The original text is from neel daftary

Compiled by|Odaily Planet Daily Golem (@web 3golem)_

The future of prediction markets may be dominated by Polymarket/Kalshi, capturing all attention and market share. However, even so, we may ultimately use entirely new designs of prediction markets that can meet everyone's needs and align with their preferences and interests.

Do you remember how trading Meme coins evolved? From 2015, when we only needed to buy tokens with a dog printed on them, to 2025, when we need to learn to use tools (Axiom), track wallets (Cielo, Nansen, Arkham), and join a community to search for tokens on platforms like Solana, BNB, and Base with others.

Every opportunity that arises in the crypto space starts with simple patterns. Over time, these simple patterns either fade away (like NFTs) or become more complex with the addition of more participants, leading to the gradual disappearance of early advantages (like Meme coins). Of course, users also want to play more complex games, as evidenced by the evolution of most video games (God of War, Assassin's Creed, FIFA, etc.). To maintain appeal and relevance to the core user base, games and game-like platforms need to increase functionality and complexity, allowing top players to stand out from 99% of players.

When this happens again, resonating with the prediction market category, it will no longer be a single, massive platform but a complete ecosystem containing numerous prediction-related applications.

These independent products can leverage the core mechanisms of prediction markets (incentivized predictions and stakeholders) to create entirely new experiences. Here are five highly anticipated categories:

Trading Expected Impact: Lightcone as an Example

This may be the latest and most complex original concept, transcending the realm of probability and allowing users to trade the impact of events.

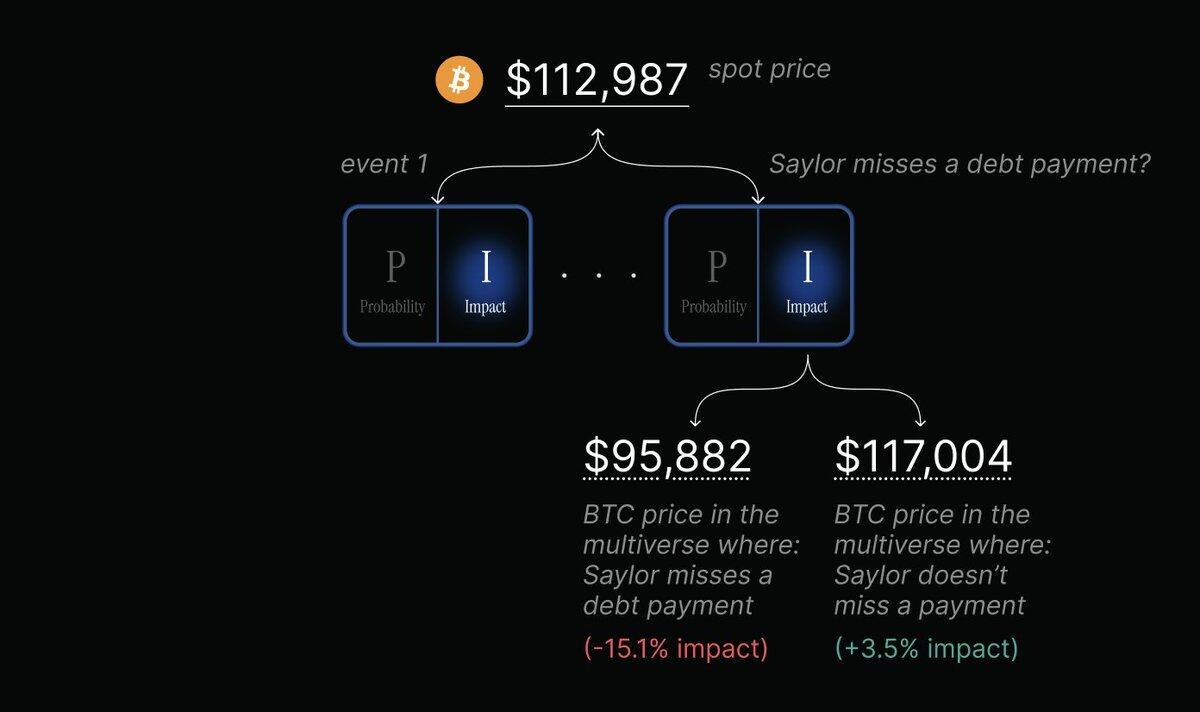

It can be understood this way: prediction markets tell you the probability (P) of an event occurring, while spot markets tell you the spot price (S) of that event. However, the new category defined by Lightcone, "impact markets," aims to separate and price impact (I).

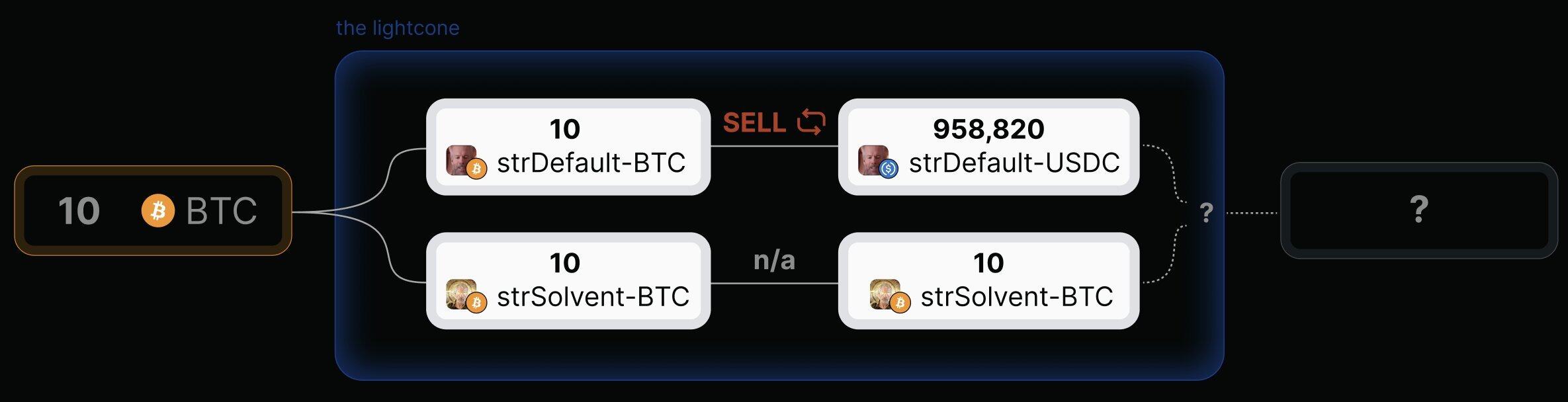

The way it works is that the platform clones assets into a "parallel universe" based on future events. For example, a user can deposit 1 BTC before the U.S. election and then receive two new tradable tokens, Trump-BTC and Kamala-BTC.

These tokens are traded in independent "parallel universes." When the event occurs (for example, Trump winning), all Trump-BTC can be exchanged for real Bitcoin, while all Kamala-BTC will go to zero (and vice versa).

The advantage of this model is that it spawns two entirely new applications:

- New Information Machines: It provides us with a testing ground for predicting financial impacts. By comparing the prices of Trump-BTC (e.g., $130,000) and Kamala-BTC (e.g., $91,000) with the current spot Bitcoin price ($102,000), the market clearly tells us the expected financial impact of each outcome, which is entirely unrelated to the probability of the outcome occurring.

- Event-Based Hedging: Traders can hedge specific risks without paying a premium unless that risk occurs. For example, traders concerned about a specific credit event (like Saylor defaulting) can hold strSolvent-BTC while selling their strDefault-BTC for strDefault-USDC.

If a default occurs, their strDefault-USDC will turn into real USDC. They have successfully hedged and sold Bitcoin before the event occurred; if no default occurs, their strSolvent-BTC can be exchanged for their original Bitcoin. They still hold a long position, and the hedging operation incurs no cost.

This is a complex tool. It removes the "probability" variable from trading, allowing institutions and traders to trade solely based on impact factors, which is indeed a new financial foundation.

Opinion Markets: Betting on Beliefs

This is an intriguing concept where participants no longer bet on objective facts (e.g., "Will Ethereum reach $5,000?") but rather on what people will believe.

For example: "Will more than 70% of participants bet 'yes' in this market?"

This model has two major advantages:

- Fast Settlement: The market can settle daily or every few hours based solely on its internal dynamics. It does not rely on slow external oracles.

- Monetization of Social Capital: It rewards players who can accurately predict collective psychology rather than facts. This is a direct way to monetize cultural influence and understanding.

Currently, platforms like Melee, vPOP, and opinions.fun are attempting to build this model, enabling people to convert social capital into profit.

Virtual Sports: High-Frequency Prediction Markets

Virtual sports are a $25 billion industry, with a cyclical prediction market at its core.

On the Football.Fun platform, users do not just place a single bet but make combination predictions. Forming a team is essentially betting on the overall performance of players, all of whom are subject to budget constraints.

The power of this model lies in:

- It generates continuous, cyclical betting volume (e.g., weekly NFL/NBA/PL tournaments).

- It allows users to monetize the expertise they accumulate by watching over 10 hours of games each week.

The native advantage of cryptocurrency lies in its tradable assets. Digital player cards themselves are predictions of players' in-game value. Cryptocurrency-native virtual sports allow players to profit through pure player card trading (similar to gacha boxes, physical collectibles) and regularly conducted cyclical prediction market games.

Opportunity Markets: Private Information Mining

This is the second innovative mechanism proposed by the Paradigm team, enabling prediction markets to address the challenges faced by enterprises: finding valuable early information.

The model is as follows:

- Initiators (VCs): Provide all liquidity for the private market (e.g., "Will we invest in Y startups this year?").

- Scouts (experts): Use their information and expertise to buy shares of "yes."

- Signals: Price increases become proprietary aggregation signals for VCs/institutions, indicating that the market should investigate/reinvestigate this project.

This is essentially a decentralized scouting program. It can also address the "free-rider problem" in some way (signals are private, accessible only to initiators) and liquidity issues (initiators are permanent market makers).

Betting Market Governance Wisdom

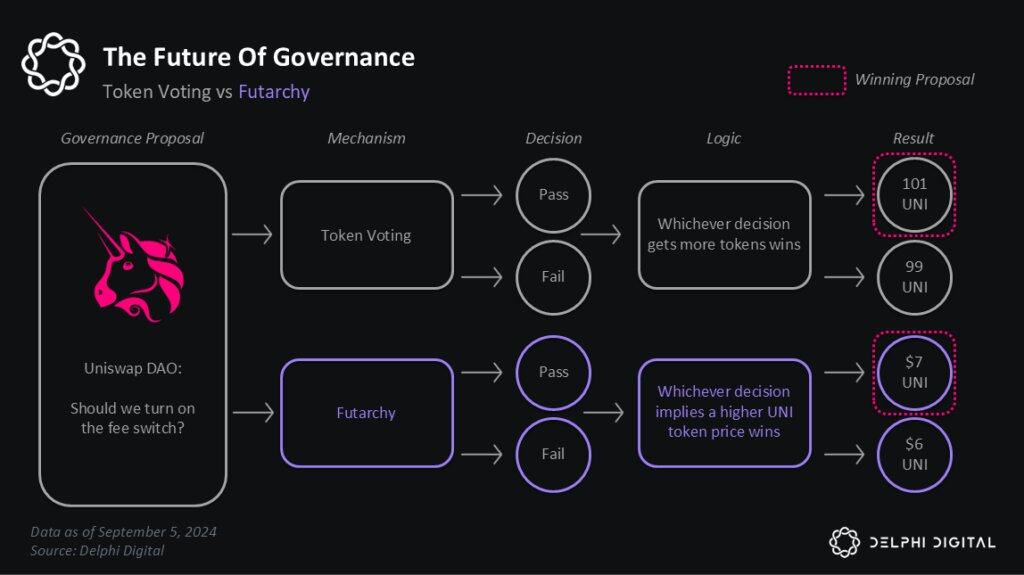

This is a governance model that delegates policy decision-making power to market wisdom. The core idea is: "People will vote based on values but will bet based on beliefs."

Here’s how it works:

- A DAO reaches consensus on a value or goal (e.g., "maximize monthly active users").

- A proposal is made ("Proposal 123: Spend 50,000 tokens on a new incentive program").

- Two conditional prediction markets are created: Market A, "If Proposal 123 passes, what will the monthly active users be on December 31?"; Market B, "If Proposal 123 fails, what will the monthly active users be on December 31?"

- If the price (predicted value) of Market A is higher than that of Market B, the proposal automatically passes.

It forces participants to put their money where their beliefs are, transforming governance from a subjective popularity contest into an information-driven practice.

But to be honest, the innovations at the application layer of prediction markets go far beyond this. In addition to the applications listed above, we also see concepts like the prediction market-based news platform Boring News and specialized prediction market fund PolyFund being constructed.

The design space for prediction market applications has only just begun to be explored, and we are not optimistic enough.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。