The essence of trading is survival, followed by profit. Therefore, before each operation, think carefully about whether your actions are reasonable and whether your capital is safe. You need to develop a trading mindset that belongs to you, continuously optimizing and improving it. Although the suggestions from the crypto circle academicians may not make you rich overnight, they can help you sustain yourself. Only those who survive in the crypto space for the long term and persist until the end can achieve the results they desire. I hope you understand.

Don't forget, the darkest moments are often just before dawn. On the road to pursuing dreams, you are never alone; you still have me.

I am a warrior in the crypto circle, always protecting the retail investors. I wish my fans financial freedom by 2025. Let's work hard together!

Crypto Circle Academician: November 26, 2025 Ethereum (ETH) Latest Market Analysis Reference

The current price of Ethereum is 2912. It is now 3:30 AM Beijing time, and the main force has not yet fully prepared to break the 3000 mark. It peaked at 2985 before retreating, only reaching the first target of 2900. There is strong resistance at the low target of 2850. Overall, the bullish trend is becoming more apparent. Pay attention to the market changes; if it breaks through the key resistance level, consider moving north.

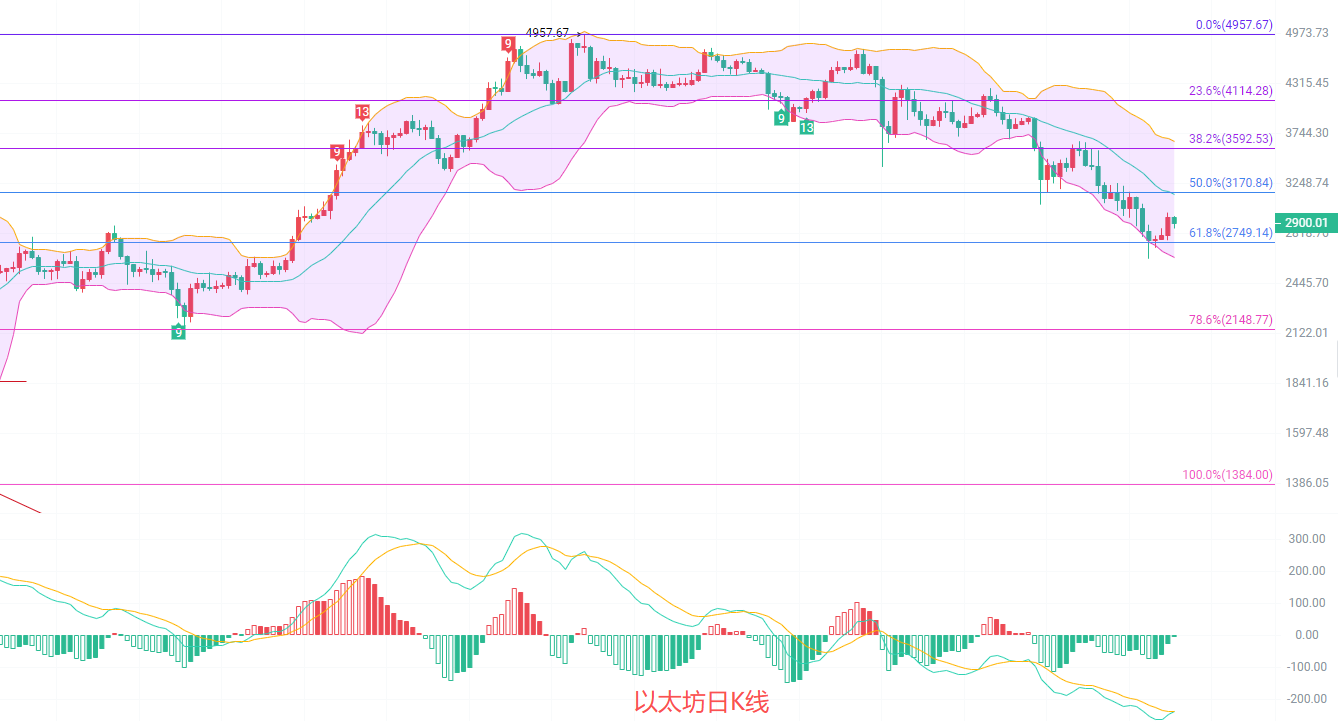

Before the publication, the daily K-line reached a maximum of 2957 and a minimum of 2855. The EMA trend indicator is alternating and expanding downwards. The EMA15 has reached 3045, with the second resistance point at 3170. The MACD shows a decrease in volume. If the main force further rises and breaks the daily high of 2957, then the DIF and DEA are likely to form a golden cross, leading to a bullish trend that could push towards the next target after breaking the 3000 mark. Pay attention to the Bollinger Band middle line at 3146 and the trend resistance point at 3170.

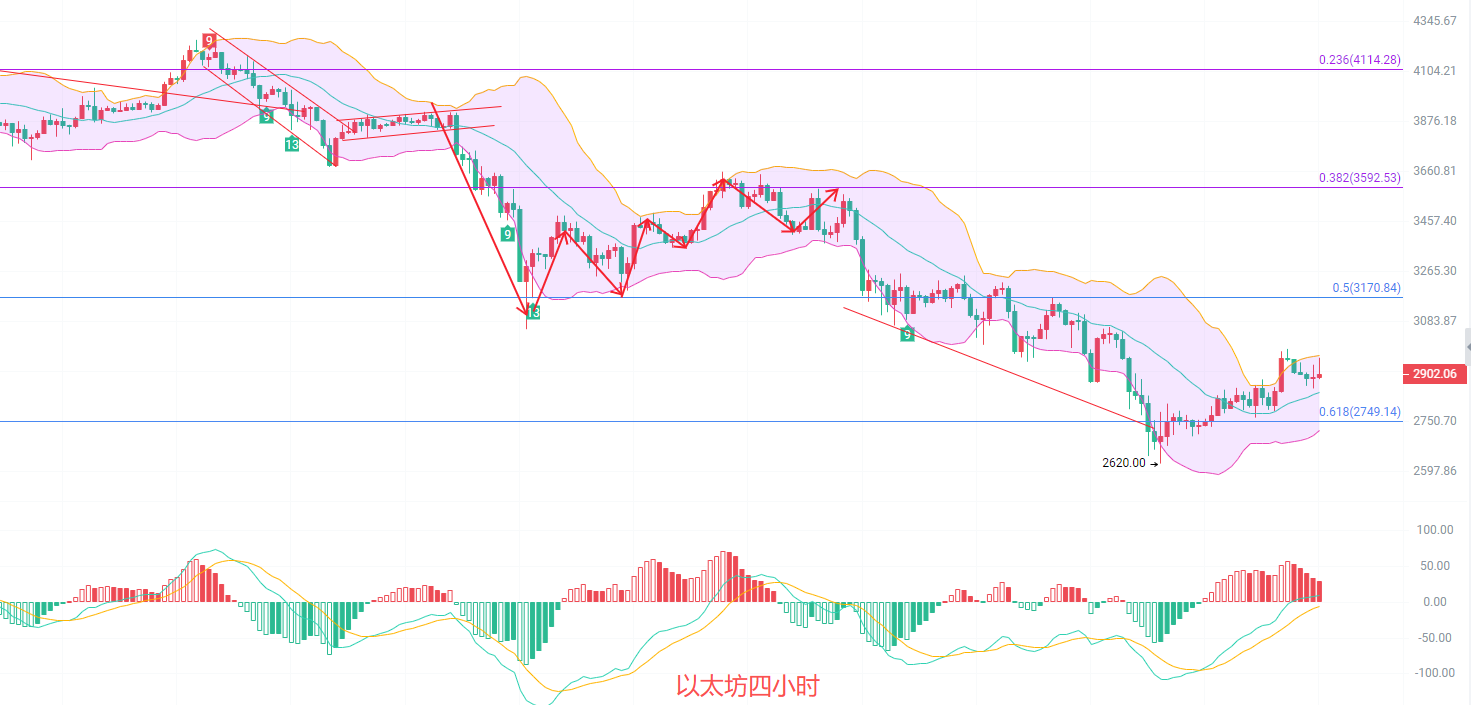

The four-hour K-line has formed an upward channel, with the support point at the intersection of EMA30 and EMA15 at 2870. The resistance point to watch is the 60 trend line at 2960. The MACD shows a decrease in volume, and the DIF and DEA are expanding upwards but encountering significant resistance. Additionally, after the K-line failed to break the upper Bollinger Band at 2965 and retreated, the possibility of another upward push cannot be ruled out. The pressure point will eventually break after sustained attacks. Overall, the offensive point given yesterday is still valid, and the market resistance point is indeed at this position. Therefore, the strategy remains unchanged from yesterday; once the pressure point is broken, increase positions and move north.

Short-term reference:

For a southward trial position from 2950 to 3000 without breaking, set a stop loss of 40 points, with a target looking at 2900 to 2850. If it breaks, look at 2800.

For a northward trial position from 2950 to 3000 breaking, set a stop loss of 40 points, with a target looking at 3050 to 3100. If it breaks, look at 3150.

Specific operations should be based on real-time market data. For more information, you can consult the author. There may be delays in article publication; the suggestions are for reference only, and risks are borne by the reader.

This article is exclusively contributed by the Crypto Circle Academician and represents the unique views of the Academician. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions may not be real-time and are for reference only. Risks are borne by the reader. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The Academician also hopes that all investors understand that the market is always right. If you are wrong, you should reflect on where the problem lies. Do not let the profits that should be yours slip away. There is no need to be smarter than the market. When a trend comes, respond to it; when there is no trend, observe and remain calm. It is not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often occur unexpectedly. Develop the habit of strictly setting stop losses and take profits for each trade. The Crypto Circle Academician wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。