corresponding pools from the front end. However, the fact is that all assets that can be borrowed using USDX and sUSDX in the DeFi market have been nearly wiped out. Similar to xUSD, the market for USDX-related assets is also established by Re7 Capital and MEV Capital. Users on X have revealed that personnel from Re7 Capital stated in the Euler Discord that they are discussing how to handle the situation with Stables Labs, but there is currently no clear conclusion.

Who is crazily "borrowing money"?

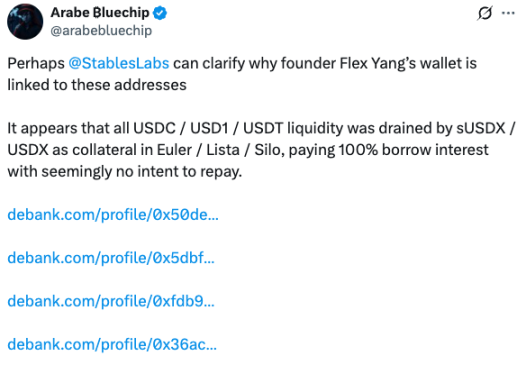

A user named Arabe ₿luechip noticed something was off yesterday morning and listed four addresses that had exhausted available borrowing funds across various markets.

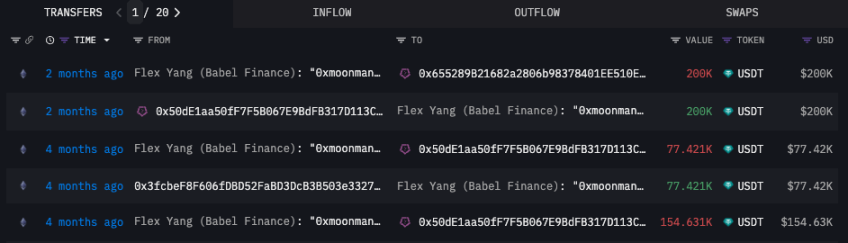

Among them, the address starting with 0x50de began receiving USDT transferred from the address starting with 0x246a since late July this year and transferred it to Binance. Since late October, it has started receiving large amounts of USDX from the address starting with 0x5bdf, as well as large amounts of sUSDX obtained from other channels, borrowing USDT, USDC, USD1, and other stablecoins from Euler, Lista DAO, and Silo, almost all of which were transferred to Binance immediately after borrowing.

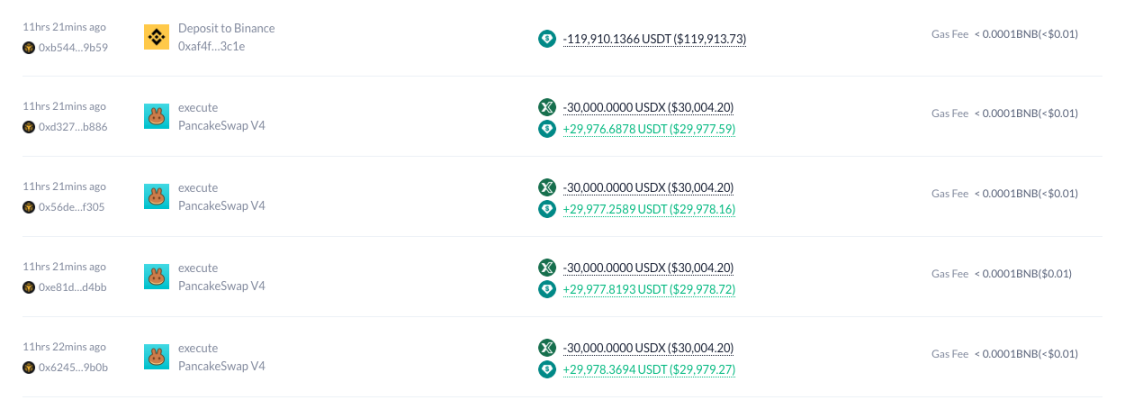

After exhausting all borrowing options, this address directly exchanged USDX for USDT on PancakeSwap and transferred it to the exchange, a process that just concluded 11 hours ago.

The address starting with 0x5bdf also had a large number of operations borrowing USDT and USD1 against USDX on Euler and Lista DAO, but currently, there are no borrowed stablecoins in the address.

As for the remaining two addresses, upon investigation, although they hold large amounts of USDX or sUSDX and have had some borrowing activities, they ceased operations in September and June respectively, and are not closely related to this incident.

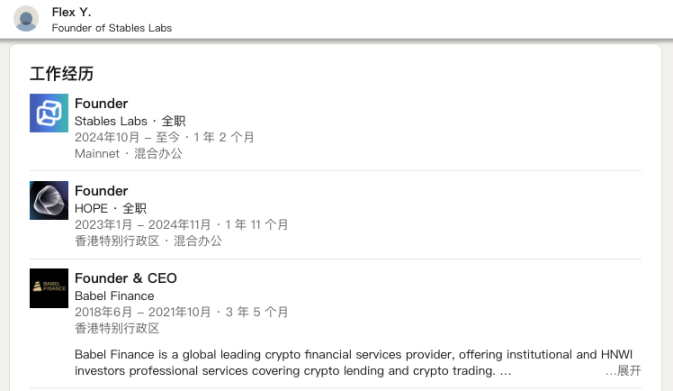

The most suspicious address starting with 0x50de has been marked by Arkham as a suspected address of Flex Yang, the former founder of Babel Finance and HOPE. The most direct evidence is that the address starting with 0x246a, directly marked as Flex Yang, transferred USDT to the address starting with 0x50de twice four months ago, which coincided with the beginning of the continuous borrowing of stablecoins and their transfer to exchanges.

Additionally, according to LinkedIn information, Flex Yang is indeed the founder of Stables Labs, the company behind usdx.money.

Addresses directly associated with the founder are ignoring borrowing rates to borrow stablecoins while frequently trading USDX for USDT on PancakeSwap and directly transferring the obtained stablecoins to exchanges. These abnormal operations have raised alarms among many users. Some users on X believe that USDX may also have encountered collateral asset shortages due to ADL or other reasons during the "10.11 crash."

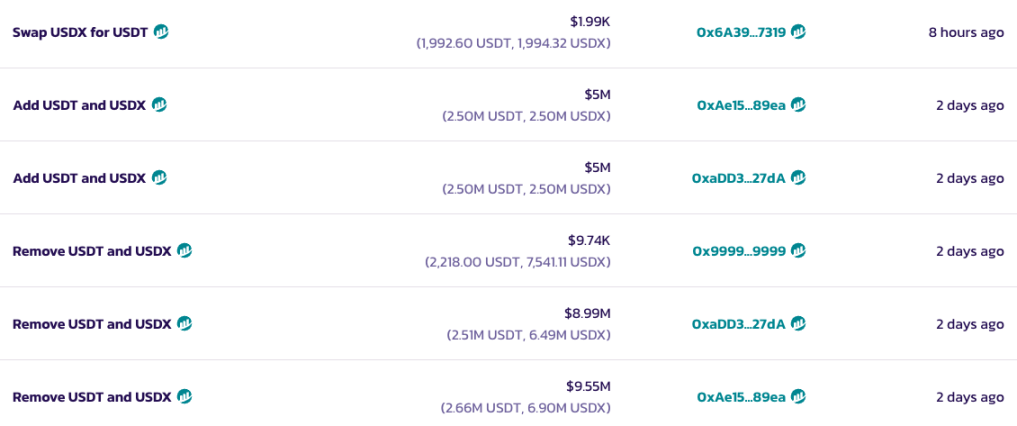

Although the multi-signature address of the Stables Labs project removed nearly $20 million in liquidity from the stablecoin pool on PancakeSwap two days ago and then added a total of $10 million in liquidity, as of the time of writing, the pool has shown a significant liquidity shift, possibly related to the trading activities of the address starting with 0x50de that began multiple transactions on PancakeSwap since 1:44 PM yesterday.

Decentralized stablecoins urgently need transparency

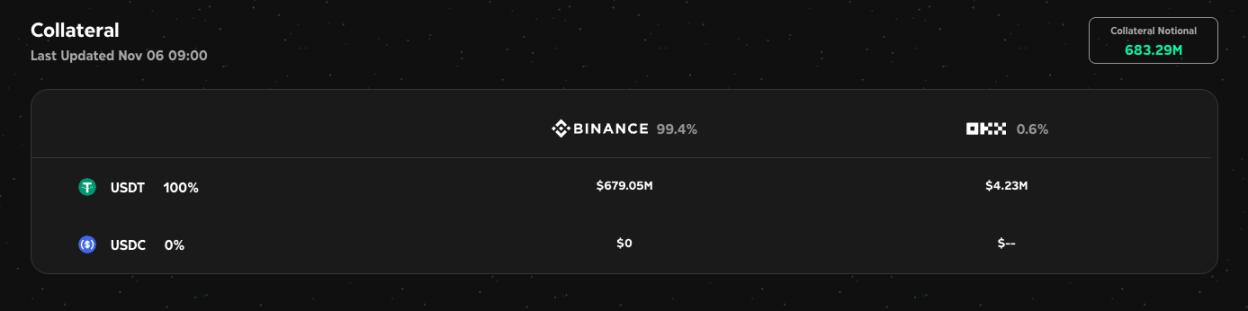

The official website of usdx.money shows that as of 9 AM today, it still has over $680 million in reserve assets on exchanges, with the majority of assets on Binance.

However, given the opacity of centralized exchanges, users have raised doubts about the authenticity of this asset report due to recent operations. Currently, we still do not have enough evidence to prove exactly what happened, but it is clear that some issues must have arisen, prompting an address directly associated with the founder to find every possible way to escape. Meanwhile, there is still no news on USD0x, which is planned by Stables Labs to be backed by U.S. Treasury bonds.

Stablecoins based on Delta neutral strategies have become quite popular since Ethena, but due to the need for sufficient contract liquidity, many project teams still choose centralized exchanges. This has turned the collateral assets behind these so-called "stablecoins" into a black box, with only the project teams knowing the actual situation. Unless regular third-party audits can be implemented, large-scale projects may trigger a butterfly effect in the DeFi space once problems arise.

In addition to transparency, the current nesting between DeFi protocols is also quite complex, with many structured products reaching a level of complexity that may be impossible to untangle. For example, crvUSD can use a stablecoin issued with crvUSD as the underlying asset to issue crvUSD, although this nesting may essentially just be a leverage issue, similar situations continue to expose risk control problems in DeFi.

The bear market of 2022 led to the bankruptcy of many highly leveraged centralized lending institutions, but at least we could still tally up how much was owed by looking at the books. Now, DeFi faces a serious problem: even if all information is publicly and transparently available on-chain, we seem unable to accurately calculate how many layers of leverage have been applied to a basic underlying asset.

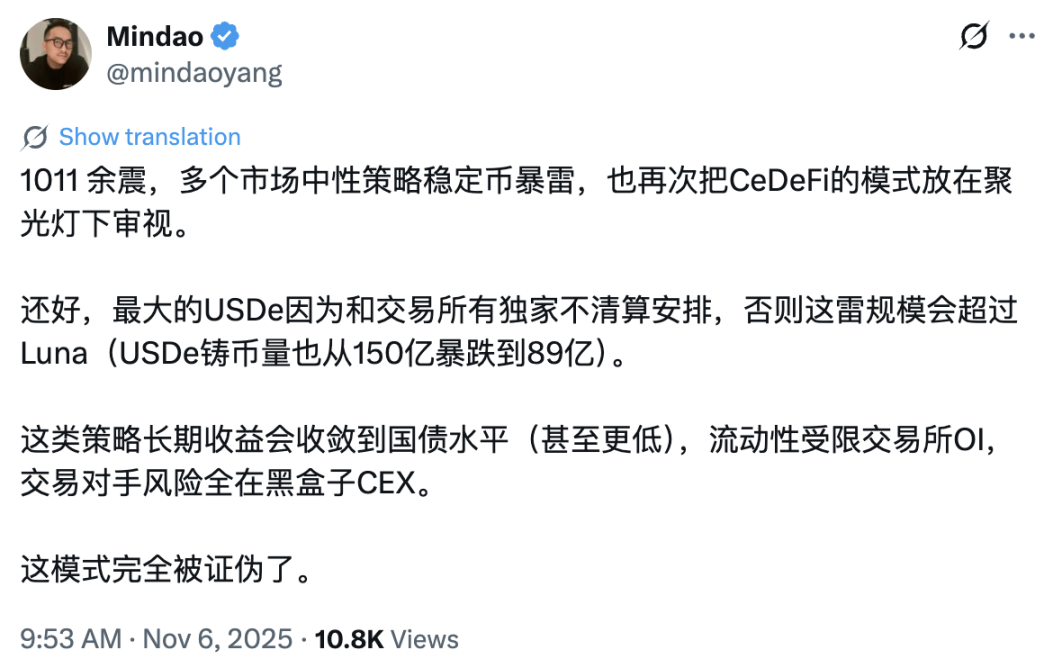

Returning to the issue of USDe-style stablecoins, user Mingdao on X even candidly stated that this model may have been falsified. After more than five years of development, we may need to reassess what DeFi needs to do better, potentially at a great cost once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。