# Introduction

In the fourth quarter of 2025, the U.S. market experienced a concentrated launch period for altcoin ETFs, with multiple single-asset spot ETFs being approved and listed in succession, creating a rare "batch issuance" situation in the previously fragmented crypto market. The successful launch of Bitcoin (BTC) and Ethereum (ETH) spot ETFs not only opened the door for institutional investors to compliantly allocate crypto assets but also established a clear approval paradigm and product pathway at the institutional level, directly catalyzing the concentrated application and accelerated promotion of altcoin ETFs.

With the ongoing adjustments by the U.S. Securities and Exchange Commission (SEC) to the approval mechanism for crypto ETFs, along with the proactive positioning of asset management institutions and market participants, the fourth quarter of 2025 became a key time window for the intensive launch of altcoin ETFs. ETFs for assets such as XRP, SOL, DOGE, LTC, HBAR, and LINK gradually went live on exchanges, while the next wave of altcoin ETFs, including AVAX and AAVE, is also accelerating. The rapid expansion of altcoin ETFs not only reflects a significant acceleration in the institutionalization process of the crypto market but also marks a transition in the product structure of crypto assets from being "dominated by a single core asset" to a more diverse and layered mature stage.

In this context, this article will systematically outline the overall development trajectory of current altcoin ETFs, focusing on the demonstration effect of Bitcoin and Ethereum ETFs, the wave of batch listings of altcoin ETFs, and the potential targets currently under application; it will also analyze specific data such as fund flows, trading activity, asset management scale, and price performance of listed altcoin ETFs. Based on this, we will further explore the opportunities and risks faced by altcoin ETFs and forecast future development trends, aiming to provide ordinary investors and institutional allocators with a clear structure, rigorous logic, and valuable industry insights to help them clarify judgments and make prudent decisions in this emerging track.

# Overview of Altcoin ETFs

1. Demonstration Effect of Bitcoin and Ethereum ETFs

In recent years, the most significant marker of crypto assets entering the traditional financial system has been the approval of Bitcoin (BTC) and Ethereum (ETH) spot ETFs in the U.S. After the debut of the Bitcoin ETF, it quickly attracted massive institutional funds, significantly boosting market participation; the Ethereum ETF followed closely, providing more institutions and retail investors with a compliant channel to invest in crypto assets.

This gate-opening effect has greatly altered the market structure: investors' risk tolerance has increased, the motivation for institutions to allocate digital assets has strengthened, asset management companies have begun to actively expand product boundaries, and regulators have gradually accumulated review practices and approval confidence. Against this backdrop, a wave of applications for various altcoin ETFs quickly formed, with multiple asset management institutions laying out plans for single-coin/multi-coin ETF products such as XRP, DOGE, LTC, HBAR, SUI, and LINK.

Source: https://x.com/Minh_BNB10000/status/1999307817430462471?s=20

Another driving force is the gradual adjustment of regulatory policies by the SEC. In September 2025, the SEC officially approved the revised "General Listing Standards for Commodity Trust Shares," providing clearer entry standards for crypto asset ETFs and shortening the approval timeline. This means that crypto assets meeting basic conditions no longer require a lengthy case-by-case review process (the original approval cycle of about 240 days has been shortened to approximately 60–75 days). This serves as an important institutional foundation for the batch application and concentrated listing of altcoin ETFs.

Additionally, a key opportunity arose from the regulatory window created by the U.S. government shutdown in November 2025—under specific legal provisions (such as Section 8(a) of the Securities Act of 1933), some fund registration statements could automatically take effect without delay clauses, indirectly creating a "tacit channel" for rapid listings. These factors collectively contributed to the recent wave of concentrated listings of altcoin ETFs.

2. Wave of Batch Listings of Altcoin ETFs

Since the second half of 2025, the pace of approval and listing of altcoin ETFs in the U.S. has noticeably accelerated, characterized by "queue listings + progressive batch approvals."

Solana ETF: In October 2025, the Solana (SOL) ETF successfully passed approval and began trading on exchanges such as the NYSE. This marked the first truly operational altcoin spot ETF to be launched in the U.S.

Hedera ETF: In the same month, multiple application documents for the Hedera (HBAR) ETF were submitted and entered review. Institutions like Canary Capital have also completed revisions to the ETF registration statement for HBAR, and the HBAR ETF is expected to be approved and listed in the following weeks.

XRP ETF: In November 2025, the XRP ETF became the second altcoin spot ETF to receive concentrated approval and quickly go live. XRP ETFs launched by Canary Capital, Grayscale, 21Shares, and others were listed on exchanges such as NYSE Arca, attracting significant capital inflows in a short period.

DOGE ETF: In November 2025, the DOGE (Dogecoin) ETF received approval from the DEC for listing, representing a cautious recognition from regulators regarding meme coins.

LTC ETF: The long-established altcoin LTC (Litecoin) ETF was also approved in November. Although the capital inflow for the ETF was relatively small, it laid the groundwork for more applications for older altcoin ETFs.

LINK ETF: Following XRP, SOL, DOGE, and LTC, the LINK (Chainlink) ETF officially launched in early December. The LINK ETF attracted tens of millions of dollars on its first day, indicating investor interest in on-chain infrastructure assets with ecological foundations and practical linking protocols.

SUI ETF: On December 5, the U.S. Securities and Exchange Commission (SEC) approved the first 2x leveraged SUI ETF (TXXS), issued by 21Shares, which has been listed on Nasdaq.

3. Altcoin ETFs Under Application

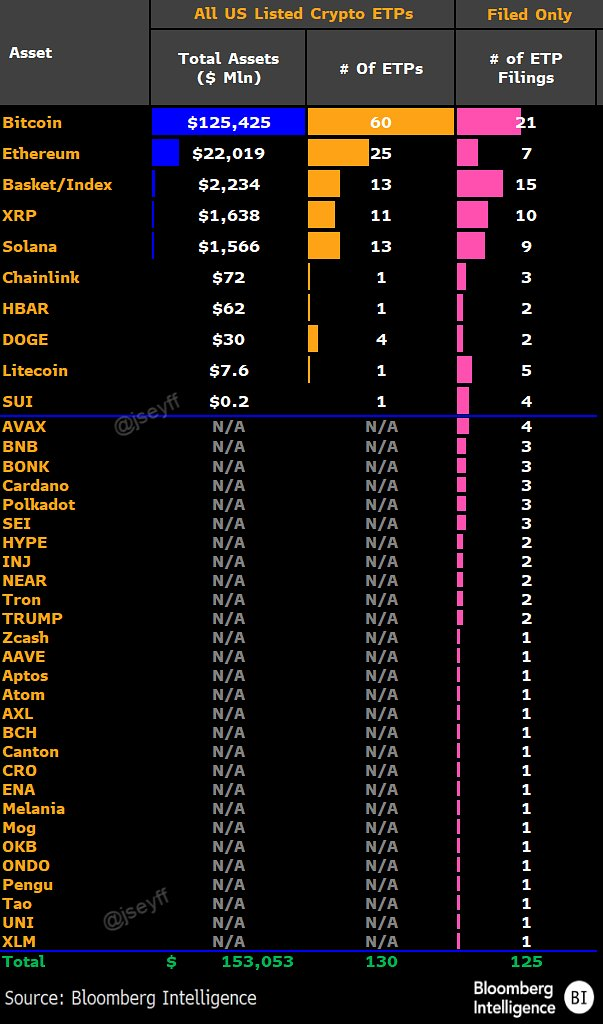

In addition to the listed altcoin ETFs, there is a large number of potential products in the SEC review queue, and the active filing of these ETFs constitutes a core driving force for the next phase of market attention.

Assets under high scrutiny include:

AVAX ETF: Avalanche, as a major smart contract chain, has the compliance and market foundation and has entered a fast-track approval process, likely to become one of the next approved assets.

BNB ETF: The ETF applications related to BNB are primarily driven by asset management institutions such as VanEck, REX Shares, and Osprey Funds, and have entered the SEC review channel, indicating that BNB is likely to become the first Binance ecosystem-related ETF product approved in the U.S.

Other Potential Assets: Assets such as ADA (Cardano), DOT (Polkadot), INJ (Injective), SEI, APTOS, and AAVE have also had ETF registration documents enter the regulatory queue. Bloomberg Intelligence analyst James Seyffart noted that there are currently dozens of asset class ETF applications backlog at the SEC, with a significant proportion being altcoin-related.

Multi-Coin ETFs: Some institutions are also attempting strategic layouts for "multi-coin combination ETFs," staking yield ETFs, and even memecoin-themed ETFs. If these innovative products are approved, they will further expand the boundaries of compliant investment in altcoins.

Overall, it is expected that the approval pace for altcoin ETFs in the U.S. will remain high-density in the next 6–12 months. The existing XRP, SOL, DOGE, LTC, HBAR, and LINK ETFs are just the "first batch of entrants," with more assets in the application queue, forming a systematic market development trend.

# Data Performance Review of Listed Altcoin ETFs

Altcoin spot ETFs have made their debut in the market, becoming a major focus in the crypto market. Although overall market sentiment has been weak for mainstream assets, some altcoin ETFs have still attracted considerable capital attention.

1. XRP Spot ETF

Source: https://sosovalue.com/assets/etf

The XRP spot ETF has been launched by multiple asset management institutions, including Canary Capital, Grayscale, Franklin Templeton, and Bitwise. It is one of the most actively participated altcoin ETFs in terms of issuance.

The XRP ETF has shown strong capital attraction after its launch, with a cumulative net inflow of approximately $970 million since its listing. All XRP funds combined have over $929 million in managed assets, and since its launch on November 13, it has recorded net inflows for several consecutive trading days, with a total inflow of approximately $756 million over nearly 11 trading days.

The XRP ETF is currently one of the most popular altcoin ETFs, becoming the "preferred entry point" for institutional allocation to altcoins due to its multiple institutional issuances, strong capital inflows, and large AUM scale.

2. SOL Spot ETF

Source: https://sosovalue.com/assets/etf

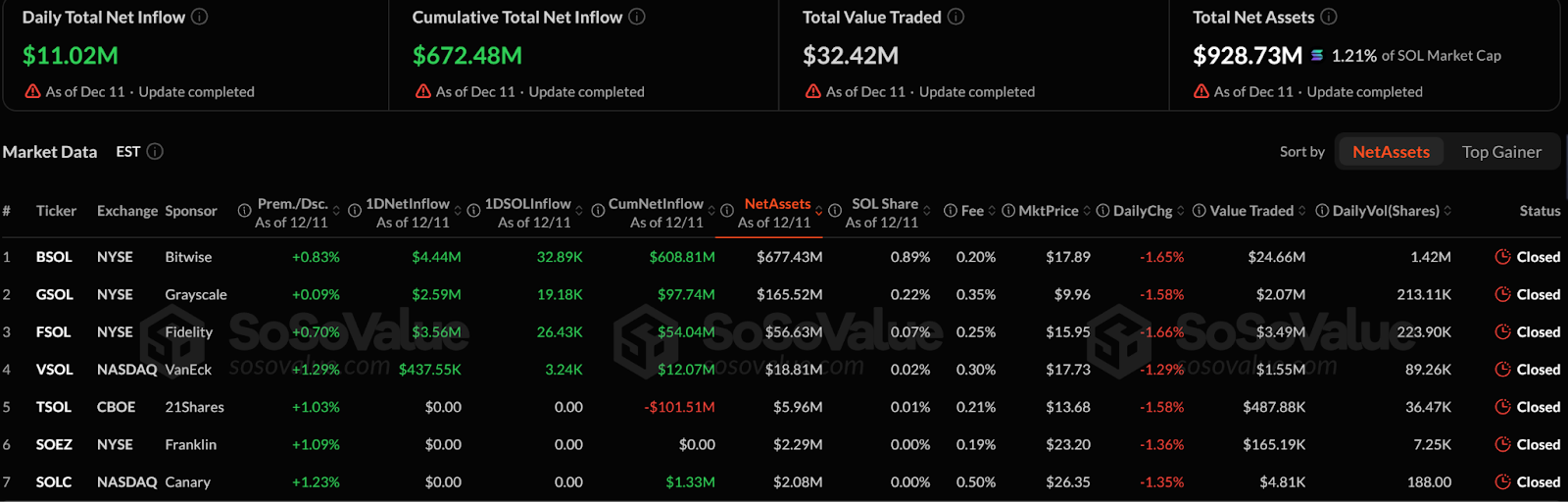

The launch of the Solana ETF has been jointly promoted by several asset management institutions. Since its listing, the Solana ETF has accumulated a net inflow of approximately $672 million, with a total AUM of about $928 million. This indicates that the Solana ETF has one of the largest "scale sizes" among altcoin products and is a representative of sustained capital absorption.

However, unlike XRP, the capital inflow into the Solana ETF has shown a more phased investment characteristic: significant capital entered on the first day, followed by a more stable rhythm of capital inflow in the following weeks rather than explosive growth. This suggests that investors may place more emphasis on long-term allocation rather than short-term arbitrage trading.

The performance of the Solana ETF demonstrates the potential of altcoin ETFs to attract institutional capital allocation and reflects the market's characteristic of "patient layout." Its ETF scale leads similar assets, but the disconnection between price and capital flow also indicates that short-term volatility risks still exist.

3. HBAR Spot ETF

Source: https://sosovalue.com/assets/etf

The Hedera (HBAR) ETF has also entered the trading market and gained some attention. The early-born Hedera ETF has attracted approximately $82 million in net capital inflow, making it a medium-sized altcoin product. Compared to XRP and SOL, HBAR's capital volume is relatively smaller.

The HBAR ETF has shown a characteristic of continuous weekly net inflows, with a relatively stable capital flow, even though the weekly scale is not large, and there has been no large-scale capital outflow. This stability is closely related to its ecological foundation and practical application scenarios, but the price has still been affected by the overall weakness of the crypto market, with HBAR's price dropping nearly 20% since the ETF's launch.

4. LTC Spot ETF

Source: https://sosovalue.com/assets/etf

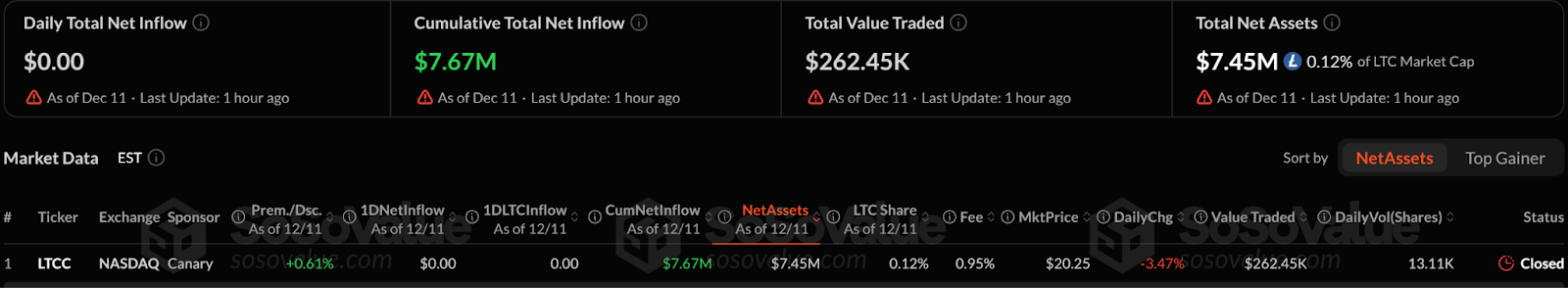

LTC (Litecoin), as one of the earliest altcoins, successfully launched its spot ETF by institutions like Canary Capital at the end of October 2025, making it one of the first approved altcoin ETF products. Despite its historical significance and high trading activity, the ETF's capital absorption performance and market attention have been noticeably lower than those of leading altcoin ETFs like XRP and SOL.

According to SoSoValue data, as of mid-November 2025, the LTC ETF (commonly referred to as LTCC) has accumulated a net inflow of approximately $7.67 million. There have even been days with zero net inflow. Compared to the hundreds of millions in inflows for the XRP ETF and tens of millions to over a hundred million for the SOL ETF, LTC's capital absorption is clearly insufficient and has not become a core target for investors building an altcoin ETF allocation system.

5. DOGE Spot ETF

Source: https://sosovalue.com/assets/etf

DOGE (Dogecoin) is one of the most iconic meme coins, long viewed in the market as a community sentiment-driven asset. With the SEC's approval in November 2025 for institutions like Rex-Osprey to list the DOGE ETF as a trading product, this marks DOGE as one of the most symbolic projects among the first meme coin ETFs.

According to the latest SoSoValue data, the historical cumulative net inflow of the DOGE spot ETF is approximately $2.05 million, indicating very limited capital allocation. In terms of trading activity, the overall trading volume of the DOGE ETF is also quite low. Although there were several million dollars in trading on the first day, the overall trading structure is unbalanced, often accompanied by sparse capital inflows and outflows. This trading performance indicates that institutional capital is unwilling to deeply allocate in the DOGE ETF.

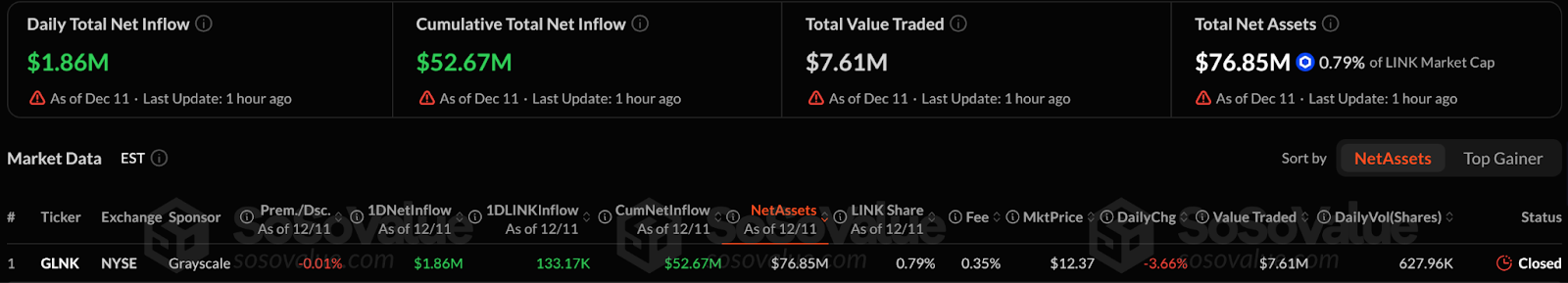

6. LINK Spot ETF

Source: https://sosovalue.com/assets/etf

The first U.S. spot ETF supporting LINK (Chainlink), the Grayscale Chainlink Trust ETF (code GLNK), was officially listed on the New York Stock Exchange (NYSE) on December 2, 2024, Eastern Time. Since its launch, the LINK ETF has seen approximately $52 million in net inflows, with an AUM of $76 million. The capital attraction partly stems from Chainlink's practical use in blockchain data infrastructure, leading some long-term institutional investors to strategically allocate to its ETF.

In terms of price, LINK itself has recently been influenced by the broader market, but the capital allocation in the ETF may provide a relatively stable foundational demand for future prices.

7. Summary of Listed Altcoin ETF Performance

From the performance of the above ETFs, it is evident that the U.S. altcoin spot ETF market shows a clear "differentiated development":

Major capital is primarily concentrated in the XRP and Solana ETFs, which have a high number of issuances, rapid capital accumulation, and large AUM, making them the core focus of the altcoin ETF market.

Medium-sized asset ETFs like HBAR and LINK show stable performance, achieving a relative balance between ecological value and institutional recognition, but still struggle to compete with leading assets.

LTC and DOGE ETFs exhibit marginalization, with small capital scales and low trading activity, coupled with a lack of significant price support, resulting in insufficient market attention.

Overall, the market has generally faced price pressure following the launch of altcoin ETFs, indicating that market sentiment and macro factors still significantly impact prices, and the capital attraction of ETFs has not immediately translated into price upward momentum.

Overall, while altcoin ETFs have not yet reached the market depth and scale of BTC/ETH ETFs, they have already shown trends of segmented allocation, long-term capital inflows, and increased institutional participation, forming the embryonic shape of a new era of "institutional investment" in the altcoin market.

# Opportunities and Risk Analysis of Altcoin ETFs

With the intensive approval and listing of U.S. altcoin spot ETFs, the market is entering a new phase of institutionalized investment. Although the current scale is still far from that of Bitcoin and Ethereum ETFs, their development potential and demonstration effect should not be overlooked.

1. From Institutionalization to Differentiation: Structural Opportunities for Altcoin ETFs

1) Realization of Institutional Dividends: The success of Bitcoin and Ethereum spot ETFs has opened a compliance channel for altcoin products. The SEC revised the general listing standards for ETFs in 2025 and implemented institutional mechanisms such as the "fast track" and Section 8(a) of the Securities Act of 1933, allowing altcoin ETFs to enter the exchange market more efficiently—this shift has shortened the approval path and increased product diversity, overall lowering the barriers for institutional entry.

2) Opportunities for Reallocation of Institutional Capital: Market data from November 2025 shows that despite large-scale capital outflows from Bitcoin and Ethereum spot ETFs, altcoin ETFs have attracted approximately $1.3 billion in capital, primarily flowing into XRP and Solana-related products, indicating that institutions are willing to reassess altcoin allocations in the short term. More importantly, this capital flow is not solely driven by market sentiment but reflects institutions' selective pursuit of specific asset fundamentals, compliance, and ecological value. For example:

The XRP ETF has garnered attention due to its relatively clear cross-border payment application logic and regulatory path;

The Solana ETF combines yield-generating structures such as staking rewards, making it attractive to institutions seeking long-term allocations.

This phenomenon of capital flowing from BTC/ETH to altcoin ETFs not only indicates a dispersion of market enthusiasm for single assets but also reflects a gradual acceptance at the institutional level of "altcoins as long-term value investment targets."

3) ETFs as a Compliance Window to Attract Retail and Institutional Investors: Altcoin ETFs provide ordinary investors with a simplified path to access on-chain assets: no need to manage wallets and private keys, no reliance on centralized exchanges, and risks are more controllable than self-custody. For institutional investors, ETFs serve as a mature compliance entry tool that can be incorporated into traditional investment frameworks such as pension funds, hedge funds, and wealth management portfolios, thereby expanding the capital base.

The existence of ETFs also enhances the visibility and transparency of the industry, making altcoin investments no longer solely dependent on decentralized trading and OTC liquidity, but rather providing a traditional financial vehicle that can be included in investment portfolios.

2. Core Risks: Market, Regulatory, and Technical Challenges Coexist

Despite the emerging opportunities, altcoin ETFs still face numerous risks, stemming from both their asset characteristics and the macro and regulatory environment.

1) Regulatory Environment Remains Uncertain: Although the approval mechanism has improved, the U.S. SEC maintains a highly cautious stance towards altcoin ETFs overall. The legal positioning of regulatory bodies, classification standards, and potentially changing compliance requirements in the future can all affect the ongoing operation and liquidity of ETFs. The SEC's ongoing scrutiny of the identity definitions of certain assets (such as whether they are securities vs. commodities) remains a focal point, and any policy reversal or judicial ruling could lead to product adjustments or suspensions. Furthermore, despite the acceleration of approvals, the rapid "default effectiveness" mechanism has raised market concerns, which may imply that some products still require compliance optimization after launch, creating uncertainty that could impact price volatility and capital allocation.

2) Market Depth and Liquidity Risks Are Apparent: Compared to the deep trading depths of BTC or ETH, many altcoins still exhibit weak market liquidity. Large-scale inflows into ETFs could cause significant market shocks, and during market corrections, redemption pressures on ETFs could exacerbate liquidity tightness. For example, while the Solana ETF has shown strong capital absorption, it faces downward pressure on SOL prices, and the price has not risen in tandem with capital inflows, indicating that the market's pricing of altcoins is not solely driven by capital flows but is also heavily influenced by market sentiment and liquidity conditions. Additionally, for some more marginal altcoins, such as DOGE and LTC, the capital absorption capacity of their ETFs is weak, and their market depth is insufficient to support rapid inflows and outflows of large institutional funds, which could lead to greater slippage risks during volatile market conditions.

3) Market Saturation and Product Competition Risks: With the rapid increase in the number of altcoin ETFs, capital may become "dispersed" among different products, making it difficult for individual ETFs to enhance their capital scale, thereby weakening their price-driving power and market attention. Observations indicate that over a hundred crypto ETF filings have been submitted to the SEC, with an increasing number of altcoins, which to some extent dilutes investor attention. If the market becomes oversaturated and "ETF fee wars" become the norm, it could lead to attracting capital by lowering fees at the expense of the product's quality and investment value, which would be detrimental to long-term holders.

4) High Volatility and Price Risks: Altcoin assets are inherently more volatile compared to BTC/ETH, meaning that even if ETFs provide a compliant entry for investors, prices may still fluctuate dramatically. Just as some altcoin ETFs did not see sustained price increases after launch, capital inflows do not guarantee price rises. The market may experience significant pullbacks due to macro sentiment, liquidity tightening, forced liquidation events, etc., posing challenges for investors with lower risk tolerance. Especially in products with high retail participation, altcoin ETFs are more susceptible to fluctuations in market sentiment, and such irrational behavior may be amplified.

5) Technical and Operational Risks: As financial products, ETFs rely on exchange custody, clearing mechanisms, and the security of underlying assets. The smart contract risks of altcoins, exchange custody risks, and zombie order book risks (where insufficient trading activity leads to widened bid-ask spreads) may all pose technical risks to ETF operations. For smaller altcoins, assets are easily affected by the "trading island effect," and if ETF growth slows, these risks may quickly become apparent.

## Outlook and Conclusion on Altcoin ETF Trends

Looking ahead, the development of altcoin ETFs will continue to profoundly impact the landscape of the crypto asset market. As institutional dividends gradually materialize, the regulatory environment becomes clearer, and institutional capital allocation interest increases, this niche sector is entering a critical stage of maturation.

From an institutional perspective, the U.S. Securities and Exchange Commission (SEC) has made significant adjustments to the approval rules for crypto ETFs, introducing general listing standards and significantly shortening approval times from hundreds of days to about 75 days, which is expected to bring higher review efficiency and predictability for altcoin ETFs. This institutional optimization not only improves regulatory signals but also paves the way for more asset classes such as SOL, XRP, LTC, HBAR, etc., to enter the ETF market, pushing the industry from case-by-case approvals to large-scale implementation. Therefore, in the coming quarters, we are likely to see an increasing number of altcoin ETFs receive listing approvals and begin trading.

In terms of market sentiment, industry participants and analytical institutions generally expect a high probability of approval for altcoin ETFs. Bloomberg ETF analysts have assessed the approval probability for mainstream altcoin spot ETFs like Solana, XRP, and LTC to be over 90%, with some analyses suggesting that the approval of certain products is almost a "done deal," and they are expected to gradually materialize in the coming months. This cautiously optimistic outlook reflects the regulatory recognition of compliance, trading transparency, and market maturity, which will help attract more institutions and long-term capital into this field.

On an international level, the trend of altcoin ETF development is also advancing simultaneously in multiple markets. Canada, Europe, and Asian markets already have crypto ETFs or similar products, each with unique product designs and regulatory frameworks. They not only provide institutional and operational references for the U.S. market but also facilitate a complementary and comparative effect for global capital when allocating digital assets across markets. For example, support for crypto asset index ETFs in countries like France and Germany, as well as the introduction of altcoin options/futures tools by some Asian exchanges, will provide U.S. investors with broader data and strategic references.

Internally, a "layered allocation" strategy trend is also forming: leading assets like XRP, SOL, ETH, and BTC remain the core of institutional and compliant allocations, while mid-sized altcoin ETFs (such as DOT, ADA, AVAX, INJ, etc.) may become choices for investors seeking high-risk, high-return opportunities. As the number of products increases, investors will place greater emphasis on ecological value, liquidity, and long-term fundamentals when constructing their portfolios, rather than merely chasing short-term trends.

It is important to note that despite the overall positive trend, altcoin ETFs still carry cyclical and structural risks. Subtle changes in regulatory policies, fluctuations in market liquidity, and the macroeconomic environment's impact on the pricing of risk assets could lead to asset performance differentiation. This means that investors must focus on risk management and dynamic adjustments when laying out ETF products, paying attention to policy changes, market sentiment, and capital flows.

In summary, altcoin ETFs are an inevitable product of the integration of traditional finance and the crypto market, and their continued advancement aligns with the trends of market demand differentiation and regulatory adaptation. It is expected that by the first half of 2026, with accumulated regulatory experience and further optimized approval processes, dozens to hundreds of altcoin ETF products submitted by various asset management companies will be launched, forming a more mature, diverse, and layered value ETF ecosystem. For ordinary investors, this not only provides a compliant and convenient investment channel but also propels the entire crypto market into a new phase characterized by institutionalization, decentralization, and professionalism. The trend of altcoin ETFs has already begun, and future investment opportunities and risks coexist, with the key being how to participate rationally and structure investments effectively.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。