Author: Bradley Peak

Source: Cointelegraph

Translation: Shaw Golden Finance

Key Points

Since 2024, the inflow and outflow of spot ETFs have been the main drivers of Bitcoin's price fluctuations.

With exchange balances nearing multi-year lows, any large orders require longer trading processes to complete.

Large holders typically split trades or use over-the-counter (OTC) platforms to mitigate the apparent "wallet transfer" impact.

Funding rates, open interest, the dollar, and yields often influence the market direction more than any single wallet address.

Everyone "knows" that whales trade Bitcoin, and they can still shake the price.

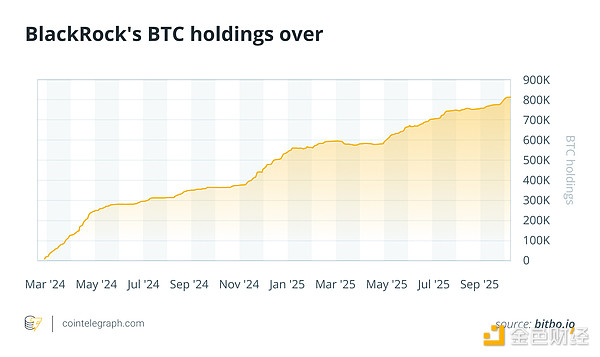

Since the emergence of spot exchange-traded funds (ETFs), Bitcoin's movements have often depended on the inflow and outflow of ETFs. It also depends on the actual supply of Bitcoin available for trading on exchanges, rather than the willingness of a single wallet. For example, BlackRock's iShares Bitcoin Trust ETF (IBIT) currently holds over 800,000 Bitcoins on behalf of thousands of investors. The volume of funds flowing in and out of this ETF is enough to rival any single holder.

Considering derivatives contracts and broader risk-on/risk-off sentiment gives a clearer picture of the reality.

This article dismisses various rumors about whale trading, explains the truly important market mechanisms, and provides a quick data checklist so you can understand market trends without chasing every "whale just made a move" headline.

What kind of investors are considered "whales"?

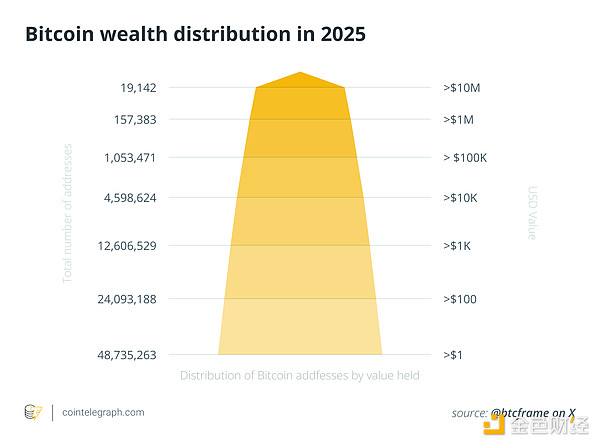

In the cryptocurrency space, "whales" refer to on-chain entities that hold at least 1,000 Bitcoins. Many dashboards specifically track Bitcoin holders in the range of 1,000 to 5,000 Bitcoins.

An entity refers to a group of addresses controlled by the same owner, rather than a single wallet. Analytics firms use heuristic methods such as common spending and change detection to group addresses, ensuring that the same holder is not counted multiple times across different deposits.

This distinction is crucial because the original "rich list" address count may exaggerate concentration. Large service entities like exchanges, ETF custodians, and payment processors operate thousands of wallets, and marking clusters helps differentiate these wallets from end investors. Research in academia and industry has long warned against drawing conclusions based solely on address data.

Methodologies vary. Some whale metrics include service entities such as exchanges, ETFs, or custodial pools, while others exclude known exchange and miner clusters to focus on true investor whales.

In this article, we use an entity-based convention (≥1,000 BTC) and clearly indicate whether service wallets are included or excluded to provide a precise understanding of what each metric means.

What is the current concentration of Bitcoin? Who holds it?

Since the launch of the U.S. spot ETF, a significant visible supply of Bitcoin has shifted into custodial pools. BlackRock's IBIT alone holds about 800,000 Bitcoins, making it the largest known holder. However, these Bitcoins are not held in a single account but are custodial for numerous investors.

The total Bitcoin held by U.S. spot ETF issuers is approximately 1.66 million, accounting for about 6.4% of the total supply of 21 million. Although underlying ownership remains widely distributed, this execution model has led to a concentration of trading.

Corporations are another major group. Strategy recently disclosed holding about 640,000 Bitcoins. Miners, exchanges, and undisclosed long-term holders make up the remaining largest groups.

Meanwhile, the tradable supply on centralized exchanges continues to shrink. Glassnode's tracking data shows that its supply dropped to about 2.83 million Bitcoins in early October 2025, marking a six-year low. With fewer tokens in exchanges, large orders can more easily impact prices.

Note that "top address" rich lists often exaggerate cryptocurrency concentration because large service providers operate thousands of wallets. Clustering at the entity level and labeling wallets of ETFs, exchanges, and corporations can provide a clearer picture of the actual controllers of cryptocurrency.

Can whales reverse market trends during trading?

Large aggressive orders can significantly impact price volatility, especially in cases of insufficient order book depth. During periods of market volatility, liquidity often dries up, and large sell orders can penetrate the order book, causing substantial shocks. This is basic market microstructure.

For this reason, many large holders avoid "impacting the market." They split orders or quietly execute large trades through OTC channels to reduce the impact of trading activity and information leakage. In fact, a considerable portion of large trading activity occurs outside exchanges, reducing the visible impact of a single wallet on public trading venues.

In different cycles, whales do not always "buy." Research combining trading and on-chain data shows that large holders often sell during strong market conditions, especially when small investors are buying. Their fund flows may suppress upward momentum rather than lead it.

The price chart for 2025 aligns with this pattern: as prices broke above $120,000 driven by strong ETF inflows and widespread buying, some "whales" took the opportunity to take profits. Daily price movements are often more influenced by ETF fund flows and available liquidity than by the actions of any single "whale" wallet.

What are the real factors that influence market fluctuations most of the time?

Since January 2024, the fund flows of spot ETFs have become one of the most reliable signals for Bitcoin's daily movements. Strong weekly inflows often coincide with Bitcoin price hitting new highs, while weak or negative inflows often correlate with Bitcoin price declines. By combining real-time fund flow dashboards, one can track the fund flows of U.S. ETFs on each trading day.

Liquidity on exchanges is equally crucial. With Bitcoin balances on centralized exchanges dropping to about 2.83 million, a six-year low, the tradable Bitcoin supply has noticeably decreased. Insufficient liquidity means that even routine buy and sell transactions can impact the order book, amplifying price volatility for all types of participants.

Contracts and leverage are often the main drivers of intraday price fluctuations. When funds are ample or severely depleted, and open interest (OI) is rebuilt after a crash, the path of least resistance may change rapidly.

Continuously monitor fund flows and open interest to assess market congestion. Recently, about 97% of the supply has been profitable, and the dividends for long-term holders have slightly slowed, making the market more sensitive to new fund flows and news.

Finally, macroeconomic factors continue to drive cryptocurrency volatility. The performance of the dollar, U.S. Treasury yields, and overall risk appetite typically align with Bitcoin's intraday movements. On days with lighter data, the volatility range often narrows; when macro factors heat up, the cryptocurrency market usually follows suit.

Quick Data Checklist

ETF Fund Flows: Track yesterday's net inflow/outflow and total trading volume.

Liquidity: Observe balance trends and order book depth at major trading venues.

Positions: Review the heatmap of funding rates after liquidation and the rebuilding of open interest.

Macroeconomic Dynamics: Monitor the dollar index, 10-year Treasury yields, and market breadth.

Will whales still determine Bitcoin's daily movements?

Whales can influence price movements, but they rarely determine the final transaction price. When liquidity is insufficient, a large order can cause price fluctuations beyond normal levels. Currently, most whales will split trades into smaller portions or trade through OTC platforms to mitigate the impact of public trading on prices.

Since 2024, the fund flows of spot ETFs and the large trading volumes of these funds have been the main factors influencing daily market trends. Observing the previous day's net fund flows and trading volume can provide a clearer understanding of this trend.

As the tradable supply on exchanges approaches multi-year lows, even small buyers or sellers—whether whales, market makers, or retail investors—can have a more significant impact on prices than usual. Large holders often sell when prices rise rather than "push up," and this pattern tends to limit upward momentum rather than drive it.

Macroeconomic factors still largely influence market trends. Changes in the dollar and U.S. Treasury yields affect risk appetite, which in turn impacts Bitcoin's movements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。